概述

本策略结合MACD动量指标和DMI趋向指标,在符合条件时进行做多操作。其 exits设置了固定止盈和自定义的波动性 trailing stop来锁定收益。

原理

该策略的 entries 依赖 MACD 和 DMI 指标:

- MACD 为正(MACD 线高于Signal线)时,表示市场上涨动能增强

- DMI中的DI+高于DI- 时,表示市场处于趋势向上阶段

当上述两个条件同时满足时,做多开仓。

Position exits 则有两个标准:

- 固定止盈:close 价格涨幅达到设置的百分比时止盈

- 波动性追踪止损:使用 ATR 和最近最高价计算出一个动态调整的止损位置。这个可以根据市场波动性来 trailing stop loss

优势

- MACD 和 DMI 的结合可以比较可靠地判断市场的趋势方向,减少错误的操作

- 止盈条件结合了固定止盈和波动性止损,可以灵活锁定利润

风险

- MACD 和 DMI 都可能产生假信号,导致不必要的亏损

- 固定止盈可能让利润无法最大化

- 波动性止损的 trails 速度可能调整不当,过于激进或保守

优化方向

- 可以考虑加入其它指标过滤入场信号,例如利用 KDJ 指标判断是否过超买过超卖

- 可以测试不同的参数以获得更好的止盈止损效果

- 可以根据具体交易品种调整移动平均线等参数,优化系统

总结

本策略综合多个指标判断市场趋势和条件,在较大概率利好情况下介入。止盈条件也做了优化设计,在保证一定利润的同时也考虑了收益锁定的灵活性。通过参数调整以及进一步的风险管理,本策略可以成为一个稳定输出的量化交易系统。

策略源码

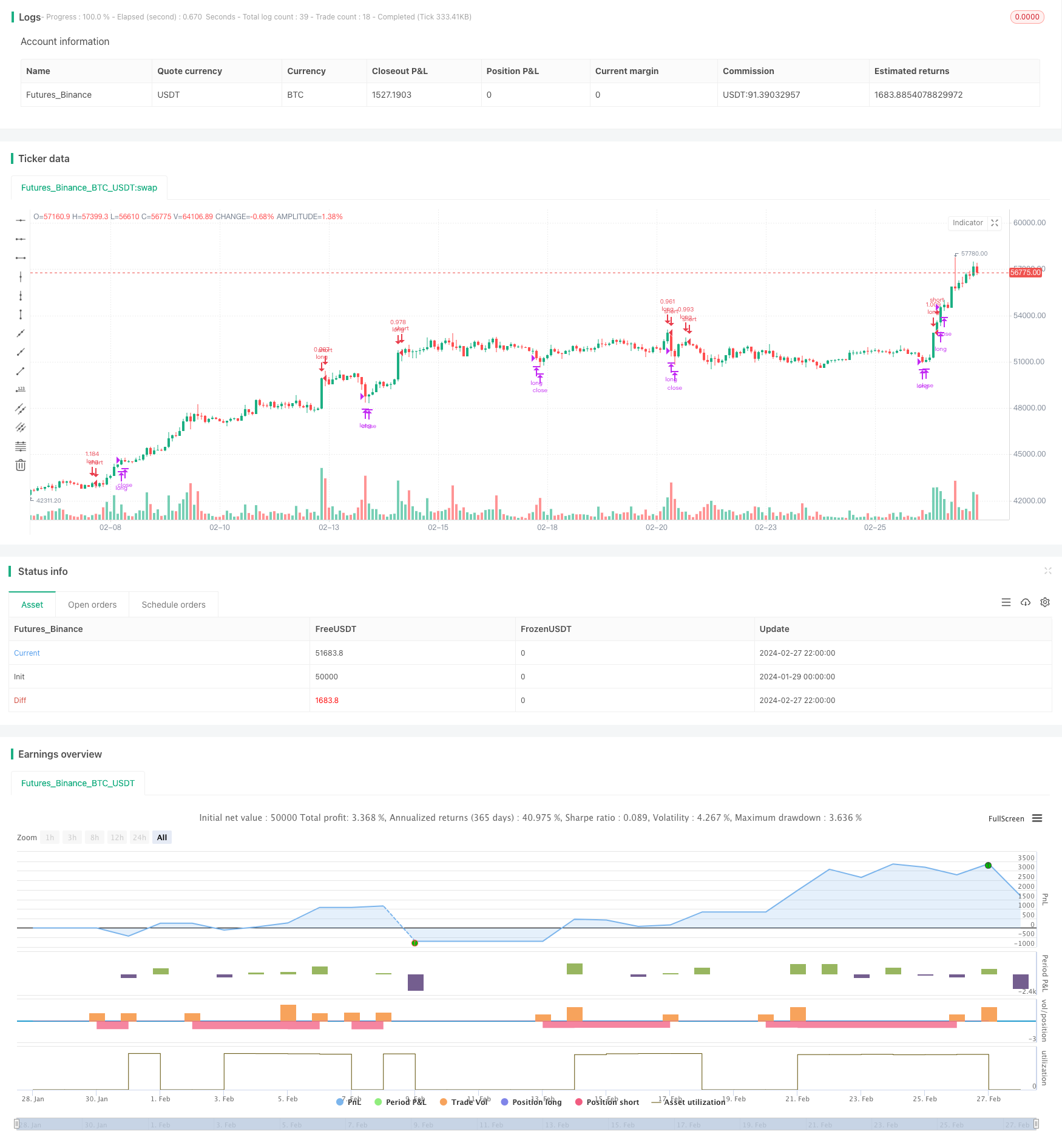

/*backtest

start: 2024-01-29 00:00:00

end: 2024-02-28 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=4

strategy(shorttitle='(MACD + DMI Scalping with Volatility Stop',title='MACD + DMI Scalping with Volatility Stop by (Coinrule)', overlay=true, initial_capital = 100, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type=strategy.commission.percent, commission_value=0.1)

// Works better on 3h, 1h, 2h, 4h

//Backtest dates

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2021, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

// DMI and MACD inputs and calculations

[pos_dm, neg_dm, avg_dm] = dmi(14, 14)

[macd, macd_signal, macd_histogram] = macd(close, 12, 26, 9)

Take_profit= ((input (3))/100)

longTakeProfit = strategy.position_avg_price * (1 + Take_profit)

length = input(20, "Length", minval = 2)

src = input(close, "Source")

factor = input(2.0, "vStop Multiplier", minval = 0.25, step = 0.25)

volStop(src, atrlen, atrfactor) =>

var max = src

var min = src

var uptrend = true

var stop = 0.0

atrM = nz(atr(atrlen) * atrfactor, tr)

max := max(max, src)

min := min(min, src)

stop := nz(uptrend ? max(stop, max - atrM) : min(stop, min + atrM), src)

uptrend := src - stop >= 0.0

if uptrend != nz(uptrend[1], true)

max := src

min := src

stop := uptrend ? max - atrM : min + atrM

[stop, uptrend]

[vStop, uptrend] = volStop(src, length, factor)

closeLong = close > longTakeProfit or crossunder(close, vStop)

//Entry

strategy.entry(id="long", long = true, when = crossover(macd, macd_signal) and pos_dm > neg_dm and window())

//Exit

strategy.close("long", when = closeLong and window())