Momentum-based ZigZag

Author: ChaoZhang, Date: 2022-05-17 15:26:51Tags: SMAMACDEMAWMAHMARMAVWMA

I spent a lot of time searching for the best ZigZag indicator . Difficulty with all of them is that they are always betting on some pre-defined rules which identify or confirm pivot points . Usually it is time factor - pivot point gets confirmed after a particular number of candles. This methodology is probably the best when market is moving relatively slow, but when price starts chopping up and down, there is no way the ZigZag follows accurately. On the other hand if you set it too tight (for example pivot confirmation after only 2 or even 1 candle), you will get hundreds of zigzag lines and they will tell you nothing.

My point of view is to follow the market. If it has reversed, then it has reversed, and there is no need to wait pre-defined number of candles for the confirmation. Such reversals will always be visible on momentum indicators, such as the most popular MACD . But a single-line moving average can be also good enough to notice reversals. Or my favourite one - QQE, which I borrowed (and improved) from JustUncleL, who borrowed it from Glaz, who borrowed it from… I don’t even know where Quantitative Qualitative Estimation originates from. Thanks to all these guys for their input and code.

So whichever momentum indicator you choose - yes, there is a pick-your-poison-type selector as in in-famous Moving Average indicators - once it reverses, a highest (or lowest) point from the impulse is caught and ZigZag gets printed.

One thing I need to emphasize. This indicator DOES NOT REPAINT. It might look like the lines are a bit delayed, especially when compared to all the other ZigZag indicators on TradingView, but they are actually TRUE. There is a value in this - my indicator prints pivot points and Zigzag exactly on the moment they have been noticed, not earlier faking to be faster than they could be.

As a bonus, the indicator marks which impulse had strength in it. It is very nice to see a progressing impulse, but without force - a very likely that reversal on a bigger move is happening.

I'm about to publish some more scripts based on this ZigZag algo, so follow me on TradingView to get notified.

Enjoy!

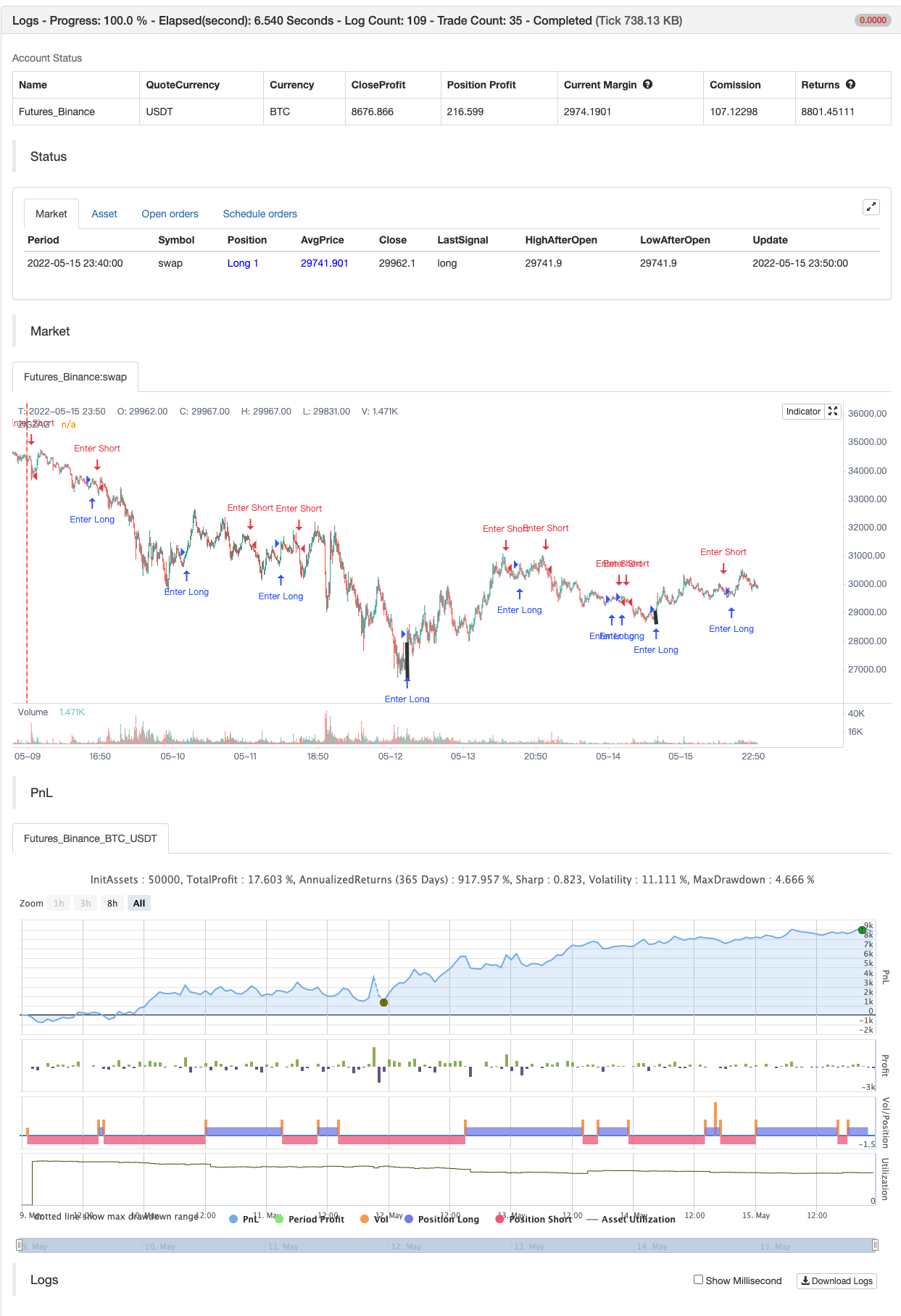

backtest

/*backtest

start: 2022-05-09 00:00:00

end: 2022-05-15 23:59:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Peter_O

//@version=5

indicator('Momentum-based ZigZag', overlay=true)

var int momentum_direction = 0

color_zigzag_lines = input(true, title='Color ZigZag lines to show force direction')

momentum_select = input.string(title='Select Momentum Indicator:', defval='QQE', options=['MACD', 'MovingAverage', 'QQE'])

// ZigZag function {

zigzag(_momentum_direction) =>

zz_goingup = _momentum_direction == 1

zz_goingdown = _momentum_direction == -1

var float zz_peak = na

var float zz_bottom = na

zz_peak := high > zz_peak[1] and zz_goingup or zz_goingdown[1] and zz_goingup ? high : nz(zz_peak[1])

zz_bottom := low < zz_bottom[1] and zz_goingdown or zz_goingup[1] and zz_goingdown ? low : nz(zz_bottom[1])

zigzag = zz_goingup and zz_goingdown[1] ? zz_bottom[1] : zz_goingup[1] and zz_goingdown ? zz_peak[1] : na

zigzag

// } End of ZigZag function

// MACD {

fast_length = input.int(title='Fast Length', defval=12, group='if MACD Selected', inline='macd')

slow_length = input.int(title='Slow Length', defval=26, group='if MACD Selected', inline='macd')

src = input.source(title='Source', defval=close, group='if MACD Selected', inline='macd')

signal_length = input.int(title='Signal Smoothing', minval=1, maxval=50, defval=9, group='if MACD Selected', inline='macd')

sma_source = input.string(title='Oscillator MA Type', defval='EMA', options=['SMA', 'EMA'], group='if MACD Selected', inline='macd')

sma_signal = input.string(title='Signal Line MA Type', defval='EMA', options=['SMA', 'EMA'], group='if MACD Selected', inline='macd')

fast_ma = sma_source == 'SMA' ? ta.sma(src, fast_length) : ta.ema(src, fast_length)

slow_ma = sma_source == 'SMA' ? ta.sma(src, slow_length) : ta.ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == 'SMA' ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length)

macdUP = ta.crossover(macd, signal)

macdDOWN = ta.crossunder(macd, signal)

// } End of MACD

// Moving Averages {

smoothing_type = input.string(title='Average type', defval='SMA', options=['EMA', 'SMA', 'WMA', 'VWMA', 'HMA', 'RMA', 'DEMA'], inline='movingaverage', group='if Moving Average selected')

ma_length = input.int(20, title='Length', inline='movingaverage', group='if Moving Average selected')

moving_average(_series, _length, _smoothing) =>

_smoothing == 'EMA' ? ta.ema(_series, _length) : _smoothing == 'SMA' ? ta.sma(_series, _length) : _smoothing == 'WMA' ? ta.wma(_series, _length) : _smoothing == 'VWMA' ? ta.vwma(_series, _length) : _smoothing == 'HMA' ? ta.hma(_series, _length) : _smoothing == 'RMA' ? ta.rma(_series, _length) : _smoothing == 'DEMA' ? 2 * ta.ema(_series, _length) - ta.ema(ta.ema(_series, _length), _length) : ta.ema(_series, _length)

movingaverage = moving_average(close, ma_length, smoothing_type)

maUP = movingaverage > movingaverage[1] and movingaverage[2] > movingaverage[1]

maDOWN = movingaverage < movingaverage[1] and movingaverage[2] < movingaverage[1]

// } End of Moving Averages

// QQE {

RSI_Period = input.int(14, title='RSI Length', inline='qqe', group='if QQE selected')

qqeslow = input.float(4.238, title='QQE Factor', inline='qqe', group='if QQE selected')

SFslow = input.int(5, title='RSI Smoothing', inline='qqe', group='if QQE selected')

ThreshHold = input.int(10, title='Thresh-hold', inline='qqe', group='if QQE selected')

rsi_currenttf = ta.rsi(close, RSI_Period)

qqenew(_qqefactor, _smoothingfactor, _rsi, _threshold, _RSI_Period) =>

RSI_Period = _RSI_Period

SF = _smoothingfactor

QQE = _qqefactor

ThreshHold = _threshold

Wilders_Period = RSI_Period * 2 - 1

Rsi = _rsi

RsiMa = ta.ema(Rsi, SF)

AtrRsi = math.abs(RsiMa[1] - RsiMa)

MaAtrRsi = ta.ema(AtrRsi, Wilders_Period)

dar = ta.ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? math.max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? math.min(shortband[1], newshortband) : newshortband

QQExlong = 0

QQExlong := nz(QQExlong[1])

QQExshort = 0

QQExshort := nz(QQExshort[1])

qqe_goingup = ta.barssince(QQExlong == 1) < ta.barssince(QQExshort == 1)

qqe_goingdown = ta.barssince(QQExlong == 1) > ta.barssince(QQExshort == 1)

var float last_qqe_high = high

var float last_qqe_low = low

last_qqe_high := high > last_qqe_high[1] and qqe_goingup or qqe_goingdown[1] and qqe_goingup ? high : nz(last_qqe_high[1])

last_qqe_low := low < last_qqe_low[1] and qqe_goingdown or qqe_goingup[1] and qqe_goingdown ? low : nz(last_qqe_low[1])

trend := ta.crossover(RSIndex, shortband[1]) or ta.crossover(high, last_qqe_high) ? 1 : ta.crossunder(RSIndex, longband[1]) or ta.crossunder(low, last_qqe_low) ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

// Find all the QQE Crosses

QQExlong := trend == 1 and trend[1] == -1 ? QQExlong + 1 : 0

QQExshort := trend == -1 and trend[1] == 1 ? QQExshort + 1 : 0

qqeLong = QQExlong == 1 ? FastAtrRsiTL[1] - 50 : na

qqeShort = QQExshort == 1 ? FastAtrRsiTL[1] - 50 : na

qqenew = qqeLong ? 1 : qqeShort ? -1 : na

qqenew

qqeUP = qqenew(qqeslow, SFslow, rsi_currenttf, ThreshHold, RSI_Period) == 1

qqeDOWN = qqenew(qqeslow, SFslow, rsi_currenttf, ThreshHold, RSI_Period) == -1

// } End of QQE

momentumUP = momentum_select == 'MACD' ? macdUP : momentum_select == 'MovingAverage' ? maUP : momentum_select == 'QQE' ? qqeUP : qqeUP

momentumDOWN = momentum_select == 'MACD' ? macdDOWN : momentum_select == 'MovingAverage' ? maDOWN : momentum_select == 'QQE' ? qqeDOWN : qqeDOWN

momentum_direction := momentumUP ? 1 : momentumDOWN ? -1 : nz(momentum_direction[1])

// { Force detection

rsi5 = ta.rsi(close, 5)

ob = 80

os = 20

barssince_momentumUP = ta.barssince(momentumUP)

barssince_momentumDOWN = ta.barssince(momentumDOWN)

momentum_DOWN_was_force_up = momentumDOWN and (barssince_momentumUP >= ta.barssince(rsi5 > ob))[1]

momentum_UP_was_force_down = momentumUP and (barssince_momentumDOWN >= ta.barssince(rsi5 < os))[1]

zzcolor_rsi5 = momentum_DOWN_was_force_up ? color.lime : momentum_UP_was_force_down ? color.red : color.black

// } End of Force detection

ZigZag = zigzag(momentum_direction)

plot(ZigZag, linewidth=5, color=color_zigzag_lines ? zzcolor_rsi5 : color.black, title='ZIGZAG', style=plot.style_line, transp=0)

GoShort = momentumDOWN and not momentum_DOWN_was_force_up

GoLong = momentumUP and not momentum_UP_was_force_down

if GoShort

label.new(bar_index, ZigZag, style=label.style_label_down, color=color.red, text=str.tostring('SHORT\n\npivot high: \n' + str.tostring(ZigZag)))

if GoLong

label.new(bar_index, ZigZag, style=label.style_label_up, color=color.lime, text=str.tostring('LONG\n\npivot low: \n' + str.tostring(ZigZag)))

var float stoploss_long = low

var float stoploss_short = high

pl = ta.valuewhen(momentumUP, ZigZag, 0)

ph = ta.valuewhen(momentumDOWN, ZigZag, 0)

if GoLong

stoploss_long := low < pl ? low : pl

stoploss_long

if GoShort

stoploss_short := high > ph ? high : ph

stoploss_short

TakeProfitLevel=input(200)

if GoLong

alertsyntax_golong = 'long slprice=' + str.tostring(stoploss_long) + ' tp=' + str.tostring(TakeProfitLevel)

alert(message=alertsyntax_golong, freq=alert.freq_once_per_bar_close)

if GoShort

alertsyntax_goshort = 'short slprice=' + str.tostring(stoploss_short) + ' tp=' + str.tostring(TakeProfitLevel)

alert(message=alertsyntax_goshort, freq=alert.freq_once_per_bar_close)

if GoLong

strategy.entry("Enter Long", strategy.long)

else if GoShort

strategy.entry("Enter Short", strategy.short)

- VWMA-ADX Momentum and Trend-Based Bitcoin Long Strategy

- Smarter MACD

- Adaptive Moving Average Crossover Strategy

- Dual Moving Average Momentum Tracking Quantitative Strategy

- Multi-Moving Average Crossover Trend Following Strategy with Volatility Filter

- Multi-Period Moving Average Crossover Trend Following Strategy

- BB Breakout Strategy

- Bollinger Bands and Moving Average Crossover Strategy

- Dynamic RSI Smart Timing Swing Trading Strategy

- MACD and RSI Combined Natural Trading Strategy

- RedK Momentum Bars

- SuperJump Turn Back Bollinger Band

- Fukuiz Trend

- Johny's BOT

- SSL Hybrid

- Chandelier Exit

- RISOTTO

- EMA Cloud Intraday Strategy

- Pivot Point Supertrend

- Supertrend+4moving

- VuManChu Cipher B + Divergences Strategy

- Concept Dual SuperTrend

- Super Scalper

- Backtesting- Indicator

- Trendelicious

- Sma BTC killer

- ML Alerts Template

- Fibonacci Progression With Breaks

- RSI MTF Ob+Os

- Fukuiz Octa-EMA + Ichimoku