概述

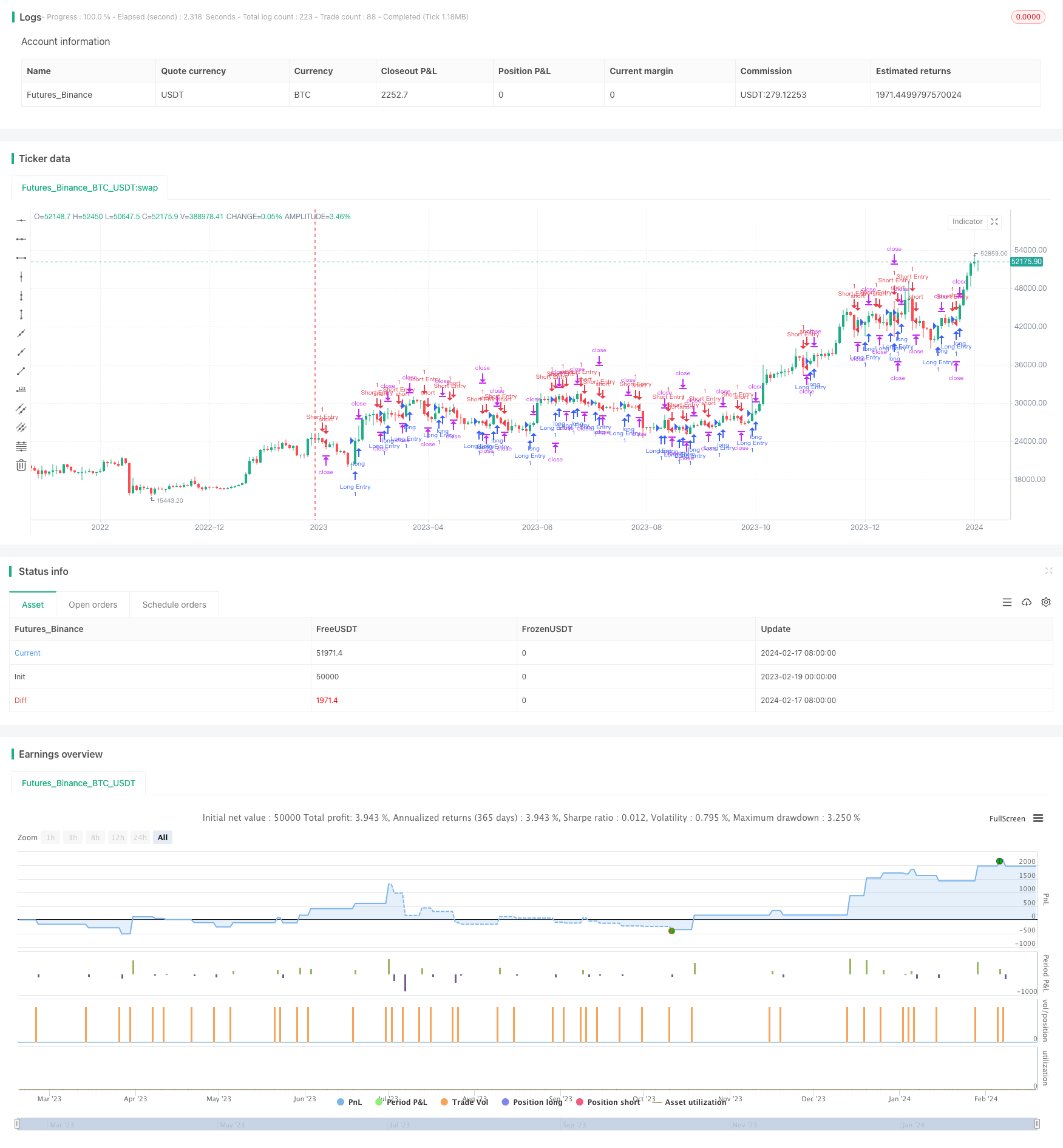

本策略是一个基于简单移动平均线的跨均线反转策略。它会使用长度为1和长度为5的简单移动平均线,当短周期移动平均线从下方上穿长周期移动平均线时做多,当从上方下穿时做空,属于典型的趋势跟踪策略。

策略原理

本策略通过计算close价格的1日简单移动平均线sma1和5日简单移动平均线sma5,在sma1上穿sma5时做多入场,在sma1下穿sma5时做空入场。做多后设置止损为入场价下方5美元,止盈为入场价上方150美元;做空后设置止损为入场价上方5美元,止盈为入场价下方150美元。

优势分析

- 使用双均线判断市场趋势方向,避免止损后立即反向入场

- 移动平均线参数简单合理,回测结果良好

- 止损幅度较小,可以承受一定的行情震荡

- 止盈幅度较大,可以获得足够盈利

风险分析

- 双均线策略容易被套,行情震荡时止损概率大

- 无法有效跟踪趋势行情,长线获利能力有限

- 参数优化空间有限,容易过优化

- 针对特定交易品种,不同品种需要调整参数

优化方向:

- 增加其他指标过滤,避免错误信号

- 动态调整止损止盈幅度

- 优化移动平均线参数

- 结合波动率指标,控制仓位规模

总结

本策略作为一个简单的双均线策略,具有操作简单、易于实现的特点,可以快速验证策略想法。但其承受能力和获利空间都比较有限,需要对参数和过滤条件进行优化,使之适应更多市场环境。作为初学者的第一份量化策略,它包含了基本的组成要素,可作为简单的框架进行 iterable 改进。

策略源码

/*backtest

start: 2023-02-19 00:00:00

end: 2024-02-19 00:00:00

period: 2d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Valeria 181 Bot Strategy Mejorado 2.21", overlay=true, margin_long=100, margin_short=100)

var float lastLongOrderPrice = na

var float lastShortOrderPrice = na

longCondition = ta.crossover(ta.sma(close, 1), ta.sma(close, 5))

if (longCondition)

strategy.entry("Long Entry", strategy.long) // Enter long

shortCondition = ta.crossunder(ta.sma(close, 1), ta.sma(close, 5))

if (shortCondition)

strategy.entry("Short Entry", strategy.short) // Enter short

if (longCondition)

lastLongOrderPrice := close

if (shortCondition)

lastShortOrderPrice := close

// Calculate stop loss and take profit based on the last executed order's price

stopLossLong = lastLongOrderPrice - 5 // 10 USDT lower than the last long order price

takeProfitLong = lastLongOrderPrice + 151 // 100 USDT higher than the last long order price

stopLossShort = lastShortOrderPrice + 5 // 10 USDT higher than the last short order price

takeProfitShort = lastShortOrderPrice - 150 // 100 USDT lower than the last short order price

// Apply stop loss and take profit to long positions

strategy.exit("Long Exit", from_entry="Long Entry", stop=stopLossLong, limit=takeProfitLong)

// Apply stop loss and take profit to short positions

strategy.exit("Short Exit", from_entry="Short Entry", stop=stopLossShort, limit=takeProfitShort)