Digital currency cash multi-variety two-way strategy (teaching)

Author: Inventors quantify - small dreams, Created: 2021-12-06 17:53:51, Updated: 2023-09-15 20:56:36

Digital currency cash multi-variety two-way strategy (teaching)

According to the requirements of the community users, it is hoped that there will be a variety of bi-directional strategies as a design reference. Then this period will be a multi-directional bi-directional strategy. The annotations will be written in the strategy code to make the strategy easier to understand, easy to learn.

Strategic thought

The logic of the two-square strategy is simple, i.e. two squares; one with a small parameter cycle (fast line) and one with a large parameter cycle (slow line). Two lines occur when a gold fork (fast line crosses the slow line from the bottom) buys more, and two lines occur when a dead fork (fast line crosses the slow line from the top down) sells out.

However, if the strategy is to be designed for multiple varieties, then the parameters of each variety may be different (different varieties use different equilateral parameters), so one needs to design the parameters in a way that the array of parameters is complex.

Parameters are designed in the form of strings, each with a comma interval. The strings are parsed when the policy starts running. The execution logic matched to each variety (transaction pair). The policy query detects the behavior of each variety, triggers the conditions of the transaction, prints the chart, etc. After all the varieties have been queried, the data is aggregated and the table information is displayed on the status bar.

The strategy is designed to be simple and easy to learn, with only 200+ lines of code in total.

The Strategy Code

// 函数作用:取消当前交易对的所有挂单

function cancelAll(e) {

while (true) {

var orders = _C(e.GetOrders)

if (orders.length == 0) {

break

} else {

for (var i = 0 ; i < orders.length ; i++) {

e.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

Sleep(500)

}

}

// 函数作用:计算实时收益盈亏

function getProfit(account, initAccount, lastPrices) {

// account为当前账户信息,initAccount为初始账户信息,lastPrices为当前所有品种的最新价格

var sum = 0

_.each(account, function(val, key) {

// 遍历当前所有资产,计算除了USDT以外的资产币差,以及金额差

if (key != "USDT" && typeof(initAccount[key]) == "number" && lastPrices[key + "_USDT"]) {

sum += (account[key] - initAccount[key]) * lastPrices[key + "_USDT"]

}

})

// 返回根据当前价格计算得出的资产盈亏

return account["USDT"] - initAccount["USDT"] + sum

}

// 函数作用:生成图表配置

function createChartConfig(symbol, ema1Period, ema2Period) {

// symbol为交易对,ema1Period为第一根EMA均线周期,ema2Period为第二根EMA均线周期

var chart = {

__isStock: true,

extension: {

layout: 'single',

height: 600,

},

title : { text : symbol},

xAxis: { type: 'datetime'},

series : [

{

type: 'candlestick', // K线数据系列

name: symbol,

id: symbol,

data: []

}, {

type: 'line', // EMA数据系列

name: symbol + ',EMA1:' + ema1Period,

data: [],

}, {

type: 'line', // EMA数据系列

name: symbol + ',EMA2:' + ema2Period,

data: []

}

]

}

return chart

}

function main() {

// 重置所有数据

if (isReset) {

_G(null) // 清空所有持久化记录的数据

LogReset(1) // 清空所有日志

LogProfitReset() // 清空所有收益日志

LogVacuum() // 释放实盘数据库占用的资源

Log("重置所有数据", "#FF0000") // 打印信息

}

// 解析参数

var arrSymbols = symbols.split(",") // 逗号分割交易品种字符串

var arrEma1Periods = ema1Periods.split(",") // 分割第一根EMA均线的参数字符串

var arrEma2Periods = ema2Periods.split(",") // 分割第二根EMA均线的参数字符串

var arrAmounts = orderAmounts.split(",") // 分割每个品种的下单量

var account = {} // 用于记录当前资产信息的变量

var initAccount = {} // 用于记录最初资产信息的变量

var currTradeMsg = {} // 用于记录当前BAR是否交易的变量

var lastPrices = {} // 用于记录监控的品种最新价格的变量

var lastBarTime = {} // 用于记录最近一根BAR的时间的变量,用于画图时BAR的更新判断

var arrChartConfig = [] // 用于记录图表配置信息,用于画图

if (_G("currTradeMsg")) { // 例如重启时,恢复currTradeMsg数据

currTradeMsg = _G("currTradeMsg")

Log("恢复记录", currTradeMsg)

}

// 初始化account

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol)

var arrCurrencyName = symbol.split("_")

var baseCurrency = arrCurrencyName[0]

var quoteCurrency = arrCurrencyName[1]

if (quoteCurrency != "USDT") {

throw "only support quoteCurrency: USDT"

}

if (!account[baseCurrency] || !account[quoteCurrency]) {

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

}

// 初始化图表相关的数据

lastBarTime[symbol] = 0

arrChartConfig.push(createChartConfig(symbol, arrEma1Periods[index], arrEma2Periods[index]))

})

if (_G("initAccount")) {

initAccount = _G("initAccount")

Log("恢复初始账户记录", initAccount)

} else {

// 用当前资产信息,初始化initAccount变量

_.each(account, function(val, key) {

initAccount[key] = val

})

}

Log("account:", account, "initAccount:", initAccount) // 打印资产信息

// 初始化图表对象

var chart = Chart(arrChartConfig)

// 图表重置

chart.reset()

// 策略主循环逻辑

while (true) {

// 遍历所有品种,逐个执行双均线逻辑

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol) // 切换交易对为symbol字符串记录的交易对

var arrCurrencyName = symbol.split("_") // 以“_”符号分割交易对

var baseCurrency = arrCurrencyName[0] // 交易币的字符串

var quoteCurrency = arrCurrencyName[1] // 计价币的字符串

// 根据index索引,获取当前交易对的EMA均线参数

var ema1Period = parseFloat(arrEma1Periods[index])

var ema2Period = parseFloat(arrEma2Periods[index])

var amount = parseFloat(arrAmounts[index])

// 获取当前交易对的K线数据

var r = exchange.GetRecords()

if (!r || r.length < Math.max(ema1Period, ema2Period)) { // K线长度不足时直接返回

Sleep(1000)

return

}

var currBarTime = r[r.length - 1].Time // 记录当前BAR时间戳

lastPrices[symbol] = r[r.length - 1].Close // 记录当前最新价格

var ema1 = TA.EMA(r, ema1Period) // 计算EMA指标

var ema2 = TA.EMA(r, ema2Period) // 计算EMA指标

if (ema1.length < 3 || ema2.length < 3) { // EMA指标数组长度过短,直接返回

Sleep(1000)

return

}

var ema1Last2 = ema1[ema1.length - 2] // 倒数第二BAR上的EMA

var ema1Last3 = ema1[ema1.length - 3] // 倒数第三BAR上的EMA

var ema2Last2 = ema2[ema2.length - 2]

var ema2Last3 = ema2[ema2.length - 3]

// 写入图表数据

var klineIndex = index + 2 * index

// 遍历K线数据

for (var i = 0 ; i < r.length ; i++) {

if (r[i].Time == lastBarTime[symbol]) { // 画图,更新当前BAR以及指标

// 更新

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close], -1)

chart.add(klineIndex + 1, [r[i].Time, ema1[i]], -1)

chart.add(klineIndex + 2, [r[i].Time, ema2[i]], -1)

} else if (r[i].Time > lastBarTime[symbol]) { // 画图,添加BAR以及指标

// 添加

lastBarTime[symbol] = r[i].Time // 更新时间戳

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close])

chart.add(klineIndex + 1, [r[i].Time, ema1[i]])

chart.add(klineIndex + 2, [r[i].Time, ema2[i]])

}

}

if (ema1Last3 < ema2Last3 && ema1Last2 > ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// 金叉

var depth = exchange.GetDepth() // 获取当前订单薄深度数据

var price = depth.Asks[Math.min(takeLevel, depth.Asks.length)].Price // 取第10档价格,吃单

if (depth && price * amount <= account[quoteCurrency]) { // 获取深度数据正常,有足够资产下单

exchange.Buy(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2) // 下单买入

cancelAll(exchange) // 取消所有挂单

var acc = _C(exchange.GetAccount) // 获取账户资产信息

if (acc.Stocks != account[baseCurrency]) { // 检测账户资产发生变动

account[baseCurrency] = acc.Stocks // 更新资产

account[quoteCurrency] = acc.Balance // 更新资产

currTradeMsg[symbol] = currBarTime // 记录当前BAR已经交易

_G("currTradeMsg", currTradeMsg) // 持久化记录

var profit = getProfit(account, initAccount, lastPrices) // 计算收益

if (profit) {

LogProfit(profit, account, initAccount) // 打印收益

}

}

}

} else if (ema1Last3 > ema2Last3 && ema1Last2 < ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// 死叉

var depth = exchange.GetDepth()

var price = depth.Bids[Math.min(takeLevel, depth.Bids.length)].Price

if (depth && amount <= account[baseCurrency]) {

exchange.Sell(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2)

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

if (acc.Stocks != account[baseCurrency]) {

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

currTradeMsg[symbol] = currBarTime

_G("currTradeMsg", currTradeMsg)

var profit = getProfit(account, initAccount, lastPrices)

if (profit) {

LogProfit(profit, account, initAccount)

}

}

}

}

Sleep(1000)

})

// 状态栏表格变量

var tbl = {

type : "table",

title : "账户信息",

cols : [],

rows : []

}

// 将数据写入状态栏表格结构

tbl.cols.push("--")

tbl.rows.push(["初始"])

tbl.rows.push(["当前"])

_.each(account, function(val, key) {

if (typeof(initAccount[key]) == "number") {

tbl.cols.push(key)

tbl.rows[0].push(initAccount[key]) // 初始

tbl.rows[1].push(val) // 当前

}

})

// 显示状态栏表格

LogStatus(_D(), "\n", "profit:", getProfit(account, initAccount, lastPrices), "\n", "`" + JSON.stringify(tbl) + "`")

}

}

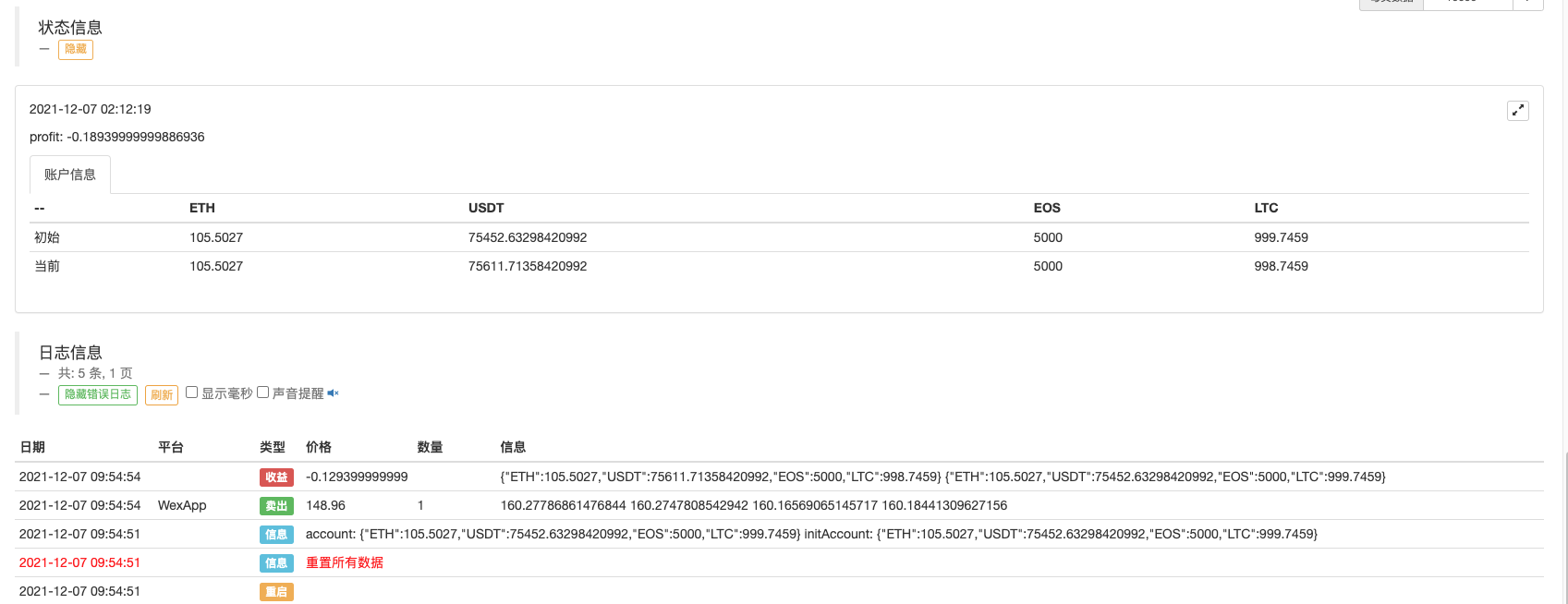

Strategic retesting

You can see that ETH, LTC, ETC are all triggered by a straightforward gold fork dead fork, and transactions take place.

You can also hang the analogue disc test.

The source code of the strategy:https://www.fmz.com/strategy/333783

The strategy is only for retesting, learning strategy design, and real-world use.

- Quantitative Practice of DEX Exchanges (2) -- Hyperliquid User Guide

- DEX exchange quantitative practices ((2) -- Hyperliquid user guide

- Quantitative Practice of DEX Exchanges (1) -- dYdX v4 User Guide

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (3)

- DEX exchange quantitative practice ((1) -- dYdX v4 user guide

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- The digital currency market has a new strategy for robbing coins (Teaching)

- Design a Multiple-Chart Plotting Library

- Designing a multigraph line library

- 60 lines of code to implement an idea -- the contract copying strategy.

- Design of an order synchronization system based on FMZ quantification (2)

- Design of an order synchronization system based on FMZ quantification (1)

- Upgrade! digital currency futures class Martin strategy

- Multiple ATR strategies for digital currency futures (teachings)

- Digital currency market review 2021 and the 10 simplest strategies to miss

- JavaScript implementation of the Fisher pointer and mapping on FMZ

- Digital currency futures with double-equal turning point strategies (Teaching)

- Updates on the capital rate strategy and recommended actions

- Research on the design of hedging strategies for single-period loans

- FMZ platform Python replicator app for the first time - crawling Binance announcements

- dYdX strategy design paradigm - Randomized trading strategy

- Inventors quantify trading platforms with quick access app

- The exchange rate of the currency's futures contract is the return of the interest rate analysis

- Inventors General Agreement for example

- How to hedge digital currencies manually

- Research platform for advanced Python for data analysis and strategic retrieval

Mr.Huang. 2

Mr.Huang. 2

Mr.Huang. 1

Light cloudsThank you so much!

wanghehe711@qq.comThank you. Thanks! Newbie is working on it ~ but the real-world test report error: GetOrders: Invalid ContractType Is this a hosting issue?

Inventors quantify - small dreamsThank you for your support.

Inventors quantify - small dreamsThis is an example of a strategy that can be seen in coding learning.

wanghehe711@qq.comIf I could, I'd try to change it.

Inventors quantify - small dreamsThis is a spot strategy, not a futures one.