概述

该策略结合了超级趋势指标和MACD指标,通过捕捉小趋势来获取利润。策略使用超级趋势指标来判断当前市场趋势,同时使用MACD指标作为进场和出场的辅助条件。策略逻辑清晰,易于理解和实现。

策略原理

- 使用ta.supertrend函数计算超级趋势指标,参数为ATR周期和乘数因子。

- 根据超级趋势指标的方向变化来判断多空趋势,当direction从大于0变为小于等于0时,视为上涨趋势;反之,则视为下跌趋势。

- 使用request.security函数获取30分钟周期的MACD指标值,包括MACD线、信号线和柱状图。

- 在上涨趋势中,如果MACD柱状图大于0,则开多仓,同时平掉之前的空仓。

- 在下跌趋势中,如果MACD柱状图小于0,则开空仓,同时平掉之前的多仓。

优势分析

- 结合了趋势跟踪和动量指标,能够较好地适应不同的市场状况。

- 使用了更长周期的MACD指标作为辅助条件,可以有效过滤掉一些假信号。

- 策略逻辑简单明了,易于理解和实现,适合初学者学习。

- 策略参数可调,可以根据不同的市场和品种进行优化。

风险分析

- 策略在震荡市场中可能会出现较多的交易信号,导致频繁交易和高滑点成本。

- 超级趋势指标对参数较为敏感,不同的参数设置可能会得到不同的结果。

- MACD指标可能会出现与价格背离的情况,导致错误的交易信号。

- 策略缺乏止损措施,在行情持续性不强或突发事件时可能会承担较大风险。

优化方向

- 可以考虑加入更多的过滤条件,如价格突破重要支撑或阻力位、交易量变化等,以提高信号的可靠性。

- 对于震荡市场,可以考虑使用更短周期的MACD指标或其他适合震荡市的指标来判断趋势。

- 可以加入止损措施,如固定点数止损、移动止损等,以控制单笔交易的最大风险。

- 可以对不同市场和品种进行参数优化,找到最适合的参数组合。

总结

该策略通过结合超级趋势指标和MACD指标,在捕捉小趋势的同时也考虑了趋势的持续性,是一个较为全面和均衡的策略。策略优势在于逻辑清晰,易于理解和实现,同时通过使用更长周期的MACD指标作为辅助条件,可以有效过滤掉一些假信号。但策略也存在一些风险,如在震荡市场中可能出现频繁交易,对参数设置较为敏感,以及缺乏止损措施等。针对这些风险,可以从加入更多过滤条件、优化参数、加入止损等方面进行优化和改进。总的来说,该策略可以作为一个基础性的策略框架,通过不断优化和改进,有望成为一个稳定盈利的策略。

策略源码

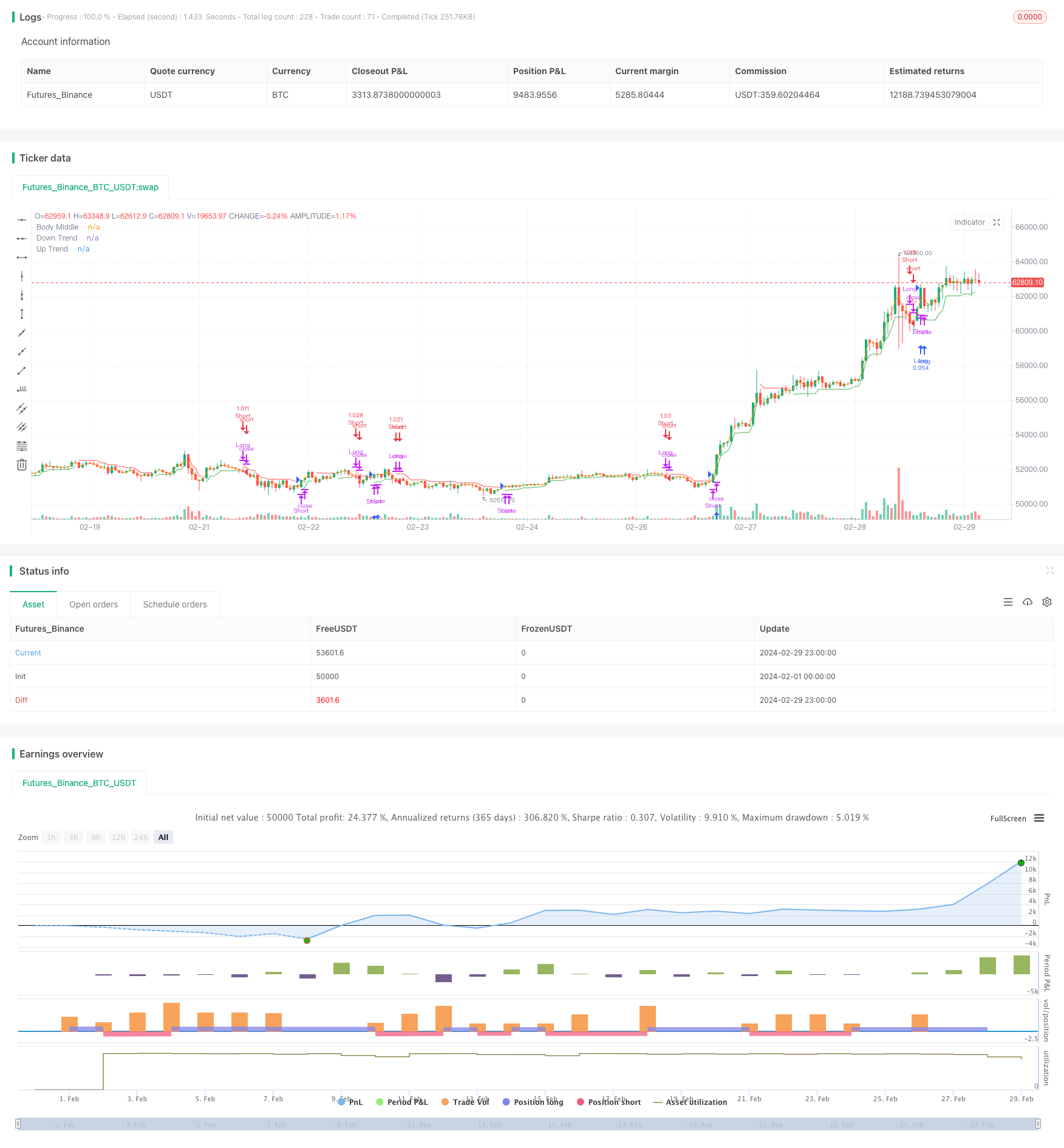

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Samsuga supertrend", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

atrPeriod = input.int(7, "ATR Length", minval = 1)

factor = input.float(1.0, "Factor", minval = 0.01, step = 0.01)

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

supertrend := barstate.isfirst ? na : supertrend

upTrend = plot(direction <= 0 ? supertrend : na, "Up Trend", color = color.green, style = plot.style_linebr)

downTrend = plot(direction <= 0 ? na : supertrend, "Down Trend", color = color.red, style = plot.style_linebr)

bodyMiddle = plot(barstate.isfirst ? na : (open + close) / 2, "Body Middle",display = display.none)

longcondition = direction[1] > direction

shortCondition = direction[1] < direction

macdp1 = 3

macdp2=10

macdp3=6

[macdLine, signalLine, histLine] =request.security(symbol = syminfo.tickerid, timeframe = "30",expression = ta.macd(close,macdp1,macdp2,macdp3),lookahead=barmerge.lookahead_on)

// plot(macdLine, title = "MACD", color = #2962FF)

// plot(signalLine, title = "Signal", color = #FF6D00)

// 8, 21, 5

// 8,13,9

// 12,26,9

// 1--> 3, 17, 5

// 3, 10, 16

// log.info(str.tostring(syminfo.tickerid)+str.tostring(histLine[0]))

// /////////----------------METHOD 1-----------------////////////////

// if(longcondition)

// if(strategy.opentrades>0)

// strategy.close("Long","Prev Exit", immediately = true)

// if( histLine[0] > 0.1)

// strategy.entry(id= "Long", direction=strategy.long, comment = "update long")

// else if(shortCondition and strategy.openprofit<=0.1)

// strategy.close("Long",comment = "Close",immediately = true)

// /////////----------------METHOD 2-----------------////////////////

// if(longcondition)

// if(histLine[0] > 0)

// strategy.entry(id= "Long", direction=strategy.long, comment = "update long" )

// strategy.exit("Long", loss = close*0.2)

// else if(shortCondition )

// strategy.close("Long",comment = "Close",immediately = true)

// /////////----------------METHOD 3-----------------////////////////

// log.info(str.tostring(syminfo.tickerid)+str.tostring(histLine[0]))

if(longcondition)

if(histLine[0] > 0)

strategy.close("Short",comment = "E-S", alert_message = "E-S",disable_alert = true)

strategy.entry(id= "Long", direction=strategy.long, comment = "L",alert_message = "L")

else if(shortCondition)

if(histLine[0] < 0)

strategy.close("Long",comment = "E-L",alert_message = "E-L",disable_alert = true)

strategy.entry(id= "Short", direction=strategy.short, comment = "S",alert_message = "S")