策略概述

双均线交叉优化止损策略(TQQQ)是一种基于两条不同周期移动平均线(SMA)交叉信号的量化交易策略。该策略只做多,当快速均线上穿慢速均线时开仓,当快速均线下穿慢速均线或价格跌破止损价位时平仓。该策略通过参数优化快慢均线周期和止损比例,以期在牛市中获得更高的收益,同时在市场下跌时降低损失。

策略原理

该策略的核心是利用不同周期移动平均线的交叉信号来捕捉市场趋势。当短期均线上穿长期均线时,表明市场可能进入上升趋势,此时开仓做多。当短期均线下穿长期均线时,表明上升趋势可能结束,此时平仓。

除了均线交叉信号外,该策略还引入了止损机制。当市场价格跌破固定百分比的止损价位时,即使均线并未产生平仓信号,策略也会止损出场。这一机制的目的在于控制回撤,防止趋势反转时的巨大损失。

具体来看,该策略包含以下步骤:

- 计算快速均线和慢速均线。

- 判断是否存在开仓信号。当快速均线上穿慢速均线,且当前无持仓时,开仓做多。

- 记录开仓价格,计算止损价位。

- 判断是否存在平仓信号。当快速均线下穿慢速均线,或者价格跌破止损价位时,平掉所有多单。

- 根据收盘价判断下一交易日是否有开平仓机会,重复步骤2-4。

通过这一系列步骤,该策略能够快速适应市场趋势的变化,在牛市中紧跟趋势,获取丰厚利润,同时在市场转熊时及时止损,控制回撤。

策略优势

趋势跟踪:通过均线交叉信号,该策略能够捕捉市场趋势,在上升趋势中持仓,获取趋势收益。

止损机制:固定百分比止损可以有效控制回撤,避免单次交易的损失过大。

参数灵活:快慢均线的周期参数和止损比例可以根据市场特征和个人风险偏好进行调整,增加了策略的适应性。

适用性广:该策略可以应用于不同的市场和标的,如股票、期货、外汇等,只需根据标的特性调整参数即可。

简单高效:策略逻辑清晰,易于理解和实现,回测效率高,便于进行大量参数优化和模拟交易。

策略风险

参数敏感:均线周期和止损比例的选择对策略表现影响很大,不恰当的参数可能导致频繁交易或者错失趋势行情。

趋势识别滞后:均线交叉信号存在一定的滞后性,特别是在市场快速变化时,可能错过最佳开平仓时机。

仓位集中:该策略始终保持100%的仓位,缺乏仓位管理和资金分配机制,面临较大的资金风险。

震荡市行情不佳:在震荡市中,频繁的交叉信号可能导致策略损失。

黑天鹅事件:极端行情下,交易信号可能失效,固定止损比例可能无法覆盖实际风险。

针对以上风险,可以从以下方面进行优化和改进:

引入动态止损:根据市场波动率或价格水平动态调整止损比例,以应对不同的市场状况。

优化开平仓信号:结合其他技术指标如MACD、RSI等,提高趋势识别的准确性和及时性。

引入仓位管理:根据市场趋势强度、波动率等指标,动态调整仓位,控制回撤风险。

结合基本面分析:综合考虑宏观经济、行业景气度等因素,避免在基本面不利时交易。

设置总止损线:针对极端行情,设置账户级别的总止损线,控制资金风险。

策略优化

动态止损:引入ATR、布林带等指标,根据市场波动率动态调整止损比例,在趋势强烈时放宽止损,在震荡市加强止损。

信号优化:尝试不同的均线组合,如EMA、WMA等,寻找更敏感和有效的开平仓信号。同时,可以结合MACD、RSI等指标作为辅助判断。

仓位管理:根据ATR、ADX等指标衡量市场趋势强度,在趋势明显时加大仓位,在趋势不明朗时减小仓位。同时,可以设置最大持仓上限,分批建仓和平仓。

多空对冲:考虑在震荡市中同时持有多空仓位,对冲市场风险。可以结合市场情绪指标如恐慌指数VIX等,动态调整多空比例。

参数自适应:针对不同的市场和标的,使用机器学习算法自动寻找最优参数组合,提高策略的适应性和稳健性。

通过以上优化方法,可以进一步提高策略的盈利能力和抗风险能力,更好地适应多变的市场环境。

总结

双均线交叉优化止损策略(TQQQ)是一个简单而有效的量化交易策略。它利用不同周期移动平均线的交叉信号,捕捉市场趋势,同时通过固定止损比例控制回撤风险。该策略逻辑清晰,易于实现和优化,适用于多种市场和标的。

通过合理选择均线周期和止损比例,该策略可以在牛市中获得可观的收益。但同时,该策略也面临参数敏感、趋势识别滞后、仓位集中等风险。针对这些风险,可以从动态止损、信号优化、仓位管理、多空对冲、参数自适应等方面进行改进和优化。

总的来说,双均线交叉优化止损策略(TQQQ)是一个值得尝试和深入研究的量化交易策略。通过不断优化和改进,它有望成为投资者的有力工具,帮助投资者在动荡的市场中获得稳健的回报。但同时,任何策略都有其局限性,投资者需要根据自己的风险偏好和市场观点,灵活运用,不断调整,才能在量化交易的道路上走得更远。

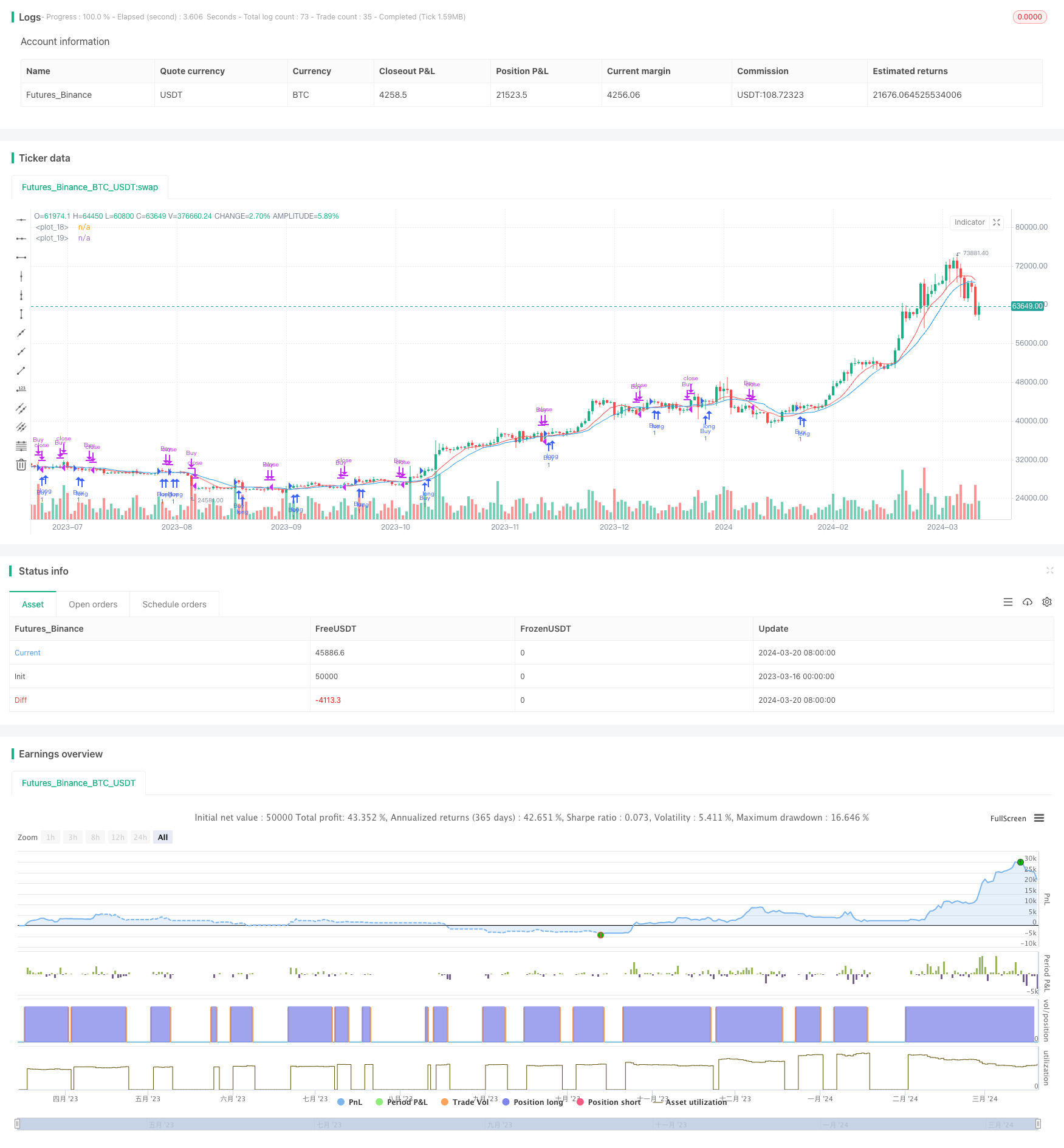

/*backtest

start: 2023-03-16 00:00:00

end: 2024-03-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("SMA Crossover Strategy with Customized Stop Loss (Long Only)", overlay=true)

// Define input variables for SMA lengths and stop loss multiplier

fast_length = input(9, "Fast SMA Length")

slow_length = input(14, "Slow SMA Length")

stop_loss_multiplier = input(0.1, "Stop Loss Multiplier")

// Calculate SMA values

fast_sma = sma(close, fast_length)

slow_sma = sma(close, slow_length)

// Define entry and exit conditions

enter_long = crossover(fast_sma, slow_sma)

exit_long = crossunder(fast_sma, slow_sma)

// Plot SMAs on chart

plot(fast_sma, color=color.red)

plot(slow_sma, color=color.blue)

// Set start date for backtest

start_date = timestamp(2022, 01, 01, 00, 00)

// Filter trades based on start date

if time >= start_date

if (enter_long)

strategy.entry("Buy", strategy.long, when = strategy.position_size == 0)

// Calculate stop loss level

buy_price = strategy.position_avg_price

stop_loss_level = buy_price * (1 - stop_loss_multiplier)

// Exit trades

if (exit_long or low <= stop_loss_level)

strategy.close("Buy")