Quantifying the coin circle is a new look -- it brings you closer to quantifying the coin circle.

Author: Inventors quantify - small dreams, Created: 2021-06-18 18:24:23, Updated: 2024-12-04 21:16:56

Coin circle quantification trading new look and feel that brings you closer to coin circle quantification (8).

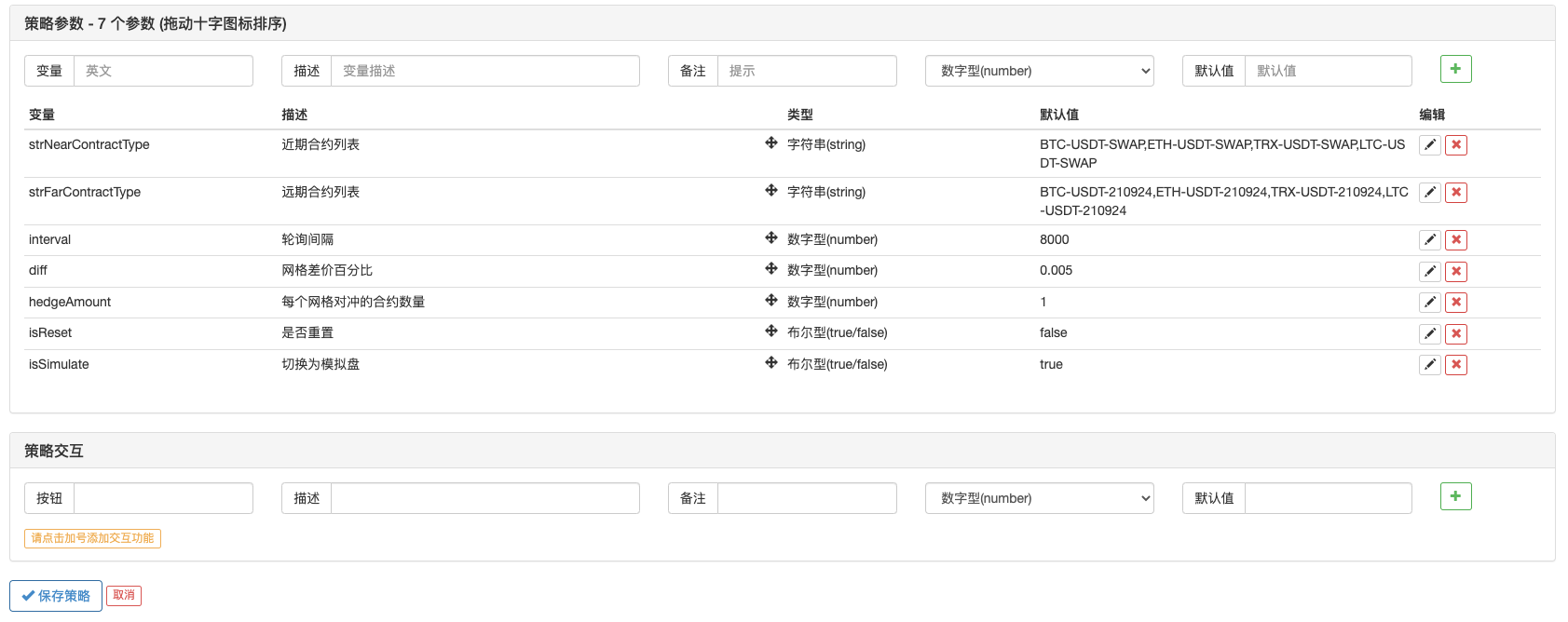

In the previous article, we designed a multi-variety contract difference monitoring strategy together, and in this article we continue to refine this idea. We will see if this idea is feasible, and we will test the strategy design with an OKEX V5 simulation.

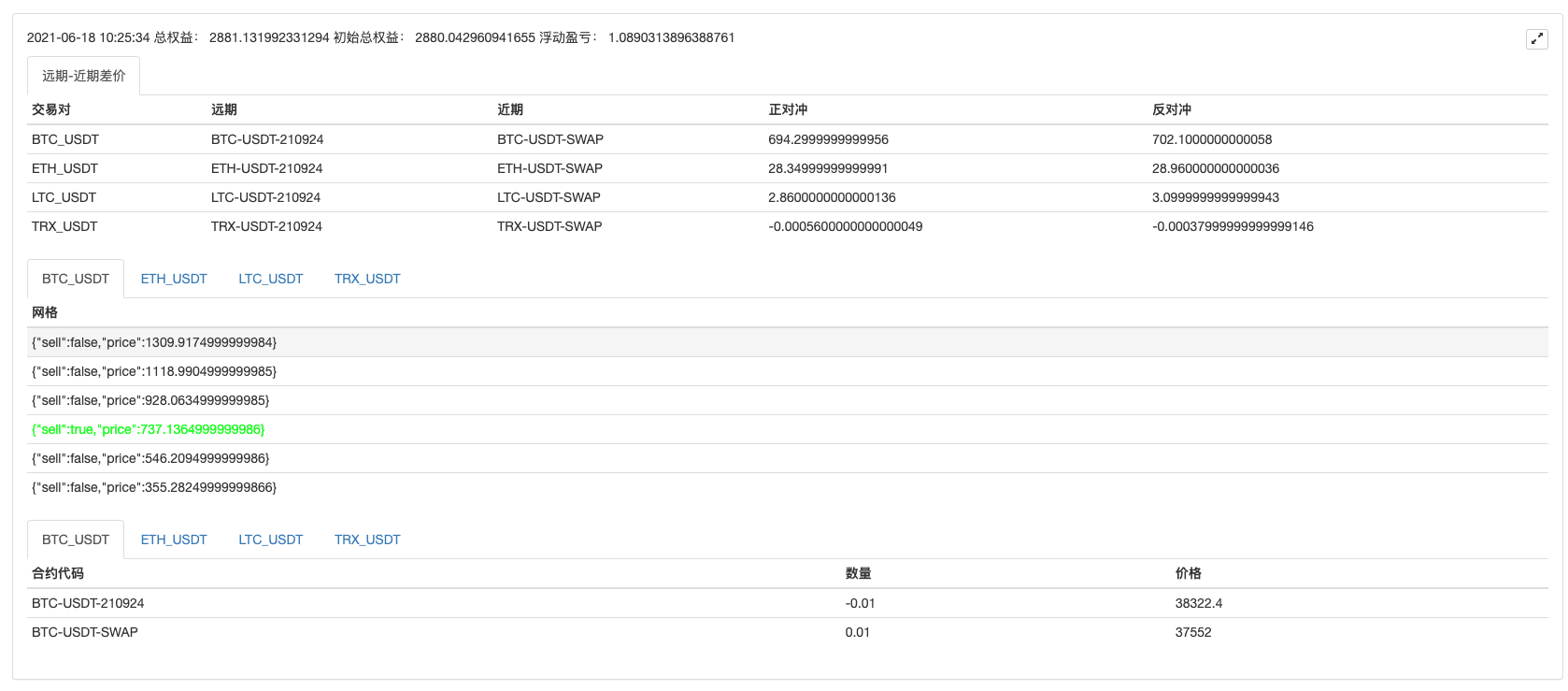

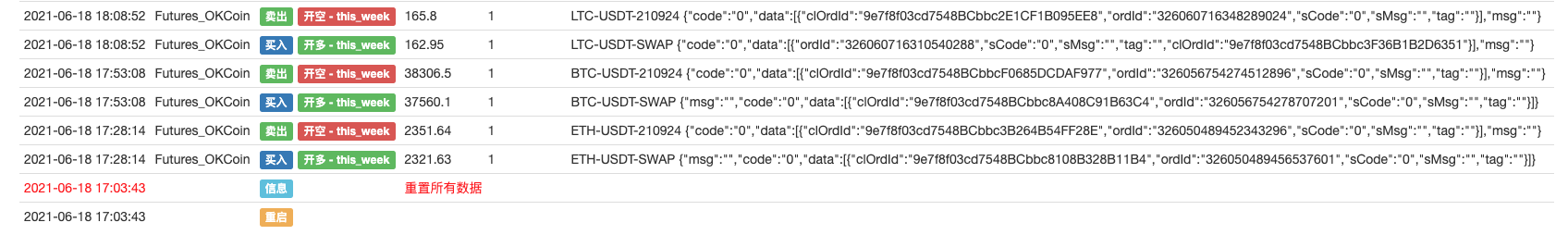

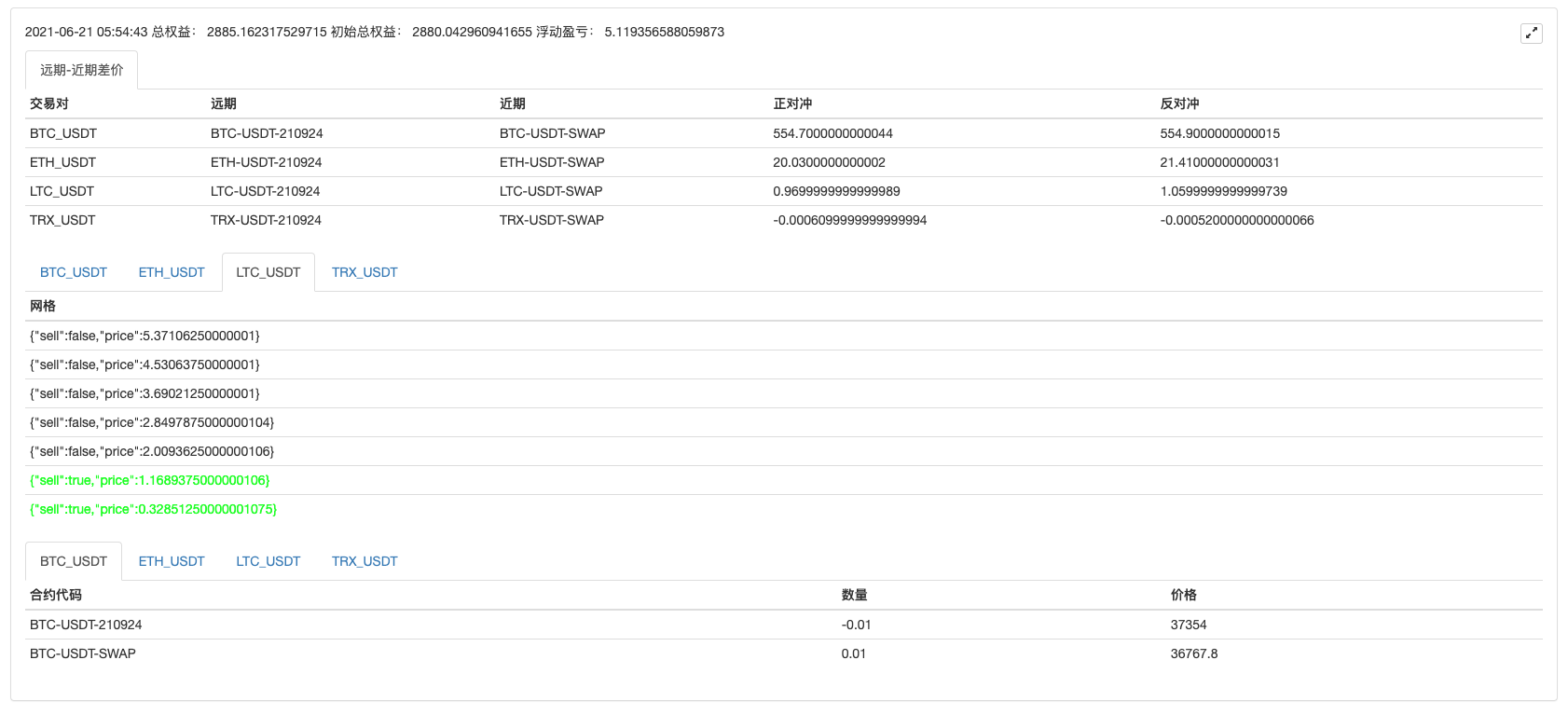

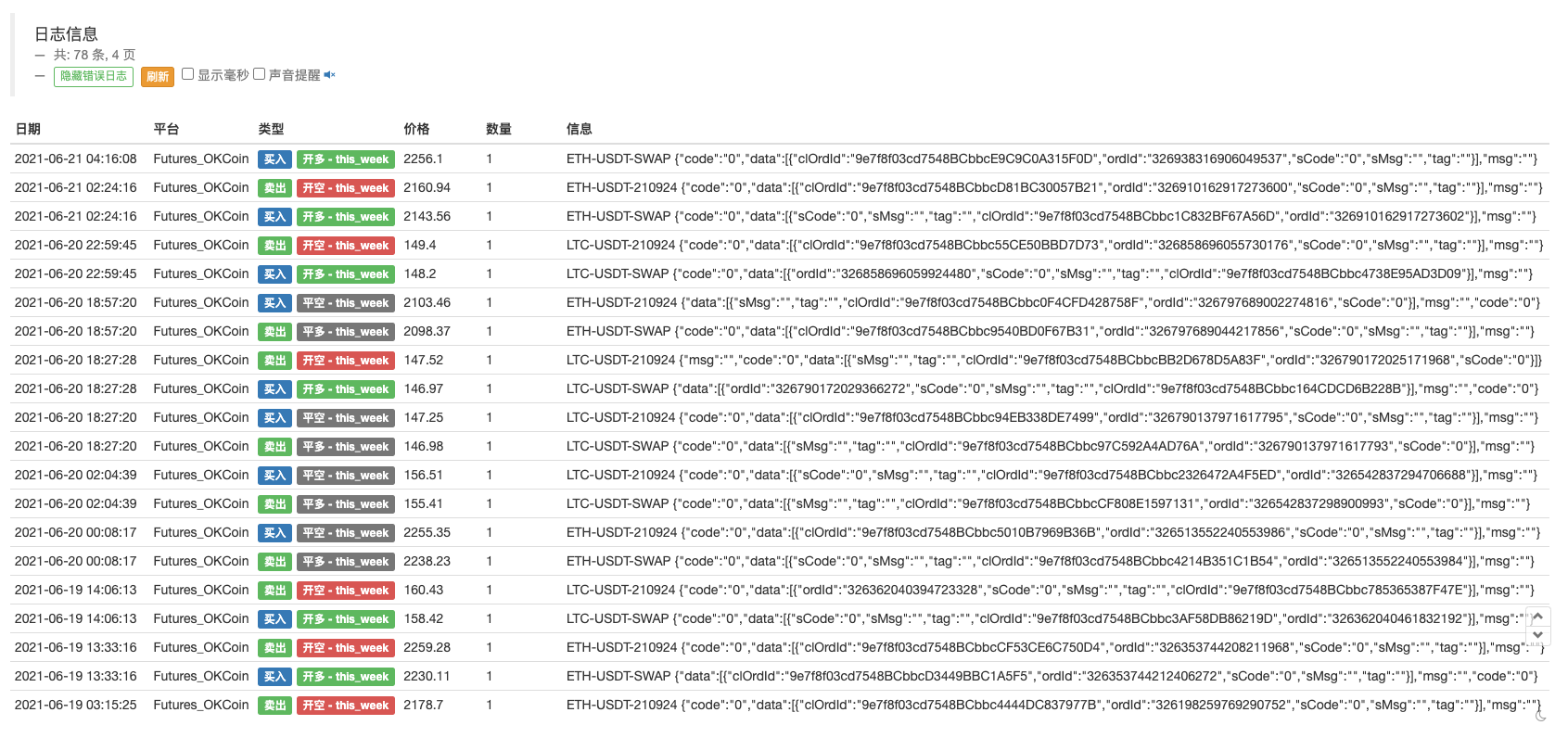

The first thing to do is to play through it, the tactics are running, a little excitement!

The overall strategy is designed to be implemented in the simplest way, although it is not too demanding for the processing of details, but it is still possible to learn some small tricks from the code. The overall strategy code is less than 400 lines, reading and understanding will not be very boring. Of course, this is only a test demo, it takes some time to run tests to see.

Back to the strategy design, based on the code in the previous post, the following is added to the strategy:

- Data persistence design (save data using the _G function, which can be restored after restart)

- Added grid data structure (used to control hedging) for each monitored contract difference pair

- Implement a simple hedging function to hedge open positions

- Added a total gain gain function to calculate floating profit and loss

- Added some status bar data output displays.

The above is the added functionality, in order to simplify the design, the strategy is only designed to be a positive hedge (empty long-term contract, more short-term contract); the current permanent contract (near term) is a negative rate, it is better to do more permanent contracts, to see if you can increase the point rate gain.

Let the strategy run for a while.

I've been testing it for about 3 days and the price fluctuation is okay.

Some of the gains can be seen in the interest rates.

Share the source code of the strategy below:

var arrNearContractType = strNearContractType.split(",")

var arrFarContractType = strFarContractType.split(",")

var nets = null

var initTotalEquity = null

var OPEN_PLUS = 1

var COVER_PLUS = 2

function createNet(begin, diff, initAvgPrice, diffUsagePercentage) {

if (diffUsagePercentage) {

diff = diff * initAvgPrice

}

var oneSideNums = 3

var up = []

var down = []

for (var i = 0 ; i < oneSideNums ; i++) {

var upObj = {

sell : false,

price : begin + diff / 2 + i * diff

}

up.push(upObj)

var j = (oneSideNums - 1) - i

var downObj = {

sell : false,

price : begin - diff / 2 - j * diff

}

if (downObj.price <= 0) { // 价格不能小于等于0

continue

}

down.push(downObj)

}

return down.concat(up)

}

function createCfg(symbol) {

var cfg = {

extension: {

layout: 'single',

height: 300,

col: 6

},

title: {

text: symbol

},

xAxis: {

type: 'datetime'

},

series: [{

name: 'plus',

data: []

}]

}

return cfg

}

function formatSymbol(originalSymbol) {

var arr = originalSymbol.split("-")

return [arr[0] + "_" + arr[1], arr[0], arr[1]]

}

function main() {

if (isSimulate) {

exchange.IO("simulate", true) // 切换为模拟环境

Log("仅支持OKEX V5 API,切换为OKEX V5 模拟盘:")

} else {

exchange.IO("simulate", false) // 切换为实盘

Log("仅支持OKEX V5 API,切换为OKEX V5 实盘:")

}

if (exchange.GetName() != "Futures_OKCoin") {

throw "支持OKEX期货"

}

// 初始化

if (isReset) {

_G(null)

LogReset(1)

LogProfitReset()

LogVacuum()

Log("重置所有数据", "#FF0000")

}

// 初始化标记

var isFirst = true

// 收益打印周期

var preProfitPrintTS = 0

// 总权益

var totalEquity = 0

var posTbls = [] // 持仓表格数组

// 声明arrCfg

var arrCfg = []

_.each(arrNearContractType, function(ct) {

arrCfg.push(createCfg(formatSymbol(ct)[0]))

})

var objCharts = Chart(arrCfg)

objCharts.reset()

// 创建对象

var exName = exchange.GetName() + "_V5"

var nearConfigureFunc = $.getConfigureFunc()[exName]

var farConfigureFunc = $.getConfigureFunc()[exName]

var nearEx = $.createBaseEx(exchange, nearConfigureFunc)

var farEx = $.createBaseEx(exchange, farConfigureFunc)

// 预先写入需要订阅的合约

_.each(arrNearContractType, function(ct) {

nearEx.pushSubscribeSymbol(ct)

})

_.each(arrFarContractType, function(ct) {

farEx.pushSubscribeSymbol(ct)

})

while (true) {

var ts = new Date().getTime()

// 获取行情数据

nearEx.goGetTickers()

farEx.goGetTickers()

var nearTickers = nearEx.getTickers()

var farTickers = farEx.getTickers()

if (!farTickers || !nearTickers) {

Sleep(2000)

continue

}

var tbl = {

type : "table",

title : "远期-近期差价",

cols : ["交易对", "远期", "近期", "正对冲", "反对冲"],

rows : []

}

var subscribeFarTickers = []

var subscribeNearTickers = []

_.each(farTickers, function(farTicker) {

_.each(arrFarContractType, function(symbol) {

if (farTicker.originalSymbol == symbol) {

subscribeFarTickers.push(farTicker)

}

})

})

_.each(nearTickers, function(nearTicker) {

_.each(arrNearContractType, function(symbol) {

if (nearTicker.originalSymbol == symbol) {

subscribeNearTickers.push(nearTicker)

}

})

})

var pairs = []

_.each(subscribeFarTickers, function(farTicker) {

_.each(subscribeNearTickers, function(nearTicker) {

if (farTicker.symbol == nearTicker.symbol) {

var pair = {symbol: nearTicker.symbol, nearTicker: nearTicker, farTicker: farTicker, plusDiff: farTicker.bid1 - nearTicker.ask1, minusDiff: farTicker.ask1 - nearTicker.bid1}

pairs.push(pair)

tbl.rows.push([pair.symbol, farTicker.originalSymbol, nearTicker.originalSymbol, pair.plusDiff, pair.minusDiff])

for (var i = 0 ; i < arrCfg.length ; i++) {

if (arrCfg[i].title.text == pair.symbol) {

objCharts.add([i, [ts, pair.plusDiff]])

}

}

}

})

})

// 初始化

if (isFirst) {

isFirst = false

var recoveryNets = _G("nets")

var recoveryInitTotalEquity = _G("initTotalEquity")

if (!recoveryNets) {

// 检查持仓

_.each(subscribeFarTickers, function(farTicker) {

var pos = farEx.getFuPos(farTicker.originalSymbol, ts)

if (pos.length != 0) {

Log(farTicker.originalSymbol, pos)

throw "初始化时有持仓"

}

})

_.each(subscribeNearTickers, function(nearTicker) {

var pos = nearEx.getFuPos(nearTicker.originalSymbol, ts)

if (pos.length != 0) {

Log(nearTicker.originalSymbol, pos)

throw "初始化时有持仓"

}

})

// 构造nets

nets = []

_.each(pairs, function (pair) {

farEx.goGetAcc(pair.farTicker.originalSymbol, ts)

nearEx.goGetAcc(pair.nearTicker.originalSymbol, ts)

var obj = {

"symbol" : pair.symbol,

"farSymbol" : pair.farTicker.originalSymbol,

"nearSymbol" : pair.nearTicker.originalSymbol,

"initPrice" : (pair.nearTicker.ask1 + pair.farTicker.bid1) / 2,

"prePlus" : pair.farTicker.bid1 - pair.nearTicker.ask1,

"net" : createNet((pair.farTicker.bid1 - pair.nearTicker.ask1), diff, (pair.nearTicker.ask1 + pair.farTicker.bid1) / 2, true),

"initFarAcc" : farEx.getAcc(pair.farTicker.originalSymbol, ts),

"initNearAcc" : nearEx.getAcc(pair.nearTicker.originalSymbol, ts),

"farTicker" : pair.farTicker,

"nearTicker" : pair.nearTicker,

"farPos" : null,

"nearPos" : null,

}

nets.push(obj)

})

var currTotalEquity = getTotalEquity()

if (currTotalEquity) {

initTotalEquity = currTotalEquity

} else {

throw "初始化获取总权益失败!"

}

} else {

// 恢复

nets = recoveryNets

initTotalEquity = recoveryInitTotalEquity

}

}

// 检索网格,检查是否触发交易

_.each(nets, function(obj) {

var currPlus = null

_.each(pairs, function(pair) {

if (pair.symbol == obj.symbol) {

currPlus = pair.plusDiff

obj.farTicker = pair.farTicker

obj.nearTicker = pair.nearTicker

}

})

if (!currPlus) {

Log("没有查询到", obj.symbol, "的差价")

return

}

// 检查网格,动态添加

while (currPlus >= obj.net[obj.net.length - 1].price) {

obj.net.push({

sell : false,

price : obj.net[obj.net.length - 1].price + diff * obj.initPrice,

})

}

while (currPlus <= obj.net[0].price) {

var price = obj.net[0].price - diff * obj.initPrice

if (price <= 0) {

break

}

obj.net.unshift({

sell : false,

price : price,

})

}

// 检索网格

for (var i = 0 ; i < obj.net.length - 1 ; i++) {

var p = obj.net[i]

var upP = obj.net[i + 1]

if (obj.prePlus <= p.price && currPlus > p.price && !p.sell) {

if (hedge(nearEx, farEx, obj.nearSymbol, obj.farSymbol, obj.nearTicker, obj.farTicker, hedgeAmount, OPEN_PLUS)) { // 正对冲开仓

p.sell = true

}

} else if (obj.prePlus >= p.price && currPlus < p.price && upP.sell) {

if (hedge(nearEx, farEx, obj.nearSymbol, obj.farSymbol, obj.nearTicker, obj.farTicker, hedgeAmount, COVER_PLUS)) { // 正对冲平仓

upP.sell = false

}

}

}

obj.prePlus = currPlus // 记录本次差价,作为缓存,下次用于判断上穿下穿

// 增加其它表格输出

})

if (ts - preProfitPrintTS > 1000 * 60 * 5) { // 5分钟打印一次

var currTotalEquity = getTotalEquity()

if (currTotalEquity) {

totalEquity = currTotalEquity

LogProfit(totalEquity - initTotalEquity, "&") // 打印动态权益收益

}

// 检查持仓

posTbls = [] // 重置,更新

_.each(nets, function(obj) {

var currFarPos = farEx.getFuPos(obj.farSymbol)

var currNearPos = nearEx.getFuPos(obj.nearSymbol)

if (currFarPos && currNearPos) {

obj.farPos = currFarPos

obj.nearPos = currNearPos

}

var posTbl = {

"type" : "table",

"title" : obj.symbol,

"cols" : ["合约代码", "数量", "价格"],

"rows" : []

}

_.each(obj.farPos, function(pos) {

posTbl.rows.push([pos.symbol, pos.amount, pos.price])

})

_.each(obj.nearPos, function(pos) {

posTbl.rows.push([pos.symbol, pos.amount, pos.price])

})

posTbls.push(posTbl)

})

preProfitPrintTS = ts

}

// 显示网格

var netTbls = []

_.each(nets, function(obj) {

var netTbl = {

"type" : "table",

"title" : obj.symbol,

"cols" : ["网格"],

"rows" : []

}

_.each(obj.net, function(p) {

var color = ""

if (p.sell) {

color = "#00FF00"

}

netTbl.rows.push([JSON.stringify(p) + color])

})

netTbl.rows.reverse()

netTbls.push(netTbl)

})

LogStatus(_D(), "总权益:", totalEquity, "初始总权益:", initTotalEquity, " 浮动盈亏:", totalEquity - initTotalEquity,

"\n`" + JSON.stringify(tbl) + "`" + "\n`" + JSON.stringify(netTbls) + "`" + "\n`" + JSON.stringify(posTbls) + "`")

Sleep(interval)

}

}

function getTotalEquity() {

var totalEquity = null

var ret = exchange.IO("api", "GET", "/api/v5/account/balance", "ccy=USDT")

if (ret) {

try {

totalEquity = parseFloat(ret.data[0].details[0].eq)

} catch(e) {

Log("获取账户总权益失败!")

return null

}

}

return totalEquity

}

function hedge(nearEx, farEx, nearSymbol, farSymbol, nearTicker, farTicker, amount, tradeType) {

var farDirection = null

var nearDirection = null

if (tradeType == OPEN_PLUS) {

farDirection = farEx.OPEN_SHORT

nearDirection = nearEx.OPEN_LONG

} else {

farDirection = farEx.COVER_SHORT

nearDirection = nearEx.COVER_LONG

}

var nearSymbolInfo = nearEx.getSymbolInfo(nearSymbol)

var farSymbolInfo = farEx.getSymbolInfo(farSymbol)

nearAmount = nearEx.calcAmount(nearSymbol, nearDirection, nearTicker.ask1, amount * nearSymbolInfo.multiplier)

farAmount = farEx.calcAmount(farSymbol, farDirection, farTicker.bid1, amount * farSymbolInfo.multiplier)

if (!nearAmount || !farAmount) {

Log(nearSymbol, farSymbol, "下单量计算错误:", nearAmount, farAmount)

return

}

nearEx.goGetTrade(nearSymbol, nearDirection, nearTicker.ask1, nearAmount[0])

farEx.goGetTrade(farSymbol, farDirection, farTicker.bid1, farAmount[0])

var nearIdMsg = nearEx.getTrade()

var farIdMsg = farEx.getTrade()

return [nearIdMsg, farIdMsg]

}

function onexit() {

Log("执行扫尾函数", "#FF0000")

_G("nets", nets)

_G("initTotalEquity", initTotalEquity)

Log("保存数据:", _G("nets"), _G("initTotalEquity"))

}

The policy's public address:https://www.fmz.com/strategy/288559

The policy uses a template class library that I wrote myself, and since the written tab is not public, the above policy source code can be modified without using this template.

If you are interested, you can attach an OKEX V5 analog test disc. Oh! That's right, this tactic cannot be retested.

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Introduction to the Lead-Lag suite in digital currency (1)

- Discussion on External Signal Reception of FMZ Platform: Extended API VS Strategy Built-in HTTP Service

- External signal reception on FMZ platforms: extended API vs. built-in HTTP services

- Discussion on Strategy Testing Method Based on Random Ticker Generator

- Strategy testing methods based on random market generators explored

- New Feature of FMZ Quant: Use _Serve Function to Create HTTP Services Easily

- Inventors quantify trading platforms with quick access app

- The exchange rate of the currency's futures contract is the return of the interest rate analysis

- Inventors General Agreement for example

- How to hedge digital currencies manually

- Research platform for advanced Python for data analysis and strategic retrieval

- My language policy pushes real-time position changes to mobile apps and WeChat

- Design of a cash hedging strategy for digital currency (2)

- Design of a cash hedging strategy for digital currency (1)

- Inventor Quantitative Trading Platform main interface and architecture

- Digital currency futures class designed by Martin Strategy

- Quantifying the coin circle is a new look -- it brings you closer to quantifying the coin circle.

- Quantifying the coin circle is a whole new thing - it brings you closer to quantifying the coin circle.

- Quantified transaction in the coin circle is a new look -- brings you closer to quantified coin circles.

- Quantifying the coin circle is a whole new thing - it brings you closer to quantifying the coin circle.

- How to specify different versions of the data to be rented by using the policy for the metadata of the taxi code

- Quantifying the coin circle is a new look -- it brings you closer to quantifying the coin circle.

- Quantifying the coin circle is a whole new thing - it brings you closer to quantifying the coin circle.

- Quantifying the coin circle is a new look -- it brings you closer to quantifying the coin circle.

- Cryptocurrency contracts are easy for robots to follow

- Build inventor quantified databases with SQLite

N95In two years' time, the strategy of setting up different trading pairs, different number of openings, and how to do it, the strategy of setting up different trading pairs, the strategy of setting up different number of openings, the strategy of setting up different trading pairs, the strategy of setting up different number of openings.

chaoI've changed it to Binance, but I don't know how to do it, so I haven't changed it successfully.

The trajectory of lifeHow can I run on an ok analog disk. I can't seem to use that plugin.

Inventors quantify - small dreamsWhat's up? // Declared by arrCfg var arrCfg = [] This is a list of all the different ways var can be used. _.each ((arrNearContractType, function ((ct)) { ArrCfg.push ((createCfg))) format Symbol ((ct) [0])) It's not. What's up? Do the same with the hedgeAmount parameter, and design the parameter as a string similar to: 100, 200, 330; this way 100 corresponds to the first hedge combination, and then you can use it specifically.

Inventors quantify - small dreamsThe sublist can be wrapped by itself, using a template library in the example, which is not public.

Inventors quantify - small dreamsWhat plugins?