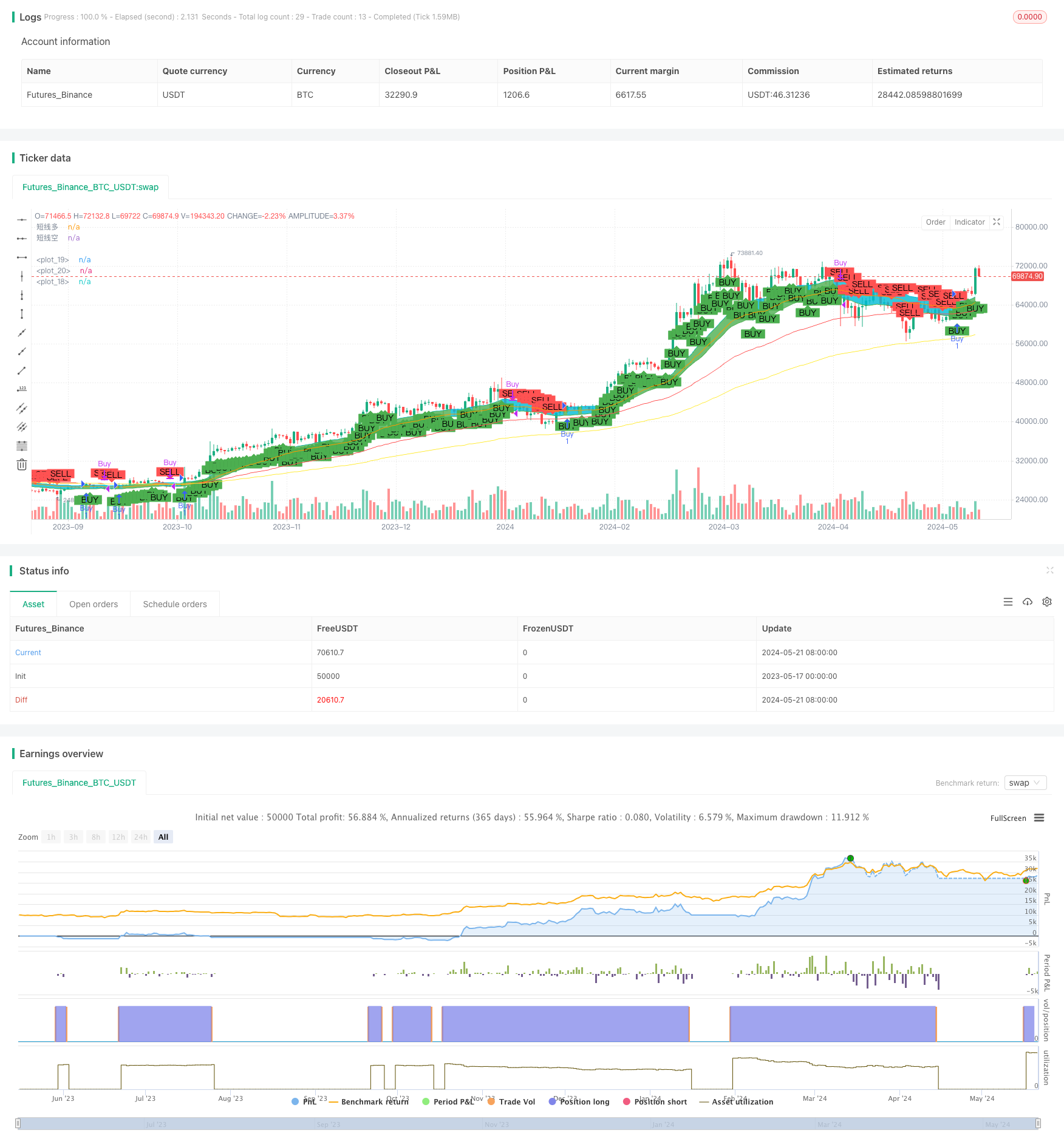

EMA均线交叉与短期信号策略

Author: ChaoZhang, Date: 2024-05-23 17:52:18Tags: EMA

概述

该策略使用三条不同周期的EMA均线(144日、34日和76日)来捕捉市场的中长期趋势,同时结合30日最高价和最低价的EMA均线作为短期多空信号,当收盘价突破短期多方信号时开多仓,突破短期空方信号时平仓。这种方法可以在把握市场主要趋势的同时,利用短期信号实现较为灵活的仓位管理。

策略原理

- 计算144日、34日和76日的EMA均线,分别代表超长期、中期和长期趋势。

- 计算30日最高价和最低价的EMA均线,分别作为短期多头和空头信号。

- 当收盘价突破30日最高价EMA均线时,开多仓;当收盘价跌破30日最低价EMA均线时,平仓。

- 在图表上绘制EMA均线以及短期多空信号区间,直观显示市场趋势和信号。

策略优势

- 结合不同周期的EMA均线,可以全面把握市场的超长期、长期和中期趋势。

- 利用30日最高价和最低价的EMA均线作为短期信号,可以在趋势中实现灵活的仓位管理,提高资金利用效率。

- 图表上清晰绘制各种信号和趋势,便于交易者直观判断市场状况。

策略风险

- EMA均线存在一定的滞后性,可能在市场转折点反应较慢。

- 短期信号受市场波动影响较大,可能出现频繁的开平仓操作,增加交易成本。

- 策略缺乏止损措施,在市场出现剧烈波动时可能承担较大风险。

策略优化方向

- 引入更多不同周期的EMA均线,如200日、50日等,丰富趋势判断维度。

- 优化短期信号的参数,如调整最高价和最低价EMA均线的周期,以更好地适应不同市场状况。

- 加入止损机制,如根据ATR设置动态止损位,以控制单笔交易的最大风险。

- 考虑加入移动止盈或trilling stop等方法,以更好地保护已有利润。

总结

EMA均线交叉与短期信号策略通过多周期EMA均线把握市场趋势,并利用短期价格信号实现灵活的仓位管理,是一种趋势跟踪与波段操作相结合的方法。但该策略也存在滞后、频繁交易和缺乏风控等问题,需要进一步优化以提升其稳健性和盈利能力。通过引入更多维度的趋势判断、动态调整信号参数、加入合理的止损止盈机制等方法,可以使该策略更加完善和可靠。

/*backtest

start: 2023-05-17 00:00:00

end: 2024-05-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover with Short-term Signals", overlay=true)

// 定义EMA

shortest = ta.ema(close, 144)

short = ta.ema(close, 34)

longer = ta.ema(close, 76)

// 绘制EMA

plot(shortest, color=color.new(color.yellow, 0))

plot(short, color=color.new(color.orange, 0))

plot(longer, color=color.new(color.red, 0))

// 定义短线多空信号的EMA

stLong = ta.ema(high, 30)

stShort = ta.ema(low, 30)

stLongPlot = plot(stLong, '短线多', color.new(color.aqua, 0))

stShortPlot = plot(stShort, '短线空', color.new(color.green, 0))

// 绘制短线多空信号

clr = close > stLong ? color.green : color.aqua

fill(stLongPlot, stShortPlot, color=clr, transp=90)

// 交易信号

if (close > stLong)

strategy.entry("Buy", strategy.long)

if (close < stShort)

strategy.close("Buy")

// 显示买卖信号

plotshape(series=close > stLong, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=close < stShort, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

相关内容

- 多维度趋势判断与ATR动态止盈止损策略

- 高级多指标趋势确认交易策略

- 自适应趋势跟踪与多重确认交易策略

- 动态均线系统结合RSI动量指标的日内交易优化策略

- 多重技术指标交叉动量趋势跟踪策略

- EMA趋势结合轮回位突破交易策略

- 多均线交叉辅助RSI动态参数量化交易策略

- 动态趋势判定RSI指标交叉策略

- 双重交叉趋势追踪策略:指数均线与MACD协同交易系统

- 多指标多维度趋势交叉高级量化策略

- 多重平滑均线动态交叉趋势跟踪与多重确认量化交易策略

更多内容

- 布林带RSI交易策略

- 基于成交量热图与实时价格的买卖策略

- 双均线回归交易策略

- 多指标量化交易策略 - 7合1超级指标策略

- SMK ULTRA TREND 双均线交叉策略

- 五重强势移动平均策略

- 均线交叉牛市支撑带策略

- 多时间框架与200EMA过滤器的趋势跟踪策略 - 仅做多

- SMC市场高低点突破策略

- 动态趋势动量交易策略

- 一目云和ATR策略

- BONK多因子交易策略

- 双均线交叉策略

- HalfTrend多空趋势追踪止损限价买入策略

- Alligator 长期趋势跟踪交易策略

- 基于脉冲MACD和双均线交叉的多时间尺度趋势追踪策略

- EMA5与EMA13交叉策略

- EMA SAR 中长期趋势跟踪策略

- 逆向波动率突破策略

- Nifty50三分钟开盘价突破策略