Durchbruch-Trendverfolgungsstrategie mit Indikatorenkombinationen

Überblick

Diese Strategie ist bekannt als “Rhino Indicator Portfolio Breakthrough Trend Tracking Strategy”. Die Strategie verwendet mehrere Indikatoren, um die Richtung der Markttrends zu identifizieren und Trend-Tracking-Operationen durchzuführen. Sie umfasst hauptsächlich folgende Teile:

- Die wichtigsten Markttrends werden anhand der Wellen-Trend-Indikatoren ermittelt.

- Die Kombination von RSI und Cashflow-Index filtert einige falsche Signale aus

- Die EMA-Indikatoren bestimmen, in welche Richtung die Maßnahmen gehen

- Eintritt mit bahnbrechenden Methoden, um zu gewährleisten, dass Trends eingehalten werden

Strategieprinzip

Die Strategie richtet sich hauptsächlich an der Richtung und Stärke der großen Trends und bietet mehrere freie, beidseitige Geschäfte. Die operativen Prinzipien sind wie folgt:

Mehrköpfige Eintrittszeichen:

- Der Preis liegt oberhalb der 200-Tage-EMA und zeigt, dass er sich in einem Flex-Markt befindet.

- Preisrückführung in die 50 Tage EMA-Grenze

- Der Wellenindikator kehrt in den Aufwärtstrend um und gibt ein Kaufsignal

- RSI und MFI zeigen Überkauft

- Drei aufeinanderfolgende K-Linien brechen die 50-Tage-EMA, was auf einen Aufwärtstrend hindeutet

Eintrittszeichen für die Luftwaffe: Im Gegensatz zu einem mehrköpfigen Eintrittssignal

Wie man einen Stop-Loss macht: Es gibt zwei Optionen: Minimum/Maximum Stop, ATR Stop

Strategische Stärkenanalyse

Diese Strategie hat folgende Vorteile:

- Mehrfache Indikatoren zur Beurteilung von Trends und zur Vermeidung von False Breaks

- Die EMA ist ein Instrument, um Trends zu ermitteln und zu verfolgen.

- Verfolgung von Stop-Loss-Methoden für nachhaltige Profitabilität

- Sie können mehrere Leerlaufzeiten gleichzeitig durchführen und dem Markt folgen.

Strategische Risikoanalyse

Die Strategie birgt auch einige Risiken:

- Wahrscheinlichkeit, dass der Indikator ein falsches Signal ausgibt

- Der Stop-Loss-Punkt ist zu klein, erhöht das Stop-Loss-Risiko

- Es gibt viele Transaktionen, und die Transaktionsgebühren sind ein versteckter Verlust.

Um die oben genannten Risiken zu verringern, können Optimierungen in folgenden Bereichen vorgenommen werden:

- Anpassung der Indikatorparameter und Filterung von Fehlsignalen

- Entspannung der Stop Losses

- Optimierung der Kennzahlen und Verringerung der Anzahl der Transaktionen

Richtung der Strategieoptimierung

Auf der Code-Ebene kann diese Strategie optimiert werden in folgenden Bereichen:

- Anpassung der Parameter für Wellen, RSI und MFI zur Auswahl der optimalen Kombination

- Testen der Leistung verschiedener EMA-Zyklusparameter

- Anpassung des Gewinn-Risiko-Faktors des Stop-Losses zur optimalen Konfiguration

Durch die Anpassung und Prüfung von Parametern kann eine Strategie zur Maximierung der Erträge und zur Verringerung der Rücknahmen und Risiken eingesetzt werden.

Zusammenfassen

Die Strategie verwendet verschiedene Indikatoren, um die Richtung der großen Trends zu bestimmen, die EMA-Indikatoren als konkrete Handlungssignale zu verwenden und die Gewinne durch die Verfolgung von Stop-Loss-Methoden zu sichern. Durch die Optimierung der Parameter können bessere stabile Erträge erzielt werden. Es sollte jedoch auch auf bestimmte Systemrisiken geachtet werden, die die Wirkung der Indikatoren und die Veränderungen der Marktumgebung ständig beobachten.

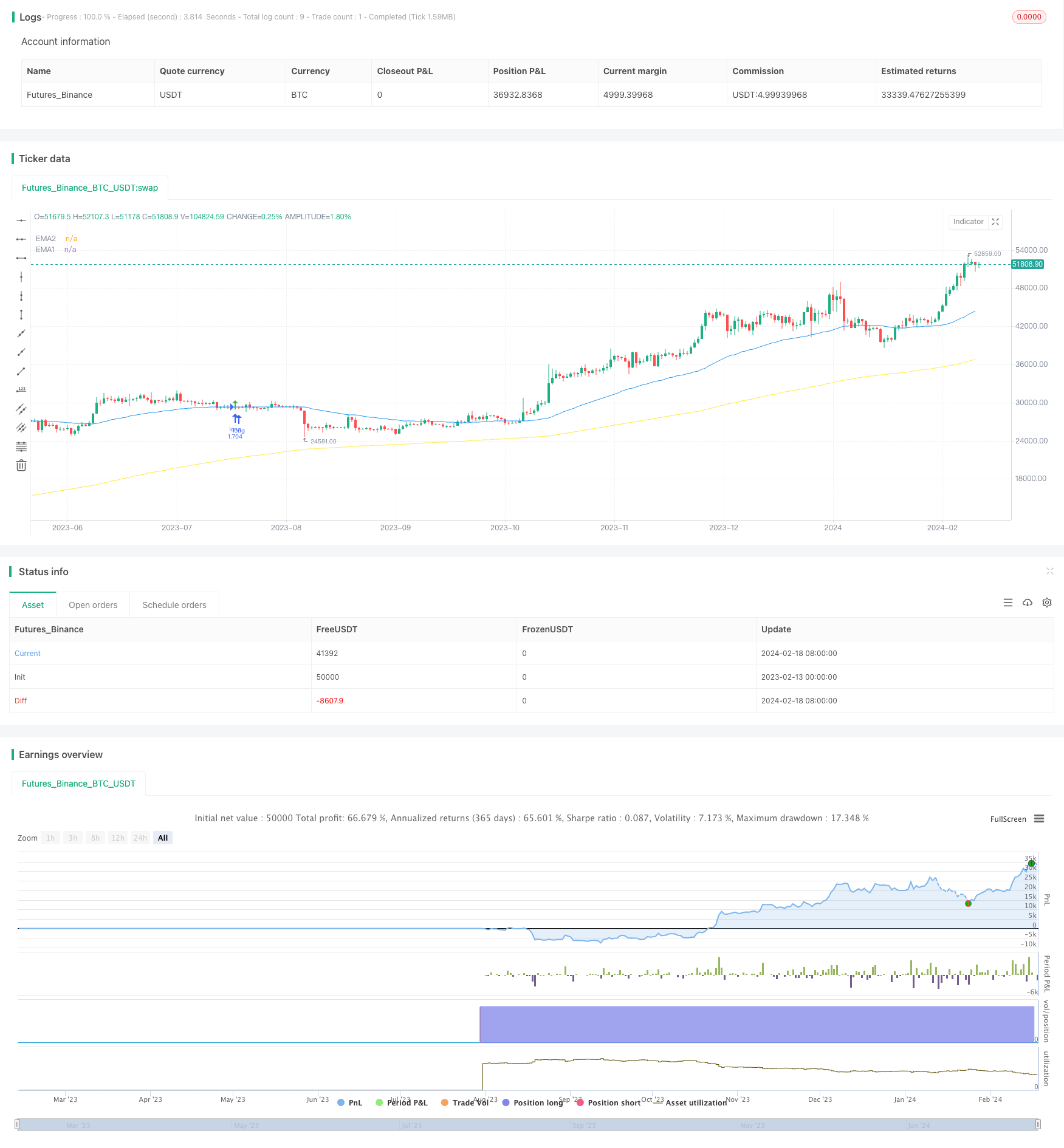

/*backtest

start: 2023-02-13 00:00:00

end: 2024-02-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Lowest Low/ Highest High & ATR Stop Loss/ Take Profit

//Optimized for the 30 minutes chart

strategy(title="TradePro's Trading Idea Cipher B+ Divergence EMA Pullback Strategy", shorttitle="WT MFI RSI EMA PB STRAT", overlay = true, pyramiding = 0, max_bars_back=5000, calc_on_order_fills = false, commission_type = strategy.commission.percent, commission_value = 0, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=5000, currency=currency.USD)

// { Time Range

FromMonth=input(defval=1,title="FromMonth",minval=1,maxval=12)

FromDay=input(defval=1,title="FromDay",minval=1,maxval=31)

FromYear=input(defval=2020,title="FromYear",minval=2016)

ToMonth=input(defval=1,title="ToMonth",minval=1,maxval=12)

ToDay=input(defval=1,title="ToDay",minval=1,maxval=31)

ToYear=input(defval=9999,title="ToYear",minval=2017)

start=timestamp(FromYear,FromMonth,FromDay,00,00)

finish=timestamp(ToYear,ToMonth,ToDay,23,59)

window()=>true

// See if this bar's time happened on/after start date

afterStartDate = time >= start and time<=finish?true:false

zeroline = 0

// } Time Range

// { Wavetrend, RSI, MFI

// WaveTrend

cl = input(12, "Channel Length")

al = input(12, "Average Length")

overbought = input(53, title = 'WT Overbought Level 1', type = input.integer)

oversold = input(-53, title = 'WT Oversold Level 1', type = input.integer)

ap = hlc3

esa = ema(ap, cl)

d = ema(abs(ap - esa), cl)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, al)

wt1 = tci

wt2 = sma(wt1,4)

wtOs = wt2 <= oversold

wtOb = wt2 >= overbought

wtX = cross(wt1, wt2)

wtUp = wt2 - wt1 <= 0

wtDown = wt2 - wt1 >= 0

buySignal = wtX and wtOs and wtUp

sellSignal = wtX and wtOb and wtDown

// RSI & MFI

rsiMFIPosY = input(2, title = 'MFI Area Y Pos', type = input.float)

rsiMFIperiod = input(80,title = 'MFI Period', type = input.integer)

rsiMFIMultiplier = input(200, title = 'MFI Area multiplier', type = input.float)

f_rsimfi(_period, _multiplier, _tf) => security(syminfo.tickerid, _tf, sma(((close - open) / (high - low)) * _multiplier, _period) - rsiMFIPosY)

rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, timeframe.period)

// } Wavetrend, RSI, MFI

// { EMA

emasrc = close

res = input(title="EMA Timeframe", type=input.resolution, defval="30")

len1 = input(title="EMA1 Length", type=input.integer, defval=200)

col1 = color.yellow

len2 = input(title="EMA2 Length", type=input.integer, defval=50)

col2 = color.blue

// Calculate EMA

ema1 = ema(emasrc, len1)

emaSmooth1 = security(syminfo.tickerid, res, ema1, barmerge.gaps_off, barmerge.lookahead_off)

ema2 = ema(emasrc, len2)

emaSmooth2 = security(syminfo.tickerid, res, ema2, barmerge.gaps_off, barmerge.lookahead_off)

// Draw EMA

plot(emaSmooth1, title="EMA1", linewidth=1, color=col1)

plot(emaSmooth2, title="EMA2", linewidth=1, color=col2)

// } EMA

// { Long Entry

enablelong = input(true, title="Enable long?")

//Long Signal

upcondition = close > emaSmooth1

wavetrendlong = wt1 and wt2 < zeroline

mfilong = rsiMFI > 0

emapblong1 = (close > emaSmooth2) and (close[1] < emaSmooth2[1])

emapblong2 = ((close[2] > emaSmooth2[2]) and (close[3] > emaSmooth2[3]) and (close[4] > emaSmooth2[4])) or ((close[5] > emaSmooth2[5]) and (close[6] > emaSmooth2[6]) and (close[7] > emaSmooth2[7])) or ((close[8] > emaSmooth2[8]) and (close[9] > emaSmooth2[9]) and (close[10] > emaSmooth2[10]))

longcondition = upcondition and wavetrendlong and buySignal and mfilong and emapblong1 and emapblong2

//strategy buy long

if (longcondition) and (afterStartDate) and strategy.opentrades < 1 and (enablelong == true)

strategy.entry("long", strategy.long)

plotshape(longcondition, style=shape.arrowup,

location=location.abovebar, color=color.green)

// } Long Entry

// { Short Entry

enableshort = input(true, title="Enable short?")

//Short Signal

downcondition = close < emaSmooth1

wavetrendshort = wt1 and wt2 > zeroline

mfishort = rsiMFI < 0

emapbshort1 = (close < emaSmooth2) and (close[1] > emaSmooth2[1])

emapbshort2 = ((close[2] < emaSmooth2[2]) and (close[3] < emaSmooth2[3]) and (close[4] < emaSmooth2[4])) or ((close[5] < emaSmooth2[5]) and (close[6] < emaSmooth2[6]) and (close[7] < emaSmooth2[7])) or ((close[8] < emaSmooth2[8]) and (close[9] < emaSmooth2[9]) and (close[10] < emaSmooth2[10]))

shortcondition = downcondition and wavetrendshort and sellSignal and mfishort and emapbshort1 and emapbshort2

//strategy buy short

if (shortcondition) and (afterStartDate) and strategy.opentrades < 1 and (enableshort == true)

strategy.entry("short", strategy.short)

plotshape(shortcondition, style=shape.arrowdown,

location=location.belowbar, color=color.red)

// } Short Entry

// { Exit Conditions

bought = strategy.position_size[1] < strategy.position_size

sold = strategy.position_size[1] > strategy.position_size

barsbought = barssince(bought)

barssold = barssince(sold)

slbuffer = input(title="SL Buffer", type=input.float, step=0.1, defval=0)

// } Exit Conditions

// { Lowest Low/ Highes High Exit Condition

enablelowhigh = input(false, title="Enable lowest low/ highest high exit?")

//Lowest Low LONG

profitfactorlong = input(title="ProfitfactorLong", type=input.float, step=0.1, defval=2)

loLen = input(title="Lowest Low Lookback", type=input.integer,

defval=50, minval=2)

stop_level_long = lowest(low, loLen)[1]

if enablelowhigh == true and strategy.position_size>0

profit_level_long = strategy.position_avg_price + ((strategy.position_avg_price - stop_level_long[barsbought])*profitfactorlong) + slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_long[barsbought] - slbuffer, limit=profit_level_long)

//Lowest Low SHORT

profitfactorshort = input(title="ProfitfactorShort", type=input.float, step=0.1, defval=2)

highLen = input(title="highest high lookback", type=input.integer,

defval=50, minval=2)

stop_level_short = highest(high, highLen)[1]

if enablelowhigh == true and strategy.position_size<0

profit_level_short = strategy.position_avg_price - ((stop_level_short[barssold] - strategy.position_avg_price)*profitfactorshort) - slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_short[barssold] + slbuffer, limit=profit_level_short)

// } Lowest Low/ Highes High Exit Condition

// { ATR Take Profit/ Stop Loss

enableatr = input(true, title="Enable ATR exit?")

atrprofitfactorlong = input(title="ATR Profitfactor Long", type=input.float, step=0.1, defval=6)

atrstopfactorlong = input(title="ATR Stopfactor Long", type=input.float, step=0.1, defval=5)

atrprofitfactorshort = input(title="ATR Profitfactor Short", type=input.float, step=0.1, defval=3)

atrstopfactorshort = input(title="ATR Stopfactor Short", type=input.float, step=0.1, defval=5)

//ATR

lengthATR = input(title="ATR Length", defval=11, minval=1)

atr = atr(lengthATR)

//LONG EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barsbought1 = barssince(bought)

profit_level = strategy.position_avg_price + (atr*atrprofitfactorlong)

stop_level = strategy.position_avg_price - (atr*atrstopfactorlong)

strategy.exit("Take Profit/ Stop Loss", "long", stop=stop_level[barsbought1], limit=profit_level[barsbought1])

//SHORT EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barssold1 = barssince(sold)

profit_level = strategy.position_avg_price - (atr*atrprofitfactorshort)

stop_level = strategy.position_avg_price + (atr*atrstopfactorshort)

strategy.exit("Take Profit/ Stop Loss", "short", stop=stop_level[barssold1], limit=profit_level[barssold1])

// } ATR Take Profit/ Stop Loss