Quantifying the coin circle is a new look -- it brings you closer to quantifying the coin circle.

Author: Inventors quantify - small dreams, Created: 2021-04-12 10:17:12, Updated: 2024-12-04 21:22:42

The coin circle quantification transaction is a new look and a new way to get closer to the coin circle quantification.

With the development of blockchain asset quantification, more and more blockchain asset traders are becoming aware of this tool. However, as a new member of this circle, you are confused about many concepts. You are confused by various names, software, information, etc. This article will take you to know, familiarise with common concepts, and learn from various angles about the various useful information in blockchain asset quantization transactions. This article first summarizes the basic concepts, and then corresponds to these basic concepts in the FMZ quantitative trading platform.

-

The Exchange

First of all, we need to understand the concept of exchanges, we need blockchain assets in the hands of traders to speculate, invest, etc. needs to be done on exchanges. Currently, all trades are many, mature, emerging, large and small.

-

Exchange accounts An exchange account is an account that is registered with the exchange. Blockchain assets can be stored in this account for trading. Some exchanges can also create, set up, and maintain accounts under the main account.Sub-accountsIt is convenient to trade assets separately, speculate. The application for the creation, mechanism, use, etc. of sub-accounts for each exchange varies, and you need to specifically consult this information on the exchange's website.

After logging in with an account on an exchange website, you can usually see where the blockchain assets can be stored in multiple tabs of tabs (this is a logical account, not an exchange account).Wallet accounts,Currency trading accounts,Financial accounting、Contractual trading accountsFor example, it is possible that each transaction will have all the differences. Usually, after pouring into blockchain assets (coins), it is under an account (may be in a wallet account, or directly to a coin trading account).

-

API interface for the exchange system Many students who haven't used this exchange feature may ask: What is an API? An API interface is an interface provided by an exchange system that allows the program to operate. Simply put, the exchange provides a pathway that allows ("real disk script") programs to place orders, withdrawals, checks, check account assets, check holdings, etc. in the exchange system. Exchange APIs are divided into several types of interfaces, usually with

RESTThe protocol interface is very simple.WebSocketProtocol Interface. Few exchanges also offer it.FIXThe protocol interface. These are just to understand, what we use the most?RESTThe interface of the protocol, which is usually documented at the bottom of the exchange's website.APIYou can find it in the literal links. Sometimes you can query some interface error reports or you need to look at the documentation. Each exchange's API system is different and differentiated, and you need to look at the documentation for specific problems. -

API KEY for the account The account API KEY is something you have to understand very well, because it is about the security of the blockchain assets that are stored in your exchange. So if you say that the API interface is a portal, then the API KEY is a portal.PassportsIt's dangerous because there is an access portal, which cannot be accessed by any program. Therefore, authentication is required, and the API KEY is used to verify identity. Therefore, the API KEY is about the security of your assets and must be properly stored. Usually, the API KEY of an exchange is created in the upper right corner of the exchange page, on the account management page ((there may also be an exchange elsewhere on the web page, click to find the link with the API keyword).); The API KEY is a two-string, the first string is usually called

access keyThe second string is usually calledsecret keyThe API KEY also has other information, such as the OKEX V5 and V3 interface.PassPhrase, is also a string ((string that needs to be set by you to enhance security verification)). The API KEY is usually set with the permission of the API KEY, which is usually set according to the purpose of the API KEY. In addition to the permission, the API KEY can also set an IP address whitelist, which will be denied access if you do not understand the concept of IP addresses. -

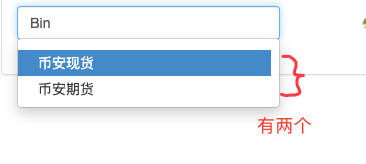

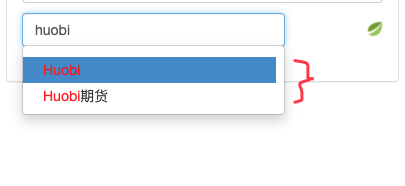

Exchange objects The concept of the exchange object was invented by the inventor of the quantitative trading platform (((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((((FMZ.COMThe concept of the exchange is based on the concept of the exchange interface. This object is called exchange in the FMZ policy code, which calls the exchange.GetTicker function, which actually calls the interface that accesses the exchange's transaction data. See the FMZ API documentation for more details:https://www.fmz.com/api#exchangeAn exchange may have a futures and spot market. Since the FMZ defines futures and spot market objects as different types of exchange objects, the distinction is made (for example, a futures exchange has several more functions than a spot exchange, such as setting leverage functions, querying holdings functions, etc.). So, for example, the Bitcoin exchange, you might see when you configure it on FMZ:

There are also two tokens.

There are also two tokens.

If the strategy is to operate on a futures exchange object, the futures are added, and if the spot is to be operated, the spot is added. The reason for this design is that the exchange may have a completely different interface to the futures spot, and even the interface base addresses are different, so they are packaged separately.

On the FMZ platform, an exchange is an exchange object that represents an exchange account.https://www.fmz.com/api#exchanges

-

-

Trading market

A trading market refers to a specific trading platform (a brain-filled trading page) that usually trades all of its multiple segments.Currency trading,Leveraged currency trading,Contract dealsAnd so on and so forth.

-

The deal What we normally call a snack bargain, in the simplest sense of the word, is something we buy and sell, like we go to the market to buy white beans.Cabbage is a type of cabbage.A transaction where the buyer pays for the white bean, the seller pays for the white bean.BTC_USDTIn this transaction, we're talking about the buy operation, which is paying USDT to get BTC. In theBTC_USDTFor example, we usually refer to BTC as a trading currency and USDT as a pricing currency.

- The exchange rate of the currency, BaseCurrency.

- In addition, the exchange rate is set by the exchange rate of the currency.

-

The cashCurrency trading,Leveraged currency trading, classified as spot transactions.The deal.It can describe which market it is trading on.

For example, if you want to trade pairs of BTC and USDT, use the FMZ quantitative trading platform. The transaction currency is BTC and the quote currency is USDT. We use the functions of the FMZ platform.exchange.SetCurrency("BTC_USDT")The exchange rate for the current trading pair is:BTC_USDTI'm not sure. For theSetCurrencyI'm not sure what you mean by that.https://www.fmz.com/api#exchange.setcurrency..I'm not sure. For theexchangeI'm not sure what you mean by that.https://www.fmz.com/api#exchange -

Contracts (including futures, options) The main difference between spot and spot trading is contract trading. Currently exchange contracts are divided into:

币本位合约、USDT本位合约For programmatic transactions, quantitative transactions not only determine the transaction pair, but also to determine the contract. For example, to do is the BTC currency, then there are many BTC currency contracts, there are quarterly contracts (expiring delivery every quarter), weekly contracts (expiring delivery every 5 weeks), permanent contracts (non-delivery), etc. Since we are describing which contract market to trade in, we need to describe what currency (trade pair) and what contract (contract code) is.-

Currency contracts The price of a currency pair is usually expressed in USD (not to be confused with most exchanges). So the trading pair is BTC_USD, and the contract is a quarterly contract.

BTC的币本位季度合约The marketplace. In addition, the FMZ Quantitative Trading Platform has a number of online trading platforms.exchange.SetCurrency("BTC_USD")Set up the transaction pairs, and thenexchange.SetContractType("quarter")This is the most common type of transaction.BTC的币本位季度合约I'm not sure. -

USDT local contract A contract with USDT as collateral (e.g. a USDT spot contract in BTC, with USDT as collateral, the gain is also USDT), the gain is also USDT. Usually, the currency of the USDT-based contract is USDT. So the trading pair is BTC_USDT, the contract is a perpetual contract.

BTC的USDT本位永续合约The marketplace. In addition, the FMZ Quantitative Trading Platform has a number of online trading platforms.exchange.SetCurrency("BTC_USDT")Set up the transaction pairs, and thenexchange.SetContractType("swap")This is the current type of transaction.BTC的USDT本位永续合约I'm not sure.

-

-

Orders What exactly is the order? Orders are the items that we submit to the exchange when we buy and sell on the exchange. Orders are divided into market list, limit price, list of conditions, etc. The most basic properties of an order are: the ordered item (simply what to buy and sell), the order quantity (how much to buy and sell), the order price (at what price to buy and sell). If the next order is no matter how much, only determine the number of buy and sell, determine what to buy and sell, then such an order is called (price.

-

Cash on hand The price list for orders on the spot market usually requires attention to the purchase, and the amount of the purchase order is not the number of coins but the amount. Since the price list does not determine the price, it can only be determined by the amount to be bought. The number of market orders is the number of coins, because even if the price is not determined, it is possible to determine how many coins are sold.

-

The Contract The number of contracts is usually the number of contracts, and the exchange's contract interface is basically the number of contracts, without the number of coins as the number of units. The USDT-based BTC perpetual contract can be ordered with a number of 0.01 BTC perpetual contract, but it is not the number of coins, but also the number of contracts, only one contract is just a BTC. Usually, the quantity of the order, regardless of the market price or the limit price, is the number of contracts.

-

What is a taker, maker order? Taker order is to provide liquidity order, in simple terms, the current order on the plate is buy price is 10, sell price is 11, this time I hang a buy buy order at 9 or sell sell order at 12, this time I give an order to the depth of the plate, my order is maker. Or this example, if I place a buy order at 11, this time my order will be settled with a sell order at 11 on the plate, this time I take an order from the plate, this time my buy order is the taker order.

For example, a sub-order function encapsulated in the inventor's quantitative trading platform.

exchange.Sell、exchange.BuyThe package is an ordinary price list, market price list interface. When ordering, the order is classified as a taker or a maker, specifically to look at the price of the order and the discount at the time, to see if our order provides liquidity or reduces liquidity. In the inventor's quantitative trading platform, the price is passed to 1, which is a take-list, note that the amount of the buy-in of the spot market order is the amount, then the market order is definitely a reduction in liquidity, it is definitely a taker order. -

Exchange terms and conditions Many exchanges also support conditional orders.

比如冰山委托、止损单,止盈单,post_only:只做maker单,fok:全部成交或立即取消,ioc:立即成交并取消剩余And so on and so forth. These orders can be used on the inventor's quantitative trading platform.exchange.IOThe function directly accesses the ordering interface of the exchange to specify the parameters to be set (specify the type of conditional order) to place the order.exchange.IOFunction usage can be found in the FMZ API documentation:https://www.fmz.com/api#exchange.io...

-

-

-

Quantitative trading platforms

A quantitative trading platform can be thought of as a quantitative trading tool, it can be an online software system, it can be a website, it can be a local executable, it can even be an open source project on GitHub.

-

FMZ is a quantitative trading platform Inventors Quantitative Trading Platform is an online distributed system, platform introductory, tutorials can refer to:https://www.fmz.com/bbs-topic/4145

-

Quantitative trading platforms with feedback systems What is a feedback system? Simply put, a retracement system is a system that allows historical data of a certain transaction variety to be replayed over and over again, and when it is replayed, a strategy is used to get the transaction performance of this strategy when the historical data is replayed simulated. So if a retracement system is just a sandbox environment (a sandbox that can create all kinds of things, but only models, and nothing to do with real things), then a retracement system cannot have any function of a real exchange.

The inventor of the QE feedback system:

Title Types Explained Bitfinex The object of the spot exchange Supports limited trading pairs such as: BTC_USD, ETH_USD, LTC_USD etc. Note that trading pairs are priced in USD Binance The object of the spot exchange Supports limited trading pairs such as: BTC_USDT, ETH_USDT, ETH_BTC, LTC_BTC etc. OKEX The object of the spot exchange Supports limited trading pairs such as: BTC_USDT, ETH_USDT, ETH_BTC, LTC_BTC etc. Coin The object of the spot exchange Supports limited trading pairs such as: BTC_USDT, ETH_USDT, ETH_BTC, LTC_BTC etc. OKEX futures Object of the futures exchange Supports limited trading pairs such as: BTC_USD, ETH_USD, etc. The trading pair is quoted in USD, after setting the specific contract code (see the exchange.SetContractType function), the contract is a currency spot contract. HuobiDM Object of the futures exchange HuobiDM is a token futures ("token contract") that supports limited trading pairs such as BTC_USD, ETH_USD, etc. The trading pair is quoted in USD, and after setting specific contract codes (see exchange.SetContractType function), the contract is a currency spot contract. BitMEX Object of the futures exchange The transaction pair is: XBT_USD, after setting the specific contract code (see the exchange.SetContractType function), the contract is a currency spot contract. Binance futures Object of the futures exchange Supports limited trading pairs such as: BTC_USDT, ETH_USDT, etc. Trading pairs priced as USDT, after setting specific contract codes (see exchange.SetContractType function), contracts as USDT local contracts The Deribit option The subject of the options exchange The transaction pair is: BTC_USD, ETH_USD, after setting the specific contract code (see exchange.SetContractType function), the contract is a currency spot contract. -

API KEY for the quantified trading platform All API interfaces are traded, and the same API interfaces are also used on quantitative trading platforms. For example, the FMZ quantitative trading platform is called FMZ.

扩展APISome of the features of the FMZ platform can be programmed. For example, batch creation of disks, batch start of disks, batch modification of disks configuration, etc.https://www.fmz.com/api#fmz平台扩展apiExtension APIs can also be used to do some fun things, like:Expanded API to enable TradingView alarm signal trading using inventor's quantified trading platform

-

-

Programmed transaction scripts

Speaking of which, what exactly is it about automated trading that controls my trading account? This is called programmatic trading. Quantitative trading is specifically embodied in the programmatic trading scripts. These real-time programs can be written in various languages, such as FMZ's quantitative trading platform, which supports writing real-time trading strategies in JavaScript, Python, and C++. These scripts perform various operations such as buying and selling on an account through the exchange's API interface.

-

Device on which the programmatic transaction script runs Virtual disk scripting programs must have a device carrier (simply put, a place where the virtual disk must be running). Quantitative trading in the coin circle usually involves deploying the virtual disk program to the Ali Cloud server in Hong Kong (of course, you can also use servers elsewhere, from other operators). Given that many exchanges currently require overseas network access, many exchanges running on domestic servers are not accessible.

timeoutI'm not sure. In FMZ, it is usually possible to deploy your own software program using the Ali Cloud server in Hong Kong (the inventor of the carrier software for the hard disk of the quantified trading platform is called the Quantified Transaction Tray, which runs on the basis of the Trader software).- Equipment systems A variety of operating systems, including Windows/Linux/MAX OS/ARM Linux, are selected based on the real disk script. In the FMZ quantification of servers, the use of the Linux system is not complicated, and simple use requires only a few commands, which are explained in the FMZ tutorial.

-

Choice of scripting language There are so many programming languages, you can basically use them to write real disk scripts. Here we will also learn about the advantages of various languages using the example of FMZ Quantified Trading Platform. In FMZ Quantified we can write strategies using the following programming languages (robot scripts).

-

JavaScript Simple to use, with little dependence on the device environment, supporting the ES6 standard. The speed of execution of the policy program is second only to the C++ policy.

-

Python Depending to a certain extent on the device environment, it is possible to install various libraries and is highly scalable.

-

C++ Strategy execution is the fastest, most efficient, and most difficult to use. Playing, other sensations

so easy!。 -

Mayan language FMZ supports the Mac language only as the most basic instruction.

- The Ma language can be used to write some trend strategies

- In Ma, trading signals are displayed, and trading instructions are executed only with orders, without support for hanging orders.

- Mac language is used for the strategy of making single exchange objects (which can only control one exchange object, although FMZ's Mac language supports embedded JS code, but is somewhat difficult to implement for Linux, which is not currently being studied)

- Mac language is only suitable for doing single-variety strategies, multi-variety strategies design is recommended or using JavaScript, Python, C++.

- FMZ uses the following resources in Malayalam:https://www.fmz.com/digest-topic/5789 https://www.fmz.com/digest-topic/5768

-

Visualize the spelling policy of modules The visualization method of creating strategies is only used to increase interest, to understand the program logic. It is not suitable for creating some simple logic, but the strategy is slightly more complex.

-

-

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Introduction to the Lead-Lag suite in digital currency (1)

- Discussion on External Signal Reception of FMZ Platform: Extended API VS Strategy Built-in HTTP Service

- External signal reception on FMZ platforms: extended API vs. built-in HTTP services

- Discussion on Strategy Testing Method Based on Random Ticker Generator

- Strategy testing methods based on random market generators explored

- New Feature of FMZ Quant: Use _Serve Function to Create HTTP Services Easily

- Inventor Quantitative Trading Platform main interface and architecture

- Digital currency futures class designed by Martin Strategy

- Quantifying the coin circle is a new look -- it brings you closer to quantifying the coin circle.

- Quantifying the coin circle is a new look -- it brings you closer to quantifying the coin circle.

- Quantifying the coin circle is a whole new thing - it brings you closer to quantifying the coin circle.

- Quantified transaction in the coin circle is a new look -- brings you closer to quantified coin circles.

- Quantifying the coin circle is a whole new thing - it brings you closer to quantifying the coin circle.

- How to specify different versions of the data to be rented by using the policy for the metadata of the taxi code

- Quantifying the coin circle is a new look -- it brings you closer to quantifying the coin circle.

- Quantifying the coin circle is a whole new thing - it brings you closer to quantifying the coin circle.

- Cryptocurrency contracts are easy for robots to follow

- Build inventor quantified databases with SQLite

- Deribit options Delta is a dynamic hedging strategy

- Build a multi-variety strategy with an aggregated market interface using a digital currency exchange

- Recently, FMZ's official pricing policy was introduced.

- High-frequency strategy design from the Magnetic Cabbage Harvester

- Implementation of a simple digital currency cash register robot

- Binance perpetual funds rate adjustment (currently bull market annualized 100%)

- How to analyze cabbage harvesters (2)

- The risk is controlled by adding to the damage... So, Gurdjan, what is the cost?

fangliangThis series is a good introduction.

lizhuliliI didn't have to spend half a month searching for information and groping for it myself.

wqyIt's easy to understand! Thank you for teaching!

singwealThank you for sharing!

singwealThank you for sharing!

wqyLooking forward to the sequel to the series.

Inventors quantify - small dreamsThank you for your support.