概述

该策略基于布林线指标,通过在价格触及布林线上轨时做空,触及下轨时做多的方式来捕捉市场趋势。同时,该策略还引入了金字塔加仓的概念,在持仓数量未达到设定的最大值时,会继续按原有方向加仓。

策略原理

布林线由三条线组成,中轨是收盘价的简单移动平均线,上轨和下轨分别在中轨的基础上加减一定的标准差。由于价格总是在均值附近波动,因此布林线的上下轨可以看作是价格的压力区间。当价格突破上轨,意味着强势上涨趋势,可以做多;突破下轨则意味着强势下跌趋势,可以做空。同时,当持仓数量小于设定的最大值时,策略会在原有仓位的基础上继续加仓,放大趋势捕捉的力度。

策略优势

- 布林线是一个被广泛使用和验证的技术指标,具有较强的趋势捕捉能力。

- 通过在上下轨突破时入场,可以有效降低假突破带来的风险。

- 金字塔加仓的方式可以放大趋势捕捉的力度,提高盈利空间。

- 代码逻辑清晰简洁,容易理解和实现。

策略风险

- 布林线属于滞后指标,在市场快速变动时,可能会出现信号滞后的情况。

- 金字塔加仓如果处理不当,在震荡行情中可能会导致大量的小亏损累积。

- 参数设置不合理会影响策略表现,需要根据不同市场特点进行优化。

策略优化方向

- 可以考虑引入多个布林线组合使用,比如不同周期、不同参数的布林线,提高信号的可靠性。

- 在趋势信号出现后,可以通过ATR等波动率指标来动态调整加仓的数量和频率,降低震荡行情的影响。

- 可以在布林线基础上,结合其他指标如MACD、RSI等,构建多因子入场条件,提高入场信号的精确性。

- 进一步优化出场条件,比如设置移动止损、获利回吐等,以降低单笔交易的风险敞口。

总结

该策略利用布林线的趋势特性,通过在价格触及上下轨时入场,同时以金字塔加仓的方式放大趋势捕捉力度,整体思路简洁有效。但是其也存在一定的滞后性和参数敏感性,在实际应用中需要注意优化参数和仓位管理,同时可以考虑与其他信号指标相结合,以期获得更稳健的策略表现。

策略源码

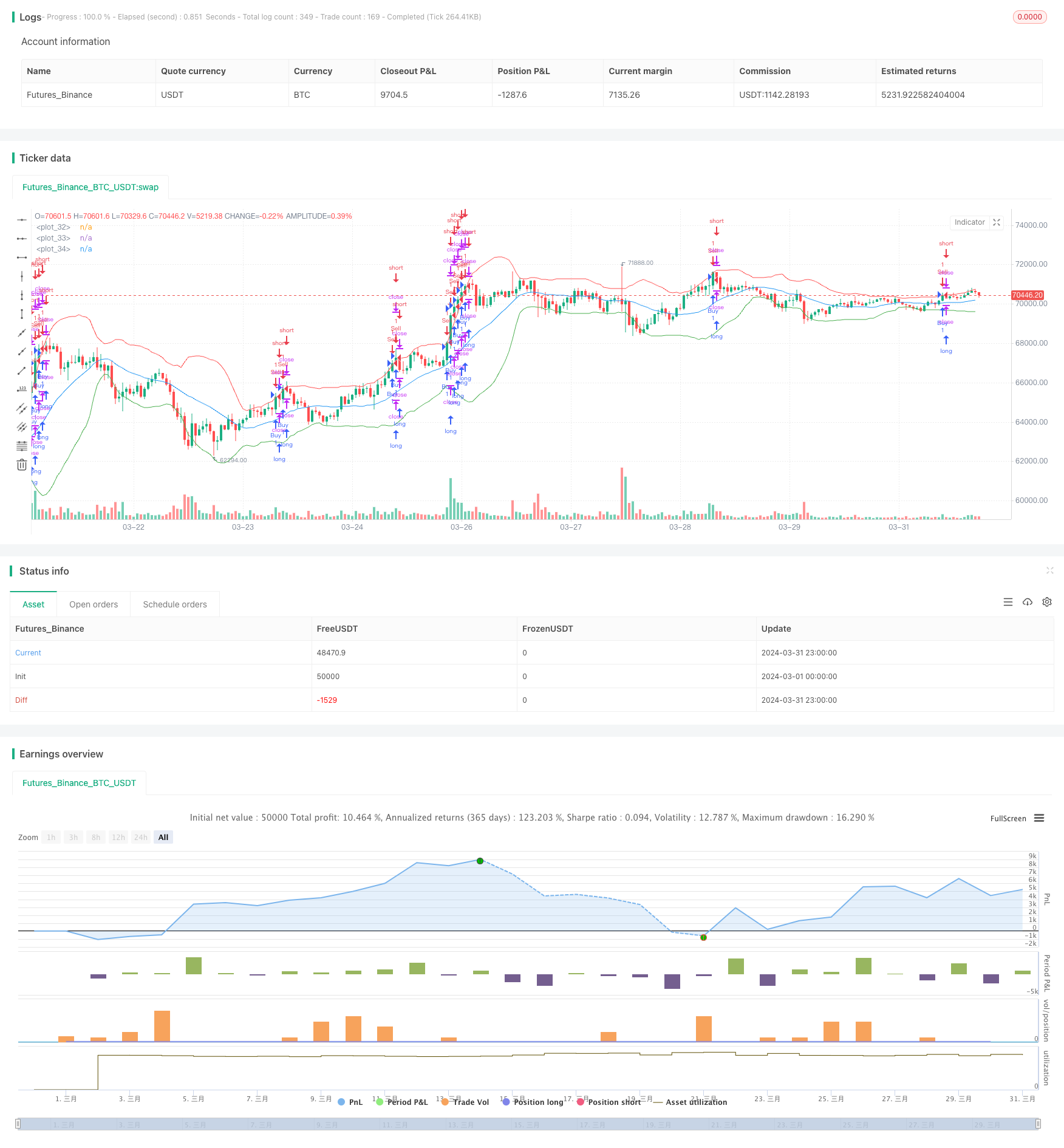

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands Breakout Strategy", overlay=true)

// Définition des paramètres

length = input(20, title="Bollinger Bands Length")

multiplier = input(2.0, title="Multiplier")

pyramiding = input(5, title="Pyramiding")

// Calcul des bandes de Bollinger

basis = ta.sma(close, length)

dev = multiplier * ta.stdev(close, length)

upper_band = basis + dev

lower_band = basis - dev

// Règles d'entrée

buy_signal = close <= lower_band

sell_signal = close >= upper_band

// Gestion des positions

if (buy_signal)

strategy.entry("Buy", strategy.long)

if (sell_signal)

strategy.entry("Sell", strategy.short)

// Pyramiding

if (strategy.opentrades < pyramiding)

strategy.entry("Buy", strategy.long)

else if (strategy.opentrades > pyramiding)

strategy.entry("Sell", strategy.short)

// Tracé des bandes de Bollinger

plot(basis, color=color.blue)

plot(upper_band, color=color.red)

plot(lower_band, color=color.green)

相关推荐