EMA-Multi-DCA-Strategie mit Trailing Stop Loss und Gewinnziel

Schriftsteller:ChaoZhang, Datum: 2024-01-19 15:16:53Tags:

Übersicht

Diese Strategie nutzt dynamische mehrere EMAs als Einstiegssignale in Kombination mit Trailing Stop Loss und Gewinnzielmechanismen für das Risikomanagement. Sie nutzt die glättende Natur von EMAs, um Trends zu identifizieren und die Kosten über Multi-DCA-Einträge zu steuern. Darüber hinaus verbessert die Integration von adaptiven Stop Loss- und Gewinnnahmefunktionen den Automatisierungsprozess.

Strategie Logik

Indikatoren

- Durchschnittliche tatsächliche Reichweite (ATR)

Eintrittssignale

Die EMA-Strategie wird von den EMA-Perioden verwendet, in denen der Kurs innerhalb einer Reihe von EMA-Perioden überschreitet oder bewegt.

Risikomanagement

Sie beinhaltet mehrere Risikokontrollmechanismen:

- ATR Stop Loss: Alle Positionen schließen, wenn ATR den Schwellenwert überschreitet

- Grenze der Eingabefrequenz: Kontrolle der Höchstzahl der Eingaben

- Der Wert des Vermögenswertes, der für die Berechnung der Vermögenswerte verwendet wird.

Gewinngewinn

Festlegung von Gewinnzielpreisen für Exits

Vorteile

- Identifizierung von Trends unter Verwendung von EMAs mit Lärmfilterung

- Kostendurchschnitt über mehrere DCA-Einträge

- Verbesserte Eintrittssignale unter Verwendung von EMA-Combos

- Adaptiver Stop-Loss-Mechanismus

- Gewinnkontrolle zum Gewinnschutz

Risiken und Verbesserungen

- EMA-Ausrichtung muss für verschiedene Märkte optimiert werden

- Übermäßige DCA-Einträge können zu viel Kapital einnehmen

- Stopp-Loss-Prozentsatz muss zurück getestet werden

Verbesserungsstrategien

- Optimierung der DCA-Frequenz und des Stop-Loss-Prozentsatzes für mehrere Variablen

- Einbeziehung von Modellen des maschinellen Lernens für Preisänderungsprognosen

- Integration eines Positionsgrößenmoduls zur Verwaltung der Gesamtverwertung des Kapitals

Schlussfolgerung

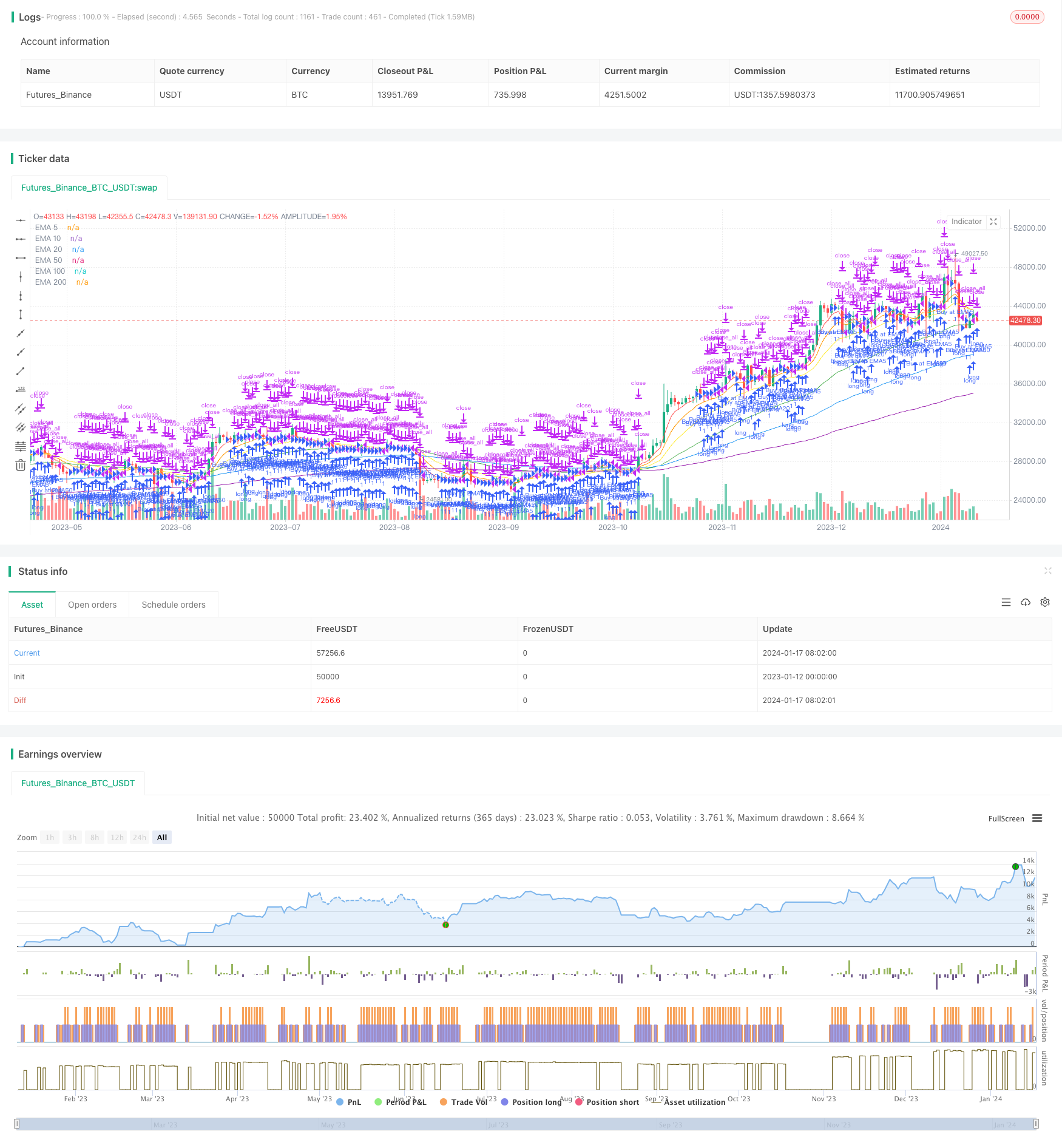

/*backtest

start: 2023-01-12 00:00:00

end: 2024-01-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("EMA DCA Strategy with Trailing Stop and Profit Target", overlay=true )

// Define the investment amount for when the condition is met

investment_per_condition = 6

// Define the EMAs

ema5 = ema(close, 5)

ema10 = ema(close, 10)

ema20 = ema(close, 20)

ema50 = ema(close, 50)

ema100 = ema(close, 100)

ema200 = ema(close, 200)

// Define ATR sell threshold

atr_sell_threshold = input(title="ATR Sell Threshold", type=input.integer, defval=10, minval=1)

// Helper function to find if the price is within 1% of the EMA

isWithin1Percent(price, ema) =>

ema_min = ema * 0.99

ema_max = ema * 1.01

price >= ema_min and price <= ema_max

// Control the number of buys

var int buy_count = 0

buy_limit = input(title="Buy Limit", type=input.integer, defval=3000)

// Calculate trailing stop and profit target levels

trail_percent = input(title="Trailing Stop Percentage", type=input.integer, defval=1, minval=0, maxval=10)

profit_target_percent = input(title="Profit Target Percentage", type=input.integer, defval=3, minval=1, maxval=10)

// Determine if the conditions are met and execute the strategy

checkConditionAndBuy(emaValue, emaName) =>

var int local_buy_count = 0 // Create a local mutable variable

if isWithin1Percent(close, emaValue) and local_buy_count < buy_limit

strategy.entry("Buy at " + emaName, strategy.long, qty=investment_per_condition / close, alert_message ="Buy condition met for " + emaName)

local_buy_count := local_buy_count + 1

// alert("Buy Condition", "Buy condition met for ", freq_once_per_bar_close)

local_buy_count // Return the updated local_buy_count

// Add ATR sell condition

atr_condition = atr(20) > atr_sell_threshold

if atr_condition

strategy.close_all()

buy_count := 0 // Reset the global buy_count when selling

// Strategy execution

buy_count := checkConditionAndBuy(ema5, "EMA5")

buy_count := checkConditionAndBuy(ema10, "EMA10")

buy_count := checkConditionAndBuy(ema20, "EMA20")

buy_count := checkConditionAndBuy(ema50, "EMA50")

buy_count := checkConditionAndBuy(ema100, "EMA100")

buy_count := checkConditionAndBuy(ema200, "EMA200")

// Calculate trailing stop level

trail_offset = close * trail_percent / 100

trail_level = close - trail_offset

// Set profit target level

profit_target_level = close * (1 + profit_target_percent / 100)

// Exit strategy: Trailing Stop and Profit Target

strategy.exit("TrailingStop", from_entry="Buy at EMA", trail_offset=trail_offset, trail_price=trail_level)

strategy.exit("ProfitTarget", from_entry="Buy at EMA", when=close >= profit_target_level)

// Plot EMAs

plot(ema5, title="EMA 5", color=color.red)

plot(ema10, title="EMA 10", color=color.orange)

plot(ema20, title="EMA 20", color=color.yellow)

plot(ema50, title="EMA 50", color=color.green)

plot(ema100, title="EMA 100", color=color.blue)

plot(ema200, title="EMA 200", color=color.purple)

Mehr

- Null-Lag-Überlappung gleitender Durchschnitt mit Chandelier-Ausgangshandelsstrategie

- RSI 5 Momentum-Handelsstrategie

- Skalierte normalisierte Vektorstrategie mit Aktivierungsfunktionen, Version 4

- Strategie auf Basis eines historischen Höchststandes

- Kryptowährungs-Trend nach Strategie auf Basis von Heiken Ashi

- Quantitative Strategie zur Nachverfolgung der Trendentwicklung der MA-Stärke

- Handelsstrategie für den Handel mit einem doppelten gleitenden Durchschnittspreis

- Bitcoin und Gold 5-Minuten-Scalping-Strategie 2.0

- Handelsstrategie für den Crossover von gleitenden Durchschnitten innerhalb des Tages

- Heiken Ashi Momentum Quant Strategie

- Trend nach Strategie auf der Grundlage der Nadaraya-Watson-Envelopes und des ROC-Indikators

- Dual Take Profit Dual Stop Loss Trailing Stop Loss Bitcoin Quantitative Strategie

- Aroon + Williams + MA + BB + ADX Leistungsstarke Multi-Indikator-Strategie

- Exponentielle gleitende Durchschnittswerte und gleitende Durchschnittswerte mit enger Strategie

- Eine Optimierung der Trendstrategie basierend auf dem Ichimoku Cloud Chart

- Kreuztrendumkehrung in Kombination mit drei Zehn-Oszillator-Doppelstrategien

- Fibonacci-Durchschnittskerze mit gleitender Durchschnittsstrategie für den quantitativen Handel

- Einfache Stop & Buy-Strategie basierend auf Prozentsatz

- Eine Analyse der quantitativen Handelsstrategie auf Basis der Gauss-Fehlerfunktion

- RSI-Umkehrstrategie