概述

该策略是一种典型的跟踪市场趋势的量化策略。它主要利用布林带、RSI指标以及MACD指标判断市场的超买超卖情况,进行反向交易。当出现超买信号时,adoption该策略通过做空获得超额收益;当出现超卖信号时,该策略通过做多获得超额收益。

策略原理

该策略主要使用三个指标进行判断。

首先,它使用布林带上下轨来判断价格是否进入超买或超卖区域。具体来说,如果价格高于上轨,表示市场可能处于超买状态;如果价格低于下轨,表示市场可能处于超卖状态。

其次,该策略使用RSI指标判断市场的超买超卖情况。RSI低于30时视为超卖信号;RSI高于70时视为超买信号。

最后,该策略还使用MACD指标的零轴交叉作为辅助判断。当MACD线从上向下跨过信号线时生成卖出信号;当MACD线从下向上跨过信号线时生成买入信号。

综合这三个指标的判断,该策略可以有效捕捉市场反转的时机,按照反向进场,随大趋势运行,获得超额收益。

策略优势分析

该策略最大的优势在于结合多重指标判断市场趋势,增强了决策的正确性。

首先,布林带本身就具有很强的趋势判断能力。结合布林带通道判断价格是否进入超买超卖区域。

其次,RSI指标是一种很典型的反转指标。RSI指标的超买超卖阈值设定,也增强了判断的准确性。

最后,MACD零轴交叉是非常经典的判断买卖点的指标。结合 MACD的零轴交叉信号,可以非常准确地判断反转点。

总的来说,该策略通过多种指标的有效结合,判断力更加准确,胜率也会比单一指标更高,从而获得稳定的超额收益。

策略风险分析

尽管该策略设计合理,结合多重指标判断,但仍然存在一定的风险需要警惕。

首先,如果遇到市场出现长期单边行情而没有明显反转时,该策略会产生较多的亏损交易。此时需要暂时退出,等待反转机会出现。

其次,RSI和MACD的参数设置需要根据不同市场谨慎测试。如果参数设置不当,也会导致错误信号,产生亏损。

最后,布林带本身对异常波动也比较敏感。当市场出现低频率的剧烈波动时,需要审慎对待布林带信号。

总的来说,该策略主要适用于波动较大、反转比较明显的市场环境。在风险管理方面,可以设置止损来控制最大亏损;另外优化参数使其适应不同市场也很关键。

策略优化方向

该策略可以从以下几个方面进行进一步优化:

优化布林带参数,使布林带更贴近市场波动范围。可以测试不同长度周期以及标准差倍数参数,找到最优参数组合。

优化RSI参数,调整超买超卖阈值,降低误报率。可以通过回测找到最佳的参数设置。

优化MACD参数,找到最佳的快线慢线和信号线参数组合,提高MACD零轴交叉的判断准确性。

增加止损策略,限制单次亏损百分比,有效控制风险。

增加仓位管理策略,根据市场波动程度动态调整每次交易的仓位和杠杆。

结合其他指标和交易信号,提高决策的准确性。例如结合交易量异常等其他信号。

通过参数优化、风险控制、信号融合等方法,可以进一步提升该策略的稳定性和收益率。

总结

该反转布林带RSI MACD量化策略,通过合理运用布林带、RSI指标和MACD指标的交叉判决,有效判断市场可能出现的反转时机,按照反向交易,跟踪市场大趋势。相比单一指标判断,该组合策略判断更加准确,胜率更高,能获得较为稳定的超额收益。当然在实际运用中,仍需要综合考虑市场环境、参数优化、风险控制等因素,以提高策略的健壮性。

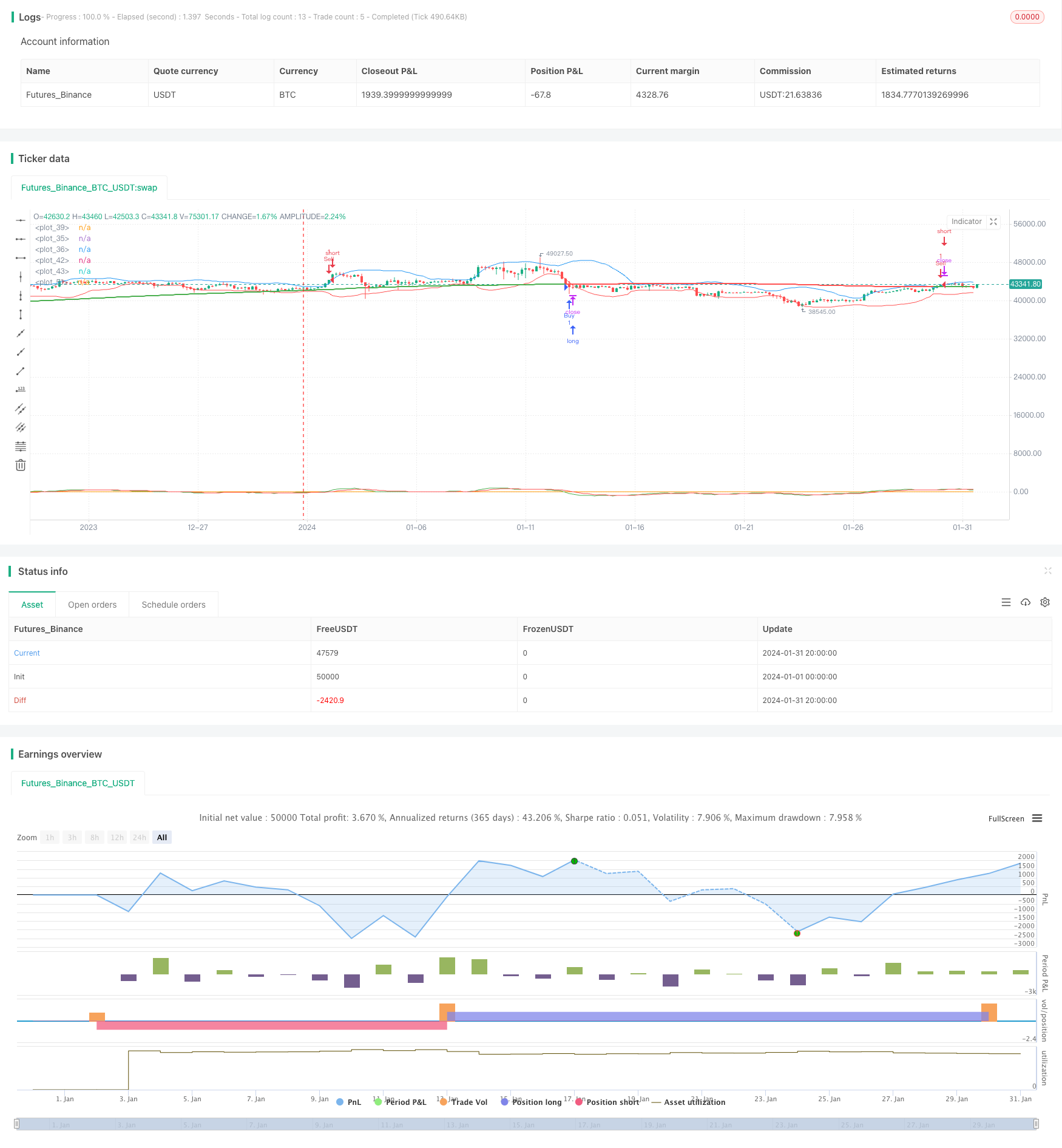

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("BBands + RSI + MACD Strategy", overlay=true)

// Bollinger Bands

lengthBB = input(20, title="BB Length")

multBB = input(2.0, title="BB Standard Deviation")

basis = sma(close, lengthBB)

dev = multBB * stdev(close, lengthBB)

upperBB = basis + dev

lowerBB = basis - dev

// RSI

lengthRSI = input(14, title="RSI Length")

oversold = input(30, title="Oversold Threshold")

overbought = input(70, title="Overbought Threshold")

rsi = rsi(close, lengthRSI)

// MACD

fastLength = input(12, title="MACD Fast Length")

slowLength = input(26, title="MACD Slow Length")

signalLength = input(9, title="MACD Signal Smoothing")

[macdLine, signalLine, _] = macd(close, fastLength, slowLength, signalLength)

// Conditions

longCondition = close < lowerBB and rsi < oversold and macdLine < signalLine

shortCondition = close > upperBB and rsi > overbought and macdLine > signalLine

// Strategy Entry and Exit

if (longCondition)

strategy.entry("Buy", strategy.long)

if (shortCondition)

strategy.entry("Sell", strategy.short)

// Plotting Bollinger Bands

plot(upperBB, color=color.blue)

plot(lowerBB, color=color.red)

// Plotting RSI

plot(rsi, color=color.orange)

// Plotting MACD

plot(macdLine, color=color.green)

plot(signalLine, color=color.red)

// 200-period SMA

sma200 = sma(close, 200)

// Determine Color Change

plot(sma200, color=close > sma200 ? color.green : color.red, linewidth=2)