概述

四重交叉策略是一种中长线交易策略。它综合使用多种技术指标来识别股价的趋势变化,在关键点产生交易信号。主要的技术指标包括均线、成交量、相对强弱指数(RSI)和移动平均聚散指标(MACD)。这种多指标组合能够提高信号的可靠性,降低错误交易的概率。

策略原理

四重交叉策略的交易决策基于下述四组指标的组合信号:

- 价格与200日指数移动平均线(EMA200)的交叉

- 价格本日收盘价与前一日收盘价的关系

- 成交量的放大特征

- RSI的超买超卖信号

- MACD的黄金交叉与死亡交叉

当这四组指标发出同一方向的信号时,即产生交易决策。另外,还设置了两个独立的信号来补充:价格与20日EMA的距离比率和布林带边界触及。总体而言,该策略追求降低错误信号的概率,取得较为可靠的交易机会。

优势分析

四重交叉策略综合运用多种指标,这是其最大的优势。单一指标很难全面判断市场,组合指标可以提供更多维度的参考,减少错误。具体来说,该策略的主要优势有:

- 使用EMA200判断主线,能识别中长线趋势

- 成交量放大特征过滤假突破

- RSI避免交易超买超卖区域

- MACD判断短期内部趋势和转折

- 双重独立信号提高可靠性

总的来说,四重交叉策略非常适合中长线持仓交易,能够在主线大趋势中获取较稳定的报酬。

风险分析

四重交叉策略也存在一些风险,主要集中在以下几个方面:

- 指标发出错误信号的概率仍存在

- 没有止损止盈设置,无法控制单笔损失

- 回撤可能较大,需要有足够的心理承受能力

- 交易频率可能过于频繁或稀疏

- 参数设置不当会影响实际效果

此外,四重交叉策略对参数和条件进行了预设,这也制约了其适应性。如果市场环境发生重大变化,该策略的效果会打折扣。

优化方向

根据上述风险分析,四重交叉策略可以从以下几个方面进行优化:

- 增加止损止盈功能,控制单笔损失

- 调整参数组合,优化交易频率

- 引入算法判断,提高策略的适应性

- 增加更多条件限制,进一步控制错误交易

这些优化能够在保持策略优点的同时,降低交易风险,提高报酬率。

总结

综上所述,四重交叉策略利用多指标判断的优势控制风险,旨在获取高概率和高可靠性的中长线交易机会。它非常适合有足够资金和心理承受能力的投资者持有。通过引入止损止盈和动态优化等手段,该策略可以得到进一步增强。它代表了多指标综合运用交易思路的典型范例。

策略源码

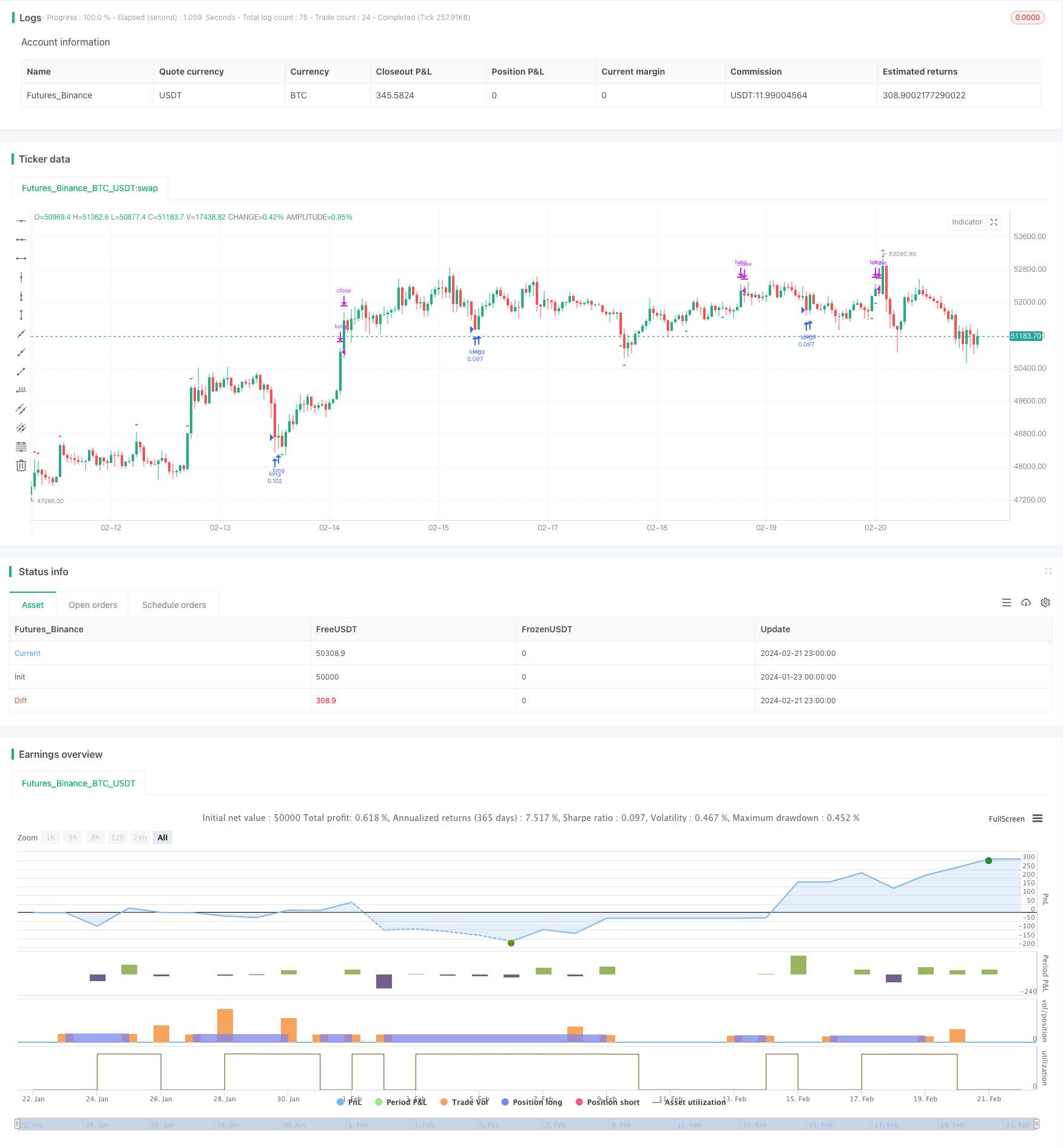

/*backtest

start: 2024-01-23 00:00:00

end: 2024-02-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © anonXmoous

//@version=5

strategy("Quadruple Cross Strategy", overlay=true, initial_capital=100000, currency="TRY", default_qty_type=strategy.percent_of_equity, default_qty_value=10, pyramiding=0, commission_type=strategy.commission.percent, commission_value=0.1)

// Verileri tanımla

price = close

ema200 = ta.ema(price, 200)

ema20 = ta.ema(price, 20)

vol= volume

rsi = ta.rsi(price, 14)

[macdLine, signalLine, histLine] = ta.macd(price, 12, 26, 9)

n = 20 // SMA periyodu

k = 2.5 // Standart sapma katsayısı

// Bollinger bandı parametrelerini tanımla

sma = ta.sma(price, n) // 20 günlük SMA

std = ta.stdev(price, n) // 20 günlük standart sapma

upperBB = sma + k * std // Bollinger bandının üst sınırı

lowerBB = sma - k * std // Bollinger bandının alt sınırı

// Alım sinyali koşullarını belirle

buyCondition1 = price > ema200 and (price - ema200) / ema200 <= 0.05 or price == ema200

buyCondition2 = price > price[1]

buyCondition3 = vol > vol[1] and vol[1] > vol[2]

buyCondition4 = rsi > 35 and rsi > rsi[1]

buyCondition5 = macdLine > signalLine and histLine > 0

buyCondition6 = price < ema20 and (price - ema20) / ema20 <= -0.14 // bağımsız al değiken 1

buyCondition7 = price < lowerBB // bağımsız al değiken 2- Bollinger bandının alt sınırına dokunduysa, alım sinyali

// Satım sinyali koşullarını belirle

sellCondition1 = price < ema200 and (price - ema200) / ema200 >= -0.03 or price == ema200

sellCondition2 = price < price[1]

sellCondition3 = vol > vol[1] and vol[1] > vol[2]

sellCondition4 = rsi < 65 and rsi < rsi[1]

sellCondition5 = macdLine < signalLine and histLine < 0

sellCondition6 = price > ema20 and (price - ema20) / ema20 >= 0.19 // bağımsız sat değiken 1

sellCondition7 = price > upperBB // bağımsız sat değiken 2- Bollinger bandının üst sınırına dokunduysa, satım sinyali

// Alım ve satım sinyallerini oluştur

buySignal = (buyCondition1 and buyCondition2 and buyCondition3 and buyCondition4 and buyCondition5) or buyCondition6 or buyCondition7

sellSignal = (sellCondition1 and sellCondition2 and sellCondition3 and sellCondition4 and sellCondition5) or sellCondition6 or sellCondition7

// Alım ve satım sinyallerini stratejiye ekle

if (buySignal)

strategy.entry("long", strategy.long, comment = "Buy")

if (sellSignal)

strategy.close("long", comment = "Sell")

// Alım ve satım sinyallerini grafik üzerinde göster

plotshape(buySignal, style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.small)

plotshape(sellSignal, style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.small)