- Die Maschine.

Schriftsteller:ChaoZhang, Datum: 2022-05-08 11:21:20Tags:ATR

Hallo Händler,

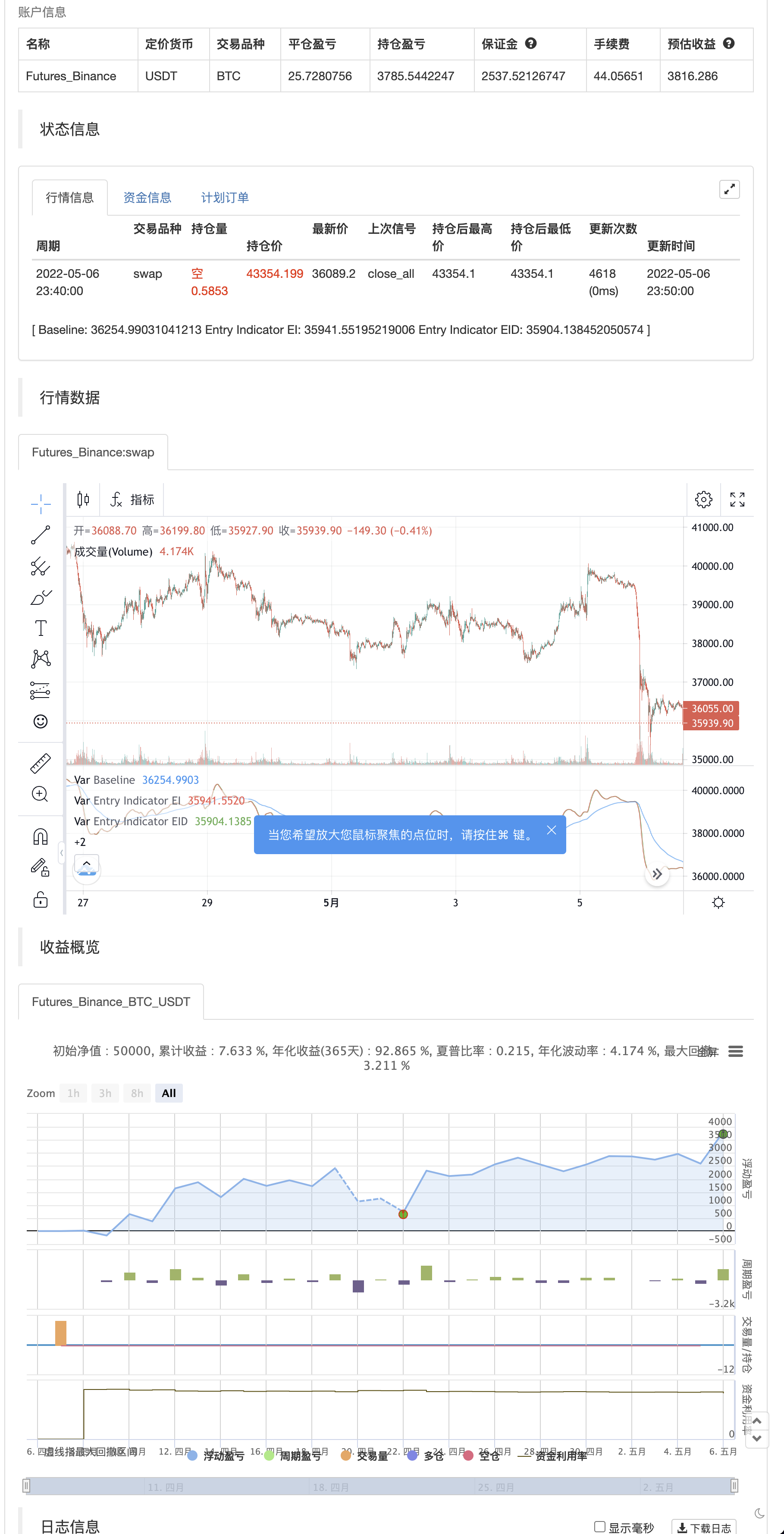

Hiermit präsentiere ich Ihnen die zweite Phase meiner Reise zur Suche nach einer zuverlässigen, profitablen Handelsstrategie.

Die

Die Strategie hat sich als sehr profitabel in Trending-Märkten erwiesen, kann aber während des Ranging-Marktes Verluste erleiden. Ich glaube, dass ein guter Trading-Bot aus mehr als 4 verschiedenen Strategien bestehen muss, basierend auf verschiedenen Systemen.

Mein Ziel bei der Veröffentlichung dieser Strategie ist es, anderen Händlern zu helfen, ihre eigenen zu entwickeln. Auf meiner Reise fand ich es schwierig, eine gute Strategie zu finden, die ein anständiges Risikomanagement einsetzt, was wirklich wichtig ist, um gute, konsistente Ergebnisse zu erzielen. Außerdem muss eine realistische Provision definiert werden, um eine realistische Leistungsvorhersage zu haben. Dies lastet auf der Rentabilität und wird daher oft von Autoren anderer Strategien auf Null gesetzt, was ich für irreführend halte.

Wenn Sie diese Strategie informativ oder nützlich fanden, hinterlassen Sie bitte einen Kommentar.

Grüße, Michael.

Zurückprüfung

// © Milleman

//@version=4

//strategy("MilleMachine", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.06)

// Additional settings

Mode = input(title="Mode", defval="LongShort", options=["LongShort", "OnlyLong", "OnlyShort","Indicator Mode"])

UseTP = false //input(false, title="Use Take Profit?")

QuickSwitch = true //input(true, title="Quickswitch")

UseTC = true //input(true, title="Use Trendchange?")

// Risk management settings

//Spacer2 = input(false, title="======= Risk management settings =======")

Risk = input(1.0, title="% Risk",minval=0)/100

RRR = 2 //input(2,title="Risk Reward Ratio",step=0.1,minval=0,maxval=20)

SL_Mode = false // input(true, title="ON = Fixed SL / OFF = Dynamic SL (ATR)")

SL_Fix = 3 //input(3,title="StopLoss %",step=0.25, minval=0)/100

ATR = atr(14) //input(14,title="Periode ATR"))

Mul = input(2,title="ATR Multiplier",step=0.1)

xATR = ATR * Mul

SL = SL_Mode ? SL_Fix : (1 - close/(close+xATR))

// INDICATORS //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Ind(type, src, len) =>

float result = 0

if type=="McGinley"

result := na(result[1]) ? ema(src, len) : result[1] + (src - result[1]) / (len * pow(src/result[1], 4))

if type=="HMA"

result := wma(2*wma(src, len/2)-wma(src, len), round(sqrt(len)))

if type=="EHMA"

result := ema(2*ema(src, len/2)-ema(src, len), round(sqrt(len)))

if type=="THMA"

lend = len/2

result := wma(wma(src, lend/3)*3-wma(src, lend/2)-wma(src,lend), lend)

if type=="SMA" // Simple

result := sma(src, len)

if type=="EMA" // Exponential

result := ema(src, len)

if type=="DEMA" // Double Exponential

e = ema(src, len)

result := 2 * e - ema(e, len)

if type=="TEMA" // Triple Exponential

e = ema(src, len)

result := 3 * (e - ema(e, len)) + ema(ema(e, len), len)

if type=="WMA" // Weighted

result := wma(src, len)

if type=="VWMA" // Volume Weighted

result := vwma(src, len)

if type=="SMMA" // Smoothed

w = wma(src, len)

result := (w[1] * (len - 1) + src) / len

if type == "RMA"

result := rma(src, len)

if type=="LSMA" // Least Squares

result := linreg(src, len, 0)

if type=="ALMA" // Arnaud Legoux

result := alma(src, len, 0.85, 6)

if type=="Kijun" //Kijun-sen

kijun = avg(lowest(len), highest(len))

result :=kijun

if type=="WWSA" // Welles Wilder Smoothed Moving Average

result := nz(result[1]) + (close -nz(result[1]))/len

result

// Baseline : Switch from Long to Short and vice versa

BL_Act = input(true, title="====== Activate Baseline - Switch L/S ======")

BL_type = input(title="Baseline Type", defval="McGinley", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

BL_src = input(close, title="BL source")

BL_len = input(50, title="BL length", minval=1)

BL = Ind(BL_type,BL_src, BL_len)

// Confirmation indicator

C1_Act = input(false, title="===== Activate Confirmation indicator =====")

C1_type = input(title="C1 Entry indicator", defval="SMA", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

C1_src = input(close, title="Source")

C1_len = input(5,title="Length", minval=1)

C1 = Ind(C1_type,C1_src,C1_len)

// Entry indicator : Hull Moving Average

Spacer5 = input(true, title="====== ENTRY indicator =======")

EI_type = input(title="EI Entry indicator", defval="HMA", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

EI_src = input(close, title="Source")

EI_Len = input(46,title="Length", minval=1)

EI = Ind(EI_type,EI_src,EI_Len)

// Trail stop settings

TrailActivation = input(true, title="===== Activate Trailing Stop =====")

TS_type = input(title="TS Traling Stop Type", defval="EMA", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

TrailSLScaling = 1 //input(100, title="SL Scaling", minval=0, step=5)/100

TrailingSourceLong = Ind(TS_type,low,input(5,"Smoothing Trail Long EMA", minval=1))

TrailingSourceShort = Ind(TS_type,high,input(2,"Smoothing Trail Short EMA", minval=1))

//VARIABLES MANAGEMENT

TriggerPrice = 0.0, TriggerPrice := TriggerPrice[1]

TriggerSL = 0.0, TriggerSL := TriggerSL[1]

SLPrice = 0.0, SLPrice := SLPrice[1], TPPrice = 0.0, TPPrice := TPPrice[1]

isLong = false, isLong := isLong[1], isShort = false, isShort := isShort[1]

//LOGIC

GoLong = crossover(EI,EI[1]) and (strategy.position_size == 0.0 and QuickSwitch) and (not BL_Act or BL/BL[1] > 1) and (not C1_Act or C1>C1[1]) and (Mode == "LongShort" or Mode == "OnlyLong")

GoShort = crossunder(EI,EI[1]) and (strategy.position_size == 0.0 and QuickSwitch) and (not BL_Act or BL/BL[1] < 1) and (not C1_Act or C1<C1[1]) and (Mode == "LongShort" or Mode == "OnlyShort")

ExitLong = isLong and crossunder(EI,EI[1]) and UseTC

ExitShort = isShort and crossover(EI,EI[1]) and UseTC

//FRAMEWORK

//Reset Long-Short memory

if isLong and strategy.position_size == 0.0

isLong := false

if isShort and strategy.position_size == 0.0

isShort := false

//Long

if GoLong

isLong := true, TriggerPrice := close, TriggerSL := SL

TPPrice := UseTP? TriggerPrice * (1 + (TriggerSL * RRR)) : na

SLPrice := TriggerPrice * (1-TriggerSL)

Entry_Contracts = strategy.equity * Risk / ((TriggerPrice-SLPrice)/TriggerPrice) / TriggerPrice

strategy.entry("Long", strategy.long, comment=str.tostring(math.round((TriggerSL/TriggerPrice)*1000)), qty=Entry_Contracts)

strategy.exit("TPSL","Long", limit=TPPrice, stop=SLPrice)

if isLong

NewValSL = TrailingSourceLong * (1 - (SL*TrailSLScaling))

if TrailActivation and NewValSL > SLPrice

SLPrice := NewValSL

strategy.exit("TPSL","Long", limit=TPPrice, stop=SLPrice)

if ExitLong

strategy.close_all(comment="TrendChange")

isLong := false

//Short

if GoShort

isShort := true, TriggerPrice := close, TriggerSL := SL

TPPrice := UseTP? TriggerPrice * (1 - (TriggerSL * RRR)) : na

SLPrice := TriggerPrice * (1 + TriggerSL)

Entry_Contracts = strategy.equity * Risk / ((SLPrice-TriggerPrice)/TriggerPrice) / TriggerPrice

strategy.entry("Short", strategy.short, comment=str.tostring(math.round((TriggerSL/TriggerPrice)*1000)), qty=Entry_Contracts)

strategy.exit("TPSL","Short", limit=TPPrice, stop=SLPrice)

if isShort

NewValSL = TrailingSourceShort * (1 + (SL*TrailSLScaling))

if TrailActivation and NewValSL < SLPrice

SLPrice := NewValSL

strategy.exit("TPSL","Short", limit=TPPrice, stop=SLPrice)

if ExitShort

strategy.close_all(comment="TrendChange")

isShort := false

//VISUALISATION

plot(BL_Act?BL:na, color=color.blue,title="Baseline")

plot(C1_Act?C1:na, color=color.yellow,title="confirmation Indicator")

EIColor = EI>EI[1] ? color.green : color.red

Fill_EI = plot(EI, color=EIColor, linewidth=1, transp=40, title="Entry Indicator EI")

Fill_EID = plot(EI[1], color=EIColor, linewidth=1, transp=40, title="Entry Indicator EID")

plot(strategy.position_size != 0.0 and (isLong or isShort) ? TriggerPrice : na, title="TriggerPrice", color=color.yellow, style=plot.style_linebr)

plot(strategy.position_size != 0.0 and (isLong or isShort) ? TPPrice : na, title="TakeProfit", color=color.green, style=plot.style_linebr)

plot(strategy.position_size != 0.0 and (isLong or isShort) ? SLPrice : na, title="StopLoss", color=color.red, style=plot.style_linebr)

- Zweigliedertragtrend-Quantifizierungsstrategie-System

- Multidimensionale Trendbeurteilung und ATR-dynamische Stop-Loss-Strategien

- Hochrangige Trends in mehreren Indikatoren bestätigen die Handelsstrategie

- Intelligente Stop-Loss-Tracking-Strategien basierend auf den gleitenden Durchschnitten und dem Tagesmodell

- Quantitative Handelssysteme mit Multifaktorregression und dynamischer Preisbandstrategie

- Multiple glatte, dynamische Kreuztrendverfolgung und mehrere bestätigte quantitative Handelsstrategien

- Erweiterte Stopp-Loss-Dynamic-Tracking-Strategien, die auf einer Vielzahl von Linien basieren, die von RSI abweichen

- Multikondensatorische Synergie Trends Umkehrung von Handelsstrategien

- Multi-Channel-Dynamik unterstützt die Kennie-Channel-Strategie

- Maschinelles Lernen passt sich an Supertrends an und quantitative Handelsstrategien

- Handelsstrategien, die durchschnittliche Trends auf Basis von Volatilitätsstopp verfolgen

- QQE MOD + SSL Hybrid + Waddah Attar Explosion

- Kauf/Verkauf von Strat

- Triple Supertrend mit EMA und ADX

- Tom DeMark Sequentielle Wärmekarte

- jma + dwma für Mehrkornprodukte

- MACD-Wert

- Z-Score mit Signalen

- Das ist eine sehr einfache Strategie für die Schwankungsrate.

- 3EMA + Boullinger + PIVOT

- Baguette nach Mehrkorn

- K-Umkehrindikator I

- Schwelende Kerzen

- MA Kaiser insilliconot

- Demark-Umkehrpunkte

- Swing Highs/Lows und Kerzenmuster

- TMA-Überlagerung

- MACD + SMA 200-Strategie

- CM-Schleudersystem

- Bollinger + RSI, Doppelstrategie v1.1

- Bollinger-Band-Strategie