Martinel's tactics, his single-handed gamble on fate?

Author: Inventors quantify - small dreams, Created: 2017-01-10 12:06:16, Updated:Martinel's tactics, his single-handed gamble on fate?

Martin's strategy, in conjunction with Fibonacci, and risk factors such as dynamically adjusted spread and multiples are a very worthwhile area of scientific research.

In theory, the charm of the Martingale trading strategy is that as long as you have enough money, you can win the whole world with a 24 hour EA.

Martin's trading strategy is one of the most enduring trading strategies in the field of financial speculation in the last hundred years. The procedural up-and-down positioning, precise calculation of the drawdown and profit in advance, regardless of entry and exit, swept the majority of the market, not surprisingly!

No trading strategy has ever been as controversial as Martin's. Behind the tyranny and the victory of the hundred battles, there is the exponential magnification of risk and a sudden and deadly hook-up. It has made it difficult for foreign exchange platforms to sleep, and it has left behind countless legends.

-

1 Simple introductory level of the Martin strategy

The basic principle of Martin's strategy is that in a bullish, bullish bilateral market, you generally only bet on one side, and if you do the opposite, you continue to bet on the other side until the market rebounds, making up for all previous losses.

Here, I'm going to share with you a step-by-step, manual calculation to evaluate the simplest Martin strategy rollback performance.

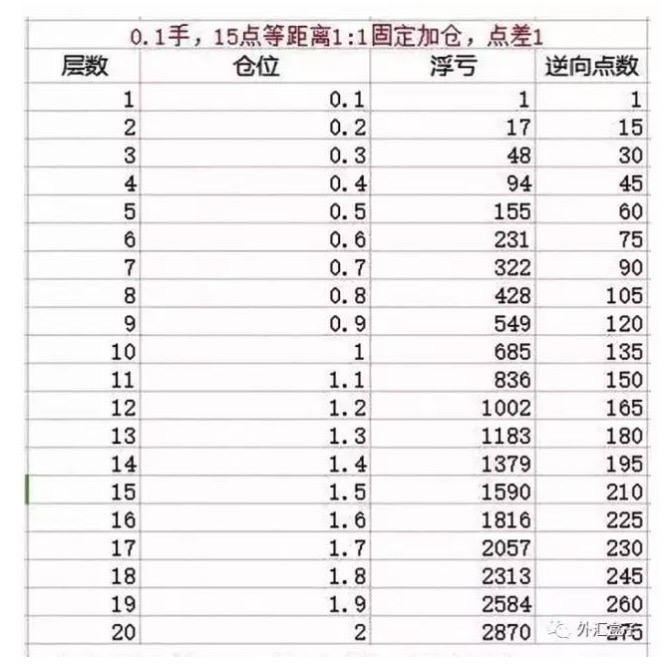

For example: In the meantime, I'm going to start with the first one. The first time you open a position 0.1 hand. Each time you open a position at an interval of 15 points, you will be able to increase your position in the same proportion. The difference is set at one point for the euro and one point for the US dollar. The level is set to 20 levels; i.e. 20 times higher in case of a large one-sided market.

We're going to analyze the retreat of this simplest of Martin's tactics.

The above is an equidistant reverse leverage trading strategy often used by forex junior traders, which we often call the reverse Martin strategy.

In the case of a bullish trader, there are basically many layers of reverse bullishness.

We see that when the 20th level is reached, the number of holders is 2 hands, reverse resistance 275 points, and a float of $2870; if the float is to be restored to the initial state, it needs to be restored 143.5 points.

Assuming that the market does not rebound at this point and the trader stops adding layers, we measure the risk of it continuing downwards.

Set the single-sided market to a full 400-point single-sided deadlock. The upper 20 levels have 275 reversal points, and the unilateral reversal is 125 points. The 2 hands have already floated at $2,870, plus 125 times 20, which equals $2,870 + 2,500 = $5,370. The second hand has to pay back $5370 and has to wait for 260 points to be paid back. This is a very silly thing.

This is just the simplest entry-level Martin strategy. Evaluating this strategy we can see that in the case of a 20th-level bullish position, a 50% point retracement of the reversal is required. In fact, in a wave of super-strong markets, it is difficult to have a 50% quick retracement, which inevitably reduces the effectiveness of this strategy.

If you want to increase the speed of quick replenishment, you need to increase the multiplier of the position in the late stages of the downturn, such as by raising the position ratio by 1.5 times or 2 times. But it will lead to a rapid increase in the position, which will accelerate rapidly if not controlled. This is why we often say that the potential risk of Martin is huge.

-

Martin's strategy has several risk factors.

We see that Martin's strategy has several variables that can be studied in depth, which we call risk factors.

Starting position: The impact is not great, it is linear, well measured and calculated.

The distance of the leverage: whether it is 15 points or 30 points, or whether the leverage is based on a certain ratio of dynamic distance, directly affects the potential risk of Martin. If the factor is converted to a leverage of dynamic distance, such as a Fibonacci ratio, then the calculation becomes very complicated.

The multiples of the leverage: whether the leverage is multiplied by a ratio of 1:1, or by multiples of 1:1,5 or 1:2, or by the control of leverage multiplied by Fibonacci ratios, directly affects the total number of positions and the complexity of the calculation.

In this case, when the leverage distance and leverage multiplier both present a dynamic curve, the entire computation model becomes very complex. The dynamic distance of the Martin strategy is accompanied by a dynamic position, which can be adjusted to a variety of different risk curves. This should be the core focus of Martin strategy research and development, which can be better assisted by computer programming.

-

Martin's strategy can be derived from several supervariants.

The following is what I thought: For risk prevention, you can choose to open the position and have a longer space at the bottom of the wavelength range. For example, after the bottom rise of 60 points, you can start backwards again, gradually increasing the position of the reverse Martin. This can eliminate some of the risk factors that accumulate at the bottom.

The pump can be selected to accommodate the Martin and other technical indicators, such as in the 30', 60', 200' and so on, or in the upstream track of the Brin belt, which accommodates different dynamic Martin positions.

In some positions, to minimize the fatal damage caused by the super-unilateral Martin, a dynamic hedge can be chosen to strategically eliminate part of the position.

The Fibonacci-Martin strategy is a very valuable area of scientific research. If a detailed deductive calculation of each factor is done, and well controlled, it is possible to produce a super-Martin.

Translated from Foreign Exchange Box

- The 10 most puzzling economics myths

- How does the Bitcoin protocol work?

- How the Bitcoin protocol works

- 3.5 Strategy framework templates

- Quantified trading strategies for the KDJ indicator

- Bayesian classifier based on KNN algorithm

- 22 pictures of the event.

- Why investing requires strategic thinking?

- Python -- numpy matrix operations

- Algorithmic trading strategies

- JSLint detects the syntax of JavaScript

- How partial equity impacts the average price of holdings

- Bitcoin exchange network error GetOrders: parameter error

- The template of the listing system triggers the design outline of ten items

- The technical gist of the shark system trading rules

- Template 3.0: Draw line class library

- Peak and slope

- The most profitable economist, writing papers and leading economist, Tom Maynard Keynes

- Template 3.2: Digital currency trading class library (integrated Cash, futures support OKCoin futures/BitVC)

- I'm sorry, but Gauss did a small job.