Bitcoin Quantitative Band Trading Strategie basierend auf mehreren Zeitrahmen

Schriftsteller:ChaoZhang, Datum: 23.12.2023Tags:

Übersicht

Diese Strategie identifiziert die Preisbänder von Bitcoin, indem sie quantitative Indikatoren über verschiedene Zeitrahmen hinweg kombiniert und Trends verfolgt.

Strategie Logik

- Der RSI-Indikator, der auf der Grundlage des täglichen Zeitrahmens berechnet wird, wird auf der Grundlage des Handelsvolumens gewogen, um falsche Ausbrüche zu filtern.

- Der tägliche RSI-Indikator wird durch eine EMA glättet, um einen quantitativen Band-Indikator zu erstellen.

- Der 5-minütige Zeitrahmen verwendet eine Kombination aus linearen Regressions- und HMA-Indikatoren, um Handelssignale zu erzeugen.

- Durch die Kombination des quantitativen Band-Indikators und der Handelssignale über Zeiträume hinweg werden mittelfristige bis langfristige Preisbereiche ermittelt.

Analyse der Vorteile

- Der volumengewichtete RSI-Indikator kann echte Bands effektiv identifizieren und falsche Ausbrüche filtern.

- Der HMA-Indikator ist anfälliger für Preisänderungen und kann Pünktlichkeiten erfassen.

- Die Kombination mehrerer Zeitrahmen führt zu einer genaueren Ermittlung der mittelfristigen bis langfristigen Bands.

- Der Handel im 5-minütigen Zeitrahmen ermöglicht eine höhere Betriebsfrequenz.

- Als Band-Tracking-Strategie erfordert sie keine genaue Auswahl von Punkten und kann länger halten.

Risikoanalyse

- Quantitative Indikatoren können falsche Signale erzeugen, eine Fundamentalanalyse wird empfohlen.

- Es kann sein, dass sich die Bands auf halbem Weg umkehren. Es sollten Stop-Loss-Mechanismen vorhanden sein.

- Signalverzögerungen können dazu führen, dass die besten Einstiegspunkte fehlen.

- Gewinnbringende Bands benötigen längere Haltedauer und erfordern Kapitaldrucktoleranz.

Optimierungsrichtlinien

- Prüfung der Wirksamkeit von RSI-Indikatoren mit verschiedenen Parametern.

- Versuchen Sie, andere Hilfsbandanzeigen einzuführen.

- Optimierung der Längenparameter des HMA-Indikators.

- Fügen Sie Stop-Loss- und Take-Profit-Strategien hinzu.

- Anpassung des Haltezyklus für Bandhandel.

Schlussfolgerung

Diese Strategie erfasst effektiv die mittelfristigen bis langfristigen Trends von Bitcoin, indem sie Zeitrahmen und Band-Tracking kombiniert. Im Vergleich zum kurzfristigen Handel sieht der mittelfristige bis langfristige Band-Handel kleinere Drawdowns und ein größeres Gewinnpotenzial.

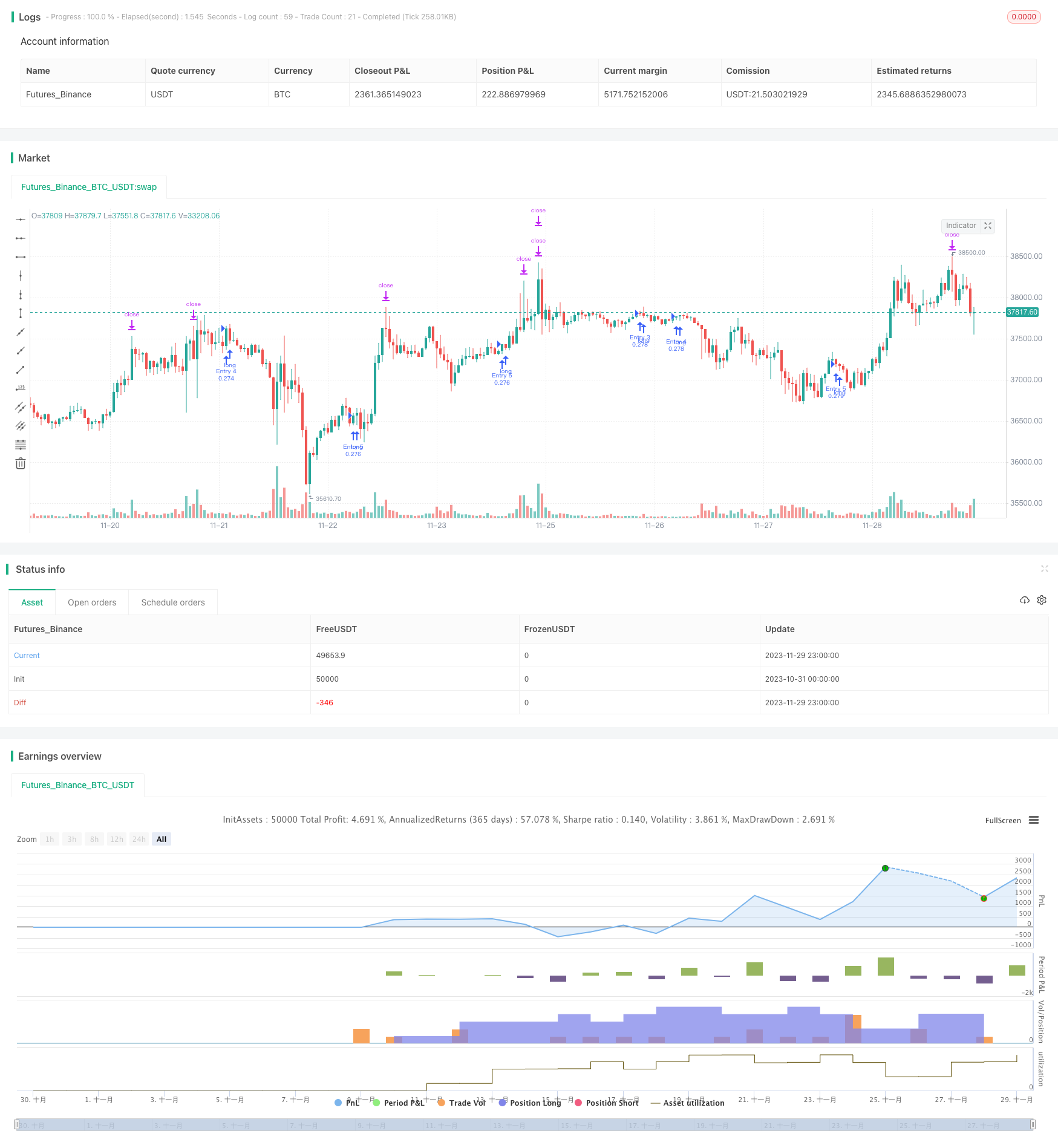

/*backtest

start: 2023-10-31 00:00:00

end: 2023-11-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title='Pyramiding BTC 5 min', overlay=true, pyramiding=5, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=20, commission_type=strategy.commission.percent, commission_value=0.075)

//the pyramide based on this script https://www.tradingview.com/script/7NNJ0sXB-Pyramiding-Entries-On-Early-Trends-by-Coinrule/

//

fastLength = input(250, title="Fast filter length ", minval=1)

slowLength = input(500,title="Slow filter length", minval=1)

source=close

v1=ema(source,fastLength)

v2=ema(source,slowLength)

//

//Backtest dates

fromMonth = input(defval=1, title="From Month")

fromDay = input(defval=10, title="From Day")

fromYear = input(defval=2020, title="From Year")

thruMonth = input(defval=1, title="Thru Month")

thruDay = input(defval=1, title="Thru Day")

thruYear = input(defval=2112, title="Thru Year")

showDate = input(defval=true, title="Show Date Range")

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => // create function "within window of time"

time >= start and time <= finish ? true : false

leng=1

p1=close[1]

len55 = 10

//taken from https://www.tradingview.com/script/Ql1FjjfX-security-free-MTF-example-JD/

HTF = input("1D", type=input.resolution)

ti = change( time(HTF) ) != 0

T_c = fixnan( ti ? close : na )

vrsi = rsi(cum(change(T_c) * volume), leng)

pp=wma(vrsi,len55)

d=(vrsi[1]-pp[1])

len100 = 10

x=ema(d,len100)

//

zx=x/-1

col=zx > 0? color.lime : color.orange

//

tf10 = input("1", title = "Timeframe", type = input.resolution, options = ["1", "5", "15", "30", "60","120", "240","360","720", "D", "W"])

length = input(50, title = "Period", type = input.integer)

shift = input(1, title = "Shift", type = input.integer)

hma(_src, _length)=>

wma((2 * wma(_src, _length / 2)) - wma(_src, _length), round(sqrt(_length)))

hma3(_src, _length)=>

p = length/2

wma(wma(close,p/3)*3 - wma(close,p/2) - wma(close,p),p)

b =security(syminfo.tickerid, tf10, hma3(close[1], length)[shift])

//plot(a,color=color.gray)

//plot(b,color=color.yellow)

close_price = close[0]

len = input(25)

linear_reg = linreg(close_price, len, 0)

filter=input(true)

buy=crossover(linear_reg, b)

longsignal = (v1 > v2 or filter == false ) and buy and window()

//set take profit

ProfitTarget_Percent = input(3)

Profit_Ticks = close * (ProfitTarget_Percent / 100) / syminfo.mintick

//set take profit

LossTarget_Percent = input(10)

Loss_Ticks = close * (LossTarget_Percent / 100) / syminfo.mintick

//Order Placing

strategy.entry("Entry 1", strategy.long, when=strategy.opentrades == 0 and longsignal)

strategy.entry("Entry 2", strategy.long, when=strategy.opentrades == 1 and longsignal)

strategy.entry("Entry 3", strategy.long, when=strategy.opentrades == 2 and longsignal)

strategy.entry("Entry 4", strategy.long, when=strategy.opentrades == 3 and longsignal)

strategy.entry("Entry 5", strategy.long, when=strategy.opentrades == 4 and longsignal)

if strategy.position_size > 0

strategy.exit(id="Exit 1", from_entry="Entry 1", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 2", from_entry="Entry 2", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 3", from_entry="Entry 3", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 4", from_entry="Entry 4", profit=Profit_Ticks, loss=Loss_Ticks)

strategy.exit(id="Exit 5", from_entry="Entry 5", profit=Profit_Ticks, loss=Loss_Ticks)

Mehr

- Doppelindikatoren-Combo Crazy Intraday Scalping-Strategie

- Dynamische Netzhandelsstrategie

- Handelsstrategie mit doppelten gleitenden Durchschnitten

- Früherer Gewinnspiel mit gleitendem Durchschnitt Eröffnungsgespräch Exitstrategie

- Monatliche parabolische Ausbruchsstrategie

- Trendfilter gleitender Durchschnitt Quantifizierungsstrategie

- RSI und quantitative Handelsstrategie auf Basis gleitender Durchschnitte

- Strategie zur Erfassung der Volatilität des RSI-Bollinger-Band

- Umgekehrte Triaden-Quantitative Strategie

- FiboBuLL-Wellenstrategie basierend auf Bollinger-Band-Breakout

- Trend nach der Strategie des exponentiellen gleitenden Durchschnitts

- Strategie zur Umkehrung von Verlusten durch Trailing Stop

- Schnelle RSI-Umkehrstrategie

- Die Risikopositionen werden in der Tabelle 1 aufgeführt.

- RSI-Strategie für den Kreuzungstrend

- Dynamische Unterstützungs- und Widerstandsstrategie auf der Grundlage historischer Daten

- Noros Bollinger-Tracking-Strategie

- EMA-Umkehr-Kauf-Verkauf-Strategie

- Harami Schlusskursstrategie

- Momentum-Handelsstrategie auf der Grundlage von CMO und WMA