Preisempfindlichkeit des PPO Momentum Doppelboden-Richtungshandelsstrategie

Schriftsteller:ChaoZhang, Datum: 2024-01-29 11:38:42Tags:

Übersicht

Die PPO Price Sensitivity Momentum Double Bottom Directional Trading Strategy ist eine Trend-folgende Handelsstrategie, die die Identifizierung von Preis-Double-Bottom-Formationen durch den PPO (Percentage Price Oscillator) Indikator zur Erzeugung von Handelssignalen nutzt.

Strategieprinzipien

Die Strategie verwendet den PPO-Indikator, um die Preis-Doppel-Boden-Funktionen zu bestimmen, und integriert gleichzeitig das Preisminimum-Punkt-Urteil, um die Bottom-Formation des PPO-Indikators in Echtzeit zu überwachen.

Auf der anderen Seite arbeitet die Strategie mit der Bestimmung des Mindestwerts des Preises zusammen, um festzustellen, ob der Preis auf relativ niedrigem Niveau liegt.

Durch den doppelten Mechanismus der Validierung von PPO-Kennzahlen und der Preisniveaubestätigung können potenzielle Chancen auf Preisumkehr effektiv ermittelt, falsche Signale herausgefiltert und die Signalqualität verbessert werden.

Analyse der Vorteile

-

Das PPO-Doppelbodenmuster ermöglicht eine präzise Zeitung an den Einstiegspunkten.

-

Durch die Kombination der Preisniveau-Bestätigung werden falsche Signale, die auf relativ hohen Niveaus auftreten, herausgefiltert und die Signalqualität verbessert.

-

PPO ist empfindlich und erfasst schnell Preisentwicklungsänderungen, die für die Trendverfolgung geeignet sind.

-

Der Doppelbestätigungsmechanismus mindert das Handelsrisiko wirksam.

Risiken und Lösungen

-

PPO neigt dazu, falsche Signale zu erzeugen, die von anderen Indikatoren bestätigt werden müssen.

-

Eine Doppelunterumkehrung kann möglicherweise nicht aufrechterhalten werden, was zu einem weiteren Rückgang führen kann.

-

Eine unangemessene Parameterkonfiguration führt zu fehlenden Gewinnen oder falschen Einträgen. Wiederholte Backtests und Optimierungen der Parameterkombination sind erforderlich.

-

Bei der Vervielfältigung ist ein erhebliches Codevolumen vorhanden.

Optimierungsrichtlinien

-

Einbeziehung von Stop-Loss-Modulen und Optimierung von Positionsgrößenstrategien.

-

Einführung von gleitenden Durchschnittswerten oder Volatilitätsindikatoren als Bestätigungsinstrumente.

-

Modularisieren Sie Codes, um überflüssige logische Urteile zu vermeiden.

-

Setzen Sie die Parameter ein, um die Stabilität zu erhöhen.

-

Testen Sie Spread-Trading-Anwendungen für mehr Produkte.

Schlussfolgerung

Die PPO Price Sensitivity Momentum Double Bottom Directional Trading Strategy erfasst die doppelten Bottom-Funktionen des PPO-Indikators in Verbindung mit der doppelten Bestätigung der Preisniveau-Positionierung, um Preisumkehrpunkte effektiv zu erkennen. Im Vergleich zum Einzeldikator-Urteil hat sie Vorteile einer verbesserten Genauigkeit und Fähigkeit, Geräusche auszufiltern. Dennoch bestehen einige Risiken für falsche Signale, die eine weitere Optimierung der Indikatorenkombinationen und strenge Positionsgrößen-Taktiken erfordern, bevor eine stabile Rentabilität im Live-Handel erzielt werden kann.

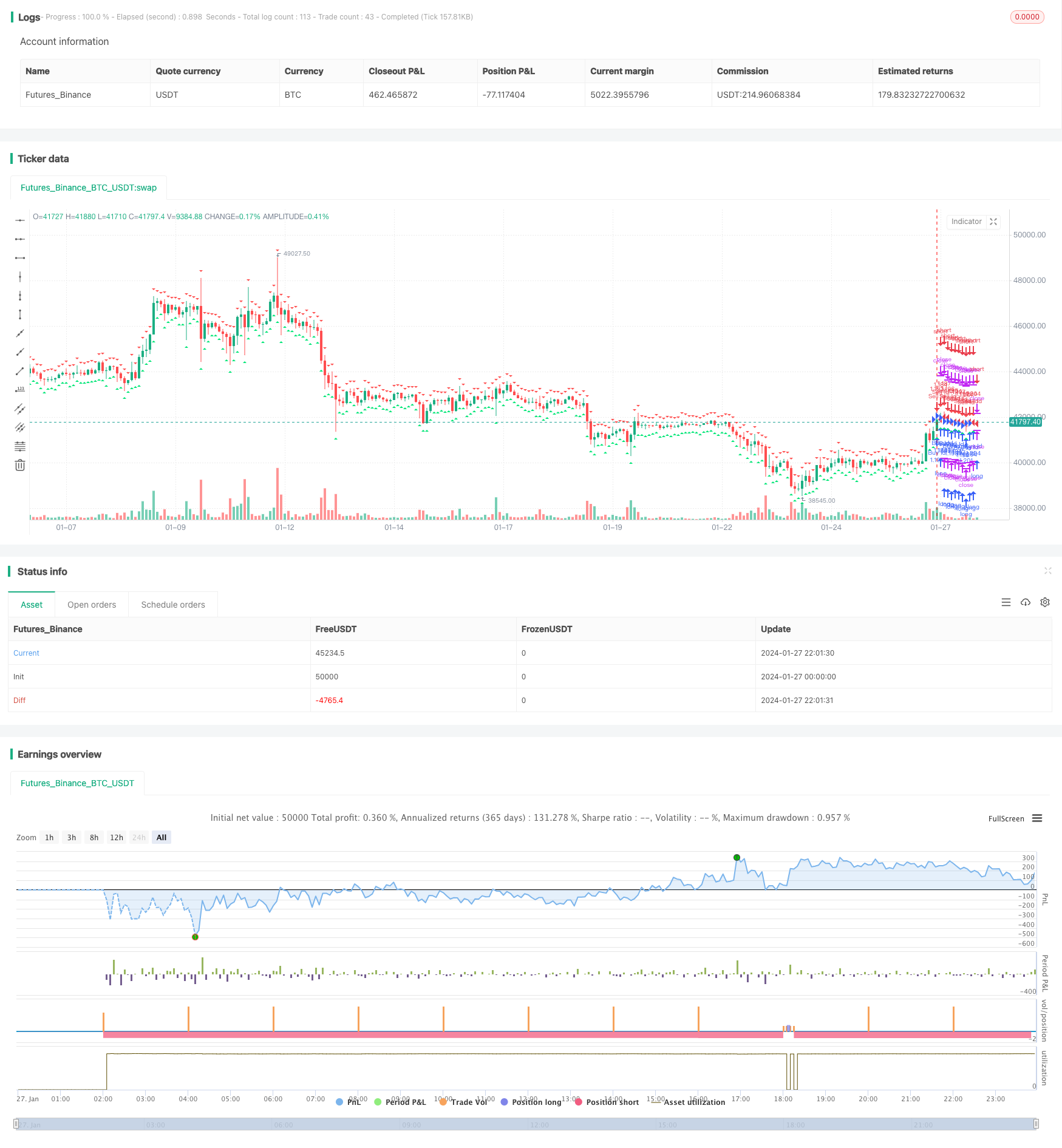

/*backtest

start: 2024-01-27 00:00:00

end: 2024-01-28 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © luciancapdefier

//@version=4

strategy("PPO Divergence ST", overlay=true, initial_capital=30000, calc_on_order_fills=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// time

FromYear = input(2019, "Backtest Start Year")

FromMonth = input(1, "Backtest Start Month")

FromDay = input(1, "Backtest Start Day")

ToYear = input(2999, "Backtest End Year")

ToMonth = input(1, "Backtest End Month")

ToDay = input(1, "Backtest End Day")

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false

source = close

topbots = input(true, title="Show PPO high/low triangles?")

long_term_div = input(true, title="Use long term divergences?")

div_lookback_period = input(55, minval=1, title="Lookback Period")

fastLength = input(12, minval=1, title="PPO Fast")

slowLength=input(26, minval=1, title="PPO Slow")

signalLength=input(9,minval=1, title="PPO Signal")

smoother = input(2,minval=1, title="PPO Smooth")

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

macd2=(macd/slowMA)*100

d = sma(macd2, smoother) // smoothing PPO

bullishPrice = low

priceMins = bullishPrice > bullishPrice[1] and bullishPrice[1] < bullishPrice[2] or low[1] == low[2] and low[1] < low and low[1] < low[3] or low[1] == low[2] and low[1] == low[3] and low[1] < low and low[1] < low[4] or low[1] == low[2] and low[1] == low[3] and low[1] and low[1] == low[4] and low[1] < low and low[1] < low[5] // this line identifies bottoms and plateaus in the price

oscMins= d > d[1] and d[1] < d[2] // this line identifies bottoms in the PPO

BottomPointsInPPO = oscMins

bearishPrice = high

priceMax = bearishPrice < bearishPrice[1] and bearishPrice[1] > bearishPrice[2] or high[1] == high[2] and high[1] > high and high[1] > high[3] or high[1] == high[2] and high[1] == high[3] and high[1] > high and high[1] > high[4] or high[1] == high[2] and high[1] == high[3] and high[1] and high[1] == high[4] and high[1] > high and high[1] > high[5] // this line identifies tops in the price

oscMax = d < d[1] and d[1] > d[2] // this line identifies tops in the PPO

TopPointsInPPO = oscMax

currenttrough4=valuewhen (oscMins, d[1], 0) // identifies the value of PPO at the most recent BOTTOM in the PPO

lasttrough4=valuewhen (oscMins, d[1], 1) // NOT USED identifies the value of PPO at the second most recent BOTTOM in the PPO

currenttrough5=valuewhen (oscMax, d[1], 0) // identifies the value of PPO at the most recent TOP in the PPO

lasttrough5=valuewhen (oscMax, d[1], 1) // NOT USED identifies the value of PPO at the second most recent TOP in the PPO

currenttrough6=valuewhen (priceMins, low[1], 0) // this line identifies the low (price) at the most recent bottom in the Price

lasttrough6=valuewhen (priceMins, low[1], 1) // NOT USED this line identifies the low (price) at the second most recent bottom in the Price

currenttrough7=valuewhen (priceMax, high[1], 0) // this line identifies the high (price) at the most recent top in the Price

lasttrough7=valuewhen (priceMax, high[1], 1) // NOT USED this line identifies the high (price) at the second most recent top in the Price

delayedlow = priceMins and barssince(oscMins) < 3 ? low[1] : na

delayedhigh = priceMax and barssince(oscMax) < 3 ? high[1] : na

// only take tops/bottoms in price when tops/bottoms are less than 5 bars away

filter = barssince(priceMins) < 5 ? lowest(currenttrough6, 4) : na

filter2 = barssince(priceMax) < 5 ? highest(currenttrough7, 4) : na

//delayedbottom/top when oscillator bottom/top is earlier than price bottom/top

y11 = valuewhen(oscMins, delayedlow, 0)

y12 = valuewhen(oscMax, delayedhigh, 0)

// only take tops/bottoms in price when tops/bottoms are less than 5 bars away, since 2nd most recent top/bottom in osc

y2=valuewhen(oscMax, filter2, 1) // identifies the highest high in the tops of price with 5 bar lookback period SINCE the SECOND most recent top in PPO

y6=valuewhen(oscMins, filter, 1) // identifies the lowest low in the bottoms of price with 5 bar lookback period SINCE the SECOND most recent bottom in PPO

long_term_bull_filt = valuewhen(priceMins, lowest(div_lookback_period), 1)

long_term_bear_filt = valuewhen(priceMax, highest(div_lookback_period), 1)

y3=valuewhen(oscMax, currenttrough5, 0) // identifies the value of PPO in the most recent top of PPO

y4=valuewhen(oscMax, currenttrough5, 1) // identifies the value of PPO in the second most recent top of PPO

y7=valuewhen(oscMins, currenttrough4, 0) // identifies the value of PPO in the most recent bottom of PPO

y8=valuewhen(oscMins, currenttrough4, 1) // identifies the value of PPO in the SECOND most recent bottom of PPO

y9=valuewhen(oscMins, currenttrough6, 0)

y10=valuewhen(oscMax, currenttrough7, 0)

bulldiv= BottomPointsInPPO ? d[1] : na // plots dots at bottoms in the PPO

beardiv= TopPointsInPPO ? d[1]: na // plots dots at tops in the PPO

i = currenttrough5 < highest(d, div_lookback_period) // long term bearish oscilator divergence

i2 = y10 > long_term_bear_filt // long term bearish top divergence

i3 = delayedhigh > long_term_bear_filt // long term bearish delayedhigh divergence

i4 = currenttrough4 > lowest(d, div_lookback_period) // long term bullish osc divergence

i5 = y9 < long_term_bull_filt // long term bullish bottom div

i6 = delayedlow < long_term_bull_filt // long term bullish delayedbottom div

//plot(0, color=gray)

//plot(d, color=black)

//plot(bulldiv, title = "Bottoms", color=maroon, style=circles, linewidth=3, offset= -1)

//plot(beardiv, title = "Tops", color=green, style=circles, linewidth=3, offset= -1)

bearishdiv1 = (y10 > y2 and oscMax and y3 < y4) ? true : false

bearishdiv2 = (delayedhigh > y2 and y3 < y4) ? true : false

bearishdiv3 = (long_term_div and oscMax and i and i2) ? true : false

bearishdiv4 = (long_term_div and i and i3) ? true : false

bullishdiv1 = (y9 < y6 and oscMins and y7 > y8) ? true : false

bullishdiv2 = (delayedlow < y6 and y7 > y8) ? true : false

bullishdiv3 = (long_term_div and oscMins and i4 and i5) ? true : false

bullishdiv4 = (long_term_div and i4 and i6) ? true : false

bearish = bearishdiv1 or bearishdiv2 or bearishdiv3 or bearishdiv4

bullish = bullishdiv1 or bullishdiv2 or bullishdiv3 or bullishdiv4

greendot = beardiv != 0 ? true : false

reddot = bulldiv != 0 ? true : false

if (reddot and window())

strategy.entry("Buy Id", strategy.long, comment="BUY")

if (greendot and window())

strategy.entry("Sell Id", strategy.short, comment="SELL")

alertcondition( bearish, title="Bearish Signal (Orange)", message="Orange & Bearish: Short " )

alertcondition( bullish, title="Bullish Signal (Purple)", message="Purple & Bullish: Long " )

alertcondition( greendot, title="PPO High (Green)", message="Green High Point: Short " )

alertcondition( reddot, title="PPO Low (Red)", message="Red Low Point: Long " )

// plotshape(bearish ? d : na, text='▼\nP', style=shape.labeldown, location=location.abovebar, color=color(orange,0), textcolor=color(white,0), offset=0)

// plotshape(bullish ? d : na, text='P\n▲', style=shape.labelup, location=location.belowbar, color=color(#C752FF,0), textcolor=color(white,0), offset=0)

plotshape(topbots and greendot ? d : na, text='', style=shape.triangledown, location=location.abovebar, color=color.red, offset=0, size=size.tiny)

plotshape(topbots and reddot ? d : na, text='', style=shape.triangleup, location=location.belowbar, color=color.lime, offset=0, size=size.tiny)

//barcolor(bearishdiv1 or bearishdiv2 or bearishdiv3 or bearishdiv4 ? orange : na)

//barcolor(bullishdiv1 or bullishdiv2 or bullishdiv3 or bullishdiv4 ? fuchsia : na)

//barcolor(#dedcdc)

- FNGU-Quantitative Handelsstrategie auf Basis von Bollinger-Bändern und RSI

- Bollinger-Bänder RSI OBV-Strategie

- Strategie zur Umkehrung des P-Signals

- RSI-Alligator-Trendstrategie

- Tägliche FX-Strategie auf Basis des gleitenden Durchschnitts und des Williams-Indikators

- Handelsstrategie für den Durchbruch des gleitenden Durchschnitts des Kanals

- Zweifelhafte bewegliche Stochastische Strategie

- Donchian Channel Breakout Strategie

- Strategie zur Verfolgung des gleitenden Durchschnittstrends

- Handelsstrategie für RSI-Indikatoren

- Scalping-Strategie mit Volumen- und VWAP-Bestätigung

- ADX, MA und EMA - Strategie zur langfristigen Trendverfolgung

- Momentum Durchbruch Golden Cross Strategie

- Strategie für eine Kollision mit drei Indikatoren

- Ausgereifte Handelsstrategie für maschinelles Lernen

- Schwankende durchschnittliche Wendepunkt-Crossover-Handelsstrategie

- Zyklusübergreifende Arbitragestrategie auf der Grundlage mehrerer Indikatoren

- Die Bollinger-Band-Breakout-Strategie ist eine langfristige Dynamik-Strategie

- Flawless Victory Quantitative Trading Strategy auf Basis von Double BB Indikatoren und RSI

- Auf RSI basierende Stop-Loss- und Take-Profit-Strategie