ডেল্টা-আরএসআই দোলক কৌশল

লেখক:চাওঝাং, তারিখঃ ২০২২-০৫-৩০ ১১ঃ১১ঃ০২ট্যাগঃআরএসআই

ডেল্টা-আরএসআই দোলক কৌশলঃ

এই কৌশলটি সম্প্রতি প্রকাশিত ডেল্টা-আরএসআই দোলককে স্বতন্ত্র সূচক হিসেবে ব্যবহারের উদাহরণ।

ডেল্টা-আরএসআই হল আরএসআই-র একটি মসৃণ সময়সূচী, যা হিস্টোগ্রামের আকারে প্রদর্শিত হয় এবং গতির সূচক হিসেবে কাজ করে ।

ট্রেডিং সিগন্যাল তৈরির জন্য তিনটি অপশনাল শর্ত রয়েছে (কিনে, বিক্রি এবং প্রস্থান সিগন্যালের জন্য পৃথকভাবে সেট করা): শূন্য-ক্রসিংঃ যখন ডি-আরএসআই নেতিবাচক থেকে ধনাত্মক মানগুলিতে শূন্য অতিক্রম করে (অন্যথায় হ্রাস) সিগন্যাল লাইন ক্রসিং: যখন ডি-আরএসআই সিগন্যাল লাইনের নিচে থেকে উপরে অতিক্রম করে (অন্যথায় হ্রাস) তখন এটি উত্থানমুখী হয়। দিক পরিবর্তনঃ যখন ডি-আরএসআই নেতিবাচক ছিল এবং উঠতে শুরু করে (অন্যথায় হ্রাস) যেহেতু ডি-আরএসআই দোলকটি আরএসআই বক্ররেখার বহুপদী ফিটিংয়ের উপর ভিত্তি করে তৈরি করা হয়েছে, তাই ফিটের মূল গড়-বর্গ ত্রুটির মাধ্যমে ট্রেড সিগন্যাল ফিল্টার করার বিকল্পও রয়েছে (নমুনা গড় দ্বারা স্বাভাবিককৃত) ।

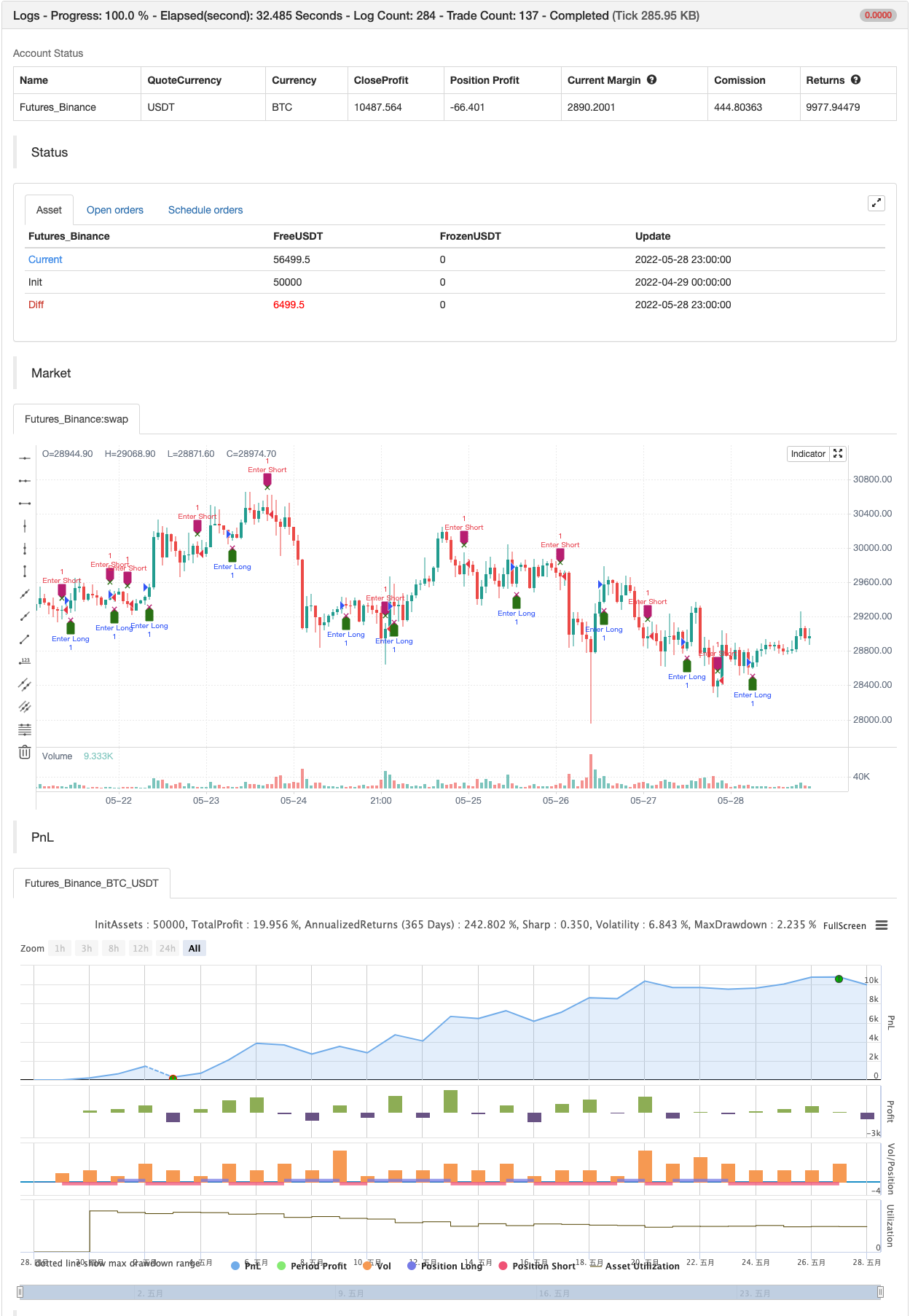

ব্যাকটেস্ট

/*backtest

start: 2022-04-29 00:00:00

end: 2022-05-28 23:59:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © tbiktag

//

// Delta-RSI Oscillator Strategy

//

// A strategy that uses Delta-RSI Oscillator (© tbiktag) as a stand-alone indicator:

// https://www.tradingview.com/script/OXQVFTQD-Delta-RSI-Oscillator/

//

// Delta-RSI is a smoothed time derivative of the RSI, plotted as a histogram

// and serving as a momentum indicator.

//

// Input parameters:

// RSI Length: The timeframe of the RSI that serves as an input to D-RSI.

// Length: The length of the lookback frame used for local regression.

// Polynomial Order: The order of the local polynomial function used to interpolate the RSI.

// Signal Length: The length of a EMA of the D-RSI series that is used as a signal line.

// Trade signals are generated based on three optional conditions:

// - Zero-crossing: bullish when D-RSI crosses zero from negative to positive values (bearish otherwise)

// - Signal Line Crossing: bullish when D-RSI crosses from below to above the signal line (bearish otherwise)

// - Direction Change: bullish when D-RSI was negative and starts ascending (bearish otherwise)

//

// Since D-RSI oscillator is based on polynomial fitting of the RSI curve, there is also an option

// to filter trade signal by means of the root mean-square error of the fit (normalized by the sample average).

//

//@version=4

study(title="Delta-RSI Oscillator Strategy", shorttitle = "D-RSI", overlay = true)

// ---Subroutines---

matrix_get(_A,_i,_j,_nrows) =>

// Get the value of the element of an implied 2d matrix

//input:

// _A :: array: pseudo 2d matrix _A = [[column_0],[column_1],...,[column_(n-1)]]

// _i :: integer: row number

// _j :: integer: column number

// _nrows :: integer: number of rows in the implied 2d matrix

array.get(_A,_i+_nrows*_j)

matrix_set(_A,_value,_i,_j,_nrows) =>

// Set a value to the element of an implied 2d matrix

//input:

// _A :: array, changed on output: pseudo 2d matrix _A = [[column_0],[column_1],...,[column_(n-1)]]

// _value :: float: the new value to be set

// _i :: integer: row number

// _j :: integer: column number

// _nrows :: integer: number of rows in the implied 2d matrix

array.set(_A,_i+_nrows*_j,_value)

transpose(_A,_nrows,_ncolumns) =>

// Transpose an implied 2d matrix

// input:

// _A :: array: pseudo 2d matrix _A = [[column_0],[column_1],...,[column_(n-1)]]

// _nrows :: integer: number of rows in _A

// _ncolumns :: integer: number of columns in _A

// output:

// _AT :: array: pseudo 2d matrix with implied dimensions: _ncolums x _nrows

var _AT = array.new_float(_nrows*_ncolumns,0)

for i = 0 to _nrows-1

for j = 0 to _ncolumns-1

matrix_set(_AT, matrix_get(_A,i,j,_nrows),j,i,_ncolumns)

_AT

multiply(_A,_B,_nrowsA,_ncolumnsA,_ncolumnsB) =>

// Calculate scalar product of two matrices

// input:

// _A :: array: pseudo 2d matrix

// _B :: array: pseudo 2d matrix

// _nrowsA :: integer: number of rows in _A

// _ncolumnsA :: integer: number of columns in _A

// _ncolumnsB :: integer: number of columns in _B

// output:

// _C:: array: pseudo 2d matrix with implied dimensions _nrowsA x _ncolumnsB

var _C = array.new_float(_nrowsA*_ncolumnsB,0)

int _nrowsB = _ncolumnsA

float elementC= 0.0

for i = 0 to _nrowsA-1

for j = 0 to _ncolumnsB-1

elementC := 0

for k = 0 to _ncolumnsA-1

elementC := elementC + matrix_get(_A,i,k,_nrowsA)*matrix_get(_B,k,j,_nrowsB)

matrix_set(_C,elementC,i,j,_nrowsA)

_C

vnorm(_X,_n) =>

//Square norm of vector _X with size _n

float _norm = 0.0

for i = 0 to _n-1

_norm := _norm + pow(array.get(_X,i),2)

sqrt(_norm)

qr_diag(_A,_nrows,_ncolumns) =>

//QR Decomposition with Modified Gram-Schmidt Algorithm (Column-Oriented)

// input:

// _A :: array: pseudo 2d matrix _A = [[column_0],[column_1],...,[column_(n-1)]]

// _nrows :: integer: number of rows in _A

// _ncolumns :: integer: number of columns in _A

// output:

// _Q: unitary matrix, implied dimenstions _nrows x _ncolumns

// _R: upper triangular matrix, implied dimansions _ncolumns x _ncolumns

var _Q = array.new_float(_nrows*_ncolumns,0)

var _R = array.new_float(_ncolumns*_ncolumns,0)

var _a = array.new_float(_nrows,0)

var _q = array.new_float(_nrows,0)

float _r = 0.0

float _aux = 0.0

//get first column of _A and its norm:

for i = 0 to _nrows-1

array.set(_a,i,matrix_get(_A,i,0,_nrows))

_r := vnorm(_a,_nrows)

//assign first diagonal element of R and first column of Q

matrix_set(_R,_r,0,0,_ncolumns)

for i = 0 to _nrows-1

matrix_set(_Q,array.get(_a,i)/_r,i,0,_nrows)

if _ncolumns != 1

//repeat for the rest of the columns

for k = 1 to _ncolumns-1

for i = 0 to _nrows-1

array.set(_a,i,matrix_get(_A,i,k,_nrows))

for j = 0 to k-1

//get R_jk as scalar product of Q_j column and A_k column:

_r := 0

for i = 0 to _nrows-1

_r := _r + matrix_get(_Q,i,j,_nrows)*array.get(_a,i)

matrix_set(_R,_r,j,k,_ncolumns)

//update vector _a

for i = 0 to _nrows-1

_aux := array.get(_a,i) - _r*matrix_get(_Q,i,j,_nrows)

array.set(_a,i,_aux)

//get diagonal R_kk and Q_k column

_r := vnorm(_a,_nrows)

matrix_set(_R,_r,k,k,_ncolumns)

for i = 0 to _nrows-1

matrix_set(_Q,array.get(_a,i)/_r,i,k,_nrows)

[_Q,_R]

pinv(_A,_nrows,_ncolumns) =>

//Pseudoinverse of matrix _A calculated using QR decomposition

// Input:

// _A:: array: implied as a (_nrows x _ncolumns) matrix _A = [[column_0],[column_1],...,[column_(_ncolumns-1)]]

// Output:

// _Ainv:: array implied as a (_ncolumns x _nrows) matrix _A = [[row_0],[row_1],...,[row_(_nrows-1)]]

// ----

// First find the QR factorization of A: A = QR,

// where R is upper triangular matrix.

// Then _Ainv = R^-1*Q^T.

// ----

[_Q,_R] = qr_diag(_A,_nrows,_ncolumns)

_QT = transpose(_Q,_nrows,_ncolumns)

// Calculate Rinv:

var _Rinv = array.new_float(_ncolumns*_ncolumns,0)

float _r = 0.0

matrix_set(_Rinv,1/matrix_get(_R,0,0,_ncolumns),0,0,_ncolumns)

if _ncolumns != 1

for j = 1 to _ncolumns-1

for i = 0 to j-1

_r := 0.0

for k = i to j-1

_r := _r + matrix_get(_Rinv,i,k,_ncolumns)*matrix_get(_R,k,j,_ncolumns)

matrix_set(_Rinv,_r,i,j,_ncolumns)

for k = 0 to j-1

matrix_set(_Rinv,-matrix_get(_Rinv,k,j,_ncolumns)/matrix_get(_R,j,j,_ncolumns),k,j,_ncolumns)

matrix_set(_Rinv,1/matrix_get(_R,j,j,_ncolumns),j,j,_ncolumns)

//

_Ainv = multiply(_Rinv,_QT,_ncolumns,_ncolumns,_nrows)

_Ainv

norm_rmse(_x, _xhat) =>

// Root Mean Square Error normalized to the sample mean

// _x. :: array float, original data

// _xhat :: array float, model estimate

// output

// _nrmse:: float

float _nrmse = 0.0

if array.size(_x) != array.size(_xhat)

_nrmse := na

else

int _N = array.size(_x)

float _mse = 0.0

for i = 0 to _N-1

_mse := _mse + pow(array.get(_x,i) - array.get(_xhat,i),2)/_N

_xmean = array.sum(_x)/_N

_nrmse := sqrt(_mse) /_xmean

_nrmse

diff(_src,_window,_degree) =>

// Polynomial differentiator

// input:

// _src:: input series

// _window:: integer: wigth of the moving lookback window

// _degree:: integer: degree of fitting polynomial

// output:

// _diff :: series: time derivative

// _nrmse:: float: normalized root mean square error

//

// Vandermonde matrix with implied dimensions (window x degree+1)

// Linear form: J = [ [z]^0, [z]^1, ... [z]^degree], with z = [ (1-window)/2 to (window-1)/2 ]

var _J = array.new_float(_window*(_degree+1),0)

for i = 0 to _window-1

for j = 0 to _degree

matrix_set(_J,pow(i,j),i,j,_window)

// Vector of raw datapoints:

var _Y_raw = array.new_float(_window,na)

for j = 0 to _window-1

array.set(_Y_raw,j,_src[_window-1-j])

// Calculate polynomial coefficients which minimize the loss function

_C = pinv(_J,_window,_degree+1)

_a_coef = multiply(_C,_Y_raw,_degree+1,_window,1)

// For first derivative, approximate the last point (i.e. z=window-1) by

float _diff = 0.0

for i = 1 to _degree

_diff := _diff + i*array.get(_a_coef,i)*pow(_window-1,i-1)

// Calculates data estimate (needed for rmse)

_Y_hat = multiply(_J,_a_coef,_window,_degree+1,1)

float _nrmse = norm_rmse(_Y_raw,_Y_hat)

[_diff,_nrmse]

/// --- main ---

degree = input(title="Polynomial Order", group = "Model Parameters:",

inline = "linepar1", type = input.integer, defval=2, minval = 1)

rsi_l = input(title = "RSI Length", group = "Model Parameters:",

inline = "linepar1", type = input.integer, defval = 21, minval = 1,

tooltip="The period length of RSI that is used as input.")

window = input(title="Length ( > Order)", group = "Model Parameters:",

inline = "linepar2", type = input.integer, defval=21, minval = 2)

signalLength = input(title="Signal Length", group = "Model Parameters:",

inline = "linepar2", type=input.integer, defval=9,

tooltip="The signal line is a EMA of the D-RSI time series.")

islong = input(title = "Buy", group = "Show Signals:",

inline = "lineent",type = input.bool, defval = true)

isshort = input(title = "Sell", group = "Show Signals:",

inline = "lineent", type = input.bool, defval= true)

showendlabels = input(title = "Exit", group = "Show Signals:",

inline = "lineent", type = input.bool, defval= true)

buycond = input(title="Buy", group = "Entry and Exit Conditions:",

inline = "linecond",type = input.string, defval="Zero-Crossing",

options=["Zero-Crossing", "Signal Line Crossing","Direction Change"])

sellcond = input(title="Sell", group = "Entry and Exit Conditions:",

inline = "linecond",type = input.string, defval="Zero-Crossing",

options=["Zero-Crossing", "Signal Line Crossing","Direction Change"])

endcond = input(title="Exit", group = "Entry and Exit Conditions:",

inline = "linecond",type = input.string, defval="Zero-Crossing",

options=["Zero-Crossing", "Signal Line Crossing","Direction Change"])

usenrmse = input(title = "", group = "Filter by Means of Root-Mean-Square Error of RSI Fitting:",

inline = "linermse",type = input.bool, defval = false)

rmse_thrs = input(title = "RSI fitting Error Threshold, %", type = input.float,

group = "Filter by Means of Root-Mean-Square Error of RSI Fitting:",

inline = "linermse", defval = 10, minval = 0.0) /100

src = rsi(close,rsi_l)

[drsi,nrmse] = diff(src,window,degree)

signalline = ema(drsi, signalLength)

// Conditions and filters

filter_rmse = usenrmse?nrmse<rmse_thrs:true

dirchangeup = (drsi>drsi[1]) and (drsi[1]<drsi[2]) and drsi[1]<0.0

dirchangedw = (drsi<drsi[1]) and (drsi[1]>drsi[2]) and drsi[1]>0.0

crossup = crossover(drsi,0.0)

crossdw = crossunder(drsi,0.0)

crosssignalup = crossover(drsi,signalline)

crosssignaldw = crossunder(drsi,signalline)

//Signals

golong = (buycond=="Direction Change"?dirchangeup:(buycond=="Zero-Crossing"?crossup:crosssignalup)) and filter_rmse

goshort= (sellcond=="Direction Change"?dirchangedw:(sellcond=="Zero-Crossing"?crossdw:crosssignaldw)) and filter_rmse

endlong = (endcond=="Direction Change"?dirchangedw:(endcond=="Zero-Crossing"?crossdw:crosssignaldw)) and filter_rmse

endshort= (endcond=="Direction Change"?dirchangeup:(endcond=="Zero-Crossing"?crossup:crosssignalup)) and filter_rmse

plotshape((golong and islong) ? low : na, location=location.belowbar, style=shape.labelup, color=#2E7C13, size=size.small, title='Buy')

plotshape((goshort and isshort) ? high: na, location=location.abovebar, style=shape.labeldown, color=#BF217C, size=size.small, title='Sell')

plotshape((showendlabels and endlong and islong) ? high: na, location=location.abovebar, style=shape.xcross, color=#2E7C13, size=size.tiny, title='Exit Long')

plotshape((showendlabels and endshort and isshort) ? low : na, location=location.belowbar, style=shape.xcross, color=#BF217C, size=size.tiny, title='Exit Short')

alertcondition(golong, title='Long Signal', message='D-RSI: Long Signal')

alertcondition(goshort, title='Short Signal', message='D-RSI: Short Signal')

alertcondition(endlong, title='Exit Long Signal', message='D-RSI: Exit Long')

alertcondition(endshort, title='Exit Short Signal', message='D-RSI: Exit Short')

if golong

strategy.entry("Enter Long", strategy.long)

else if goshort

strategy.entry("Enter Short", strategy.short)

- দ্বি-পরিমাপক গতিশীলতা প্রবণতা পরিমাণগত কৌশল সিস্টেম

- দ্বি-সমতল-আরএসআই মাল্টি সিগন্যাল ট্রেন্ড ট্রেডিং কৌশল

- ডায়নামিক ওয়াইনারি সিস্টেমের সাথে RSI গতির সূচকগুলির সাথে দিনের ব্যবসায়ের অপ্টিমাইজেশন কৌশল

- একাধিক প্রযুক্তিগত সূচক ক্রস গতিশীলতা প্রবণতা ট্র্যাকিং কৌশল

- ডায়নামিক অ্যাডজাস্টমেন্ট স্টপ লস ইলিফ্যান্ট পিলার আকারের ট্রেন্ড ট্র্যাকিং কৌশল

- দ্বি-চক্রীয় আরএসআই ট্রেন্ড গতির তীব্রতা কৌশল পিরিডেমিক অবস্থান ব্যবস্থাপনা সিস্টেমের সাথে মিলিত

- মাল্টি-ইউনিট্রি ক্রস-সাহায্যকারী আরএসআই ডায়নামিক প্যারামিটার পরিমাণগত ট্রেডিং কৌশল

- গতিশীল প্রবণতা RSI ক্রস কৌশল নির্ধারণ করে

- মাল্টি-ডিমেন্সনাল কে-প্রতিবেশী অ্যালগরিদম এবং ক্যাটাগরিয়াল বিশ্লেষণ ট্রেডিং কৌশল

- স্বনির্ধারিত মাল্টি-কৌশল ডায়নামিক স্যুইচিং সিস্টেমঃ কনফার্মেশন ট্রেন্ড ট্র্যাকিং এবং ব্যাপ্তি কম্পনের জন্য পরিমাণগত ট্রেডিং কৌশল

- মাল্টি-পরিমাপক মাল্টি-মাত্রিক প্রবণতা ক্রস উচ্চতর পরিমাণগত কৌশল

- ডিমার্ক সেটআপ সূচক

- Bollinger Bands স্টোকাস্টিক RSI Extreme

- AK MACD BB INDICATOR V ১.০০

- প্যারাবোলিক এসএআর

- আরএসআই ডিভার্জেন্স ইন্ডিকেটর

- OBV MACD সূচক

- পিভট ট্রেন্ড

- মূল্য বৈষম্য কৌশল v1.0

- সাপোর্ট-রেসিস্ট্যান্স ব্রেকআউট

- ঢাল অনুকূলনামূলক চলমান গড়

- নিম্ন স্ক্যানার কৌশল ক্রিপ্টো

- [blackcat] L2 বিপরীত লেবেল কৌশল

- সুপার বি

- উচ্চ নিম্ন SAR

- সুপারট্রেক্স

- পিক ডিটেক্টর

- নিম্ন সন্ধানকারী

- এসএমএ ট্রেন্ড

- বোলিংজার সর্বনিম্ন

- সুপার ট্রেন্ড বি