KENTNA channel upgraded version of the KENTNA kingkeltner strategy

Author: Inventors quantify - small dreams, Created: 2019-07-27 16:14:26, Updated: 2023-10-23 17:33:36[TOC]

How to get to Kintana

The Keltner channel is a trading system invented by Chester W. Keltner in the 1960s, with the central idea of linear equations. The system has achieved remarkable results over a very long period of time. Although the original Keltner channel system was not as effective when it first appeared, its core ideas have had a profound impact on the trading world to this day.

The principle of the Kenta Tunnel

When it comes to channel strategies, one might think of the famous Boll line, but the difference is that the Kenta line uses the average of the highest, lowest, and closing prices as a base price, and then calculates the N-cycle average of this base price, which is the mean of the Kenta line.

So, how does this amplitude of volatility be calculated? That is, the N-cycle average of the "highest price - lowest price", multiplied by a certain multiple. This way, you will find that it is similar to the Boll line, with a price trajectory and an upward trajectory calculated based on the price trajectory.

Calculation of the Cantonal Tunnel

- Base price: (highest price + lowest price + closing price) / 3

- Mid-track: N-cycle moving average of the underlying price

- The range of the fluctuation: highest price - lowest price

- On track: mid-track + amplitude of oscillation * multiples

- Lower track: mid-track - amplitude of oscillation * multiples

The upgraded version of King Kentner

Later, the Kettner channel was improved by Linda Raschke. Linda Raschke is a well-known American commodity futures trader and president of LBR Asset Management. The original Kettner trajectory was a straight line, changed to an index average. - Base price: ((highest price + lowest price + closing price) / 3 - Mid-track: N-cycle moving average of the underlying price - Variable amplitude: mean true amplitude (ATR) - On track: mid-track + amplitude of oscillation - Downstream: Midstream - The magnitude of the fluctuations

Kenta channel trading strategy

We know that prices don't always operate in a trend or turbulent way, but rather in a way that the trend and turbulence do not alternate completely randomly. So Kentner uses the channel as a dividing line to separate the trend and turbulent markets. When prices operate between up and down the track, we can think of it as a turbulent market.

The entrance- The middle rail is going up, and the price is going up, and more orders are going in. - The mid-range is down, and the price has dropped below the mid-range, opening a blank order;

The appearance- When holding multiple orders, the price drops below the mid-range, cheap multiple orders; - When holding empty orders, the price rises above the mid-range, flat empty orders;

Kim Kentner's strategy for my language

Using the above trading logic, we can build this strategy on the inventor's quantified trading platform. We use My language as an example, first of all, open: fmz.com > Login > Control Center > Policy Library > Create a new policy > Click on the drawer in the upper left corner to select My language and start writing the policy, note the notes in the code below.

// 参数

MAN:=20;

ATRN:=50;

JG:=(HIGH+LOW+CLOSE)/3; // 基础价格

ZG:MA(JG,MAN); // 中轨

TRUEHIGH1:=IF(HIGH>REF(C,1),HIGH,REF(C,1));

TRUELOW1:=IF(LOW<=REF(C,1),LOW,REF(C,1));

TRUERANGE1:=IF(ISLASTBAR,H-L,TRUEHIGH1-TRUELOW1); // 计算真实波动幅度

SG:ZG+MA(TRUERANGE1,ATRN); // 上轨

XG:ZG-MA(TRUERANGE1,ATRN); // 下轨

ZG>REF(ZG,1)&&C>SG,BK; // 中轨向上,并且价格升破上轨,开多单

C<ZG,SP; // 持有多单时,价格跌破中轨,平多单

ZG<REF(ZG,1)&&C<XG,SK; // 中轨向下,并且价格跌破下轨,开空单

C>ZG,BP; // 持有空单时,价格升破中轨,平空单

AUTOFILTER; // 设置信号过滤方式

King Kentner's strategy is reviewed

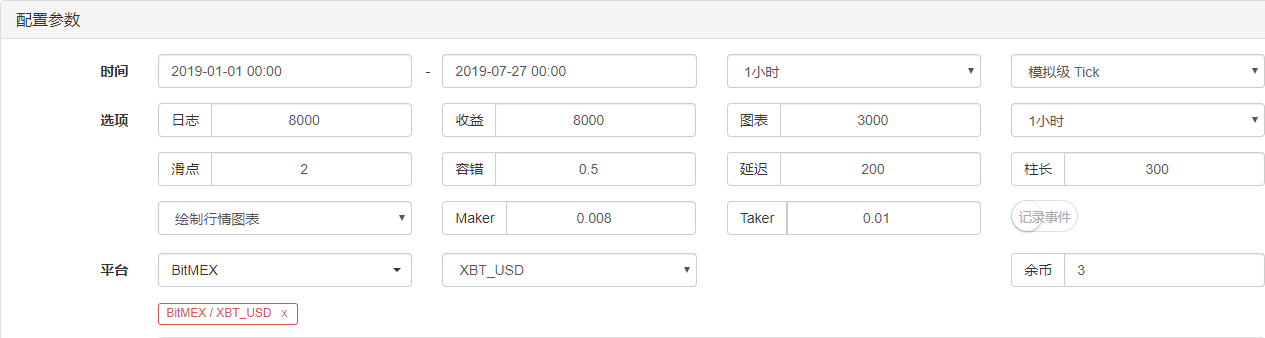

In order to get closer to the real trading environment, we used a stress test with 2 jumps in the open position and 2 times the transaction fees in the retest, testing the environment as follows:

- The exchange: BitMEX

- Trade varieties: XBTUSD

- Time: January 01, 2019 to July 27, 2019

- Cycle: One hour

- Slide point: 2 jumps to the open position

- Fee: Exchange doubled

Testing environment

Benefits are clear

Benefits are clear

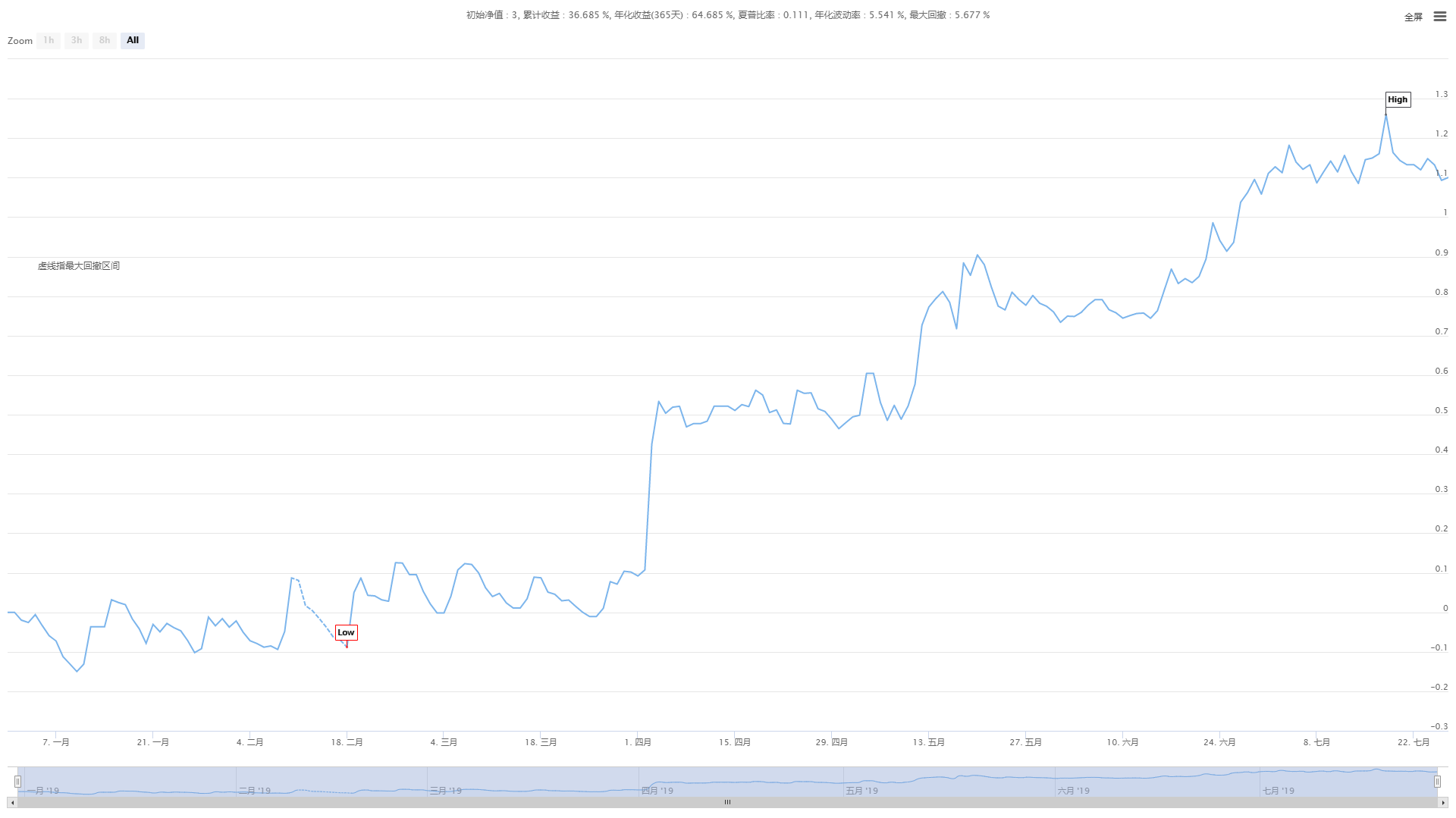

The funding curve

The funding curve

The above graphs are a retrospective of the XBTUSD perpetual contract on the BitMEX exchange, which has maintained its effectiveness in the trending market, although the efficiency is not too high, but overall the capital curve is up, even when the market trend retreated in July 2019, the net value curve did not retreat much.

The above graphs are a retrospective of the XBTUSD perpetual contract on the BitMEX exchange, which has maintained its effectiveness in the trending market, although the efficiency is not too high, but overall the capital curve is up, even when the market trend retreated in July 2019, the net value curve did not retreat much.

Policy source code

Click to copy the full policy source code

Summary

Although Kenta is an old trading method, we have restored and improved it with code, which proves that the strategy is still effective today. Especially in the medium and low frequency CTA strategy, Kenta still has something worth learning, which is to cut losses and let profits run!

It can be said that most of the successful trading methods are based on the idea of losing a little when you make a loss, making a little more money when you make a loss, and then constantly implementing this idea. So, as a long-term trading strategy, short-term losses are inevitable costs, short-term profits are not our goal.

- Quantitative Practice of DEX Exchanges (2) -- Hyperliquid User Guide

- DEX exchange quantitative practices ((2) -- Hyperliquid user guide

- Quantitative Practice of DEX Exchanges (1) -- dYdX v4 User Guide

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (3)

- DEX exchange quantitative practice ((1) -- dYdX v4 user guide

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Timeline data analysis with Tick data retrieval

- The experience of developing trading strategies

- Calculation and application of DMI indicators

- Detailed usage and practical skills of energy tide(OBV) indicator in quantitative trading

- The development of CTA strategies and the inventor quantification platform standard library

- The use of a combination strategy for the strength and weakness of the RSI versus the straight line

- Upgrade Edition of Keltner Channel trading Strategy

- Neural network and digital currency quantitative trading series ((2)) Deep reinforcement learning training Bitcoin trading strategies

- Implementation and application of the inventor quantified platform in the fall line trading strategy

- Visualizing modules to build trading strategies - out

- Quantitative trading strategies with a trade index weighting

- Introducing the Aroon indicator

- The relative strengths and weaknesses of price-based quantitative trading strategies

- Introducing the adaptive moving average KAMA

- Implementation of Dual Thrust trading algorithms using My language on the inventor's quantification platform

- Introduction to RangeBreak Strategy

- Trading strategy based on box theory

- Trading strategies based on box theory that support commodity futures and digital currencies

- Thermometer strategies in the practice and application of inventor quantization platforms

- The strategic framework for the indicators