多交易所现货价差套利策略逻辑分享

Author: @cqz, Created: 2022-06-27 21:26:27, Updated: 2024-12-02 21:35:44

策略原理

由于流动性原因,当市场出现大额砸盘拉盘时必然会出现大额价格波动,交易所之间就会形成瞬间的价差,策略就是要捕捉这些瞬间执行快速交易完成低买高卖的过程。 有客户问我为啥要弄那么多交易所,这个是必然的,我们赚的是交易所之间的瞬时价差,交易所越多,交叉之后所形成的价差机会肯定越多。

策略核心逻辑

- 并发获取多交易所盘口信息,一定要并发获取,减少获取到的盘口延迟,并发获取可以参考我分享的工具插件多交易所并发插件

- 将所有交易所盘口的ask跟bid合并,得到一个合并的盘口信息,其中RealPrice是扣除手续费后的价格,

function createOrders(depths, askOrders, bidOrders) {

let asksIndex = 0;

let bidIndex = 0;

for (let i = 0; i < depths.length; i++) {

let exchangeTariff = getExchangeTariff(i);

let asks = depths[i].Asks;

let bids = depths[i].Bids;

for (let j = 0; j < Math.min(asks.length, bids.length, 20); j++) {

if (asks[j].Amount >= minTakerAmount) {

askOrders[asksIndex] = {

"Price": asks[j].Price,

"Amount": asks[j].Amount,

"Fee": asks[j].Price * exchangeTariff,

"RealPrice": asks[j].Price * (1 + exchangeTariff),

"Index": i,

};

asksIndex++;

}

if (bids[j].Amount >= minTakerAmount) {

bidOrders[bidIndex] = {

"Price": bids[j].Price,

"Amount": bids[j].Amount,

"Fee": bids[j].Price * exchangeTariff,

"RealPrice": bids[j].Price * (1 - exchangeTariff),

"Index": i,

};

bidIndex++;

}

}

}

askOrders.sort(function (a, b) {

return a.RealPrice - b.RealPrice;

});

bidOrders.sort(function (a, b) {

return b.RealPrice - a.RealPrice;

});

}

- 从合并的盘口信息,计算出最有的套利差价。由于我们是吃单,即从最低价ask买入,从最高价bid卖出,只要bid.RealPrice > ask.RealPrice即有盈利空间

function getArbitrageOrders(askOrders, bidOrders) {

let ret = [];

for (let i = 0; i < askOrders.length; i++) {

for (let j = 0; j < bidOrders.length; j++) {

let bidOrder = bidOrders[j];

let askOrder = askOrders[i];

if (bidOrder.Index === askOrder.Index) {

continue

}

let minMigrateDiffPrice = ((askOrder.Price + bidOrder.Price) / 2 * minMigrateDiffPricePercent / 100);

if (bidOrder.RealPrice - askOrder.RealPrice > minMigrateDiffPrice) {

ret.push({

"Ask": askOrder,

"Bid": bidOrder,

})

}

}

}

if (ret.length === 0) {

ret.push({

"Ask": askOrders[0],

"Bid": bidOrders[0],

});

}

//按最优价差排序

ret.sort((a, b) => {

return (b.Bid.RealPrice - b.Ask.RealPrice) - (a.Bid.RealPrice - a.Ask.RealPrice);

});

return ret;

}

- 到了这里我们已经获取到市场中的可套利价差信息,那么怎么取舍是否执行交易,以及交易多少数量,这里有几个判断要点:

- 当前剩余的资产

- 价差大小(价差太小就只均衡货币数量,价差够大才最大化交易数量)

- 盘口挂单数量

var askOrder = arbitrageOrder.Ask;

var bidOrder = arbitrageOrder.Bid;

var perAmountFee = arbitrageOrder.Ask.Fee + arbitrageOrder.Bid.Fee;

var minRealDiffPrice = (askOrder.Price + bidOrder.Price) / 2 * minDiffPricePercent / 100;

var minMigrateDiffPrice = ((askOrder.Price + bidOrder.Price) / 2 * minMigrateDiffPricePercent / 100);

var curRealDiffPrice = arbitrageOrder.Bid.RealPrice - arbitrageOrder.Ask.RealPrice;

var buyExchange = exchanges[arbitrageOrder.Ask.Index];

var sellExchange = exchanges[arbitrageOrder.Bid.Index];

var buySellAmount = 0;

if (curRealDiffPrice > minRealDiffPrice) {

buySellAmount = math.min(

bidOrder.Amount,

askOrder.Amount,

maxTakerAmount,

runningInfo.Accounts[bidOrder.Index].CurStocks,

runningInfo.Accounts[askOrder.Index].CurBalance / askOrder.Price

);

} else if (bidOrder.Index !== askOrder.Index) {

if (migrateCoinEx == -1) {

if (curRealDiffPrice > minMigrateDiffPrice && runningInfo.Accounts[bidOrder.Index].CurStocks - runningInfo.Accounts[askOrder.Index].CurStocks > maxAmountDeviation) {

buySellAmount = math.min(

bidOrder.Amount,

askOrder.Amount,

maxTakerAmount,

runningInfo.Accounts[bidOrder.Index].CurStocks,

runningInfo.Accounts[askOrder.Index].CurBalance / askOrder.Price,

runningInfo.Accounts[bidOrder.Index].CurStocks - ((runningInfo.Accounts[bidOrder.Index].CurStocks + runningInfo.Accounts[askOrder.Index].CurStocks) / 2)

);

if (buySellAmount >= minTakerAmount) {

Log("启动交易所平衡!");

}

}

} else if (migrateCoinEx == askOrder.Index) {

if (curRealDiffPrice > minMigrateDiffPrice && runningInfo.Accounts[bidOrder.Index].CurStocks > 0) {

buySellAmount = math.min(

bidOrder.Amount,

askOrder.Amount,

maxTakerAmount,

runningInfo.Accounts[bidOrder.Index].CurStocks,

runningInfo.Accounts[askOrder.Index].CurBalance / askOrder.Price

);

if (buySellAmount >= minTakerAmount) {

Log("启动货币迁移:", exchanges[bidOrder.Index].GetName(), "-->", exchanges[askOrder.Index].GetName());

}

}

}

}

- 计算得到下单数量即可执行交易,策略采用直接加滑点吃单的方式同时下单

var buyWait = buyExchange.Go("Buy", _N(askOrder.Price * (1.01), pricePrecision), buySellAmount);

var sellWait = sellExchange.Go("Sell", _N(bidOrder.Price * (0.99), pricePrecision), buySellAmount);

var startWaitTime = new Date().getTime()

Sleep(3000);

var buyOrder = buyWait.wait()

var sellOrder = sellWait.wait()

- 剩下的就是计算收益,处理失败订单止损之类的逻辑了。

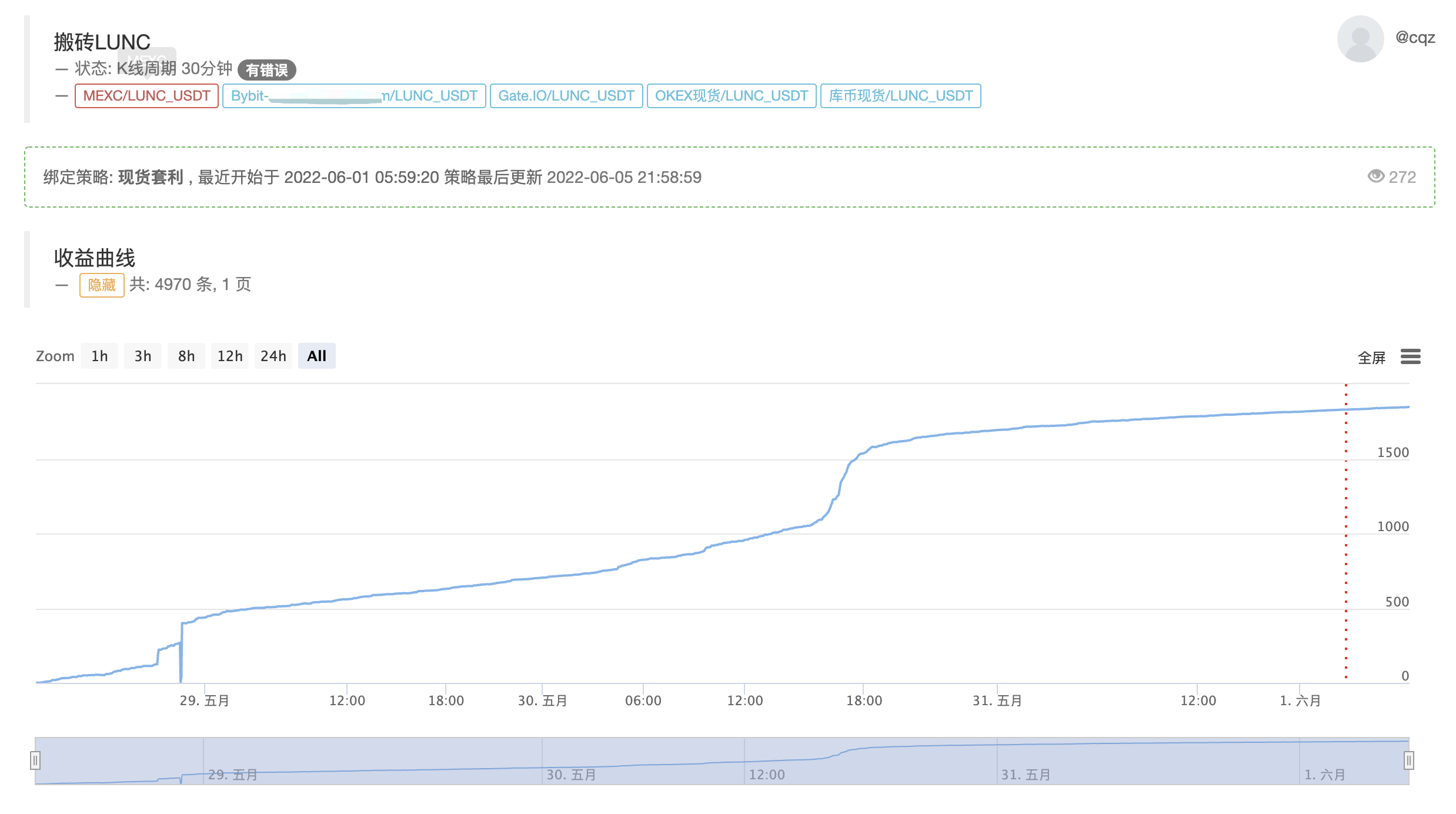

本策略实战收益

当前实盘展示,核心逻辑不变,优化支持多币种

https://www.fmz.com/robot/464965

最后,欢迎加入老秋量化交流:https://t.me/laoqiu_arbitrage

Related

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- 数字货币中的Lead-Lag套利介绍(2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- FMZ平台外部信号接收的探讨:策略内置Http服务接收信号的完整方案

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- 数字货币中的Lead-Lag套利介绍(1)

- Discussion on External Signal Reception of FMZ Platform: Extended API VS Strategy Built-in HTTP Service

- FMZ平台外部信号接收的探讨:扩展API vs 策略内置HTTP服务

- Discussion on Strategy Testing Method Based on Random Ticker Generator

- 基于随机行情生成器的策略测试方法探讨

- New Feature of FMZ Quant: Use _Serve Function to Create HTTP Services Easily

More

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (4)

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (3)

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (2)

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (1)

- Cryptocurrency spot hedging strategy design(2)

- An example of general protocol contract access on FMZ

- Multi-Exchange Spot Spread Arbitrage Strategy Logic Sharing

- Visualization module to build trading strategies - in-depth

- Use the KLineChart function to make strategy drawing design easier

- 使用KLineChart函数让策略画图设计更加简单

- JavaScript strategy backtesting is debugged in DevTools of Chrome browser

- JavaScript策略回测在Chrome浏览器DevTools调试

- 可视化模块搭建交易策略--深入

- 适合熊市抄底的永续平衡策略

- 用这么易学易用的Pine语言如果还不会写策略的话,那我就...

- Detailed Explanation of Equilibrium & Grid Strategies

- 简约是一种美--如何设计简单有效的策略

- 数字货币现货打新抢币策略(教学)

- Design a Multiple-Chart Plotting Library

- 设计一个多图表画线类库

ianzeng123 大佬,minTakerAmount参数是怎么设置的

诺女也 就怕小交易所跑路啊。

Johnny 赞

h503059288 秋哥威武。