Upgrade! digital currency futures class Martin strategy

Author: Inventors quantify - small dreams, Created: 2022-02-07 09:12:36, Updated: 2024-12-02 21:32:43

Upgrade! digital currency futures class Martin strategy

作为一个教学策略,兼顾一定的实战性能当然是最好的。「数字货币期货类马丁策略」在FMZ.COM围观板块也已经展示了小半年了。经历了好几拨风吹雨打,马丁、网格策略有其风险硬伤,参数保守一点也不是不能用。

- Binance futures on the spot

- dYdX physical drive

The dream is to guarantee that there is absolutely no rechargeable aluminum production aluminum yield curve ((handy dog head)).

However, the first edition of the strategy design is relatively simple, the interface has only one holding, total rights and benefits data output, the earnings curve is only printed to achieve profit and loss, not counting the inflow and loss.

This post is about upgrading this six-month strategy of stability and stability.

The upgrade plan

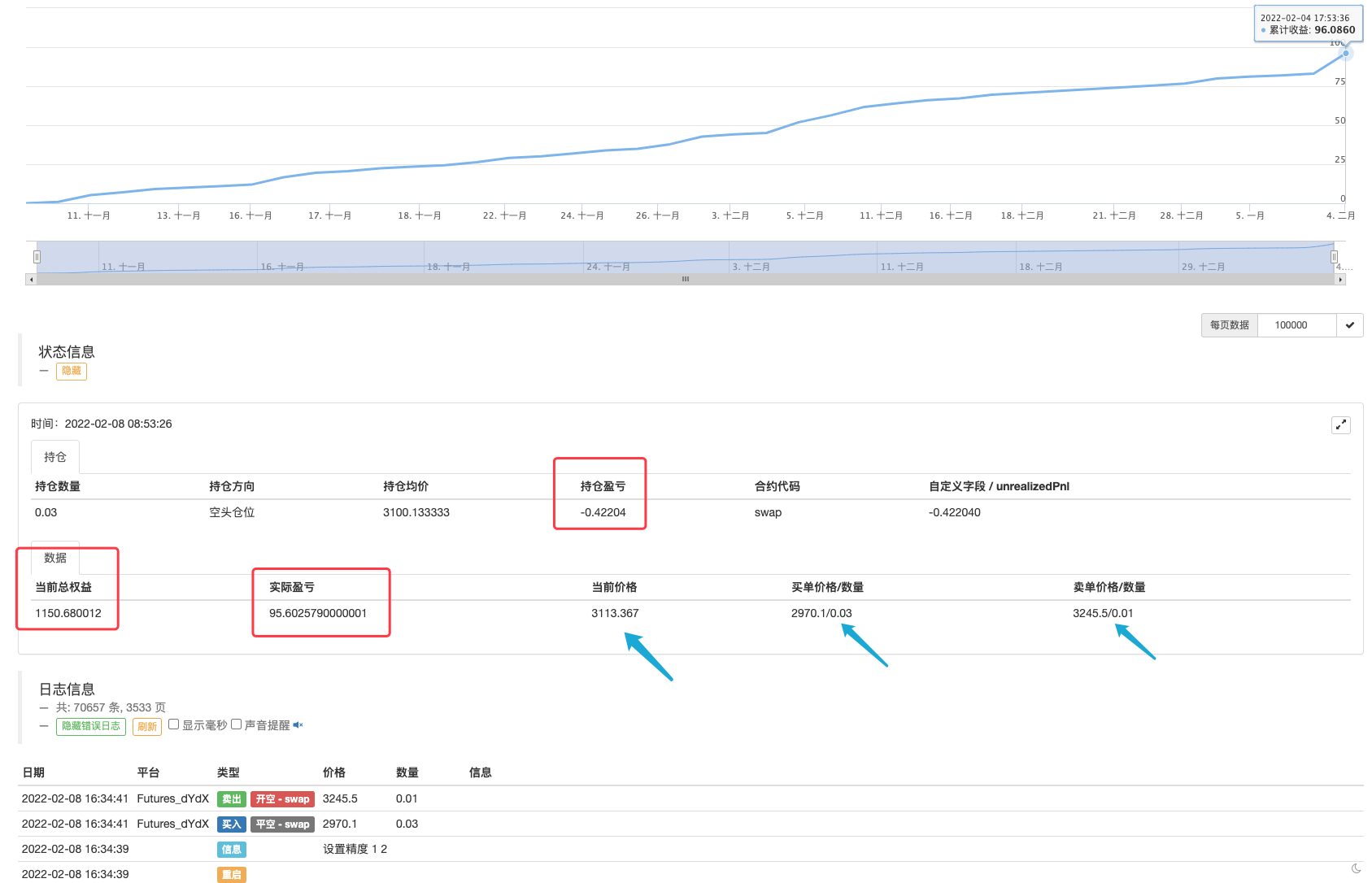

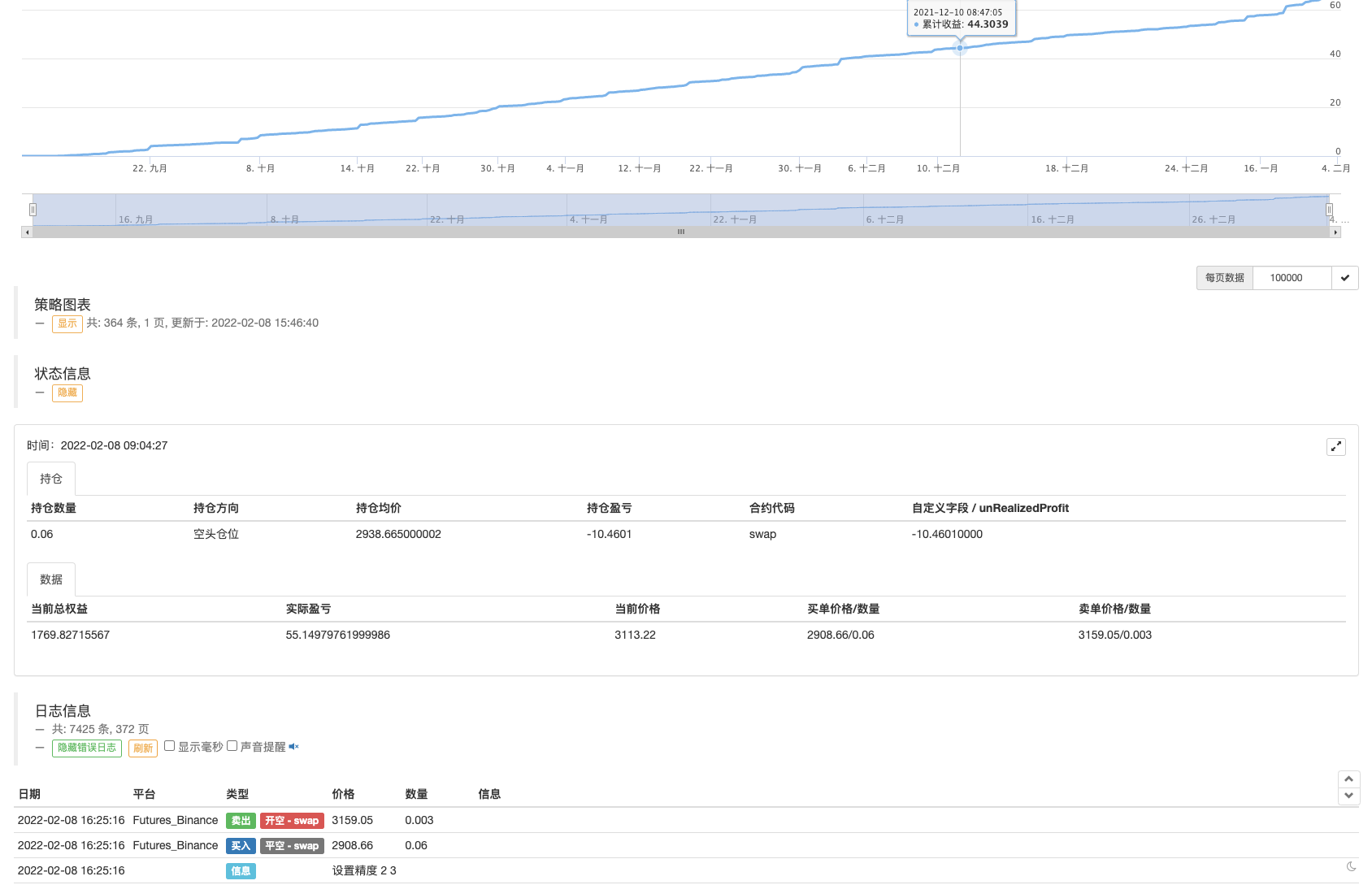

- Upgraded status bar displays information about current holdings, rather than a printed set of data. Displays current total equity gains, floating gains, actual gains and losses (total gains and losses already accounted for by floating gains and losses)

- The chart below shows the current location of the listing.

The policy version before the upgrade is recorded on the policy's "Notes" page.

这个也是我的个人开发习惯,在FMZ.COM上很方便记录策略开发、迭代的点点滴滴。

Start the upgrade!

The first thing we do is optimize the status bar to show that students who are familiar with FMZ development documentation know that displaying the status bar data on FMZ is useful.LogStatusThe function. Then we find this cut-off point to start designing the code.

The next thing you want to do is add a big code:

var tblPos = {

"type" : "table",

"title" : "持仓",

"cols" : ["持仓数量", "持仓方向", "持仓均价", "持仓盈亏", "合约代码", "自定义字段 / " + SpecifyPosField],

"rows" : []

}

var descType = ["多头仓位", "空头仓位"]

for (var posIndex = 0 ; posIndex < pos.length ; posIndex++) {

tblPos.rows.push([pos[posIndex].Amount, descType[pos[posIndex].Type], pos[posIndex].Price, pos[posIndex].Profit, pos[posIndex].ContractType, SpecifyPosField == "" ? "--" : pos[posIndex].Info[SpecifyPosField]])

}

var tbl = {

"type" : "table",

"title" : "数据",

"cols" : ["当前总权益", "实际盈亏", "当前价格", "买单价格/数量", "卖单价格/数量"],

"rows" : []

}

var buyOrder = null

var sellOrder = null

for (var orderIndex = 0 ; orderIndex < orders.length ; orderIndex++) {

if (orders[orderIndex].Type == ORDER_TYPE_BUY) {

buyOrder = orders[orderIndex]

} else {

sellOrder = orders[orderIndex]

}

}

var realProfit = currTotalEq - totalEq

if (exchange.GetName() == "Futures_Binance") {

_.each(pos, function(p) {

realProfit += parseFloat(p.Info.unRealizedProfit)

})

}

var t = exchange.GetTicker()

tbl.rows.push([currTotalEq, realProfit, t ? t.Last : "--", (buyOrder.Price + "/" + buyOrder.Amount), (sellOrder.Price + "/" + sellOrder.Amount)])

// 更新图表数据

if (t && showLine) {

_.each(pos, function(p) {

$.PlotLine(descType[p.Type] + "持仓价格", p.Price)

})

$.PlotLine("买单挂单价格", buyOrder.Price)

$.PlotLine("卖单挂单价格", sellOrder.Price)

$.PlotLine("当前价格", t.Last)

}

// 更新状态栏数据

LogStatus("时间:" + _D() + "\n" + "`" + JSON.stringify(tblPos) + "`" + "\n" + "`" + JSON.stringify(tbl) + "`")

It replaces the previously simplisticLogStatusExports

LogStatus(_D(), "当前总权益:", currTotalEq, "持仓:", pos)

The strategy adds two parameters:

showLine parameters If selected, you can use the drawing line library to draw a graph on the real disk page, drawing the holding price, the hanging price, the current price curve.

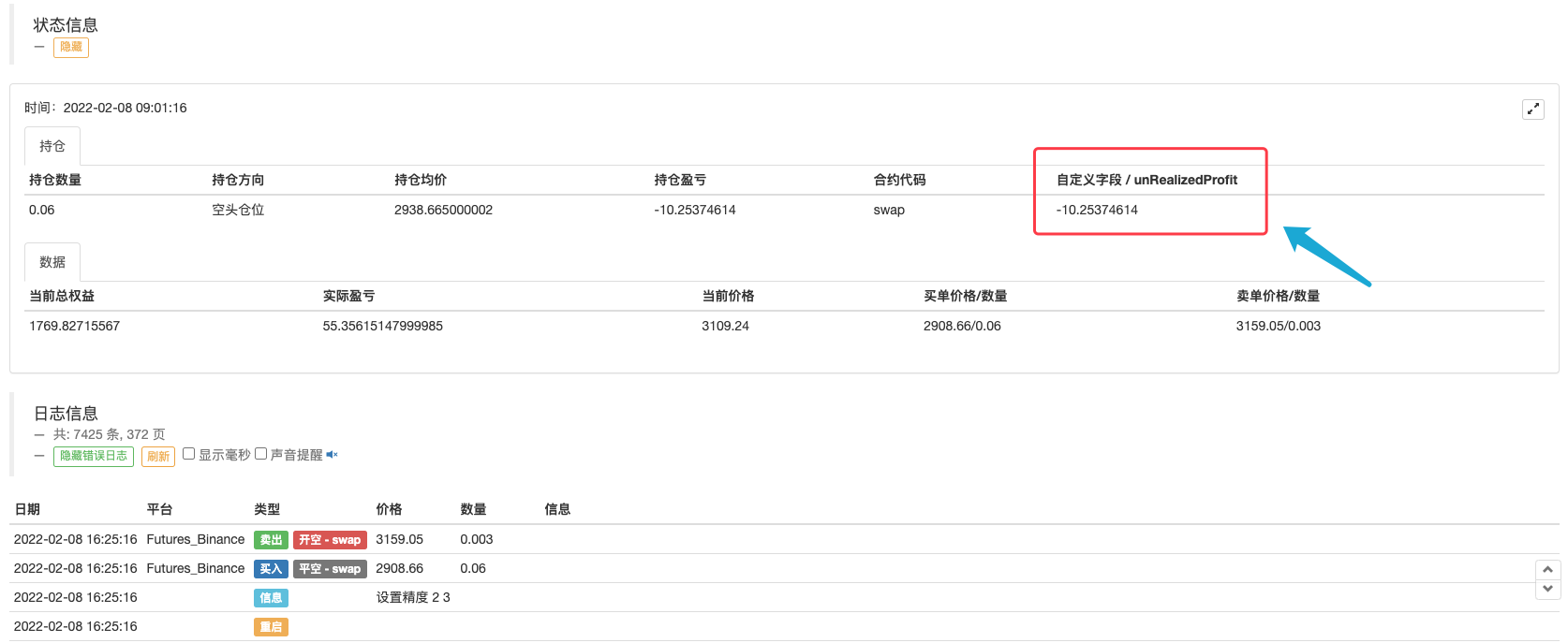

Specify PosField To set the raw field of the holding information that needs to be displayed, since the name of the raw data field of the holding is different for each exchange. So here a custom parameter is designed to specify the field name to be displayed. For example, my Bitcoin hard drive:

I want to display the information data in the Info field (exchange interface raw data)unRealizedProfitThe property, that is, the holding did not achieve a profit or loss. The parameter SpecifyPosField can be set to unRealizedProfit.

A similar design allows policies to adapt the output to non-uniform data, giving users the option to customize the output content themselves.

Restart the Binance, dYdX hard drive after the upgrade policy

You can see the data you need to display at a glance. It is very convenient to observe the trading progress of the strategy, the current holding price, the profit and loss, the hanging order price. The strategy has a certain risk, the real disk sets control parameters according to its own risk, self-assured profit and loss. The strategy is open only for exchange and learning.

- Quantitative Practice of DEX Exchanges (2) -- Hyperliquid User Guide

- DEX exchange quantitative practices ((2) -- Hyperliquid user guide

- Quantitative Practice of DEX Exchanges (1) -- dYdX v4 User Guide

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (3)

- DEX exchange quantitative practice ((1) -- dYdX v4 user guide

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Sustainable balancing strategies for bear markets

- If you haven't written a strategy yet with Pine, which is so easy to learn, then I...

- Detailed Explanation of Equilibrium & Grid Strategies

- It's about a beauty - how to design simple and effective strategies.

- The digital currency market has a new strategy for robbing coins (Teaching)

- Design a Multiple-Chart Plotting Library

- Designing a multigraph line library

- 60 lines of code to implement an idea -- the contract copying strategy.

- Design of an order synchronization system based on FMZ quantification (2)

- Design of an order synchronization system based on FMZ quantification (1)

- Multiple ATR strategies for digital currency futures (teachings)

- Digital currency market review 2021 and the 10 simplest strategies to miss

- JavaScript implementation of the Fisher pointer and mapping on FMZ

- Digital currency cash multi-variety two-way strategy (teaching)

- Digital currency futures with double-equal turning point strategies (Teaching)

- Updates on the capital rate strategy and recommended actions

- Research on the design of hedging strategies for single-period loans

- FMZ platform Python replicator app for the first time - crawling Binance announcements

- dYdX strategy design paradigm - Randomized trading strategy

- Inventors quantify trading platforms with quick access app

AAA386In general, n=1 in the source code doesn't seem to make sense?

HermitI think it's good to do gold XAUUSD relatively bullish down there's no ring that strong

Oh, my God.Multi-variety, dream total, first of all the profit variable, the parameter needs to be changed to the ratio so that you can run multiple currencies at the same time

Inventors quantify - small dreamsIt's possible to design it, but it feels like it's a bigger risk, so it's written n=1.

Inventors quantify - small dreamsYes, because the price difference between different trading pairs is so far apart that it is not intuitively possible to represent the price difference, it needs to be designed in percentages. If you want to continue to represent the price difference, you need to set an array parameter to set the price difference of these different varieties separately.