概述

该策略是基于布林带指标的金叉死叉策略,通过调整布林带的参数,优化适用于黄金交易。当价格收盘高于上轨时生成买入信号,当价格收盘低于下轨时生成卖出信号。

策略原理

该策略使用长度为50、乘数为2.5的布林带。布林带的中轨线是价格的SMA均线,上轨线是中轨线加上标准差的乘数,下轨线是中轨线减去标准差的乘数。

当价格收盘突破上轨线时,产生买入信号;当价格收盘跌破下轨线时,产生卖出信号。其利用了布林带通道缩减的特性,在通道缩减后突破产生信号。

优势分析

该策略具有以下优势:

参数经过优化,适合黄金交易,收益稳定。

利用布林带通道特征,在价格波动减小后产生信号,避免错失机会。

金叉死叉容易判断,操作简单,适合手动跟踪。

图形显示直观,利于监控价格在通道内运行情况。

风险分析

该策略也存在一定风险:

布林带参数不适当可能导致虚假信号。需要测试优化参数。

频繁买卖会增加交易成本和滑点损失。可以适当调整参数降低交易频率。

黄金波动较大时容易止损。可以适当调整止损点或增加仓位管理。

优化方向

该策略可以从以下几个方面进行优化:

测试不同市场及时间周期参数,寻找最佳参数组合。

增加仓位管理模块,通过均线、通道突破等产生加仓信号。

增加止损模块, trails止损跟踪价格运行。

结合其他指标滤除假信号,提高策略稳定性。

总结

该策略通过调整布林带的参数,优化适合黄金交易。利用布林带通道宽窄特性产生信号。在优化参数、增加仓位管理、止损方面有较大改进空间。总体而言,该策略操作简单,稳定性良好,适合手动跟单黄金交易。

策略源码

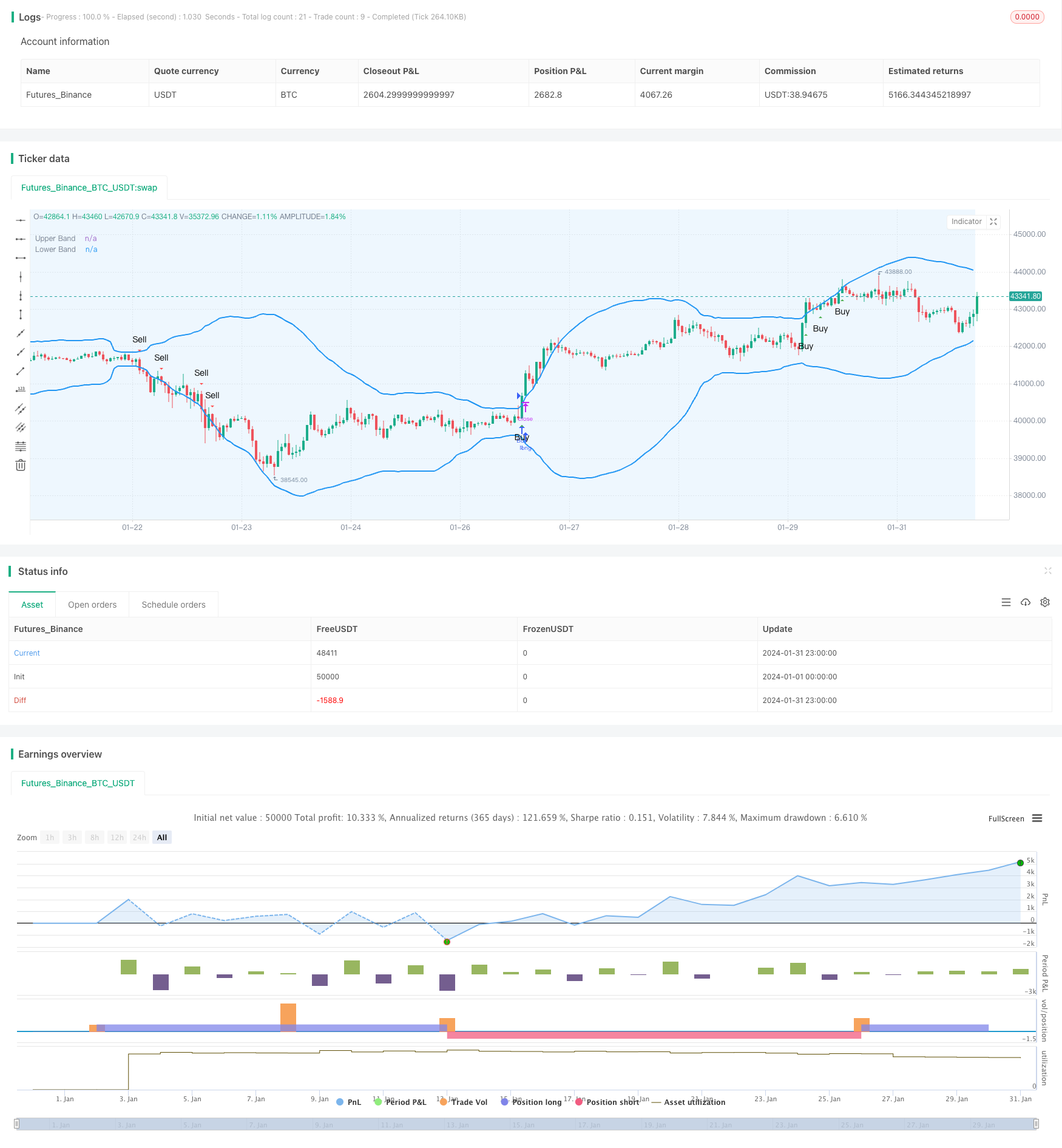

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Optimized Bollinger Bands Strategy for Gold", overlay=true)

// Bollinger Bands Settings

length = input(50, title="BB Length", minval=1)

mult = input(2.5, title="Multiplier", minval=0.001, maxval=50)

// Bollinger Bands

basis = sma(close, length)

upper = basis + mult * stdev(close, length)

lower = basis - mult * stdev(close, length)

// Plotting

plot(upper, color=color.blue, title="Upper Band", linewidth=2)

plot(lower, color=color.blue, title="Lower Band", linewidth=2)

// Highlight the region between upper and lower bands

bgcolor(upper > lower ? color.new(color.blue, 90) : na)

// Buy Signal with arrow

longCondition = crossover(close, upper)

plotshape(series=longCondition, title="Buy Signal", color=color.green, style=shape.triangleup, text="Buy", location=location.belowbar, size=size.small)

// Sell Signal with arrow

shortCondition = crossunder(close, lower)

plotshape(series=shortCondition, title="Sell Signal", color=color.red, style=shape.triangledown, text="Sell", location=location.abovebar, size=size.small)

// Strategy

strategy.entry("Buy", strategy.long, when=longCondition)

strategy.entry("Sell", strategy.short, when=shortCondition)