Trendfolgestrategie mit einzelnem exponentiellen gleitenden Durchschnitt und Trailing Stop

Überblick

Die Strategie kombiniert den Einsatz eines einfachen Index-Gleichlauf-Moving Averages (SESMA) mit einer begleitenden Tanger-Leiterumrundung, um eine sehr stabile und effiziente Trendverfolgung zu bilden. Die SESMA dient als Leitlinie zur Identifizierung der Richtung der Preisentwicklung. Die Trailing Stop-Strategie kann die Risiken der Strategie effektiv reduzieren und gleichzeitig die Gewinne der Strategie schützen.

Strategieprinzip

Die Strategie besteht aus zwei zentralen Indikatoren:

Einfacher gleitender gleitender Durchschnitt (SESMA): Das SESMA nutzt die Idee der EMA und verbessert gleichzeitig die Parameter, um die Kurve zu glätten und die Verzögerung zu verringern. Die Preisentwicklung wird durch die Richtung und die Preisbeziehung des SESMA beurteilt.

Tracking-Stop-Mechanismus: Die Stop-Line wird in Echtzeit berechnet, wenn der höchste Preis, der niedrigste Preis und der ATR-Indikator kombiniert werden. Es handelt sich um einen dynamisch angepassten Stop-Line-Mechanismus, der die Stop-Loss-Werte an die Marktvolatilität und die Trends anpasst.

Die Eintrittsbasis für diese Strategie ist der Preisbruch des SESMA. Das Ausstiegssignal wird von der Stop-Loss-Linie ausgelöst. Es kann eingestellt werden, ob ein Marker angezeigt wird.

Strategische Vorteile

- Die SESMA-Rechnungsmethode wurde verbessert, um die Verzögerung zu verringern und die Überschwemmungskapazität zu verbessern.

- Die Schleppschutzmechanismen können die Stop-Loss-Werte anhand von Echtzeit-Schwankungen anpassen, um zu schleppende oder zu enge Stop-Losses zu vermeiden.

- Ein zusätzliches visuelles Hilfsmittel, das den Zeitpunkt der Ein- und Ausfahrt bestimmen soll.

- Anpassbare Parameter für verschiedene Sorten und Parameteroptimierungen.

Risiken und Optimierung

- Bei einer Trendwende kann ein Stop-Loss ausgelöst werden, der zu einem vorzeitigen Ausstieg führt. Die Stop-Loss-Marge kann entsprechend gelockert werden.

- Die SESMA-Parameter können optimiert werden, um die optimale Länge zu finden.

- Die ATR-Parameter können auch verschiedene Periodenlängen testen.

- Wirkung des Tests auf die Markierung.

Zusammenfassen

Die Strategie kombiniert Trendbeurteilung mit Risikokontrollindikatoren zu einer robusteren Trendverfolgungsstrategie. Im Vergleich zu einer einfachen Moving Average-Strategie bietet die Strategie eine größere Flexibilität, Trends zu erfassen und Rückschläge zu reduzieren. Durch Parameteroptimierung kann die Strategie in verschiedenen Märkten besser funktionieren.

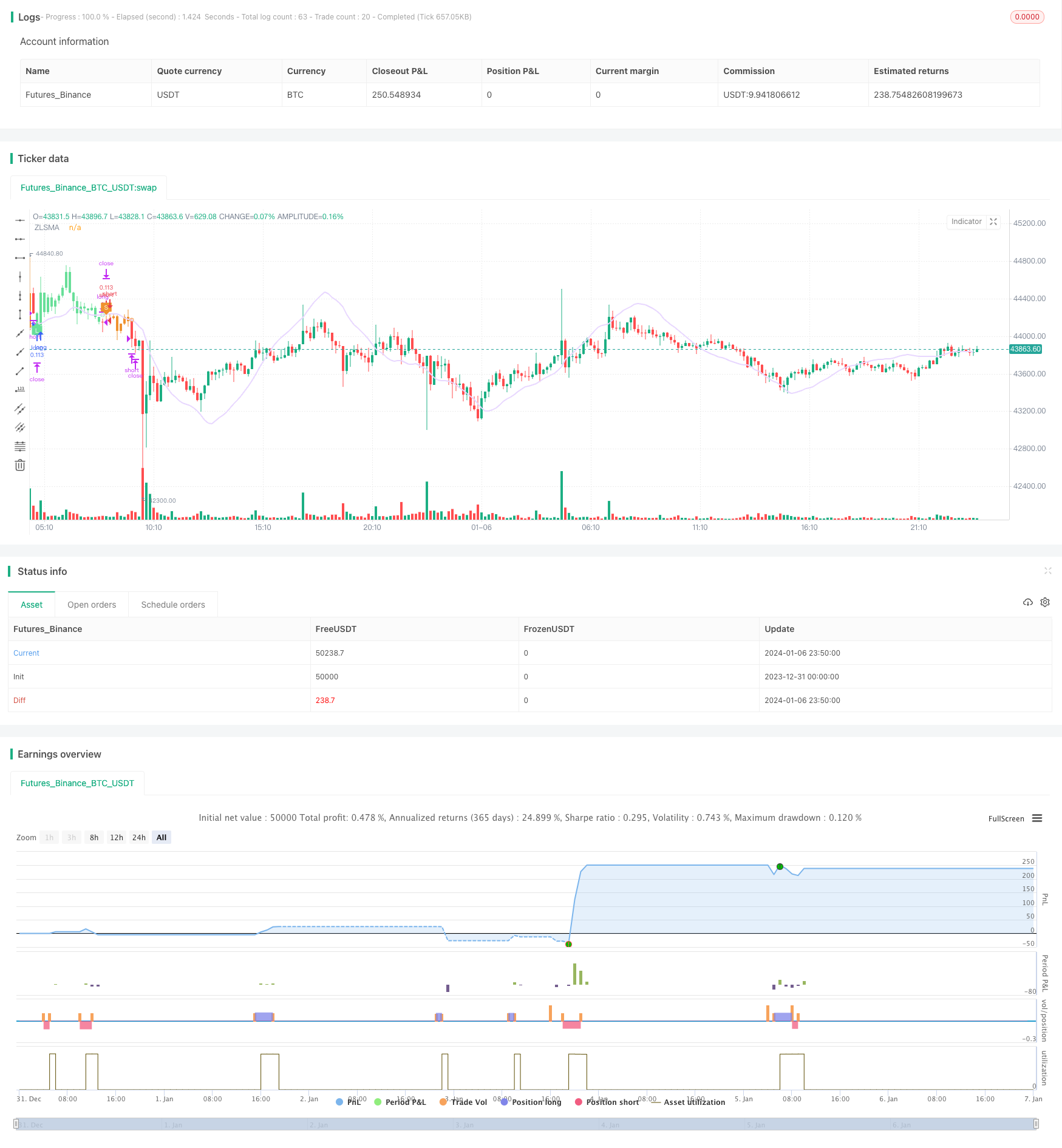

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-07 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © simwai

strategy('Chandelier Exit ZLSMA Strategy', shorttitle='CE_ZLSMA', overlay = true, initial_capital = 1000, default_qty_value = 10, default_qty_type = strategy.percent_of_equity, calc_on_every_tick = false, process_orders_on_close = true, commission_value = 0.075)

// -- Colors --

color maximumYellowRed = color.rgb(255, 203, 98) // yellow

color rajah = color.rgb(242, 166, 84) // orange

color magicMint = color.rgb(171, 237, 198)

color languidLavender = color.rgb(232, 215, 255)

color maximumBluePurple = color.rgb(181, 161, 226)

color skyBlue = color.rgb(144, 226, 244)

color lightGray = color.rgb(214, 214, 214)

color quickSilver = color.rgb(163, 163, 163)

color mediumAquamarine = color.rgb(104, 223, 153)

color carrotOrange = color.rgb(239, 146, 46)

// -- Inputs --

length = input(title='ATR Period', defval=1)

mult = input.float(title='ATR Multiplier', step=0.1, defval=2)

showLabels = input(title='Show Buy/Sell Labels ?', tooltip='Created by Chandelier Exit (CE)', defval=false)

isSignalLabelEnabled = input(title='Show Signal Labels ?', defval=true)

useClose = input(title='Use Close Price for Extrema ?', defval=true)

zcolorchange = input(title='Enable Rising/Decreasing Highlightning', defval=false)

zlsmaLength = input(title='ZLSMA Length', defval=50)

offset = input(title='Offset', defval=0)

// -- CE - Credits to @everget --

float haClose = float(1) / 4 * (open[1] + high[1] + low[1] + close[1])

atr = mult * ta.atr(length)[1]

longStop = (useClose ? ta.highest(haClose, length) : ta.highest(haClose, length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := haClose > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(haClose, length) : ta.lowest(haClose, length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := haClose < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := haClose > shortStopPrev ? 1 : haClose < longStopPrev ? -1 : dir

buySignal = dir == 1 and dir[1] == -1

plotshape(buySignal and showLabels ? longStop : na, title='Buy Label', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=mediumAquamarine, textcolor=color.white)

sellSignal = dir == -1 and dir[1] == 1

plotshape(sellSignal and showLabels ? shortStop : na, title='Sell Label', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=carrotOrange, textcolor=color.white)

changeCond = dir != dir[1]

// -- ZLSMA - Credits to @netweaver2011 --

lsma = ta.linreg(haClose, zlsmaLength, offset)

lsma2 = ta.linreg(lsma, zlsmaLength, offset)

eq = lsma - lsma2

zlsma = lsma + eq

zColor = zcolorchange ? zlsma > zlsma[1] ? magicMint : rajah : languidLavender

plot(zlsma, title='ZLSMA', linewidth=2, color=zColor)

// -- Signals --

var string isTradeOpen = ''

var string signalCache = ''

bool enterLong = buySignal and ta.crossover(haClose, zlsma)

bool exitLong = ta.crossunder(haClose, zlsma)

bool enterShort = sellSignal and ta.crossunder(haClose, zlsma)

bool exitShort = ta.crossover(haClose, zlsma)

if (signalCache == 'long entry')

signalCache := ''

enterLong := true

else if (signalCache == 'short entry')

signalCache := ''

enterShort := true

if (isTradeOpen == '')

if (exitShort and (not enterLong))

exitShort := false

if (exitLong and (not enterShort))

exitLong := false

if (enterLong and exitShort)

isTradeOpen := 'long'

exitShort := false

else if (enterShort and exitLong)

isTradeOpen := 'short'

exitLong := false

else if (enterLong)

isTradeOpen := 'long'

else if (enterShort)

isTradeOpen := 'short'

else if (isTradeOpen == 'long')

if (exitShort)

exitShort := false

if (enterLong)

enterLong := false

if (enterShort and exitLong)

enterShort := false

signalCache := 'short entry'

if (exitLong)

isTradeOpen := ''

else if (isTradeOpen == 'short')

if (exitLong)

exitLong := false

if (enterShort)

enterShort := false

if (enterLong and exitShort)

enterLong := false

signalCache := 'long entry'

if (exitShort)

isTradeOpen := ''

plotshape((isSignalLabelEnabled and enterLong) ? zlsma : na, title='LONG', text='L', style=shape.labelup, color=mediumAquamarine, textcolor=color.white, size=size.tiny, location=location.absolute)

plotshape((isSignalLabelEnabled and enterShort) ? zlsma : na, title='SHORT', text='S', style=shape.labeldown, color=carrotOrange, textcolor=color.white, size=size.tiny, location=location.absolute)

plotshape((isSignalLabelEnabled and exitLong) ? zlsma : na, title='LONG EXIT', style=shape.circle, color=magicMint, size=size.tiny, location=location.absolute)

plotshape((isSignalLabelEnabled and exitShort) ? zlsma : na, title='SHORT EXIT', style=shape.circle, color=rajah, size=size.tiny, location=location.absolute)

barcolor(color=isTradeOpen == 'long' ? mediumAquamarine : isTradeOpen == 'short' ? carrotOrange : na)

// -- Long Exits --

if (exitLong and strategy.position_size > 0)

strategy.close('long', comment='EXIT_LONG')

// -- Short Exits --

if (exitShort and strategy.position_size < 0)

strategy.close('short', comment='EXIT_SHORT')

// -- Long Entries --

if (enterLong)

strategy.entry('long', strategy.long, comment='ENTER_LONG')

// -- Short Entries --

if (enterShort)

strategy.entry('short', strategy.short, comment='ENTER_SHORT')