Reserve orders and iceberg orders for high-frequency trading strategies

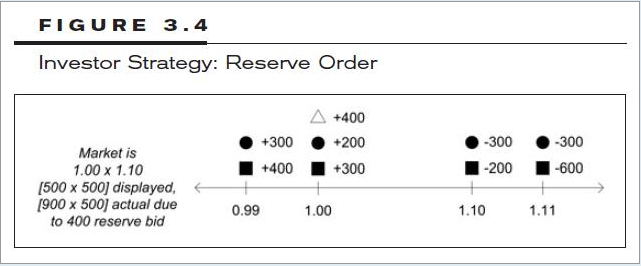

Author: Zero, Created: 2015-06-07 08:27:49, Updated: 2015-06-09 11:23:30Today's report is about two concepts Reserve Orders and Iceberg Orders, which should be translated into Chinese as Hidden Orders and Iceberg Orders. This is because some exchanges in the US ("dark pools" as previously reported) allow traders to post orders without revealing the information about the order. In the example shown below, the order book is now displayed inThere are two orders that can be seen at the price of $1.00 and they are 200 shares and 300 shares, but there is actually a hidden order of 400 shares that is not disclosed, and this hidden 400 share buy order is a Reserve order.The order volume at 1.00 should be 900 shares, not the 500 shares seen in the order book.

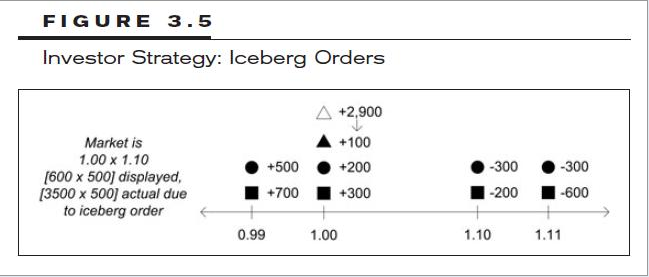

Another type of order is an iceberg order, which, as the name suggests, is a small volume of iceberg at sea level. An iceberg order is an order that reveals only a small amount of the order book, while most of the order is hidden. As shown in the figure below, you can see from the order book that there are three orders, 300 shares, 200 shares and 100 shares, for a total of 600 shares, but in reality there is a 3,000 share order, where the trader only reveals the amount of 100 shares in the order book, and hides the remaining 2,900 shares.

When someone eats 100 shares of the iceberg order displayed on a $1.00 buy order, the exchange immediately posts 100 more shares of the hidden order in the order book until all 2,900 of the hidden orders are sold. If the 100 share order revealed by the iceberg orders is executed, the exchange does not immediately post the 100 shares in the order book from the hidden order, but after two seconds (or an indefinite amount of time to prevent detection) displays the 100 share order, which is called time slicing. The main reason for the existence of reserve orders and iceberg orders is that large investors don't want their buy/sell messages to be detected. However, the big investment firms will use reserve orders and iceberg orders to hide their trading motives, and high-frequency traders will use more powerful strategies to eat the tofu of these big investors. Subsequent strategies such as push the elephant and tow the iceberg are the strategies of high-frequency traders to deal with these large investors.

- One of the newcomers to the K-line collection on the hard disk

- Some tips for re-testing the wrong packaging

- TypeError: Cannot access member 'GetRecords' of undefined at

:1:-1 Where is the problem? - On the strategy of single platform balancing

- Why choose to trade strategically on the FMZ Quantitative Trading Platform (BotVS)

- The strategy of making money could also be a coin.

- Inventors quantify the path of automated trading

- The Law of Grid Trading

- I've created a forum, use it for a while.

- Join the Makers in high-frequency trading strategy

- Poke for bargain high-frequency trading strategy

- Improvements and advantages of multi-platform hedge stability swap V2.7

- About being sucked in

- Single-point sniper with high-frequency stacking automatic counter-hand unlocking algorithm

- Penny Jump for high-frequency trading strategy

- Take out slow movers of high frequency trading strategy

- Push the Elephant in high-frequency trading strategy

- Scratch for the Rebate high frequency trading strategy