The core of money management -- the choice of leverage

Author: Inventors quantify - small dreams, Created: 2016-12-22 12:02:17, Updated:Effects of leverage in trading

- ### 1, leverage is at the core of stable profitability with a profit model that is not equal to profit Some investors may think that making money is inevitable as long as there is an expected positive profit pattern.

Let's start with a simple example:

The first year, 60% profit, the second year, 40% loss, and so on.

The arithmetic mean is E = 0.6-0.4) / 0.1 = 10%.

The geometric mean gain is rg = [(1+0.6) × ((1-0.4)]0.5-1 = 0.96 0.5-1 = 0.98-1 = -2%.

In the last two years, investments have lost 4%; the average annual loss is 2%.

Why is it that the simple mathematical expectation of a profit model is supposed to be a profitable transaction, but a loss when it actually happens?

From the indicators we have calculated, it can be seen that the return on investment depends on the geometric average return, not the arithmetic average return. And the deeper reason is that the investor has put all the money in by default. This is the fundamental reason for trading losses with a profit pattern.

- ### 2, stocks are less risky and relatively safe than futures? Many investors feel that futures are more risky than stocks, and when talking about the bullish period, they turn pale, like a tiger. This is because futures use a collateral system, the average collateral ratio is only about 10%, i.e. a market value of 1 million, and investors can buy and sell with only 100,000 funds. This is leverage, and is 10 times the leverage.

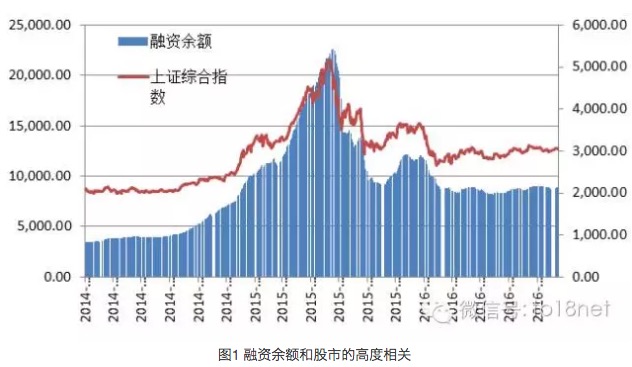

These investors believe that stocks are relatively safe and believe that the worst outcome of the stock market is that the stock is sold to shareholders, so the stock is fearlessly overbought. The 2015 stock market bull market, which achieved many brave and brave investors. They are not only overbought, but also actively leveraged through financing.

However, in July 2015, the stock market began to fall, the chain of liquidation of the financing balance account, triggered a major crash of the stock market, and for a time, a thousand stocks plummeted and plummeted. How many people have a dream, high-rise failed. What did they really ignore, so that they got to this tragedy. The answer is obvious, the financing balance, that is, the leverage in stock trading.

Let's go back and see if stocks are really less risky and safer than futures.

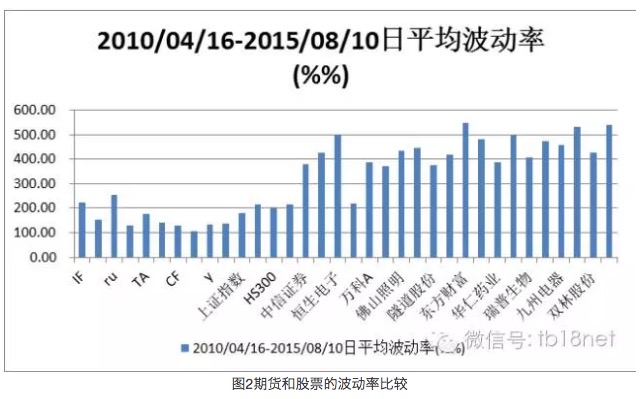

2.1 Stocks are more volatile than futures Comparing the volatility of futures to stocks, it is clear that stock fluctuations are even greater than futures. The largest volatility in futures is the RU, but it is small compared to the random one share of a stock.

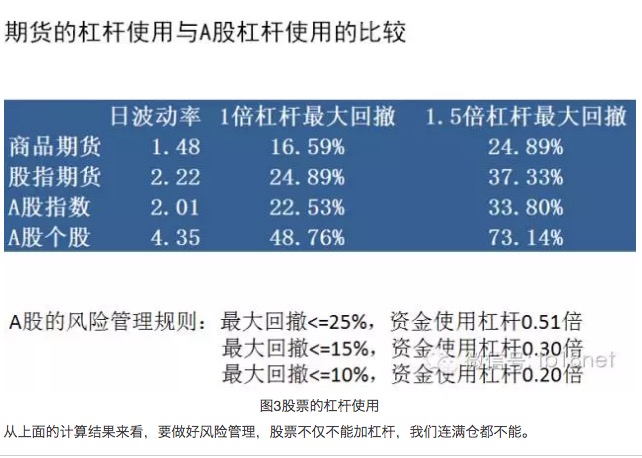

2.2 Stock trading also needs leverage. Let's continue to calculate how leverage should be controlled for the same fund account, trading stocks and futures, under the same risk management objectives.

-

The key to managing account funds is the choice of leverage

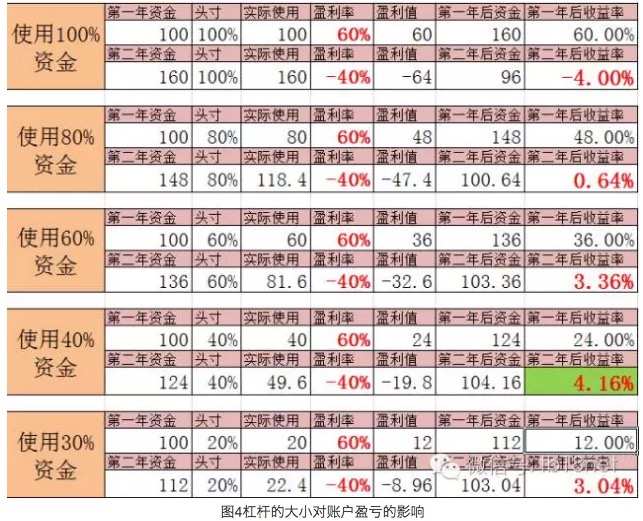

Since leverage is so important, we made the following estimate of the effect of leverage size on account gains and losses:

From this point of view, leverage in futures trading is an extremely important factor in determining profit and loss, and if the investor does not use leverage correctly, the probability of long-term profitability is extremely low. There are some cases of short-term profits that are often encouraged as an incentive story for investors.

-

4 The Myth of Leveraged Bullying

The market is always full of stars, with a few dozen times the year's performance. As a risk-conscious investor, you may be distracted by these myths and give up your control of leverage.

4.1 High leverage of individual accounts is not necessarily high leverage of all assets If Investor A uses a full-stock operation on a million-dollar futures trading account, the leverage is about 10 times. This is very dangerous from a single account's perspective. But if Investor A's overall risk assets are 100 million, then the full-stock of this futures trading account is only about 0.1 times the leverage for Investor A's overall risk assets, which is not high leverage.

4.2 High leverage is unsustainable The myth of profiting too much from high leverage or even full positions is often unsustainable. There is no trading system with a 100% win rate, so all trading systems are subject to leverage controlled management. Too much leverage or full positions can lead to myths, but the end is often a bust.

4.3 The high leverage offered by the foreign exchange market is also a dangerous weapon for investors Black platforms in the forex market give investors 400 times the leverage they need, which is not a leverage they offer. For most investors, the corresponding leverage of a minimum trading unit can be very high, not to mention that investors who do not have a sense of control can be overwhelmed. High leverage is just a means of black platforms to accelerate the laundering of investor funds.

The lever is a double-edged sword.

Translated from Pioneer Financial Network

- Beware of the Linear Mind Trap

- I've heard that reading like this can make a lot of money.

- The story of the escape and the survival of the gambler and the gambler

- 30 lines of code that takes you into the world of quantitative investing (python version)

- Gambling is a form of high-tech business

- The quantity-price relationship is an important indicator!

- A strong demand for the platform to add do-as-you-go retargeting

- How to read the Big Three financial statements in a way that's interesting and interesting?

- Mathematical thinking in investment finance, how many have you done?

- Why slippage occurs in programmatic transactions

- Financial knowledge

- Causes and uses of ionization rates

- Robots often report mistakes and disconnect

- How do traders sell off risk?

- Robots are getting information that is often wrong, is there a good solution?

- The least common multiple of the linear regression theorem

- Seven regression techniques you should master

- Gauss and the Black Swan

- The Bretton Woods system

- Which god can help me write a simple strategy?