Digital currency options strategy back to basics

Author: Inventors quantify - small dreams, Created: 2020-08-11 14:21:28, Updated: 2024-12-10 10:10:30

Digital currency options strategy back to basics

Recently the inventors of the quantitative trading platform upgraded the retesting system to support the retesting of digital currency options, this time supporting the retesting of digital currency options.DeribitSome options data on the exchange. So we have better tools for learning options trading, as well as strategy verification.

Deribit option reassessment

Defined in the retesting systemDeribitOptions are European in nature, with a contract value of 1 BTC.BTC-7AUG20-12750-C。

| Signature | Date of entry into force | The price of the power | (Ball and up) Options |

|---|---|---|---|

| BTC | 7AUG20 | 12750 | C |

| Bitcoin | Right of way August 7, 20 | The price of the ticket is 12750. | See also Options |

| BTC | 7AUG20 | 12750 | P |

| Bitcoin | Right of way August 7, 20 | The price of the ticket is 12750. | Options to decline |

In the same way as digital currency futures, it is also possible to set up contracts, acquire holdings, etc.

Set up a contract:exchange.SetContractType("BTC-7AUG20-12750-C")Acquiring a holding:var pos = exchange.GetPosition()

The price of an option contract is the amount of an option contract that the option buyer must pay to the option seller. The buyer obtains the option rights, the seller has the obligation rights. The option contract is tradable before the option rights (e.g. breakeven, closing obligation).

Common options trading portfolios

In addition to selling the options, the company is also selling the options for cash.

/*backtest

start: 2020-07-27 00:00:00

end: 2020-08-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Deribit","currency":"BTC_USD"},{"eid":"OKEX","currency":"BTC_USDT","balance":100000}]

*/

function main() {

exchanges[0].SetContractType('BTC-7AUG20-12750-C');

var initSpotAcc = _C(exchanges[1].GetAccount)

var isFirst = true

while(true) {

var optionTicker = exchanges[0].GetTicker()

var spotTicker = exchanges[1].GetTicker()

if(isFirst) {

exchanges[0].SetDirection("sell")

exchanges[0].Sell(optionTicker.Buy, 1)

exchanges[1].Buy(spotTicker.Sell, 1)

isFirst = false

}

var optionPos = _C(exchanges[0].GetPosition)

var nowSpotAcc = _C(exchanges[1].GetAccount)

var diffStocks = (nowSpotAcc.Stocks - initSpotAcc.Stocks)

var diffBalance = (nowSpotAcc.Balance - initSpotAcc.Balance)

var spotProfit = diffBalance + diffStocks * spotTicker.Last

var optionProfit = optionPos[0].Profit * spotTicker.Last

LogProfit(spotProfit + optionProfit)

$.PlotLine("现货", spotProfit)

$.PlotLine("期权", optionProfit)

Sleep(500)

}

}

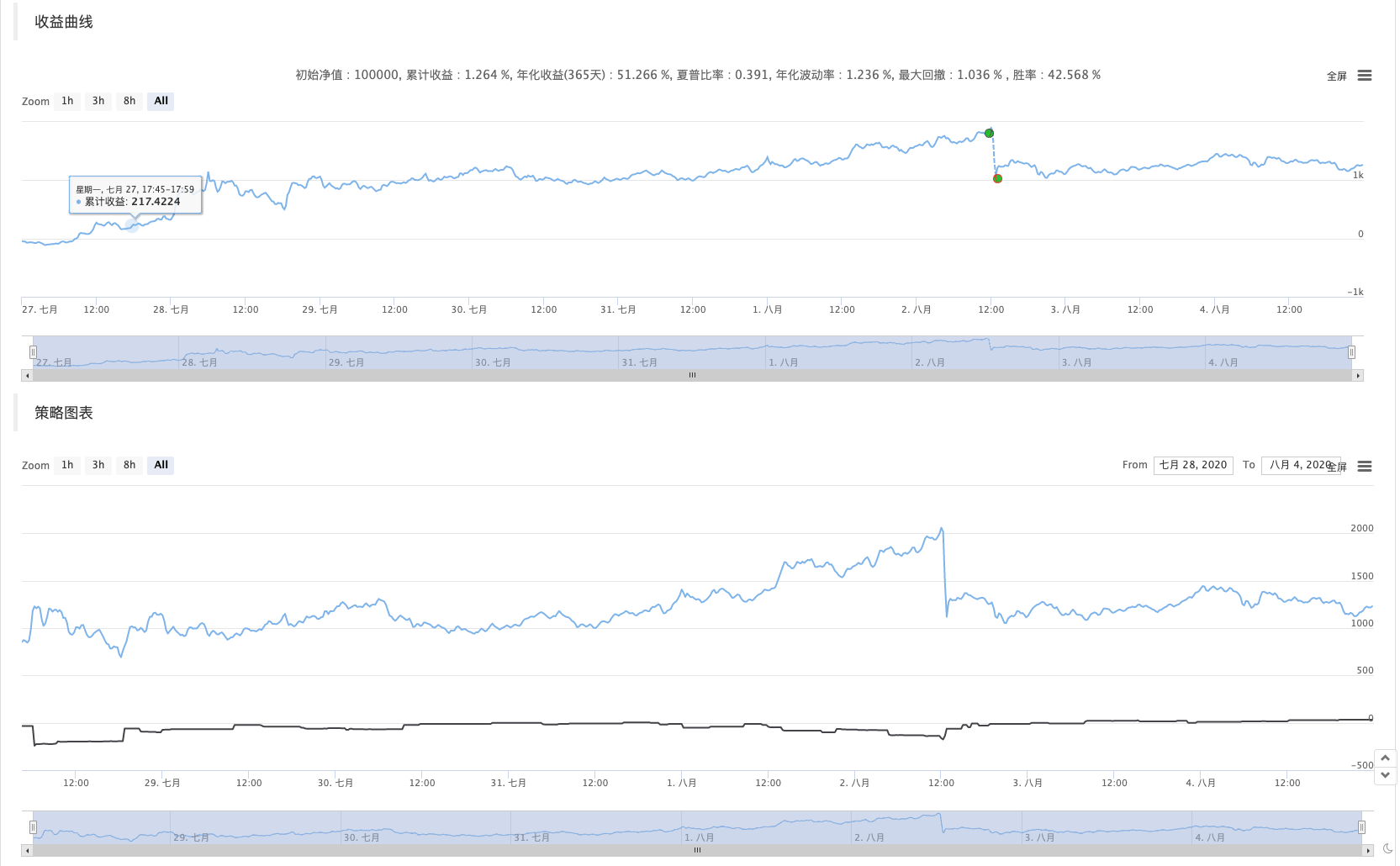

Options can provide a degree of hedging protection for purchased assets. They are generally used when the option is positive and the option is willing to be held. The risk is that the option price falls, and although the option can compensate for a certain amount of the loss in the spot market, the net loss occurs after the loss exceeds the amount of the option.

In addition, the liquidity of the digital currency options market in general, often sometimes does not find a counter; this is also a problem to consider.

Similarly, we can replace the spot to the futures, the code is as follows:

/*backtest

start: 2020-07-27 00:00:00

end: 2020-08-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Deribit","currency":"BTC_USD"},{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

*/

function main() {

exchanges[0].SetContractType('BTC-7AUG20-12750-C');

exchanges[1].SetContractType("quarter")

var isFirst = true

while(true) {

var optionTicker = exchanges[0].GetTicker()

var futuresTicker = exchanges[1].GetTicker()

if(isFirst) {

exchanges[0].SetDirection("sell")

exchanges[0].Sell(optionTicker.Buy, 1)

exchanges[1].SetDirection("buy")

exchanges[1].Buy(futuresTicker.Sell, _N(1 * futuresTicker.Sell / 100, 0))

isFirst = false

}

var optionPos = _C(exchanges[0].GetPosition)

var futuresPos = _C(exchanges[1].GetPosition)

var futuresProfit = futuresPos[0].Profit

var optionProfit = optionPos[0].Profit

LogProfit(futuresProfit + optionProfit)

$.PlotLine("期货", futuresProfit)

$.PlotLine("期权", optionProfit)

Sleep(500)

}

}

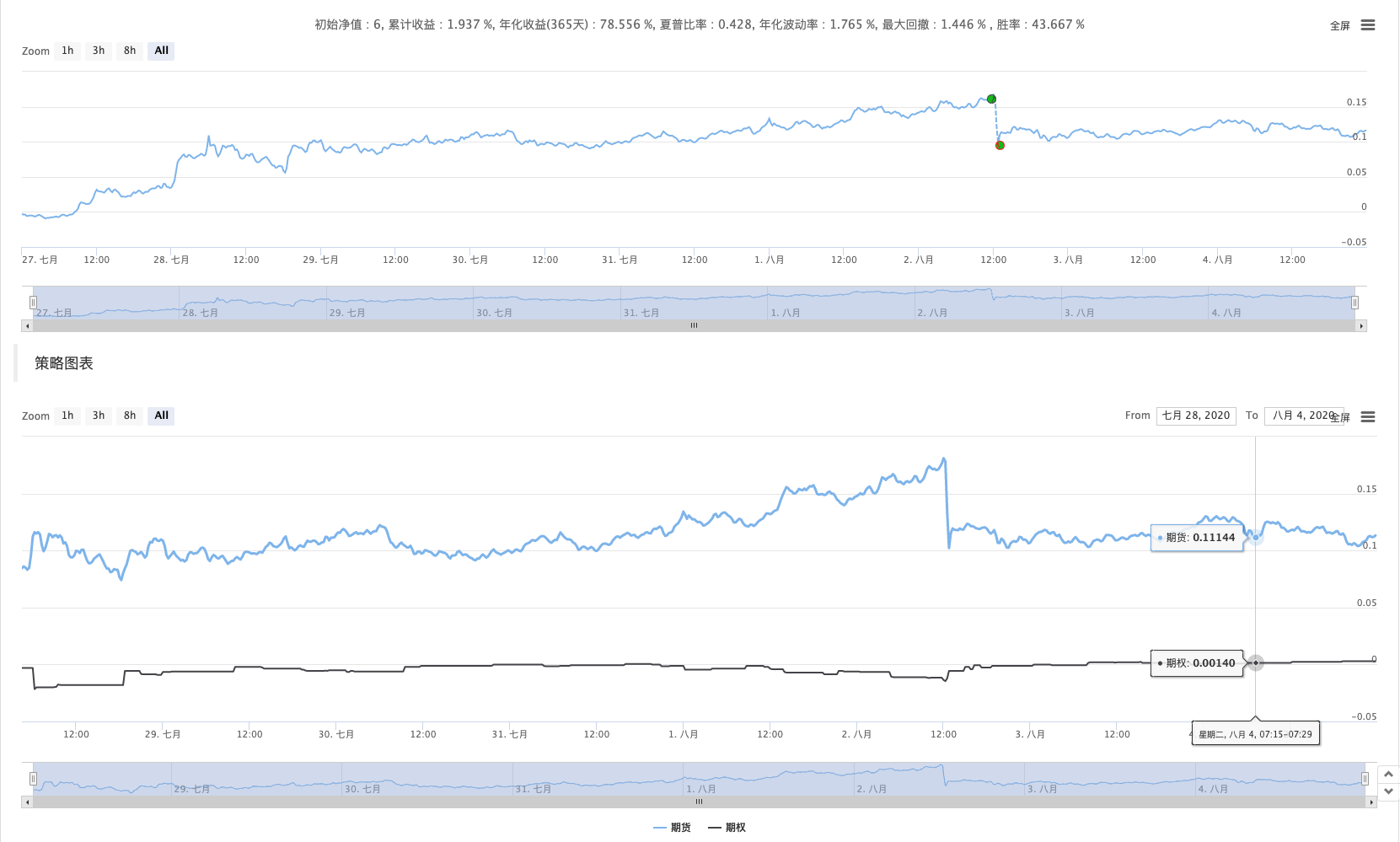

The results are as follows:

Futures can reduce the amount of money they hold compared to cash, but the risk is somewhat higher compared to cash.

In addition, there are many other options trading portfolios:

- Bull market bull call spread

- The bear market is falling, bear put spread

Interested can research it in a retesting system.

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Introduction to the Lead-Lag suite in digital currency (1)

- Discussion on External Signal Reception of FMZ Platform: Extended API VS Strategy Built-in HTTP Service

- External signal reception on FMZ platforms: extended API vs. built-in HTTP services

- Discussion on Strategy Testing Method Based on Random Ticker Generator

- Strategy testing methods based on random market generators explored

- New Feature of FMZ Quant: Use _Serve Function to Create HTTP Services Easily

- Balancing listing strategies with teaching strategies

- RSI2 Mean Reversion Strategy using in futures

- The futures and cryptocurrency API explanation

- Quickly implement a semi-automatic quantitative trading tool

- Introducing the Aroon indicator

- Preliminary Study on Backtesting of Digital Currency Options Strategy

- The Difference between Quantitative Trading and Subjective Trading

- ATR Channel strategy Implemented on crypto market

- Thermostat Strategy using on crypto market by MyLanguage

- hans123 intraday breakthrough strategy

- TradingViewWebHook alarm directly connected to FMZ robot

- Add an alarm clock to the trading strategy

- OKEX futures contract hedging strategy by using C++

- Trading strategy based on the active flow of funds

- Use trading terminal plug-in to facilitate manual trading

- Quantitative typing rate trading strategy

- Balance strategy and grid strategy

- Multi-robot market quotes sharing solution

- Robot WeChat message push implementation scheme

- Balancing strategy and grid strategy explained