概述

三重确认趋势追踪策略通过组合使用均线、意忆线和超级趋势等三大指标的信号,实现对趋势的高概率捕捉。当三大指标同时发出买入或卖出信号时,策略会及时入场,追踪趋势;当趋势反转时,策略会快速止损、反手做空。

策略原理

均线判断主趋势

策略使用长度为52周期的均线判断主趋势方向。当价格上穿均线时,判断为上升趋势;当价格下穿均线时,判断为下降趋势。

意忆线识别次级反转

策略同时使用意忘线来识别短期的次级反转。意忘线的计算方式与均线类似,但CLOSE价用开盘价替代,能更快速地反映价格反转信息。当价格上穿下跌的意忘线时,预示着Prices短线企稳反弹的信号;当价格下穿上升的意忘线时,预示着价格短线回落的信号。

超级趋势判断反转点

策略还同时结合超级趋势指标判断关键的反转点。超级趋势指标结合ATR指标的窗口期和价格 datos,动态调整通道上下轨,从而判断反转的时机。

三重确认信号过滤

当均线、意忘线、超级趋势三个指标同时发出买入信号时,策略才会做多;当三个指标同时发出卖出信号时,策略才会做空。通过三重指标确认,可有效过滤假信号,提高入场的概率。

优势分析

多维度判断,高概率

策略通过组合均线、意忘线、超级趋势三个指标,从不同维度判断趋势和关键点,确保高概率入场。

快速反应,实时跟踪

意忘线的引入,保证了策略可以快速反应价格的短线反转;ATR自适应通道的超级趋势指标,也可实时跟踪价格变化。

自动止盈止损,有效控制风险

策略内置自动止盈止损逻辑,可根据ATR动态调整止盈止损点,有效控制单笔亏损。

风险及解决方法

交易频率过高风险

由于策略交易信号频繁,容易造成过度交易。可适当调大均线周期参数,减少交易频率。

反转不确定性风险

意忘线和超级趋势指标判断反转点的效果并不确定,可能出现误判风险。可增加指标参数的过滤条件,确保更高概率的反转信号。

震荡行情亏损风险

震荡行情中,由于反复交叉,策略会频繁开仓又止损,造成亏损风险。可识别震荡行情,在此阶段暂停策略交易。

优化方向

结合波动率指标

可考虑结合波动率类指标,比如布林带。当价格接近布林带上下轨时,避免新开仓,可有效规避震荡市的风险。

增加入场过滤条件

可尝试增加其他辅助判断指标,如KDJ、MACD等,当它们也同时发出信号时,才入场。这可进一步过滤假信号,减少不必要的交易。

优化止盈止损策略

可优化止盈止损策略,比如移动止盈、指数移动止盈、半仓间隔止盈等方式,使盈利更多更稳定。

总结

三重确认趋势追踪策略充分利用均线、意忘线、超级趋势三大指标的优势,实现对趋势的高概率判断和捕捉。同时设置自动止盈止损机制有效控制单笔亏损。值得进一步优化的是,可结合其他辅助指标过滤入场,以及改进止盈止损策略,使策略更实用。

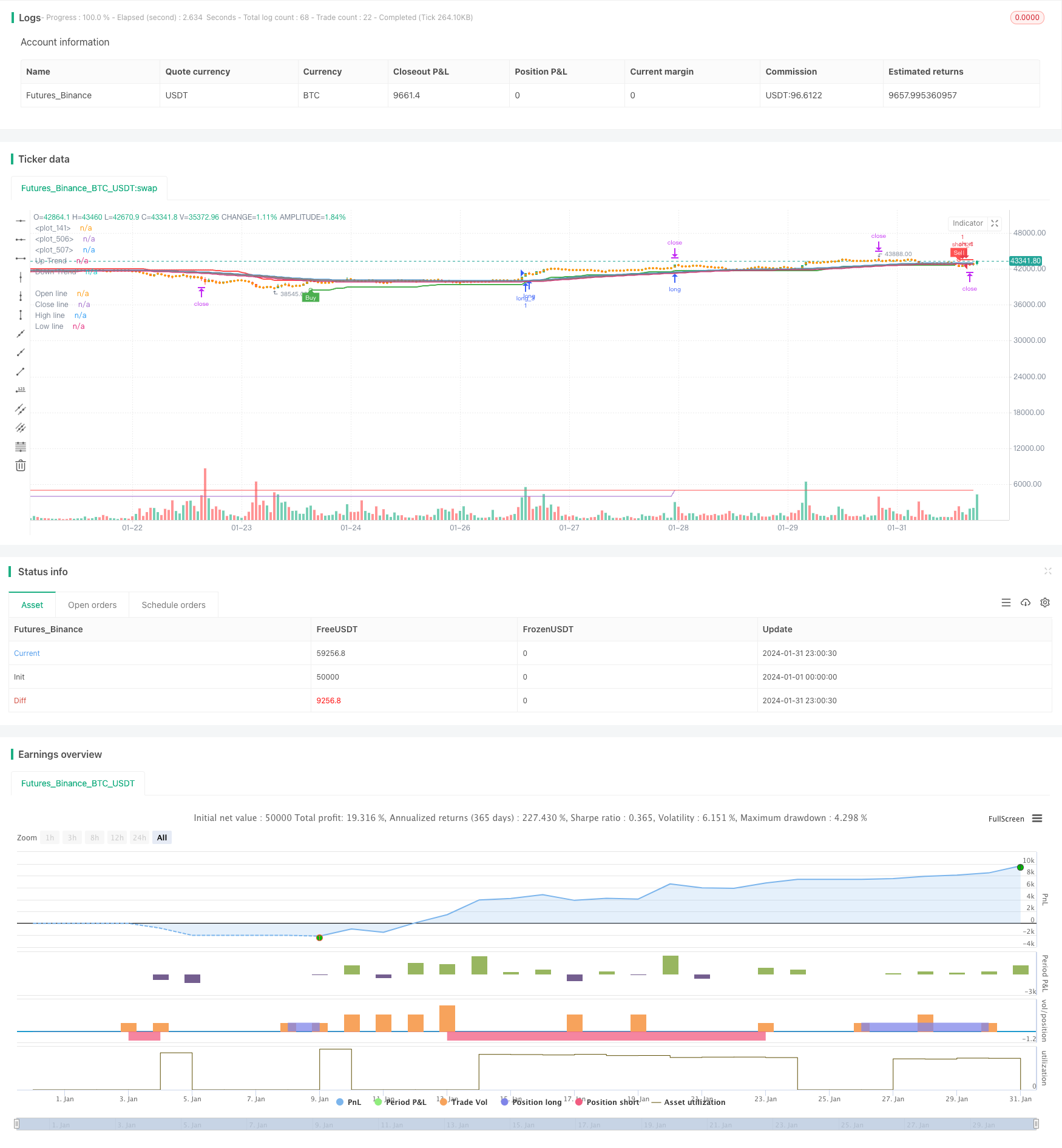

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//custom variables

hei_col = 0 //1 for green 0 for red

qqe_col = 0 //1 for blue 0 for red

supa_col = 0 //1 for buy 0 for sell

float upratr=0

float lwratr=0

//end

strategy(title='Death_star', overlay=true,calc_on_every_tick = true)

ma_type = input.string(title='MA Type', defval='EMA', options=['EMA', 'SMA', 'SWMA', 'VWMA', 'WMA'])

ma_period = input.int(title='MA Period (Length)', defval=52, minval=1)

ma_period_smoothing = input.int(title='MA Period smoothing (Length)', defval=10, minval=1)

color_positive = input(title='Positive color (Bullish)', defval=color.new(#26A69A, 50))

color_negative = input(title='Negative color (Bearish)', defval=color.new(#EF5350, 50))

color_hl = input(title='High & Low cloud color', defval=color.new(#808080, 80))

show_line = input(title='Show (lines)', defval=false)

show_hl_cloud = input(title='Show (High & Low cloud)', defval=true)

show_oc_cloud = input(title='Show (Open & Close cloud)', defval=true)

//————————————————————————————————————————————————————————————————————————————————

// I.2. Settings, Function definition — — — — — — — — — — — — — — — — — — — — — —

//————————————————————————————————————————————————————————————————————————————————

f_ma_type(input_ma_type, input_source, input_ma_period) =>

result = float(na)

if input_ma_type == 'EMA'

result := ta.ema(input_source, input_ma_period)

result

if input_ma_type == 'SMA'

result := ta.sma(input_source, input_ma_period)

result

if input_ma_type == 'SWMA'

result := ta.swma(input_source)

result

if input_ma_type == 'VWMA'

result := ta.vwma(input_source, input_ma_period)

result

if input_ma_type == 'WMA'

result := ta.wma(input_source, input_ma_period)

result

result

//————————————————————————————————————————————————————————————————————————————————

// II.1. Calculations, MA — — — — — — — — — — — — — — — — — — — — — — — — — — — —

//————————————————————————————————————————————————————————————————————————————————

o = f_ma_type(ma_type, open, ma_period)

c = f_ma_type(ma_type, close, ma_period)

h = f_ma_type(ma_type, high, ma_period)

l = f_ma_type(ma_type, low, ma_period)

//————————————————————————————————————————————————————————————————————————————————

// II.2. Calculations, Heikin Ashi — — — — — — — — — — — — — — — — — — — — — — — —

//————————————————————————————————————————————————————————————————————————————————

ha = ticker.heikinashi(syminfo.tickerid)

ha_o = request.security(ha, timeframe.period, o)

ha_c = request.security(ha, timeframe.period, c)

ha_h = request.security(ha, timeframe.period, h)

ha_l = request.security(ha, timeframe.period, l)

//————————————————————————————————————————————————————————————————————————————————

// II.3. Calculations, MA (Smoothing) — — — — — — — — — — — — — — — — — — — — — —

//————————————————————————————————————————————————————————————————————————————————

ha_o_smooth = f_ma_type(ma_type, ha_o, ma_period_smoothing)

ha_c_smooth = f_ma_type(ma_type, ha_c, ma_period_smoothing)

ha_h_smooth = f_ma_type(ma_type, ha_h, ma_period_smoothing)

ha_l_smooth = f_ma_type(ma_type, ha_l, ma_period_smoothing)

//————————————————————————————————————————————————————————————————————————————————

// III.1. Display, Colors — — — — — — — — — — — — — — — — — — — — — — — — — — — —

//————————————————————————————————————————————————————————————————————————————————

tren = ha_c_smooth >= ha_o_smooth

color_trend = tren ? color_positive : color_negative

hei_col := tren ? 1 : 0

color_show_line_positive = show_line ? color_positive : na

color_show_line_negative = show_line ? color_negative : na

color_show_hl_cloud = show_hl_cloud ? color_hl : na

color_show_oc_cloud = show_oc_cloud ? color_trend : na

//————————————————————————————————————————————————————————————————————————————————

// III.2. Display, Plotting & Filling — — — — — — — — — — — — — — — — — — — — — —

//————————————————————————————————————————————————————————————————————————————————

o_line = plot(ha_o_smooth, color=color_show_line_positive, title='Open line')

c_line = plot(ha_c_smooth, color=color_show_line_negative, title='Close line')

h_line = plot(ha_h_smooth, color=color_show_line_positive, title='High line')

l_line = plot(ha_l_smooth, color=color_show_line_negative, title='Low line')

fill(o_line, c_line, color=color_show_oc_cloud, title='Open & Close Trendcloud', transp=90)

fill(h_line, l_line, color=color_show_hl_cloud, title='High & Low Trendcloud', transp=90)

upratr:=(ha_h_smooth)

lwratr:=(ha_l_smooth)

// supa

Periods = input(title='ATR Period', defval=9)

src = input(hl2, title='Source')

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=3.9)

changeATR = input(title='Change ATR Calculation Method ?', defval=true)

showsignals = input(title='Show Buy/Sell Signals ?', defval=true)

highlighting = input(title='Highlighter On/Off ?', defval=true)

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

up = src - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title='UpTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

plotshape(buySignal and showsignals ? up : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title='DownTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

plotshape(sellSignal and showsignals ? dn : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0)

longFillColor = highlighting ? trend == 1 ? color.green : color.white : color.white

shortFillColor = highlighting ? trend == -1 ? color.red : color.white : color.white

supa_col := trend == 1 ? 1 : 0

fill(mPlot, upPlot, title='UpTrend Highligter', color=longFillColor, transp=90)

fill(mPlot, dnPlot, title='DownTrend Highligter', color=shortFillColor, transp=90)

alertcondition(buySignal, title='SuperTrend Buy', message='SuperTrend Buy!')

alertcondition(sellSignal, title='SuperTrend Sell', message='SuperTrend Sell!')

changeCond = trend != trend[1]

alertcondition(changeCond, title='SuperTrend Direction Change', message='SuperTrend has changed direction!')

//QQE

//By Glaz, Modified

//study("QQE MOD")

RSI_Period = input(6, title='RSI Length')

SF = input(5, title='RSI Smoothing')

QQE = input(3, title='Fast QQE Factor')

ThreshHold = input(3, title='Thresh-hold')

//

srctt = input(close, title='RSI Source')

//

//

Wilders_Period = RSI_Period * 2 - 1

Rsi = ta.rsi(srctt, RSI_Period)

RsiMa = ta.ema(Rsi, SF)

AtrRsi = math.abs(RsiMa[1] - RsiMa)

MaAtrRsi = ta.ema(AtrRsi, Wilders_Period)

dar = ta.ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trenda = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? math.max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? math.min(shortband[1], newshortband) : newshortband

cross_1 = ta.cross(longband[1], RSIndex)

trenda := ta.cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trenda[1], 1)

FastAtrRsiTL = trenda == 1 ? longband : shortband

////////////////////

length = input.int(50, minval=1, title='Bollinger Length')

mult = input.float(0.35, minval=0.001, maxval=5, step=0.1, title='BB Multiplier')

basis = ta.sma(FastAtrRsiTL - 50, length)

dev = mult * ta.stdev(FastAtrRsiTL - 50, length)

upper = basis + dev

lower = basis - dev

color_bar = RsiMa - 50 > upper ? #00c3ff : RsiMa - 50 < lower ? #ff0062 : color.gray

//

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := RSIndex < 50 ? QQEzshort + 1 : 0

//

//Zero = hline(0, color=color.rgb(116, 26, 26), linestyle=hline.style_dotted, linewidth=1)

////////////////////////////////////////////////////////////////

RSI_Period2 = input(6, title='RSI Length')

SF2 = input(5, title='RSI Smoothing')

QQE2 = input(1.61, title='Fast QQE2 Factor')

ThreshHold2 = input(3, title='Thresh-hold')

src2 = input(close, title='RSI Source')

//

//

Wilders_Period2 = RSI_Period2 * 2 - 1

Rsi2 = ta.rsi(src2, RSI_Period2)

RsiMa2 = ta.ema(Rsi2, SF2)

AtrRsi2 = math.abs(RsiMa2[1] - RsiMa2)

MaAtrRsi2 = ta.ema(AtrRsi2, Wilders_Period2)

dar2 = ta.ema(MaAtrRsi2, Wilders_Period2) * QQE2

longband2 = 0.0

shortband2 = 0.0

trend2 = 0

DeltaFastAtrRsi2 = dar2

RSIndex2 = RsiMa2

newshortband2 = RSIndex2 + DeltaFastAtrRsi2

newlongband2 = RSIndex2 - DeltaFastAtrRsi2

longband2 := RSIndex2[1] > longband2[1] and RSIndex2 > longband2[1] ? math.max(longband2[1], newlongband2) : newlongband2

shortband2 := RSIndex2[1] < shortband2[1] and RSIndex2 < shortband2[1] ? math.min(shortband2[1], newshortband2) : newshortband2

cross_2 = ta.cross(longband2[1], RSIndex2)

trend2 := ta.cross(RSIndex2, shortband2[1]) ? 1 : cross_2 ? -1 : nz(trend2[1], 1)

FastAtrRsi2TL = trend2 == 1 ? longband2 : shortband2

//

// Zero cross

QQE2zlong = 0

QQE2zlong := nz(QQE2zlong[1])

QQE2zshort = 0

QQE2zshort := nz(QQE2zshort[1])

QQE2zlong := RSIndex2 >= 50 ? QQE2zlong + 1 : 0

QQE2zshort := RSIndex2 < 50 ? QQE2zshort + 1 : 0

//

hcolor2 = RsiMa2 - 50 > ThreshHold2 ? color.silver : RsiMa2 - 50 < 0 - ThreshHold2 ? color.silver : na

// plot(FastAtrRsi2TL - 50, title='QQE Line', color=color.new(color.white, 0), linewidth=2)

// plot(RsiMa2 - 50, color=hcolor2, title='Histo2', style=plot.style_columns, transp=50)

Greenbar1 = RsiMa2 - 50 > ThreshHold2

Greenbar2 = RsiMa - 50 > upper

Redbar1 = RsiMa2 - 50 < 0 - ThreshHold2

Redbar2 = RsiMa - 50 < lower

// plot(Greenbar1 and Greenbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Up', style=plot.style_columns, color=color.new(#00c3ff, 0))

// plot(Redbar1 and Redbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Down', style=plot.style_columns, color=color.new(#ff0062, 0))

qqe_col:=Greenbar1 and Greenbar2 == 1 ?1:(Redbar1 and Redbar2 == 1 ?0:-1)

//lab=label.new(bar_index,50,str.tostring(qqe_col))

// ////////////////////////////////////////////////////////////////

// //custom code

// ////////////////////////////////////////////////////////////////

// sma=((lhitt+shitt)/cnt)

// plot(sma*1000)

// plot(250,color=color.red)

//begin

sess=input("0916-1200","time for reversals!!")

v=time(timeframe.period,sess)

rr=input.float(1,"enter the reward..def is 3")

on=na(v)?false:true

bool daybreak=input.bool(false,"daybreak ? true means day end close")

bool apply_on=input.bool(true,"do u want time for reversal?")

apply_on:=not apply_on

test=input.int(2,"train(0) test(1) all(2)?")

// if str.tonumber(timeframe.period)!=5

// runtime.error("backtests and stocks only valid for 5 min tf!!")

on:=apply_on or on

pts=1/syminfo.mintick

var float sl=0

var float profit=0

// var dud=0

// var counter=0

var con_win=0

var con_lose=0

var tempwin=0

var templose=0

//adding analytics variables

var float[] stararr=array.new_float(10,-1)

var float[] sslarr=array.new_float(10,-1)

var float skipper=-1

var float[] ltararr=array.new_float(10,-1)

var float[] lslarr=array.new_float(10,-1)

var float lhit=0

var float shit=0

var float miss=0

var float cnt=0

var lflag=0

var sflag=0

var i=0

var dud=0

var gap=0

float begin=0

float end=0

// ei_col = 0 //1 for green 0 for red

// qqe_col = 0 //1 for blue 0 for red

// supa_col = 0

//plot(i)

//code begins here

if test==0

begin:=0

end:=5500/2

else if test==1

begin:=5500/2

end:=bar_index

else if test==2

begin:=0

end:=bar_index

if hei_col==1 and qqe_col==1 and supa_col==1 and lflag==0 and low>upratr and bar_index>=begin and bar_index<=end and on

lflag:=1

sflag:=0

if array.get(lslarr,i)!=-1

dud:=dud+1

array.set(lslarr,i,upratr)

array.set(ltararr,i,(close+rr*(close-upratr)))

cnt:=cnt+1

skipper:=i

// lab=label.new(bar_index,close+100,str.tostring(array.get(lslarr,i)) +"\n"+ str.tostring(array.get(ltararr,i)) +"\n"+str.tostring(i))

i:=(i+1)%9

strategy.order("long_"+str.tostring(i-1),strategy.long,1)

strategy.order("sl_l"+str.tostring(i-1),strategy.short,stop=upratr,oca_name = "exit"+str.tostring(i-1))

strategy.order("target_l"+str.tostring(i-1),strategy.short,limit=((close+rr*(close-upratr))),oca_name = "exit"+str.tostring(i-1))

if hei_col==0 and qqe_col==0 and supa_col==0 and sflag==0 and high<lwratr and bar_index>=begin and bar_index<=end and on

sflag:=1

lflag:=0

if array.get(sslarr,i)!=-1

dud:=dud+1

array.set(sslarr,i,lwratr)

array.set(stararr,i,(close-rr*(lwratr-close)))

skipper:=i

// lab=label.new(bar_index,close+100,str.tostring(array.get(sslarr,i)) +"\n"+ str.tostring(array.get(stararr,i)) +"\n"+str.tostring(i))

i:=(i+1)%9

cnt:=cnt+1

strategy.order("short_"+str.tostring(i-1),strategy.short,1)

strategy.order("sl_s"+str.tostring(i-1),strategy.long,stop=lwratr,oca_name = "exit"+str.tostring(i-1))

strategy.order("target_s"+str.tostring(i-1),strategy.long,limit=((close-rr*(lwratr-close))),oca_name = "exit"+str.tostring(i-1))

for j=0 to 9

if array.get(lslarr,j)!=-1 and j!=skipper

if low < array.get(lslarr,j) and array.get(lslarr,j)!=-1// and open>array.get(lslarr,j)

miss:=miss+1

array.set(ltararr,j,-1)

array.set(lslarr,j,-1)

else if high > array.get(ltararr,j) and array.get(lslarr,j)!=-1 //and open<array.get(ltararr,j)

lhit:=lhit+1

array.set(ltararr,j,-1)

array.set(lslarr,j,-1)

if array.get(sslarr,j)!=-1 and j!=skipper

if high > array.get(sslarr,j) and array.get(sslarr,j)!=-1 //and open<array.get(sslarr,j)

miss:=miss+1

array.set(stararr,j,-1)

array.set(sslarr,j,-1)

else if low < array.get(stararr,j) and array.get(sslarr,j)!=-1 //and open>array.get(stararr,j)

shit:=shit+1

array.set(stararr,j,-1)

array.set(sslarr,j,-1)

skipper:=-1

var day_miss=0

string ender=""

if (timeframe.period)=="1"

ender:="1528-1529"

else if (timeframe.period)=="5"

ender:="1520-1525"

else if (timeframe.period)=="15"

ender:="1500-1515"

else if (timeframe.period)=="60"

ender:="1330-1430"

else

//runtime.error("not accounted tf!!")

daybreak:=false

if time(timeframe.period,ender) and daybreak

if strategy.position_size!=0

day_miss+=1

strategy.cancel_all()

strategy.close_all("day_end_close")

for k=0 to (array.size(stararr)==0?na:(array.size(stararr)-1))

array.set(stararr,k,-1)

array.set(sslarr,k,-1)

array.set(ltararr,k,-1)

array.set(lslarr,k,-1)

i:=0

if (lhit+shit)>(lhit[1]+shit[1])

tempwin:=tempwin+1

templose:=0

else if (miss)>(miss[1])

templose:=templose+1

tempwin:=0

if tempwin>con_win

con_win:=tempwin

if templose>con_lose

con_lose:=templose

// //*********************adding randomness indicator************

var float nhit=0,var float nphit=0

if cnt%10==0 and cnt>0

nhit:=(lhit+shit)-nphit

nphit:=(lhit+shit)

t=table.new(position.top_right,1,6,bgcolor = color.rgb(236, 172, 172))

table.cell(t,0,0,str.tostring(((lhit+shit)/cnt)*100))

table.cell(t,0,1,str.tostring(((lhit+shit)/(lhit+shit+miss))*100))

table.cell(t,0,2,"daymiss "+str.tostring(day_miss))

//table.cell(t,0,1,str.tostring(((lhit)/cnt)*100))

//table.cell(t,0,2,str.tostring(((shit)/cnt)*100))

table.cell(t,0,3,str.tostring(con_win))

// table.cell(t,0,4,str.tostring(gap))

table.cell(t,0,4,str.tostring(con_lose))

table.cell(t,0,5,str.tostring(cnt))

//plot(1000*cnt,color =color.rgb(105, 28, 28))

// // plot(40000+lhit+shit,color=strategy.closedtrades%10==0?color.green:color.white,style=plot.style_circles)

//plot(1000*(lhit+shit),color=color.green)

//plot(1000*miss,color=color.red)

// // hitrate=strategy.wintrades/strategy.closedtrades

// // plot(hitrate*100)

// // plot(strategy.wintrades)

//plot(nhit*10000)

//dud is overwritten trades whereas day_miss are the trades closed at days end

// sma=(lhit+shit)/(lhit+shit+miss)

// plot(sma*100000)

// plot(50000,color=color.red)

// plot(con_win*1000,color=color.green)

// plot(con_lose*1000,color=color.red)

var float[] dat=array.new_float(10,-1)

var dati=0

var float datp=0

if miss>miss[1]

for cd=0 to ((miss-miss[1])-1)

array.set(dat,dati,0)

dati:=(dati+1)%10

if (lhit+shit)>(lhit[1]+shit[1])

for cd=0 to ( ((lhit+shit)-(lhit[1]+shit[1])) -1)

array.set(dat,dati,1)

dati:=(dati+1)%10

if array.get(dat,9)!=-1

for cd=0 to 9

datp:=datp+array.get(dat,cd)

plot((datp/10)*10000)

plot(5000,color = color.red)

datp:=0