概述

四均线多时间框架趋势策略是一种基于4个不同周期的双指数移动平均线(DEMA)构建多时间框架判断趋势方向的策略。该策略同时利用10日线、15日线、21日线和30日线四条均线判断价格趋势,通过多时间框架过滤误报机会,寻找高概率的趋势方向。

策略原理

该策略通过计算10日、15日、21日和30日四条双指数移动平均线,并比较其大小关系来判断行情趋势方向。具体规则如下:

计算10日线DEMA、15日线DEMA、21日线DEMA和30日线DEMA。

当10日线上穿15日线,15日线上穿21日线,21日线上穿30日线时,判断为多头趋势形成,做多。

当30日线下穿21日线,21日线下穿15日线,15日线下穿10日线时,判断为空头趋势形成,做空。

盈利平仓或止损退出。

该策略通过多时间框架判断,能过滤掉部分噪音,锁定较高概率的趋势方向。同时,越长周期的均线过滤效果越好,所以策略采用了10、15、21、30日四条均线构建判断逻辑。

策略优势

多时间框架设计,通过longer timeframe的DEMA过滤noise,抓住高概率趋势。

利用DEMA指标的趋势跟踪性能更好的特点。

规则清晰简单,容易理解实现,适合量化交易。

风险及解决

多头止损或空头止损风险。采用移动止损来控制单笔止损。

回撤较长。调整持仓规模,降低单笔风险。

参数优化空间有限。加入 Aux信号辅助判断。

优化空间

加入停损策略,进一步控制风险。

优化 DEMA 周期参数。加入更多 Aux信号判断。

结合趋势指标,降低趋势反转概率。

总结

四均线多时间框架趋势策略通过比较10日线、15日线、21日线和30日线DEMA的大小关系,判断价格趋势方向,属于典型的趋势追踪策略。相比单一均线,该策略采用了多时间框架判断,能有效过滤部分噪音,提高判断准确性。同时,策略规则简单清晰,容易理解和实现,适合量化交易。总体来说,该策略利用DEMA指标的优势,设计了多时间框架的判断逻辑,抓住了高概率精准趋势,值得推荐。

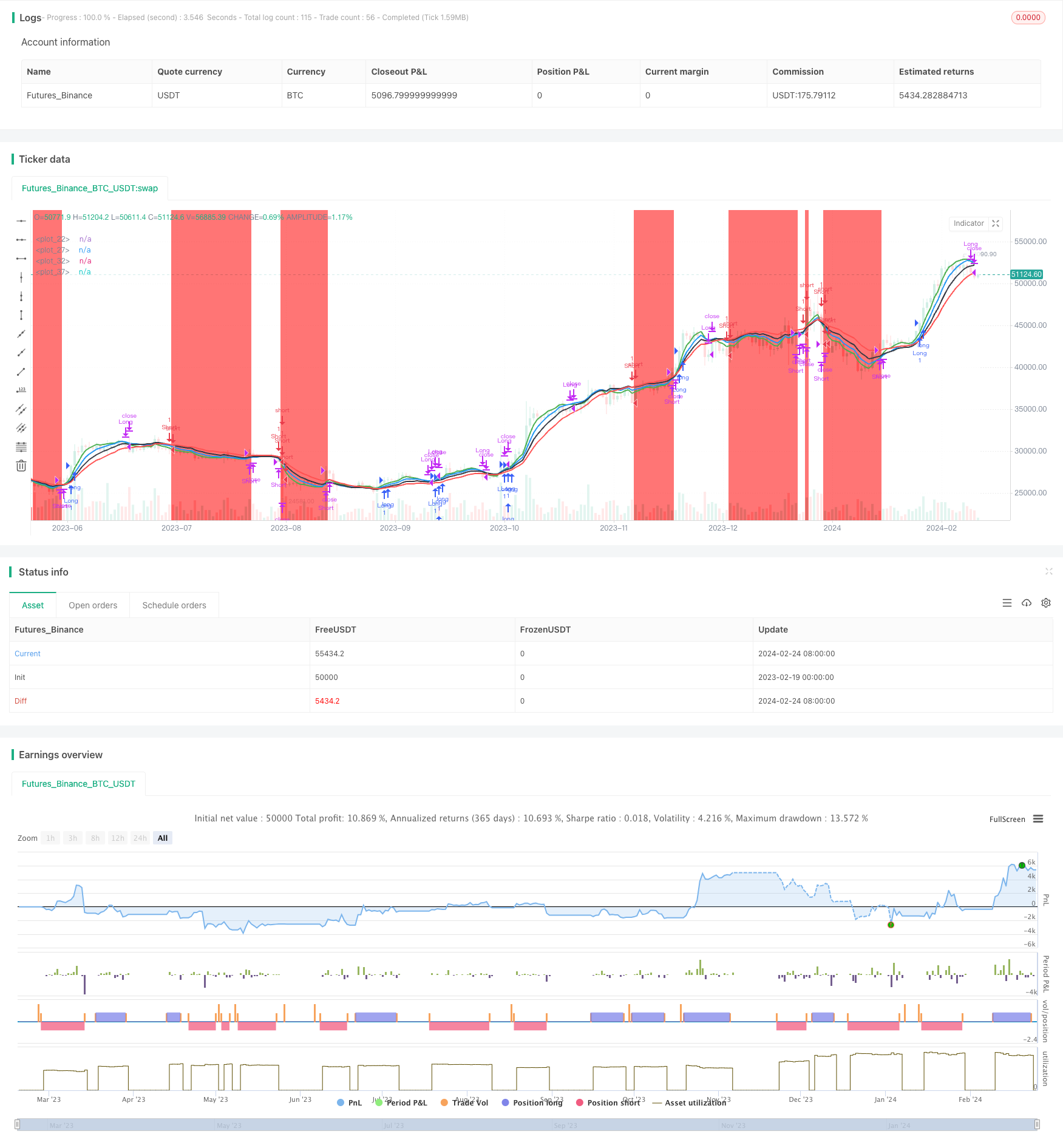

/*backtest

start: 2023-02-19 00:00:00

end: 2024-02-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Author: HighProfit

//Lead-In

strategy("dema10-15-21-30", shorttitle="4dema", overlay=true)

short = input(10, minval=1)

srcShort = input(close, title="Source Dema 1")

long = input(15, minval=1)

srcLong = input(close, title="Source Dema 2")

long2 = input(21, minval=1)

srcLong2 = input(close, title="Source Dema 3")

long3 = input(30, minval=1)

srcLong3 = input(close, title="Source Dema 4")

e1 = ema(srcShort, short)

e2 = ema(e1, short)

dema1 = 2 * e1 - e2

plot(dema1, color=green, linewidth = 2)

e3 = ema(srcLong, long)

e4 = ema(e3, long)

dema2 = 2 * e3 - e4

plot(dema2, color=blue, linewidth = 2)

e5 = ema(srcLong2, long2)

e6 = ema(e5, long2)

dema3 = 2 * e5 - e6

plot(dema3, color=black, linewidth = 2)

e7 = ema(srcLong3, long3)

e8 = ema(e7, long3)

dema4 = 2 * e7 - e8

plot(dema4, color=red, linewidth = 2)

//Conditions

longCondition = (dema1>dema2) and (dema1>dema3) and (dema1>dema4) and (dema2>dema3) and (dema2>dema4) and (dema3>dema4)

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.close("Long", cross(dema1,dema2))

shortCondition = (dema4>dema3) and (dema4>dema2) and (dema4>dema1) and (dema3>dema2) and (dema3>dema1) and (dema2>dema1)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.close("Short", cross(dema1,dema2))

bgcolor(longCondition?green:white , transp=70, offset=1)

bgcolor(shortCondition?red:white , transp=70, offset=1)