概述

本策略名为“基于价格行为的机构交易策略”。它attempts to利用机构交易者的某些交易模式,特别是他们倾向于在特定“订单区块”附近下单的倾向。 该策略结合了公平价值、流动性和价格行为的元素,以确定进入和退出市场的时机。

策略原理

该策略的核心是识别“订单区块”- 即过去发生过大量机构交易活动的价格区域。 这些区域与显著的流动性相关。订单区块是使用价格结构确定的,通常与关键的技术价格水平相关。

公平价值被定义为基于移动平均线等指标的工具的“合理”价格。当当前价格远离公平价值时,这被视为市场失衡的信号。

流动性也是一个关键因素,因为机构交易者倾向于在高流动性区域执行交易。

该策略通过计算简单移动平均线来确定公平价值。然后它识别长度为20个周期的潜在订单区块。 如果关闭价格与公平价值之间的差距低于订单区块总高度的38.2%,则确定订单区块。

多头订单区块被认为是买入信号。空头订单区块被视为卖出信号。

优势分析

该策略的主要优势是利用了机构交易者的交易模式,这可能使其超越基于更机械化指标的策略。通过关注订单流和价值区域,它结合了几种不同类型的分析。

其他优势包括:

- 利用流动性获取较优执行

- 依赖易于可视化和理解的概念如订单流

- 容易在图表上可视化订单区块

- 有灵活性调整参数如区块长度

风险分析

该策略也面临一些潜在的风险,比如:

- 依赖对过去价格行为的判断

- 在没有订单流的市场中可能无法正常运行

- 可能会产生虚假信号

- 可能会错过短期趋势

为了缓解这些风险,建议考虑:

- 结合其他指标过滤虚假信号

- 调整参数如区块长度

- 对交易发出的信号进行过滤

优化方向

以下是本策略的一些潜在优化:

- 测试并优化关键参数值如区块长度和公平价偏差百分比。

- 添加其他指标和过滤器以提高质量

- 建立止损和获利获取机制

- 结合更多的数据源如订单簿活动

- 测试在不同期间(日内,多日等)和不同市场中的健壮性

- 添加机器学习预测来过滤信号

总结

总而言之,该策略提供了一种独特的方法来利用机构交易员的交易行为。它融合了多个要素,并具有一定的优势。但是像大多数交易策略一样,它也会面临市场发生变化和出现非预期价格行为时的风险。 通过持续的测试、优化和风险管理,该策略可以成为一个有价值的量化交易工具。

策略源码

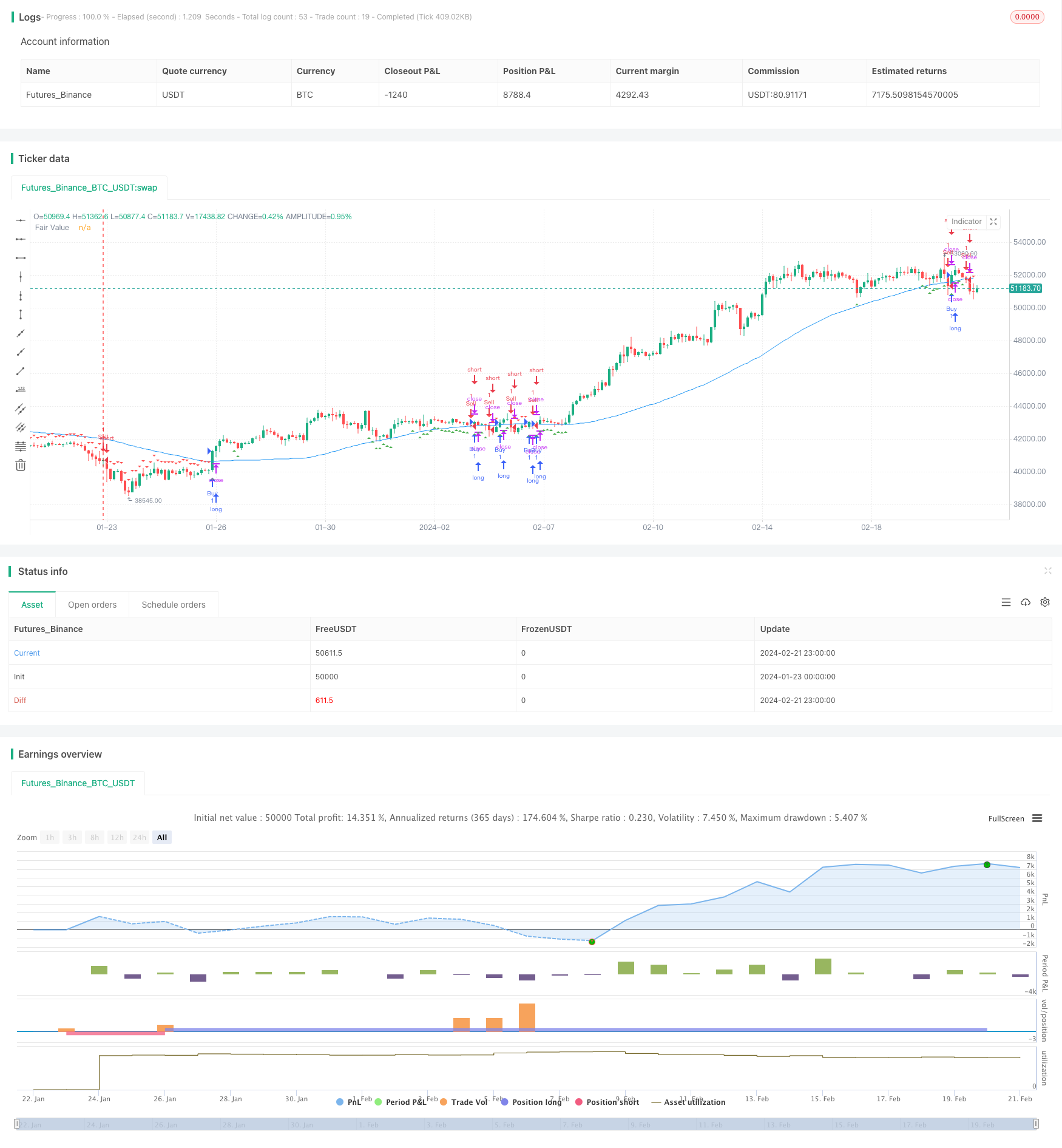

/*backtest

start: 2024-01-23 00:00:00

end: 2024-02-22 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("ICT Strategy", overlay=true)

// Input variables

length = input.int(20, minval=1, title="Order Block Length")

fairValuePeriod = input.int(60, minval=1, title="Fair Value Period")

// Calculate fair value

fairValue = ta.sma(close, fairValuePeriod)

// Determine order blocks

isOrderBlock(high, low) =>

highestHigh = ta.highest(high, length)

lowestLow = ta.lowest(low, length)

absHighLowDiff = highestHigh - lowestLow

absCloseFairValueDiff = (close - fairValue)

(absCloseFairValueDiff <= 0.382 * absHighLowDiff)

isBuyBlock = isOrderBlock(high, low) and close > fairValue

isSellBlock = isOrderBlock(high, low) and close < fairValue

// Plot fair value and order blocks

plot(fairValue, color=color.blue, title="Fair Value")

plotshape(isBuyBlock, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(isSellBlock, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// Strategy logic

if (isBuyBlock)

strategy.entry("Buy", strategy.long)

if (isSellBlock)

strategy.entry("Sell", strategy.short)