概述

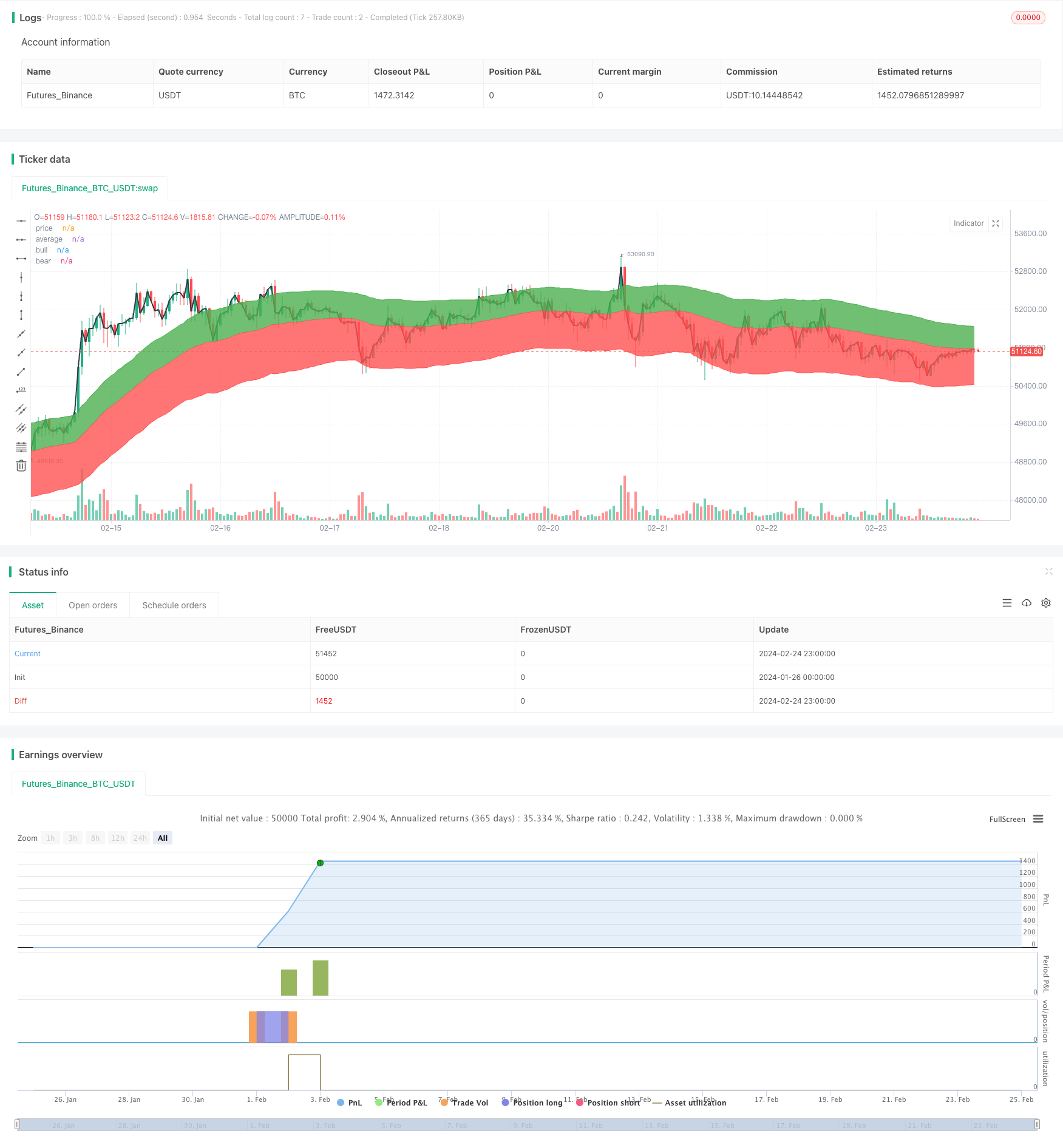

本策略是一个利用ATR指标构建交易信号的突破策略。该策略运用均线系统产生交易信号,通过黄金分割放大后的ATR指标上下通道构建多空仓位。能够在趋势中大幅获利,在震荡行情中获得小额稳定收益。

策略原理

代码中通过求取收盘价的ATR周期指标,并放大1.618倍作为上轨,放大2.618倍作为下轨,与均线ema结合构建布林通道突破交易系统。当价格从下轨突破向上时做多,价格从上轨突破向下时做空,实现趋势跟踪获利。

策略优势

- ATR指标能有效地捕捉市场波动率,利用波动率构建自适应交易通道,避免使用固定参数导致的过拟合。

- 黄金分割放大后的ATR上下轨能在不增加交易频率的前提下扩大收益空间。

- 均线系统过滤了短期噪音,与ATR通道配合能锁定中长线趋势。

策略风险

- ATR指标对极端行情的应对存在滞后。

- 黄金分割放大倍数不当可能导致交易频率过高。

- 长周期均线切换信号发生滞后。

策略优化

- ATR指标可以考虑与市场波动率指数VIX结合使用或调整放大倍数。

- 均线系统可以引入多时间周期EMA,构建自适应交易系统。

- 可以设立止损机制降低单笔交易最大损失。

总结

本策略综合运用均线过滤、ATR通道跟踪和黄金分割原理。能够有效跟踪中长线趋势,具有良好的稳定性。通过参数调整可以适应不同品种不同周期的应用,值得探索其良好的市场适应性。

策略源码

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("ATR Long Only Strategy lower band buy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

len = input(52, type=input.integer, minval=1, title="Length")

mul = input(1.618, type=input.float, minval=0, title="Length")

mullow = input(2.618, type=input.float, minval=0, title="Length")

price = sma(close, 1)

average = ema(close, len)

diff = atr(len) * mul

difflow = atr(len) * mullow

bull_level = average + diff

bear_level = average - difflow

bull_cross = crossunder(price, bear_level)

bear_cross = crossunder(bull_level, price)

FromMonth = input(defval = 8, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 18, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2008, title = "From Year", minval = 2008)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2020, title = "To Year", minval = 2019)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

startTimeOk() => true

if (startTimeOk())

strategy.entry("KOP", strategy.long, when=bull_cross)

strategy.close("KOP", when=bear_cross) //strategy.entry("Sell", strategy.short, when=bear_cross)

plot(price, title="price", color=color.black, transp=50, linewidth=2)

a0 = plot(average, title="average", color=color.red, transp=50, linewidth=1)

a1 = plot(bull_level, title="bull", color=color.green, transp=50, linewidth=1)

a2 = plot(bear_level, title="bear", color=color.red, transp=50, linewidth=1)

fill(a0, a1, color=color.green, transp=97)

fill(a0, a2, color=color.red, transp=97)