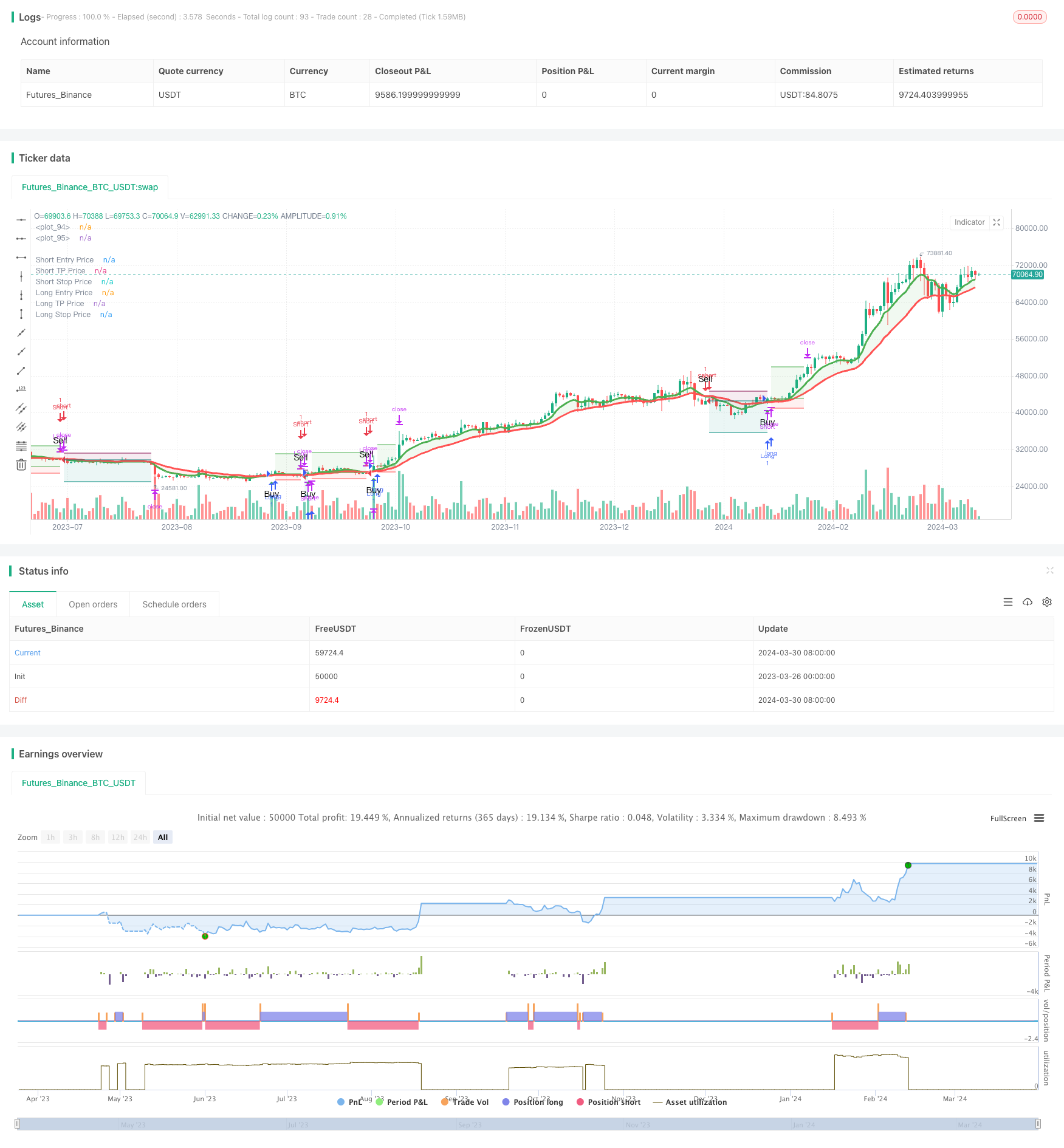

概述

该策略使用8周期和21周期的指数移动平均线(EMA)来识别市场趋势的变化。当较短周期的EMA从下方穿越较长周期的EMA时,产生买入信号;反之,当较短周期的EMA从上方穿越较长周期的EMA时,产生卖出信号。该策略还结合了三个连续更高的低点(HLL)和三个连续更低的高点(LLH)作为进一步确认趋势反转的信号。此外,该策略还设置了止损和止盈水平,以控制风险和锁定利润。

策略原理

- 计算8周期和21周期的EMA,用于识别主要趋势方向。

- 识别三个连续更高的低点(HLL)和三个连续更低的高点(LLH),作为趋势反转的早期信号。

- 当8周期EMA从下方穿越21周期EMA,且出现HLL突破时,产生买入信号;当8周期EMA从上方穿越21周期EMA,且出现LLH突破时,产生卖出信号。

- 设置止损水平为入场价格的5%,止盈水平为入场价格的16%,以控制风险和锁定利润。

- 当出现反向信号时,平仓并反向开仓。

策略优势

- 结合EMA和价格行为模式(HLL和LLH)来确认趋势,提高信号可靠性。

- 设置明确的止损和止盈水平,有助于控制风险和锁定利润。

- 适用于多个时间框架和不同市场,具有一定的普适性。

- 逻辑清晰,易于理解和实现。

策略风险

- 在震荡市场中,频繁的交叉可能导致多次虚假信号,导致亏损。

- 固定的止损和止盈水平可能无法适应不同的市场环境,导致潜在的机会成本或更大的损失。

- 策略依赖于历史数据,对于突发事件或基本面变化的适应性可能较差。

策略优化方向

- 引入自适应止损和止盈机制,如基于波动率(如ATR)来调整止损和止盈水平,以更好地适应不同市场状况。

- 结合其他指标或因子,如成交量、相对强弱指数(RSI)等,以进一步过滤信号并提高可靠性。

- 对参数(如EMA周期、止损止盈比例等)进行优化,找到在特定市场或标的上表现最佳的参数组合。

- 考虑引入风险管理措施,如仓位sizing,以控制单次交易的风险敞口。

总结

该策略利用8周期和21周期EMA的交叉,结合HLL和LLH价格模式,以识别趋势反转并产生交易信号。明确的止损止盈规则有助于控制风险和锁定利润。然而,该策略在震荡市场中可能产生虚假信号,固定的止损止盈水平也可能无法适应不同市场环境。为进一步改进,可考虑引入自适应止损止盈、结合其他指标、优化参数以及引入风险管理措施等。总的来说,该策略提供了一个基于动量和趋势跟踪的交易框架,但仍需要根据具体市场和个人偏好进行调整和优化。

策略源码

/*backtest

start: 2023-03-26 00:00:00

end: 2024-03-31 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Trend Following 8&21EMA with strategy tester [ukiuro7]', overlay=true, process_orders_on_close=true, calc_on_every_tick=true, initial_capital = 10000)

//INPUTS

lh3On = true

hl3On = true

emaOn = input(title='105ema / 30min', defval=true)

assistantOn = input(title='Assistant', defval=true)

textOn = input(title='Text', defval=true)

showRiskReward = input.bool(true, title='Show Risk/Reward Area', group="TP/SL")

stopPerc = input.float(5.0, step=0.1, minval=0.1, title='Stop-Loss %:',group="TP/SL") / 100

tpPerc = input.float(16.0, step=0.1, minval=0.1, title='Take-Profit %:',group="TP/SL") / 100

backtestFilter = input(false, title='Backtest Entries to Date Range',group="Backtest Date Range")

i_startTime = input(defval=timestamp('01 Jan 2022 00:00'), inline="b_1", title='Start',group="Backtest Date Range")

i_endTime = input(defval=timestamp('01 Jan 2029 00:00'), inline="b_1", title='End',group="Backtest Date Range")

inDateRange = true

message_long_entry = input.string(title='Alert Msg: LONG Entry', defval ='', group='Alert Message')

message_short_entry = input.string(title='Alert Msg: SHORT Entry', defval='', group='Alert Message')

message_long_exit = input.string(title='Alert Msg: LONG SL/TP', defval='', group='Alert Message')

message_short_exit = input.string(title='Alert Msg: SHORT SL/TP', defval='', group='Alert Message')

//CALCS

threeHigherLows() =>

low[0] >= low[1] and low[1] >= low[2]

threeLowerHighs() =>

high[2] >= high[1] and high[1] >= high[0]

breakHigher() =>

padding = timeframe.isintraday ? .02 : .1

high >= high[1] + padding

breakLower() =>

padding = timeframe.isintraday ? .02 : .1

low <= low[1] - padding

lh3 = threeLowerHighs() and lh3On

lh3bh = lh3[1] and breakHigher() and lh3On

hl3 = threeHigherLows() and hl3On

hl3bl = hl3[1] and breakLower() and hl3On

ema8 = ta.ema(close, 8)

ema21 = ta.ema(close, 21)

//VARS

var float longStop = na, var float longTp = na

var float shortStop = na, var float shortTp = na

//CONDS

isUptrend = ema8 >= ema21

isDowntrend = ema8 <= ema21

trendChanging = ta.cross(ema8, ema21)

buySignal = lh3bh and lh3[2] and lh3[3] and isUptrend and timeframe.isintraday

sellSignal = hl3bl and hl3[2] and hl3[3] and isDowntrend and timeframe.isintraday

goingDown = hl3 and isDowntrend and timeframe.isintraday

goingUp = lh3 and isUptrend and timeframe.isintraday

projectXBuy = trendChanging and isUptrend

projectXSell = trendChanging and isDowntrend

longCond = trendChanging and isUptrend and assistantOn

shortCond = trendChanging and isDowntrend and assistantOn

//STRATEGY

if shortCond and strategy.position_size > 0 and barstate.isconfirmed

strategy.close('Long', comment='CLOSE LONG', alert_message=message_long_exit)

if longCond and strategy.position_size < 0 and barstate.isconfirmed

strategy.close('Short', comment='CLOSE SHORT', alert_message=message_short_exit)

if longCond and strategy.position_size <= 0 and barstate.isconfirmed and inDateRange

longStop := close * (1 - stopPerc)

longTp := close * (1 + tpPerc)

strategy.entry('Long', strategy.long, comment='LONG', alert_message=message_long_entry)

strategy.exit('Long Exit', 'Long', comment_loss="SL LONG", comment_profit = "TP LONG", stop=longStop, limit=longTp, alert_message=message_long_exit)

if shortCond and strategy.position_size >= 0 and barstate.isconfirmed and inDateRange

shortStop := close * (1 + stopPerc)

shortTp := close * (1 - tpPerc)

strategy.entry('Short', strategy.short, comment='SHORT', alert_message=message_short_entry)

strategy.exit('Short Exit', 'Short', comment_loss="SL SHORT", comment_profit="TP SHORT", stop=shortStop, limit=shortTp, alert_message=message_short_exit)

//PLOTS

plotshape(longCond, style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.small, text='Buy')

plotshape(shortCond, style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.small, text='Sell')

plotchar(trendChanging and isUptrend and close < open and assistantOn, char='!', location=location.abovebar, color=color.new(color.green, 0), size=size.small)

aa = plot(ema8, linewidth=3, color=color.new(color.green, 0), editable=true)

bb = plot(ema21, linewidth=3, color=color.new(color.red, 0), editable=true)

fill(aa, bb, color=isUptrend ? color.new(color.green,90) : color.new(color.red,90))

buyZone = isUptrend and lh3 and high < ema21 and timeframe.isintraday

sellZone = isDowntrend and hl3 and low > ema21 and timeframe.isintraday

L1 = plot(showRiskReward and strategy.position_size > 0 ? strategy.position_avg_price : na, color=color.new(color.green, 0), linewidth=1, style=plot.style_linebr, title='Long Entry Price')

L2 = plot(showRiskReward and strategy.position_size > 0 ? longTp : na, color=color.new(color.green, 0), linewidth=1, style=plot.style_linebr, title='Long TP Price')

L3 = plot(showRiskReward and strategy.position_size > 0 ? longStop : na, color=color.new(color.red, 0), linewidth=1, style=plot.style_linebr, title='Long Stop Price')

S1 = plot(showRiskReward and strategy.position_size < 0 ? strategy.position_avg_price : na, color=color.new(color.teal, 0), linewidth=1, style=plot.style_linebr, title='Short Entry Price')

S2 = plot(showRiskReward and strategy.position_size < 0 ? shortTp : na, color=color.new(color.teal, 0), linewidth=1, style=plot.style_linebr, title='Short TP Price')

S3 = plot(showRiskReward and strategy.position_size < 0 ? shortStop : na, color=color.new(color.maroon, 0), linewidth=1, style=plot.style_linebr, title='Short Stop Price')

fill(L1, L2, color=color.new(color.green, 90))

fill(L1, L3, color=color.new(color.red, 90))

fill(S1, S2, color=color.new(color.teal, 90))

fill(S1, S3, color=color.new(color.maroon, 90))

bgcolor(inDateRange == false ? color.new(color.red,90) : na, title="Backtest Off-Range")