EMA + AROON + ASH

Author: ChaoZhang, Date: 2022-05-10 10:34:06Tags: EMAAROONASH

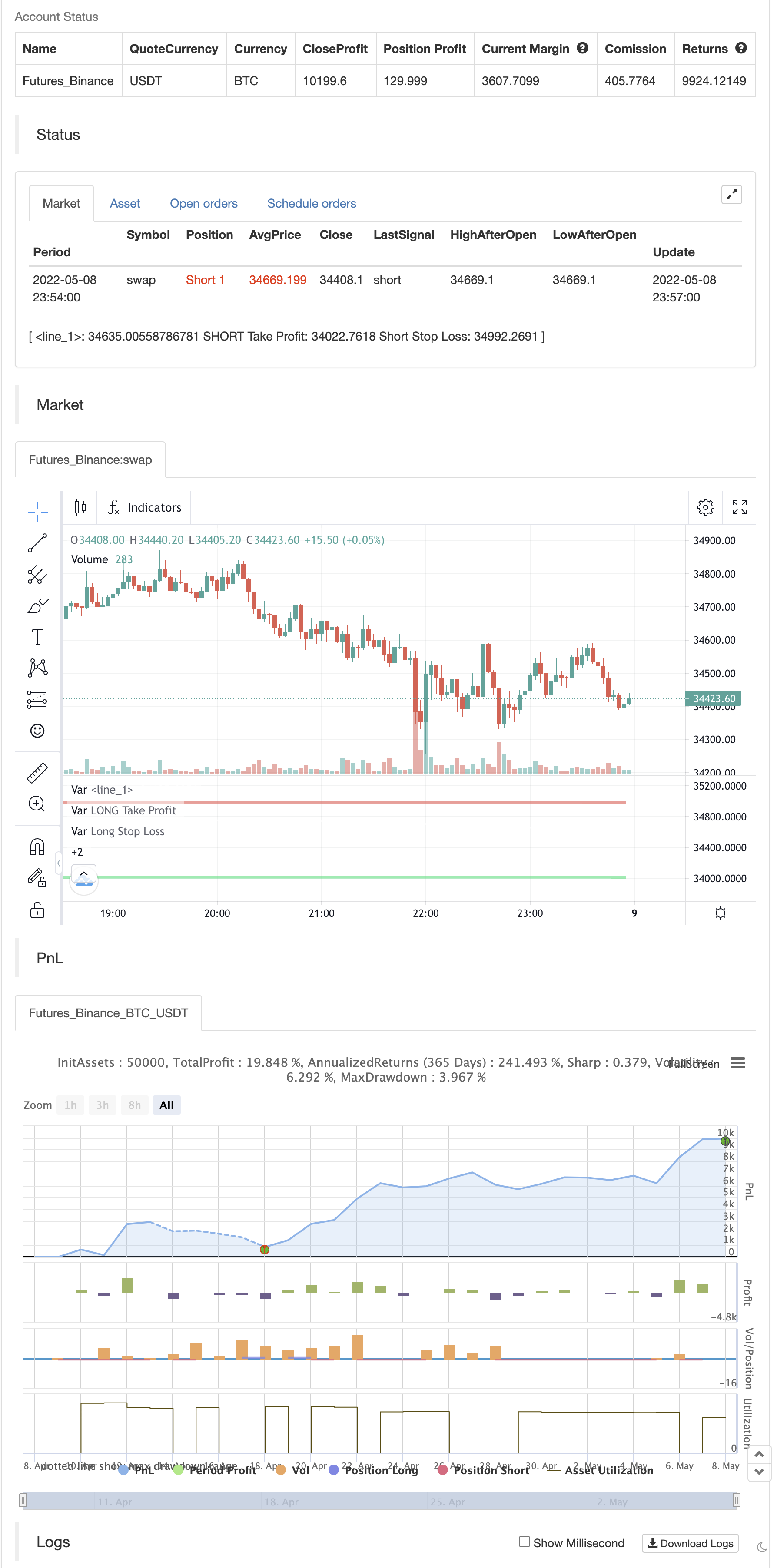

=== IMPORTANT === My intention is to find the best strategies and dump the bad ones, as you can check by yourself using this automated strategy, the result is… *** BAD STRATEGY, AVOID ***

=== INTRO and CREDITS === This script is a mix of 3 indicators in order to recreate TRADE KING’s strategy from YouTube. First indicator is an EMA ( Exponential Moving Average ) (200 periods). Second is the classic Aroon indicator. And third is the Absolute Strength Histogram, the one by “jiehonglim”, name is A”bsolute Strength Histogram v2 | jh”. Credit for each indicator belongs to them, i just modified those to add some extra options, settings, etc, also updated all the code to PineScript 5.

=== THE STRATEGY === Default settings are already as TRADE KING requires, so you don’t have to change anything. FOR LONGS (green background shows LONG entries). 1. Price must be ABOVE the EMA . 2. Bullish Aroon crossover. 3. Bullish absolute strength histogram line must be ABOVE the bearish one.

FOR SHORTS (red background shows SHORT entries). 1. Price must be BELOW the EMA . 2. Bearish Aroon crossover. 3. Bearish absolute strength histogram line must be ABOVE the bullish one.

Please check TRADE KING’s YouTube channel for more info.

=== GENERAL IMPROVEMENTS === Upgrade to PineScript 5. Some performance improvements.

=== PERSONAL NOTES === The author of this strategy recommends 5M charts, however, 4H shows to be the best.

Thanks again to the authors of the indicators that compose this script and to TRADE KING to create this strategy.

backtest

/*backtest

start: 2022-04-09 00:00:00

end: 2022-05-08 23:59:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © JoseMetal

//@version=5

//

//== Constantes

c_verde_radiactivo = color.rgb(0, 255, 0, 0)

c_verde = color.rgb(0, 128, 0, 0)

c_verde_oscuro = color.rgb(0, 80, 0, 0)

c_rojo_radiactivo = color.rgb(255, 0, 0, 0)

c_rojo = color.rgb(128, 0, 0, 0)

c_rojo_oscuro = color.rgb(80, 0, 0, 0)

//== Funciones

//== Declarar estrategia y período de testeo

//strategy("EMA + AROON + ASH (TRADE KING's STRATEGY)", shorttitle="EMA + AROON + ASH (TRADE KING's STRATEGY)", overlay=true, initial_capital=10000, pyramiding=0, default_qty_value=10, default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, commission_value=0.00075, max_labels_count=500, max_bars_back=1000)

//fecha_inicio = input.time(timestamp("1 Jan 2000"), title="• Start date", group="Test period", inline="periodo_de_pruebas")

vela_en_fecha = true

posicion_abierta = strategy.position_size != 0

LONG_abierto = strategy.position_size > 0

SHORT_abierto = strategy.position_size < 0

//== Condiciones de entrada y salida de estrategia

GRUPO_P = "Positions"

P_permitir_LONGS = input.bool(title="¿LONGS?", group=GRUPO_P, defval=true)

P_permitir_SHORTS = input.bool(title="¿SHORTS?", group=GRUPO_P, defval=true)

GRUPO_TPSL = "TP y SL"

TPSL_TP_pivot_lookback = input.int(title="• SL lookback for pivot / Mult. TP", group=GRUPO_TPSL, defval=20, minval=1, step=1, inline="tp_sl")

TPSL_SL_mult = input.float(title="", group=GRUPO_TPSL, defval=2.0, minval=0.1, step=0.2, inline="tp_sl")

//== Inputs de indicadores

// EMA

GRUPO_EMA = "Exponential Moving Average (EMA)"

EMA_length = input.int(200, minval=1, title="Length", group=GRUPO_EMA)

EMA_src = input(close, title="Source", group=GRUPO_EMA)

EMA = ta.ema(EMA_src, EMA_length)

// Aroon

GRUPO_Aroon = "Aroon"

Aroon_length = input.int(title="• Length", group=GRUPO_Aroon, defval=20, minval=1)

Aroon_upper = 100 * (ta.highestbars(high, Aroon_length+1) + Aroon_length) / Aroon_length

Aroon_lower = 100 * (ta.lowestbars(low, Aroon_length+1) + Aroon_length) / Aroon_length

// ASH

GRUPO_ASH = "Absolute Strength Histogram v2 | jh"

ASH_Length = input(9, title='Period of Evaluation', group=GRUPO_ASH)

ASH_Smooth = input(3, title='Period of Smoothing', group=GRUPO_ASH)

ASH_src = input(close, title='Source')

ASH_Mode = input.string(title='Indicator Method', defval='RSI', options=['RSI', 'STOCHASTIC', 'ADX'])

ASH_ma_type = input.string(title='MA', defval='WMA', options=['ALMA', 'EMA', 'WMA', 'SMA', 'SMMA', 'HMA'])

ASH_alma_offset = input.float(defval=0.85, title='* Arnaud Legoux (ALMA) Only - Offset Value', minval=0, step=0.01)

ASH_alma_sigma = input.int(defval=6, title='* Arnaud Legoux (ALMA) Only - Sigma Value', minval=0)

_MA(type, src, len) =>

float result = 0

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'SMMA' // Smoothed

w = ta.wma(src, len)

result := na(w[1]) ? ta.sma(src, len) : (w[1] * (len - 1) + src) / len

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'ALMA' // Arnaud Legoux

result := ta.alma(src, len, ASH_alma_offset, ASH_alma_sigma)

result

result

Price1 = _MA('SMA', ASH_src, 1)

Price2 = _MA('SMA', ASH_src[1], 1)

// RSI

Bulls0 = 0.5 * (math.abs(Price1 - Price2) + Price1 - Price2)

Bears0 = 0.5 * (math.abs(Price1 - Price2) - (Price1 - Price2))

// STOCHASTIC

Bulls1 = Price1 - ta.lowest(Price1, ASH_Length)

Bears1 = ta.highest(Price1, ASH_Length) - Price1

// ADX

Bulls2 = 0.5 * (math.abs(high - high[1]) + high - high[1])

Bears2 = 0.5 * (math.abs(low[1] - low) + low[1] - low)

Bulls = ASH_Mode == 'RSI' ? Bulls0 : ASH_Mode == 'STOCHASTIC' ? Bulls1 : Bulls2

Bears = ASH_Mode == 'RSI' ? Bears0 : ASH_Mode == 'STOCHASTIC' ? Bears1 : Bears2

AvgBulls = _MA(ASH_ma_type, Bulls, ASH_Length)

AvgBears = _MA(ASH_ma_type, Bears, ASH_Length)

SmthBulls = _MA(ASH_ma_type, AvgBulls, ASH_Smooth)

SmthBears = _MA(ASH_ma_type, AvgBears, ASH_Smooth)

difference = math.abs(SmthBulls - SmthBears)

//== Cálculo de condiciones

EMA_alcista = close > EMA

EMA_bajista = close < EMA

Aroon_cruce_alcista = ta.crossover(Aroon_upper, Aroon_lower)

Aroon_cruce_bajista = ta.crossunder(Aroon_upper, Aroon_lower)

ASH_alcista = SmthBulls > SmthBears

ASH_bajista = SmthBulls < SmthBears

//== Entrada (deben cumplirse todas para entrar)

longCondition1 = EMA_alcista

longCondition2 = Aroon_cruce_alcista

longCondition3 = ASH_alcista

long_conditions = longCondition1 and longCondition2 and longCondition3

entrar_en_LONG = P_permitir_LONGS and long_conditions and vela_en_fecha and not posicion_abierta

shortCondition1 = EMA_bajista

shortCondition2 = Aroon_cruce_bajista

shortCondition3 = ASH_bajista

short_conditions = shortCondition1 and shortCondition2 and shortCondition3

entrar_en_SHORT = P_permitir_SHORTS and short_conditions and vela_en_fecha and not posicion_abierta

var LONG_stop_loss = 0.0

var LONG_take_profit = 0.0

var SHORT_stop_loss = 0.0

var SHORT_take_profit = 0.0

//psl = ta.pivotlow(TPSL_TP_pivot_lookback, TPSL_TP_pivot_lookback)

//psh = ta.pivothigh(TPSL_TP_pivot_lookback, TPSL_TP_pivot_lookback)

psl = ta.lowest(TPSL_TP_pivot_lookback)

psh = ta.highest(TPSL_TP_pivot_lookback)

if (entrar_en_LONG)

LONG_stop_loss := psl - close*0.001

LONG_take_profit := close + ((close - LONG_stop_loss) * TPSL_SL_mult)

strategy.entry("+ Long", strategy.long)

strategy.exit("- Long", "+ Long", limit=LONG_take_profit, stop=LONG_stop_loss)

if (entrar_en_SHORT)

SHORT_stop_loss := psh + close*0.001

SHORT_take_profit := close - ((SHORT_stop_loss - close) * TPSL_SL_mult)

strategy.entry("+ Short", strategy.short)

strategy.exit("- Short", "+ Short", limit=SHORT_take_profit, stop=SHORT_stop_loss)

//== Ploteo en pantalla

// EMA

plot(EMA, color=color.white, linewidth=2)

// Símbolo de entrada (entre o no en compra)

bgcolor = color.new(color.black, 100)

if (entrar_en_LONG or entrar_en_SHORT)

bgcolor := color.new(color.green, 90)

bgcolor(bgcolor)

// Precio de compra, Take Profit, Stop Loss y relleno

avg_position_price_plot = plot(series=posicion_abierta ? strategy.position_avg_price : na, color=color.new(color.white, 25), style=plot.style_linebr, linewidth=2, title="Precio Entrada")

LONG_tp_plot = plot(LONG_abierto and LONG_take_profit > 0.0 ? LONG_take_profit : na, color=color.new(color.lime, 25), style=plot.style_linebr, linewidth=3, title="LONG Take Profit")

LONG_sl_plot = plot(LONG_abierto and LONG_stop_loss > 0.0 ? LONG_stop_loss : na, color=color.new(color.red, 25), style=plot.style_linebr, linewidth=3, title="Long Stop Loss")

fill(avg_position_price_plot, LONG_tp_plot, color=color.new(color.olive, 85))

fill(avg_position_price_plot, LONG_sl_plot, color=color.new(color.maroon, 85))

SHORT_tp_plot = plot(SHORT_abierto and SHORT_take_profit > 0.0 ? SHORT_take_profit : na, color=color.new(color.lime, 25), style=plot.style_linebr, linewidth=3, title="SHORT Take Profit")

SHORT_sl_plot = plot(SHORT_abierto and SHORT_stop_loss > 0.0 ? SHORT_stop_loss : na, color=color.new(color.red, 25), style=plot.style_linebr, linewidth=3, title="Short Stop Loss")

fill(avg_position_price_plot, SHORT_tp_plot, color=color.new(color.olive, 85))

fill(avg_position_price_plot, SHORT_sl_plot, color=color.new(color.maroon, 85))

- HA Market Bias

- Dynamic Dual EMA Crossover Quantitative Trading Strategy

- TrendScalp-FractalBox-3EMA

- EMA Crossover with Short-term Signals Strategy

- Dual EMA Crossover Dynamic Trend Following Quantitative Trading Strategy

- Ichimoku Cloud Smooth Oscillator

- EMA TREND CLOUD

- MA Emperor insiliconot

- Dual EMA Momentum Trend Trading Strategy with Full Body Candle Signal System

- Multi-EMA Golden Cross Strategy with Tiered Take-Profit

- BB-RSI-ADX Entry Points

- Hull-4ema

- Angle Attack Follow Line Indicator

- KijunSen Line With Cross

- AMACD - All Moving Average Convergence Divergence

- MA HYBRID BY RAJ

- Diamond Trend

- Nik Stoch

- stoch supertrd atr 200ma

- MTF RSI & STOCH Strategy

- Momentum 2.0

- EHMA Range Strategy

- Moving Average Buy-Sell

- Midas Mk. II - Ultimate Crypto Swing

- TMA-Legacy

- TV highs and lows

- Best TradingView Strategy

- Big Snapper Alerts R3.0 + Chaiking Volatility condition + TP RSI

- Chande Kroll Stop

- CCI + EMA with RSI Cross Strategy