The digital currency pairing trading strategy is detailed

Author: The grass, Created: 2024-07-05 16:23:42, Updated: 2024-11-05 17:42:06

The digital currency pairing trading strategy is detailed

The Preface

Recently, the quantitative diary of the BoE mentioned that it is possible to use negative correlation coins to make a profit based on price gap breakouts. Digital currencies are basically positive correlation, negative correlation is a small number of currencies, often with special markets, such as the independent market of MEME coins of the past period, completely do not follow the trend of the big disc, filter out these coins, break out and do more, this way can be profitable under certain circumstances.

Cryptocurrency pairing is a trading strategy based on statistical profit, whereby two highly correlated digital currency perpetual contracts are bought and sold at the same time in order to profit from price deviations. This article details the principles of the strategy, the profit mechanism, the method of filtering the coin species, the potential risks and how to improve it, and provides some practical Python code examples.

The Principles of Strategy

Pairing trading strategies rely on historical correlation between the prices of two digital currencies. When the prices of two currencies are strongly correlated, their price movements are largely synchronous. If the price ratios of the two appear to deviate significantly at a certain moment, it can be considered a temporary anomaly, with prices tending to return to normal. The digital currency market has a high degree of interconnectivity, and when one major digital currency (such as Bitcoin) experiences significant fluctuations, it usually triggers the interconnectivity of other digital currencies.

Assume that A and B have a higher price correlation. At a certain point in time, the average value of the A/B price ratio is 1. If at a certain point in time, the A/B price ratio deviates more than 0.001, that is, more than 1.001, then the transaction can be done as follows: open more B, open more A. Conversely, when the A/B price ratio is less than 0.999, open more A, open more B.

The key to profitability is the difference gain when the price deviates back to normal. Since the price deviation is usually short-lived, traders can break even when the price returns to the mean and profit from it, earning the difference.

Prepared data

Introducing the appropriate library

These codes can be used directly, preferably by downloading an Anancoda and debugging it in a Jupyer notebook.

import requests

from datetime import date,datetime

import time

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import requests, zipfile, io

%matplotlib inline

Get all the trading pairs that are being traded

Info = requests.get('https://fapi.binance.com/fapi/v1/exchangeInfo')

b_symbols = [s['symbol'] for s in Info.json()['symbols'] if s['contractType'] == 'PERPETUAL' and s['status'] == 'TRADING' and s['quoteAsset'] == 'USDT']

b_symbols = list(filter(lambda x: x[-4:] == 'USDT', [s.split('_')[0] for s in b_symbols]))

b_symbols = [x[:-4] for x in b_symbols]

print(b_symbols) # 获取所有的正在交易的交易对

The function to download the K-line

The main function of the GetKlines function is to retrieve historical K-line data from the Binance exchange for specified trades on perpetual contracts and store this data in a Pandas DataFrame. The K-line data includes information such as opening price, maximum price, minimum price, closing price, volume of trades.

def GetKlines(symbol='BTCUSDT',start='2020-8-10',end='2024-7-01',period='1h',base='fapi',v = 'v1'):

Klines = []

start_time = int(time.mktime(datetime.strptime(start, "%Y-%m-%d").timetuple()))*1000 + 8*60*60*1000

end_time = min(int(time.mktime(datetime.strptime(end, "%Y-%m-%d").timetuple()))*1000 + 8*60*60*1000,time.time()*1000)

intervel_map = {'m':60*1000,'h':60*60*1000,'d':24*60*60*1000}

while start_time < end_time:

time.sleep(0.3)

mid_time = start_time+1000*int(period[:-1])*intervel_map[period[-1]]

url = 'https://'+base+'.binance.com/'+base+'/'+v+'/klines?symbol=%s&interval=%s&startTime=%s&endTime=%s&limit=1000'%(symbol,period,start_time,mid_time)

res = requests.get(url)

res_list = res.json()

if type(res_list) == list and len(res_list) > 0:

start_time = res_list[-1][0]+int(period[:-1])*intervel_map[period[-1]]

Klines += res_list

if type(res_list) == list and len(res_list) == 0:

start_time = start_time+1000*int(period[:-1])*intervel_map[period[-1]]

if mid_time >= end_time:

break

df = pd.DataFrame(Klines,columns=['time','open','high','low','close','amount','end_time','volume','count','buy_amount','buy_volume','null']).astype('float')

df.index = pd.to_datetime(df.time,unit='ms')

return df

Downloading data

The data volume is relatively large, and only the latest 3 months of K-line data are obtained for faster downloads.

start_date = '2024-04-01'

end_date = '2024-07-05'

period = '1h'

df_dict = {}

for symbol in b_symbols:

print(symbol)

if symbol in df_dict.keys():

continue

df_s = GetKlines(symbol=symbol+'USDT',start=start_date,end=end_date,period=period)

if not df_s.empty:

df_dict[symbol] = df_s

df_close = pd.DataFrame(index=pd.date_range(start=start_date, end=end_date, freq=period),columns=df_dict.keys())

for symbol in symbols:

df_close[symbol] = df_dict[symbol].close

df_close = df_close.dropna(how='all')

The retest engine

Defines an Exchange object for the next retest

class Exchange:

def __init__(self, trade_symbols, fee=0.0002, initial_balance=10000):

self.initial_balance = initial_balance #初始的资产

self.fee = fee

self.trade_symbols = trade_symbols

self.account = {'USDT':{'realised_profit':0, 'unrealised_profit':0, 'total':initial_balance,

'fee':0, 'leverage':0, 'hold':0, 'long':0, 'short':0}}

for symbol in trade_symbols:

self.account[symbol] = {'amount':0, 'hold_price':0, 'value':0, 'price':0, 'realised_profit':0,'unrealised_profit':0,'fee':0}

def Trade(self, symbol, direction, price, amount):

cover_amount = 0 if direction*self.account[symbol]['amount'] >=0 else min(abs(self.account[symbol]['amount']), amount)

open_amount = amount - cover_amount

self.account['USDT']['realised_profit'] -= price*amount*self.fee #扣除手续费

self.account['USDT']['fee'] += price*amount*self.fee

self.account[symbol]['fee'] += price*amount*self.fee

if cover_amount > 0: #先平仓

self.account['USDT']['realised_profit'] += -direction*(price - self.account[symbol]['hold_price'])*cover_amount #利润

self.account[symbol]['realised_profit'] += -direction*(price - self.account[symbol]['hold_price'])*cover_amount

self.account[symbol]['amount'] -= -direction*cover_amount

self.account[symbol]['hold_price'] = 0 if self.account[symbol]['amount'] == 0 else self.account[symbol]['hold_price']

if open_amount > 0:

total_cost = self.account[symbol]['hold_price']*direction*self.account[symbol]['amount'] + price*open_amount

total_amount = direction*self.account[symbol]['amount']+open_amount

self.account[symbol]['hold_price'] = total_cost/total_amount

self.account[symbol]['amount'] += direction*open_amount

def Buy(self, symbol, price, amount):

self.Trade(symbol, 1, price, amount)

def Sell(self, symbol, price, amount):

self.Trade(symbol, -1, price, amount)

def Update(self, close_price): #对资产进行更新

self.account['USDT']['unrealised_profit'] = 0

self.account['USDT']['hold'] = 0

self.account['USDT']['long'] = 0

self.account['USDT']['short'] = 0

for symbol in self.trade_symbols:

if not np.isnan(close_price[symbol]):

self.account[symbol]['unrealised_profit'] = (close_price[symbol] - self.account[symbol]['hold_price'])*self.account[symbol]['amount']

self.account[symbol]['price'] = close_price[symbol]

self.account[symbol]['value'] = self.account[symbol]['amount']*close_price[symbol]

if self.account[symbol]['amount'] > 0:

self.account['USDT']['long'] += self.account[symbol]['value']

if self.account[symbol]['amount'] < 0:

self.account['USDT']['short'] += self.account[symbol]['value']

self.account['USDT']['hold'] += abs(self.account[symbol]['value'])

self.account['USDT']['unrealised_profit'] += self.account[symbol]['unrealised_profit']

self.account['USDT']['total'] = round(self.account['USDT']['realised_profit'] + self.initial_balance + self.account['USDT']['unrealised_profit'],6)

self.account['USDT']['leverage'] = round(self.account['USDT']['hold']/self.account['USDT']['total'],3)

Relevance analysis to screen for currency

Relativity calculus is a method in statistics used to measure the linear relationship between two variables. The most commonly used correlational calculus method is the Pearson correlation coefficient. The following are the principles, formulas, and implementations of correlational calculus. Pearson correlation coefficients are used to measure the linear relationship between two variables, taking values in the range from -1 to 1: - What?1Indicates that the two variables are always in synchronous change. When one variable increases, the other variable increases proportionally. The closer one is to one, the stronger the correlation. - What?-1This means that the two variables are always inversely related. The closer to -1 the stronger the negative correlation. - What?0Indicates wireless correlation, no linear relationship between the two variables.

The Pearson correlation coefficient is determined by calculating the covariance and standard deviation of the two variables. The formula is as follows:

[ \rho_{X,Y} = \frac{\text{cov}(X,Y)}{\sigma_X \sigma_Y} ]

Some of them are: - ( \rho_{X,Y}) is the Pearson coefficient of the variables (X) and (Y) - (\text{cov}(X,Y) is the covariance of (X) and (Y). - (\sigma_X) and (\sigma_Y) are the standard deviations of (X) and (Y) respectively.

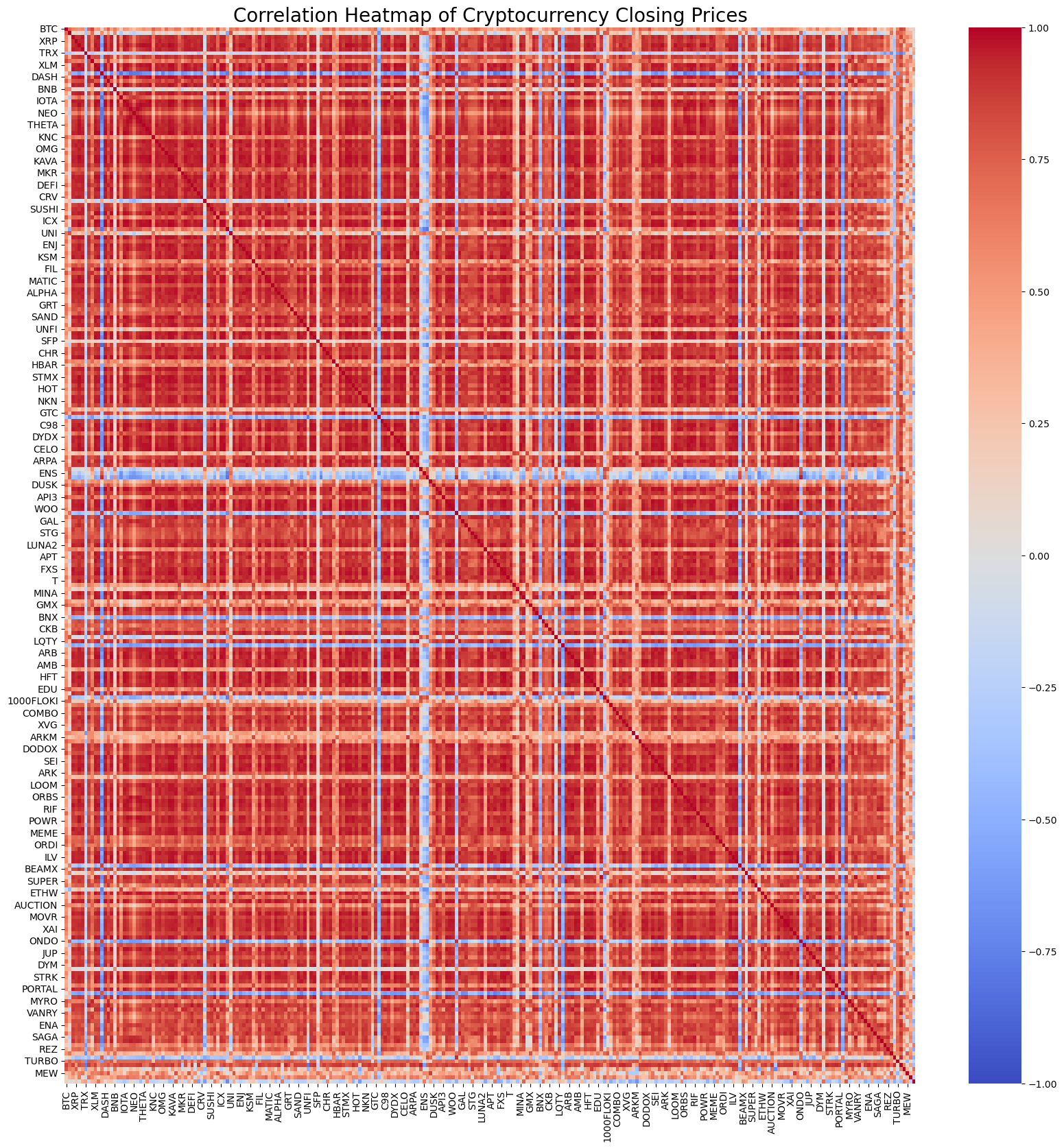

Of course, no matter how it is calculated, you can calculate the correlation of all the currencies using Python 1 line of code. The diagram shows the correlation heat graph, the red representation is positive correlation, the blue representation is negative correlation, the deeper the correlation, the stronger the correlation.

import seaborn as sns

corr = df_close.corr()

plt.figure(figsize=(20, 20))

sns.heatmap(corr, annot=False, cmap='coolwarm', vmin=-1, vmax=1)

plt.title('Correlation Heatmap of Cryptocurrency Closing Prices', fontsize=20);

The top 20 most relevant currency pairs were filtered by relevance. The results were as follows. They were all very strongly related, both above 0.99.

MANA SAND 0.996562

ICX ZIL 0.996000

STORJ FLOW 0.994193

FLOW SXP 0.993861

STORJ SXP 0.993822

IOTA ZIL 0.993204

SAND 0.993095

KAVA SAND 0.992303

ZIL SXP 0.992285

SAND 0.992103

DYDX ZIL 0.992053

DENT REEF 0.991789

RDNT MANTA 0.991690

STMX STORJ 0.991222

BIGTIME ACE 0.990987

RDNT HOOK 0.990718

IOST GAS 0.990643

ZIL HOOK 0.990576

MATIC FLOW 0.990564

MANTA HOOK 0.990563

The code is as follows:

corr_pairs = corr.unstack()

# 移除自身相关性(即对角线上的值)

corr_pairs = corr_pairs[corr_pairs != 1]

sorted_corr_pairs = corr_pairs.sort_values(kind="quicksort")

# 提取最相关和最不相关的前20个币种对

most_correlated = sorted_corr_pairs.tail(40)[::-2]

print("最相关的前20个币种对:")

print(most_correlated)

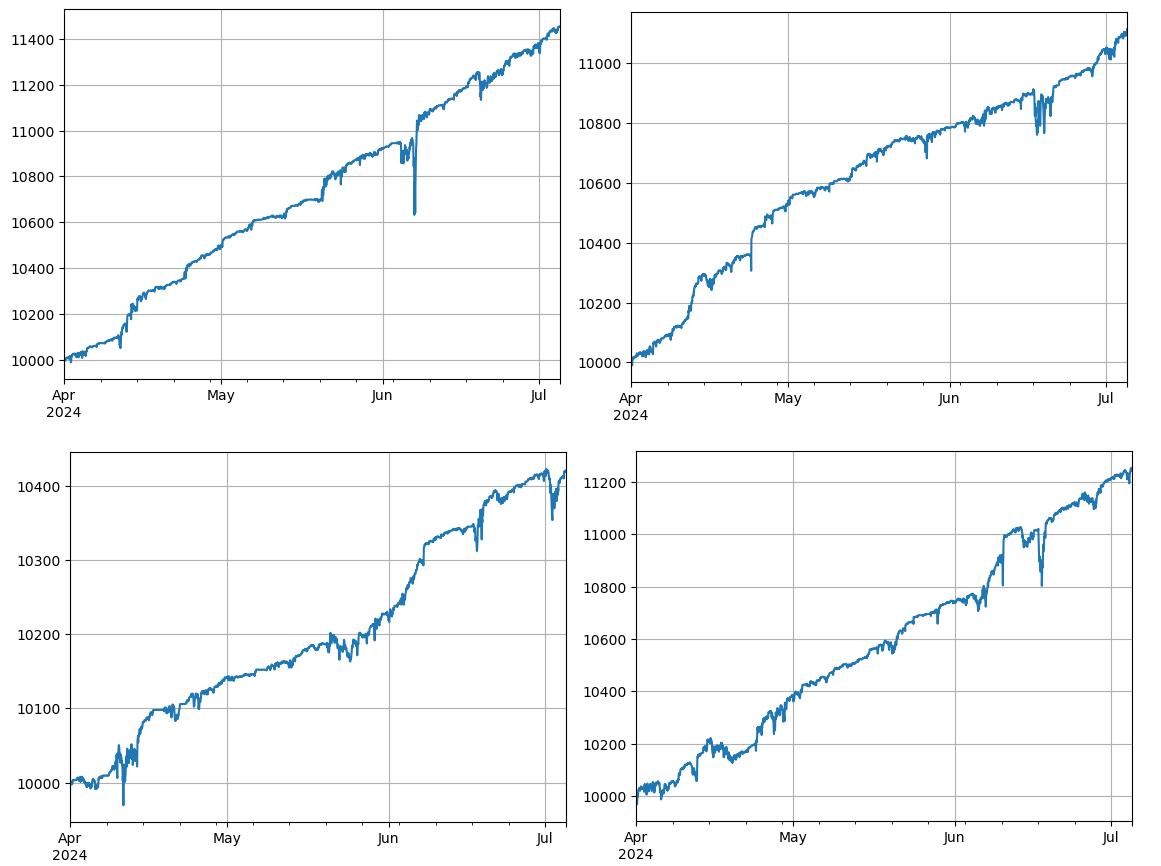

Re-test and verify

The specific feedback codes are as follows. The main observation of the demo strategy is the price ratio of the two cryptocurrencies (IOTA and ZIL) and the transaction is based on changes in this ratio. The specific steps are as follows:

Initialization:

- The definition of a transaction pair is as follows: pair_a =

IOTA , pair_b = ZIL . - Create an exchange object

eThe initial balance is $10,000 and the transaction fee is 0.02%. - Calculation of the initial average price ratio

avg。 - Set an initial transaction value

value = 1000。

- The definition of a transaction pair is as follows: pair_a =

Iterative processing of price data:

- Price data across all time points

df_close。 - Calculate the deviation of the current price ratio from the average

diff。 - Target transaction value calculated by deviation

aim_value, for each deviation of 0.01, a value is traded. The buy and sell operation is decided based on the current account holdings and price conditions. - If the deviation is too large, execute the sale.

pair_aand buypair_bThe operation. - If the deviation is too small, execute the purchase.

pair_aand sellpair_bThe operation.

- Price data across all time points

Adjusting the Average:

- Updated average price ratio

avgIn addition to the above, the price of the product is also subject to a number of restrictions.

- Updated average price ratio

Updating accounts and records:

- Updated information on holdings and balances of exchange accounts.

- Record the balance sheet status of each step (total assets, holdings, transaction fees, multi-head and empty-head positions) until

res_list。

The output:

- It will.

res_listConverted to dataframeresThis is the first time that the project has been shown to be effective.

- It will.

pair_a = 'IOTA'

pair_b = "ZIL"

e = Exchange([pair_a,pair_b], fee=0.0002, initial_balance=10000) #Exchange定义放在评论区

res_list = []

index_list = []

avg = df_close[pair_a][0] / df_close[pair_b][0]

value = 1000

for idx, row in df_close.iterrows():

diff = (row[pair_a] / row[pair_b] - avg)/avg

aim_value = -value * diff / 0.01

if -aim_value + e.account[pair_a]['amount']*row[pair_a] > 0.5*value:

e.Sell(pair_a,row[pair_a],(-aim_value + e.account[pair_a]['amount']*row[pair_a])/row[pair_a])

e.Buy(pair_b,row[pair_b],(-aim_value - e.account[pair_b]['amount']*row[pair_b])/row[pair_b])

if -aim_value + e.account[pair_a]['amount']*row[pair_a] < -0.5*value:

e.Buy(pair_a, row[pair_a],(aim_value - e.account[pair_a]['amount']*row[pair_a])/row[pair_a])

e.Sell(pair_b, row[pair_b],(aim_value + e.account[pair_b]['amount']*row[pair_b])/row[pair_b])

avg = 0.99*avg + 0.01*row[pair_a] / row[pair_b]

index_list.append(idx)

e.Update(row)

res_list.append([e.account['USDT']['total'],e.account['USDT']['hold'],

e.account['USDT']['fee'],e.account['USDT']['long'],e.account['USDT']['short']])

res = pd.DataFrame(data=res_list, columns=['total','hold', 'fee', 'long', 'short'],index = index_list)

res['total'].plot(grid=True);

A total of 4 groups of currencies were retested, with the result being relatively ideal. The calculation of the current correlation is based on future data, so it is not very accurate. This article also divides the data into two parts, based on the correlation of the previous calculation, the retest of the latter.

Potential risks and ways to improve

Although pairing trading strategies can be profitable in theory, there are some risks in practical operation: correlations between currencies may change over time, causing the strategy to fail; price deviations may intensify under extreme market conditions, leading to larger losses; some currencies have low liquidity, which may make transactions difficult to execute or increase costs; and the handling fees generated by frequent trading may erode profits.

In order to reduce risk and improve the stability of the strategy, the following improvements can be considered: regularly recalculate the correlation between currency pairs, timely adjustment of trading pairs; set stop-loss and stop-loss points, controlling the maximum loss of a single trade; simultaneously trade multiple currency pairs, spreading the risk.

Conclusions

The digital currency pairing trading strategy is profitable by exploiting the correlation between the price of a currency and using leverage when the price deviates. The strategy has a high theoretical feasibility. A simple real-world strategy source code based on the strategy will then be released. If you have any further questions or need further discussion, please feel free to contact us.

- DCA Trading: A Widely Used Quantitative Strategy

- DCA transactions: a widely used quantification strategy

- Exploring FMZ: Practice of Communication Protocol Between Live Trading Strategies

- Explore FMZ: Trading strategies and the practice of real-world communication protocols

- Exploring FMZ: New Application of Status Bar Buttons (Part 1)

- Explore FMZ: the newest application of the status button

- Introduction to the Source Code of Digital Currency Pair Trading Strategy and the Latest API of FMZ Platform

- Digital currency pairing trading strategy source code and the latest API of FMZ platform

- Detailed Explanation of Digital Currency Pair Trading Strategy

- FMZ Quant & OKX: How Do Ordinary People Master Quantitative Trading? The Answers Are All Here!

- Detailed Explanation of FMZ Quant API Upgrade: Improving the Strategy Design Experience

- Detailed Explanation of New Features of Strategy Interface Parameters and Interactive Controls

- FMZ Quantify & OKX: How can ordinary people play Quantify?

- Inventors quantify trading platform API upgrades: enhancing the strategic design experience

- Policy interface parameters and interactive controller additions

- Quantifying Fundamental Analysis in the Cryptocurrency Market: Let Data Speak for Itself!

- Quantified research on the basics of coin circles - stop believing in all kinds of crazy professors, data is objective!

- An Essential Tool in the Field of Quantitative Trading - FMZ Quant Data Exploration Module

- The inventor of the Quantitative Data Exploration Module, an essential tool in the field of quantitative trading.

- Mastering Everything - Introduction to FMZ New Version of Trading Terminal (with TRB Arbitrage Source Code)

77924998This is worth studying, what about the source code?

Beans 888Zhang is working overtime - ha! ha!