Momentum Pullback-Strategie

Schriftsteller:ChaoZhang, Datum: 2024-01-26 11:07:47Tags:

Übersicht

Die Momentum Pullback Strategie ist eine mittelfristige Handelsstrategie, die gleitende Durchschnitte und Kerzenmuster kombiniert, um Handelschancen zu identifizieren, indem Breakouts und Pullbacks erkannt werden.

Strategie Logik

Die Kernlogik dieser Strategie basiert auf dem 5-tägigen einfachen gleitenden Durchschnitt. Wenn der Preis kurz davor steht, diese Durchschnittslinie zu durchbrechen, bildet er eine Lücke hoch oder niedrig, was eine potenzielle lange oder kurze Gelegenheit signalisiert. Das Einstiegssignal wird ausgelöst, wenn die zweite Kerze, die über den gleitenden Durchschnitt hinaus schließt, die vorherige Lücke nicht durchbricht. Stop-Loss- und Gewinnziele werden dann basierend auf dem Risiko-Rendite-Verhältnis festgelegt.

Wenn der Preis über den 5-Tage-MA bricht und schließt, ist das vorherige Gap Candle's High das Stop-Loss-Level. Das Gewinnziel wird durch Subtrahieren eines bestimmten Retracement-Bereichs aus dem Tief, multipliziert mit dem gewünschten Risiko-Rendite-Verhältnis, festgelegt. Ähnlich für einen Abwärtsausbruch ist das vorherige Gap Candle's Low das Stop-Loss, während das Take-Profit-Level über dem High ist plus ein Retracement-Bereich, der durch das Risiko-Rendite-Verhältnis berechnet wird.

Für zusätzliche Bestätigung ist ein optionales Filter vorhanden, wenn der Strom-Candle-Schluß etwas niedriger oder höher sein sollte als der Gap-Candle-Schluß, um falsche Signale zu vermeiden.

Analyse der Vorteile

- Einfach verständliche und umsetzbare klare und einfache Strategielogik

- Identifiziert Trends und Rückgänge anhand gleitender Durchschnitte

- Genaueres Handelstiming mit Kombination von Kerzenmustern

- Passt Risiko und Gewinn zusammen, passt sich dem umsichtigen Handel an

- Einstellbare Parameter für verschiedene Produkte und Zeitrahmen

- Optionaler Filter vermeidet einige falsche Signale

Risikoanalyse

- Gewohnheitsrisiken der technischen Analyse wie Trends, Stopp-Run-throughs

- Die rückständige Natur der gleitenden Durchschnitte kann schnelle Umkehrungen verpassen

- Wahrscheinlich mehr falsche Signale in den Range-bound Markten

- Übermäßiger Handel durch schlechte Einstellung der Parameter

Die Risiken können durch vernünftige Stop-Losses, Positionsgröße, weniger häufige Handelsbeziehungen usw. verringert werden.

Optimierungsrichtlinien

- Verschiedene Parametermengen für beste Leistung testen

- Hinzufügen anderer Indikatoren oder Diagrammmuster zu Filtersignalen

- Erforschen Sie dynamische, nachfolgende Stop-Loss-Verbesserungen

- Anwendung von maschinellem Lernen zur automatischen Optimierung von Parametern

- Entwickeln Sie automatische Stop-Loss / Take-Profit-Plugins

- Überprüfungen der Robustheit für verschiedene Produkte und Zeitrahmen

Schlussfolgerung

Insgesamt ist dies eine leicht verständliche und umsetzbare mittelfristige Handelsstrategie. Es profitiert von Trendumkehrungen, die durch gleitende Durchschnitte und Gap-Kerzen identifiziert werden, mit einem rationalen Risikokontrollrahmen.

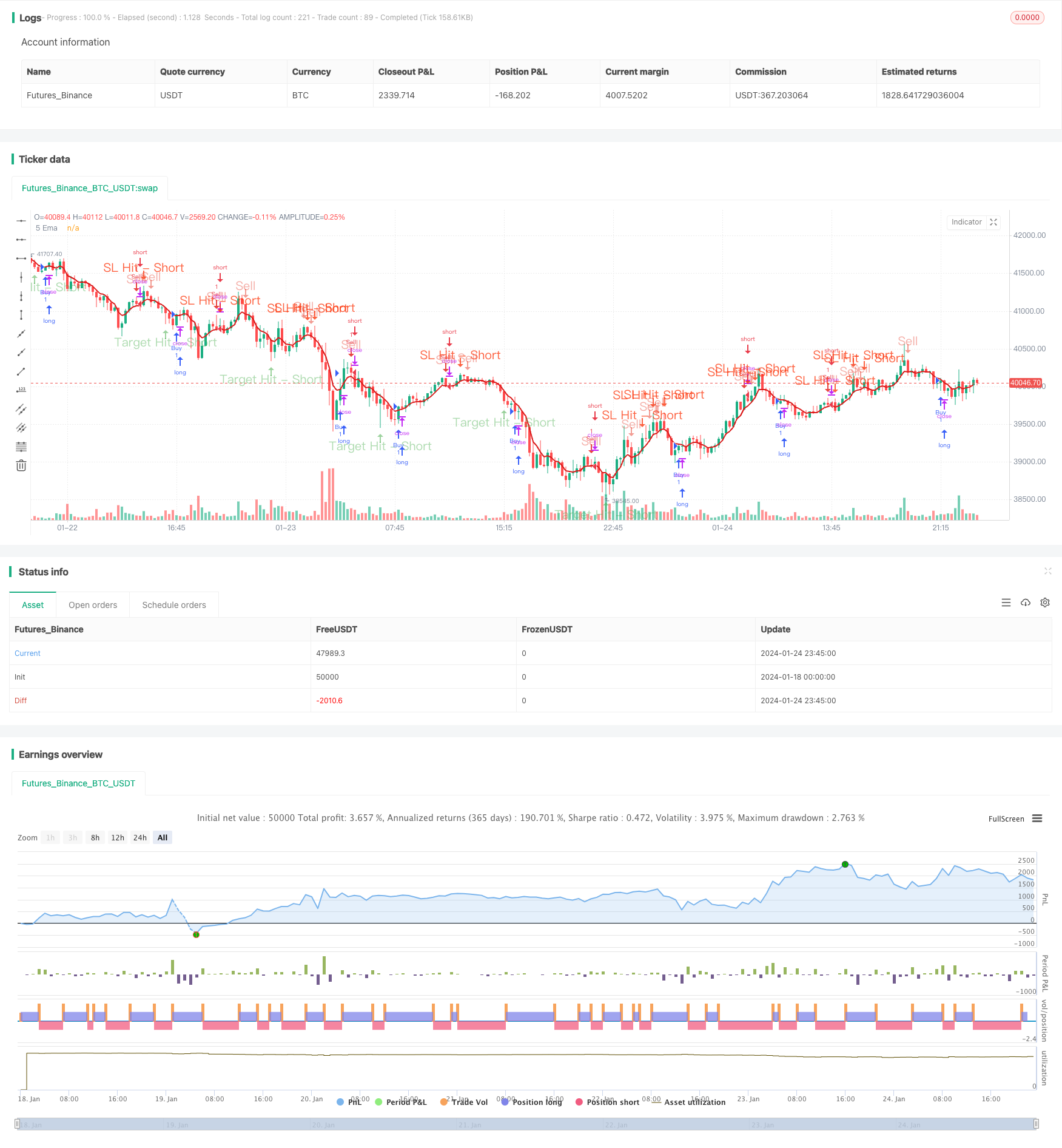

/*backtest

start: 2024-01-18 00:00:00

end: 2024-01-25 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TradingInsights2

//@version=5

strategy("Ultimate 5EMA Strategy By PowerOfStocks", overlay=true)

Eusl = input.bool(false, title="Enable the Extra SL shown below")

usl = input.int(defval=5, title='Value to set SL number of points below-low or above-high', minval=1, maxval=100)

RiRe = input.int(defval=3, title='Risk to Reward Ratio', minval=1, maxval=25)

ShowSell = input.bool(true, 'Show Sell Signals')

ShowBuy = input.bool(false, 'Show Buy Signals')

BSWCon = input.bool(defval=false, title='Buy/Sell with Extra Condition - candle close')

// Moving Average

ema5 = ta.ema(close, 5)

pema5 = plot(ema5, '5 Ema', color=color.new(#da1a1a, 0), linewidth=2)

var bool Short = na

var bool Long = na

var shortC = 0

var sslhitC = 0

var starhitC = 0

var float ssl = na

var float starl = na

var float star = na

var float sellat = na

var float alert_shorthigh = na

var float alert_shortlow = na

var line lssl = na

var line lstar = na

var line lsell = na

var label lssllbl = na

var label lstarlbl = na

var label lselllbl = na

var longC = 0

var lslhitC = 0

var ltarhitC = 0

var float lsl = na

var float ltarl = na

var float ltar = na

var float buyat = na

var float alert_longhigh = na

var float alert_longlow = na

var line llsl = na

var line lltar = na

var line lbuy = na

var label llsllbl = na

var label lltarlbl = na

var label lbuylbl = na

ShortWC = low[1] > ema5[1] and low[1] > low and shortC == 0 and close < close[1]

ShortWOC = low[1] > ema5[1] and low[1] > low and shortC == 0

Short := BSWCon ? ShortWC : ShortWOC

sslhit = high > ssl and shortC > 0 and sslhitC == 0

starhit = low < star and shortC > 0 and starhitC == 0

LongWC = high[1] < ema5[1] and high[1] < high and longC == 0 and close > close[1]

LongWOC = high[1] < ema5[1] and high[1] < high and longC == 0

Long := BSWCon ? LongWC : LongWOC

lslhit = low < lsl and longC > 0 and lslhitC == 0

ltarhit = high > ltar and longC > 0 and ltarhitC == 0

if Short and ShowSell

shortC := shortC + 1

sslhitC := 0

starhitC := 0

alert_shorthigh := high[1]

if Eusl

ssl := high[1] + usl

starl := BSWCon ? ((high[1] - close) + usl) * RiRe : ((high[1] - low[1]) + usl) * RiRe

else

ssl := high[1]

starl := BSWCon ? (high[1] - close) * RiRe : (high[1] - low[1]) * RiRe

star := BSWCon ? close - starl : low[1] - starl

sellat := BSWCon ? close : low[1]

// lssl := line.new(bar_index, ssl, bar_index, ssl, color=color.new(#fc2d01, 45), style=line.style_dashed)

// lstar := line.new(bar_index, star, bar_index, star, color=color.new(color.green, 45), style=line.style_dashed)

// lsell := line.new(bar_index, sellat, bar_index, sellat, color=color.new(color.orange, 45), style=line.style_dashed)

// lssllbl := label.new(bar_index, ssl, style=label.style_none, text='Stop Loss - Short' + ' (' + str.tostring(ssl) + ')', textcolor=color.new(#fc2d01, 35), color=color.new(#fc2d01, 35))

// lstarlbl := label.new(bar_index, star, style=label.style_none, text='Target - Short' + ' (' + str.tostring(star) + ')', textcolor=color.new(color.green, 35), color=color.new(color.green, 35))

// lselllbl := label.new(bar_index, sellat, style=label.style_none, text='Sell at' + ' (' + str.tostring(sellat) + ')', textcolor=color.new(color.orange, 35), color=color.new(color.orange, 35))

if sslhit == false and starhit == false and shortC > 0

// line.set_x2(lssl, bar_index)

// line.set_x2(lstar, bar_index)

// line.set_x2(lsell, bar_index)

sslhitC := 0

starhitC := 0

else

if sslhit

shortC := 0

sslhitC := sslhitC + 1

else

if starhit

shortC := 0

starhitC := starhitC + 1

if Long and ShowBuy

longC := longC + 1

lslhitC := 0

ltarhitC := 0

alert_longlow := low[1]

if Eusl

lsl := low[1] - usl

ltarl := BSWCon ? ((close - low[1]) + usl) * RiRe : ((high[1] - low[1]) + usl) * RiRe

else

lsl := low[1]

ltarl := BSWCon ? (close - low[1]) * RiRe : (high[1] - low[1]) * RiRe

ltar := BSWCon ? close + ltarl : high[1] + ltarl

buyat := BSWCon ? close : high[1]

llsl := line.new(bar_index, lsl, bar_index, lsl, color=color.new(#fc2d01, 45), style=line.style_dotted)

lltar := line.new(bar_index, ltar, bar_index, ltar, color=color.new(color.green, 45), style=line.style_dotted)

lbuy := line.new(bar_index, buyat, bar_index, buyat, color=color.new(color.orange, 45), style=line.style_dotted)

llsllbl := label.new(bar_index, lsl, style=label.style_none, text='Stop Loss - Long' + ' (' + str.tostring(lsl) + ')', textcolor=color.new(#fc2d01, 35), color=color.new(#fc2d01, 35))

lltarlbl := label.new(bar_index, ltar, style=label.style_none, text='Target - Long' + ' (' + str.tostring(ltar) + ')', textcolor=color.new(color.green, 35), color=color.new(color.green, 35))

lbuylbl := label.new(bar_index, buyat, style=label.style_none, text='Buy at' + ' (' + str.tostring(buyat) + ')', textcolor=color.new(color.orange, 35), color=color.new(color.orange, 35))

if lslhit == false and ltarhit == false and longC > 0

// line.set_x2(llsl, bar_index)

// line.set_x2(lltar, bar_index)

// line.set_x2(lbuy, bar_index)

lslhitC := 0

ltarhitC := 0

else

if lslhit

longC := 0

lslhitC := lslhitC + 1

else

if ltarhit

longC := 0

ltarhitC := ltarhitC + 1

strategy.entry("Buy", strategy.long, when=Long)

strategy.entry("Sell", strategy.short, when=Short)

strategy.close("ExitBuy", when=sslhit or starhit)

strategy.close("ExitSell", when=lslhit or ltarhit)

plotshape(ShowSell and Short, title='Sell', location=location.abovebar, offset=0, color=color.new(#e74c3c, 45), style=shape.arrowdown, size=size.normal, text='Sell', textcolor=color.new(#e74c3c, 55))

plotshape(ShowSell and sslhit, title='SL Hit - Short', location=location.abovebar, offset=0, color=color.new(#fc2d01, 25), style=shape.arrowdown, size=size.normal, text='SL Hit - Short', textcolor=color.new(#fc2d01, 25))

plotshape(ShowSell and starhit, title='Target Hit - Short', location=location.belowbar, offset=0, color=color.new(color.green, 45), style=shape.arrowup, size=size.normal, text='Target Hit - Short', textcolor=color.new(color.green, 55))

plotshape(ShowBuy and Long, title='Buy', location=location.belowbar, offset=0, color=color.new(#2ecc71, 45), style=shape.arrowup, size=size.normal, text='Buy', textcolor=color.new(#2ecc71, 55))

plotshape(ShowBuy and lslhit, title='SL Hit - Long', location=location.belowbar, offset=0, color=color.new(#fc2d01, 25), style=shape.arrowdown, size=size.normal, text='SL Hit - Long', textcolor=color.new(#fc2d01, 25))

plotshape(ShowBuy and ltarhit, title='Target Hit - Long', location=location.abovebar, offset=0, color=color.new(color.green, 45), style=shape.arrowup, size=size.normal, text='Target Hit - Long', textcolor=color.new(color.green, 55))

if ShowSell and Short

alert("Go Short@ " + str.tostring(sellat) + " : SL@ " + str.tostring(ssl) + " : Target@ " + str.tostring(star) + " ", alert.freq_once_per_bar )

if ShowBuy and Long

alert("Go Long@ " + str.tostring(buyat) + " : SL@ " + str.tostring(lsl) + " : Target@ " + str.tostring(ltar) + " ", alert.freq_once_per_bar )

///// End of code

- Tägliche offene Umkehrstrategie

- Handelsstrategie der Golden Cross SMA

- Strategie des gleitenden Durchschnitts des Golden Cross

- MACD Krypto-Handelsstrategie

- Kurzfristige Strategie der linearen Regression und des doppelten gleitenden Durchschnitts

- Dreifach überlappende Stochastik-Momentumsstrategie

- Strategie für die Dynamikentwicklung

- Momentum Moving Average Crossover Quant Strategie

- Kombinationsstrategie der doppelten Umkehrung des gleitenden Durchschnitts und des ATR Trailing Stop

- Handelsstrategie mit Leveraged Martingale-Futures

- Zweikandelsvorhersage Schließstrategie

- Stochastic Supertrend Tracking Stop Loss Handelsstrategie

- Trend der doppelten Umkehrung des Schwingungsbandes nach Strategie

- Trend-Nachfolge-Strategie auf Basis von DMI und RSI

- Trendfolgende Strategie mit 3 EMA, DMI und MACD

- Durchbruchsstrategie für Doppelindikatoren

- Pete Wave Handelssystem Strategie

- Quantitative Strategie auf der Grundlage eines exponentiellen gleitenden Durchschnitts und einer Volumengewichtung