Gambling is a form of high-tech business

Author: Inventors quantify - small dreams, Created: 2016-12-24 12:09:49, Updated:Gambling is a form of high-tech business

Let's first look at why it is so often the case that we see rose petals in our stews or that we see white cabbage being eaten by pigs.

- ### Let's look at an example:

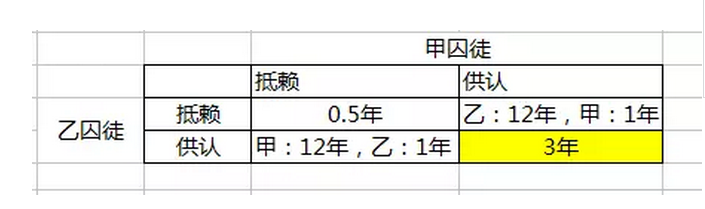

Two criminals were arrested and interrogated separately in the police station, where they confessed or not, deciding their own fate and the fate of the other:

Obviously, both of them are fighting each other to keep their sentences to a minimum. However, if you are a party, what would you choose? For you, if you confess, you will not risk 12 years in prison, or at worst 3 years in prison, regardless of whether the other offender confesses.

This is the famous case of the Gambling theory introduction to the Prisoner's Dilemma, in which both prisoners are given the minimum sentence if they choose to disobey. But because of mutual suspicion, both prisoners eventually choose to confess, which is the case of the Gambling theory's Nash equilibrium, which is the choice of the best strategy for themselves.

You may ask, what does this have to do with the phenomenon of white cabbage being cooked by pigs with garlic flowers in a stew?

Firstly, because there are a lot of people chasing Angkor, chasing the extreme beauty may appear a vacuum phenomenon, so for him, the most stable strategy is definitely not to chase the beauty. Secondly, because everyone knows that the extreme beauty will definitely be chased by many people, so the general people will not move. On the contrary, the conditions are particularly general, unlike Angkor, there are many options, because there is no worry, so the most stable strategy for him is to escape, anyway, not to chase the beauty and there will be no loss, the result is fixed.

However, gambling is not about discovering a phenomenon, it is about choosing the best strategy in life and gaining the maximum advantage in the competition.

Over a year ago, the S&P 500 began to collapse, and in order to prevent systemic risks, Guoqiang conducted a bailout. At that time, almost all the fund managers came out to tell people to stay calm and avoid irrational trampling.

But if you understand the balance of the prisoner's dilemma, you will know that most people would choose the selfish and stable option of running before others.

The stock market is like a prisoner's dilemma, it's also a gamble.

The stock market is essentially a tool for financing enterprises, but there is a more important property of price speculation, which is particularly evident in A-shares, as it allows for buying and selling transactions. The stock market is therefore also a tool for playing with landowners and ordinary investors.

- ### Why is it that the excess profits of the death squad are essentially a gamble?

Continue to look at the example:

The game theorist Martin Shubik devised a trap party game played by economists called the $1 auction trick. The game participants auction off a $1 bill, which is priced one cent higher at each bid. The highest bidder gets the $1 instead.

Initial bids may be low, but will soon be close to $1. The highest bid will quickly reach 99 cents, and the second will reach 98 cents. At this point, the second bidder will not benefit from the trade if the bid price is $1. This is better than losing 98 cents. At this point, the auction will have an unexpected outcome.

Second place always raises the price again. So the auction may continue until the participant spends the money. The game will end, but it will never be a good result. It is said that someone paid $200 to win $1.00 in the Shubique lottery.

This example shows us that when something makes you feel the risk of losing, you buy it at all costs and reduce your losses.

There is a stock that you have been focusing on that suddenly pulls a stop sign, and at this point when you can't buy it, you feel like you missed 10% and you feel like you lost 10%; but at this point if you keep pulling two more boards, this sense of loss and scarcity will become more intense, which is exactly what the landlords use. They then trigger your psychological loss by doing the second and third boards in reverse, and eventually make you choose to buy at a higher level rather than rational in remorse, at which point they make the sale.

The landlord often uses this manufacturing scarcity to make the ordinary investor more consistent, to gamble against the ordinary investor. This is also why the high opening after the shrinking board is often a sales method: because to make the retailers regret not being able to buy, the opening of the people will definitely be irrational to buy, means that there is a counter-disc.

If one of the prisoners in the prisoner's dilemma knows the choice of another prisoner, he must be able to know how to make the best strategy. But to know the choice of another prisoner, you need to use good knowledge of the mass, psychological behavior and aesthetics. In the stock market, the landowners know the masses, psychological behavior and aesthetics, and they have used this knowledge well to gamble with retailers.

So stock speculation is essentially a tool for the landlord to gamble with the retailer, which is often exploited by human weaknesses; and the key to zero and gambling is the need to use common knowledge to break through the prisoner's dilemma, knowing that the opponent's strategy will make the best choice. What is the most classic example of this?

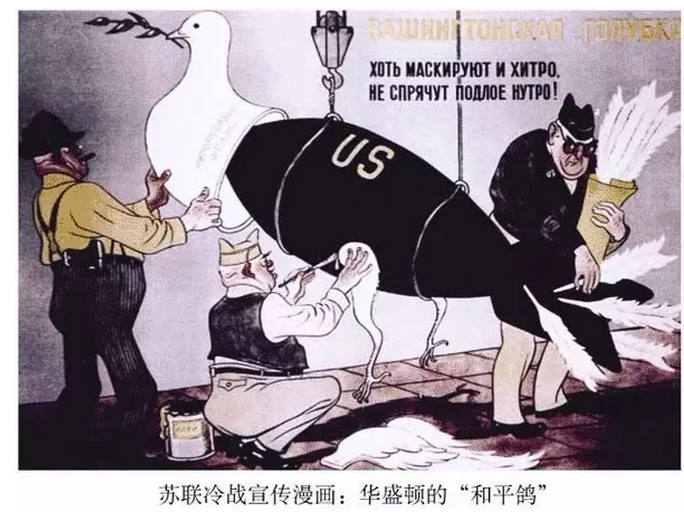

During the Cold War, the United States, through intelligence, was aware of the specifics of the Soviet economy, and it was able to follow the Soviet arms race, deliberately setting up something called the Space Shuttle Program, which was later put into place in the midst of a dispute. The Soviet Union invested a lot of money to build a space program, but the final investigation found that the cost of the United States in this regard was actually very high.

- ### There is another case:

During the Vietnam War, it was also the case that the United States would not launch nuclear weapons, and used Vietnam's geographical advantage to wage a lasting war of attrition, but later the United States fled due to domestic pressure.

So, from a strategic point of view, gambling is the most crucial factor.

- ### Finally, think about a question: why is compromise an art?

This involves the types of games, which are divided into zero and zero, positive and negative games. The stock market is a zero and zero game, zero and zero games means that you infer the choice of the handset through common knowledge, and then match your own optimal options. But many aspects of life are actually non-zero and zero games, which can be positive and negative games or negative and negative games.

Suppose you have an important ball to watch tonight, and your girlfriend asks you to watch TV with her, and if you stubbornly refuse and tell your girlfriend not to take any money, the result will be a double win and a draw. But if you promise to watch TV with her, and then you look at the ball with your phone, obviously it is a positive draw, then the result may be a happy one. So compromise is an art.

- ### Summary

In the context of the following article: An analysis of the prisoner's dilemma, a discussion of the phenomenon of the planting of rose petals in a cow's nest, an analysis of the theory of gambling, a strategic application of gambling theory in the stock market, and the use of gambling: compromise, also an art.

Whether it's the stock market or life itself, a good gambling mindset is definitely a manifestation of a high-spirited businessman. Gambling is not about flirting, it's about avoiding making something in life that could have been better turned into something bad.

In fact, the good thing about studying abroad is that it stimulates students' diffuse thinking through some cases, and only when the valves of diffuse thinking are opened, will there be a continuous creativity, and while giving something, the training has always been committed to stimulating the potential of all students in this way.

The game theory requires knowledge of homosexuality, and the correct reading of this knowledge was also discussed at length last week.

Finally, I hope you will share this kind of game-thinking post with your friends and invite them to think with me and then continue to help me unlock the comment section, because co-operation is a positive game and an artistic game.

Translated from the original by Siddhartha Gautama

- python: Please be careful in these places.

- A synergistic understanding of intuition

- The hidden Markov model

- Interested in understanding the simplicity of Bayes

- 2.11 API: Simple example of use of Chart function (graph function)

- Details of the currency pair

- Beware of the Linear Mind Trap

- I've heard that reading like this can make a lot of money.

- The story of the escape and the survival of the gambler and the gambler

- 30 lines of code that takes you into the world of quantitative investing (python version)

- The quantity-price relationship is an important indicator!

- A strong demand for the platform to add do-as-you-go retargeting

- How to read the Big Three financial statements in a way that's interesting and interesting?

- Mathematical thinking in investment finance, how many have you done?

- Why slippage occurs in programmatic transactions

- The core of money management -- the choice of leverage

- Financial knowledge

- Causes and uses of ionization rates

- Robots often report mistakes and disconnect

- How do traders sell off risk?