概述

该策略利用了多个移动平均线(VWMA)、平均方向性指数(ADX)以及动向指标(DMI)来捕捉比特币市场中的多头机会。通过结合价格动量、趋势方向和交易量等多个技术指标,该策略旨在找到上涨趋势强劲、动量充足的入场点,同时严格控制风险。

策略原理

- 使用9日和14日VWMA来判断多头趋势,当短期均线上穿长期均线时产生多头信号。

- 引入一条由89日最高价和最低价VWMA构建的自适应均线作为趋势过滤,只有当收盘价或开盘价高于该均线时才考虑开仓。

- 通过ADX和DMI指标来确认趋势强度,只有当ADX大于18且+DI与-DI的差值大于15时,才认为趋势足够强劲。

- 利用交易量百分位函数过滤出交易量处于60%~95%区间的棒线,避开交易量过低的时段。

- 设置止损位于前一根K线高点的0.96~0.99倍,并且随着时间框架的增大而递减,以控制风险。

- 达到预设的持仓时间或价格跌破自适应均线时平仓。

优势分析

- 结合多个技术指标,从趋势、动量和交易量等多个维度来评估市场状态,信号更加可靠。

- 自适应均线和交易量过滤机制能够有效过滤掉虚假信号,减少无效交易。

- 严格的止损设置和持仓时间限制,大大降低了策略的风险敞口。

- 代码模块化设计,可读性和可维护性较好,便于进一步优化和扩展。

风险分析

- 当市场处于震荡或趋势不明朗时,该策略可能会产生较多的虚假信号。

- 止损位置相对较近,在行情波动较大时可能会过早触发止损,导致损失扩大。

- 缺乏对宏观经济形势和重大事件的考量,面对”黑天鹅”事件可能会失效。

- 参数设置相对固定,缺乏自适应性,在不同的市场环境下表现可能不稳定。

优化方向

- 引入更多能够刻画市场环境的指标,如相对强弱指数(RSI)、布林带等,提高信号的可靠性。

- 对止损位置进行动态优化,例如采用ATR或百分比止损,以应对不同的市场波动状况。

- 结合宏观经济数据和舆情分析,对策略的风险控制模块进行增强。

- 采用机器学习算法对参数进行自动优化,提高策略的适应性和稳定性。

总结

VWMA-ADX 比特币多头策略通过综合考虑价格趋势、动量、交易量等多个技术指标,能够较为有效地捕捉比特币市场中的上涨机会。同时,严格的风控措施和清晰的平仓条件,使得该策略的风险得到了较好的控制。但是,该策略也存在一些局限性,如对市场环境变化的适应性不足,以及止损策略有待优化等。未来可以从信号的可靠性、风险控制、参数优化等方面入手,进一步提升策略的稳健性和盈利能力。总的来说,VWMA-ADX 比特币多头策略为投资者提供了一种基于动量和趋势的系统化交易思路,值得进一步探索和改进。

策略源码

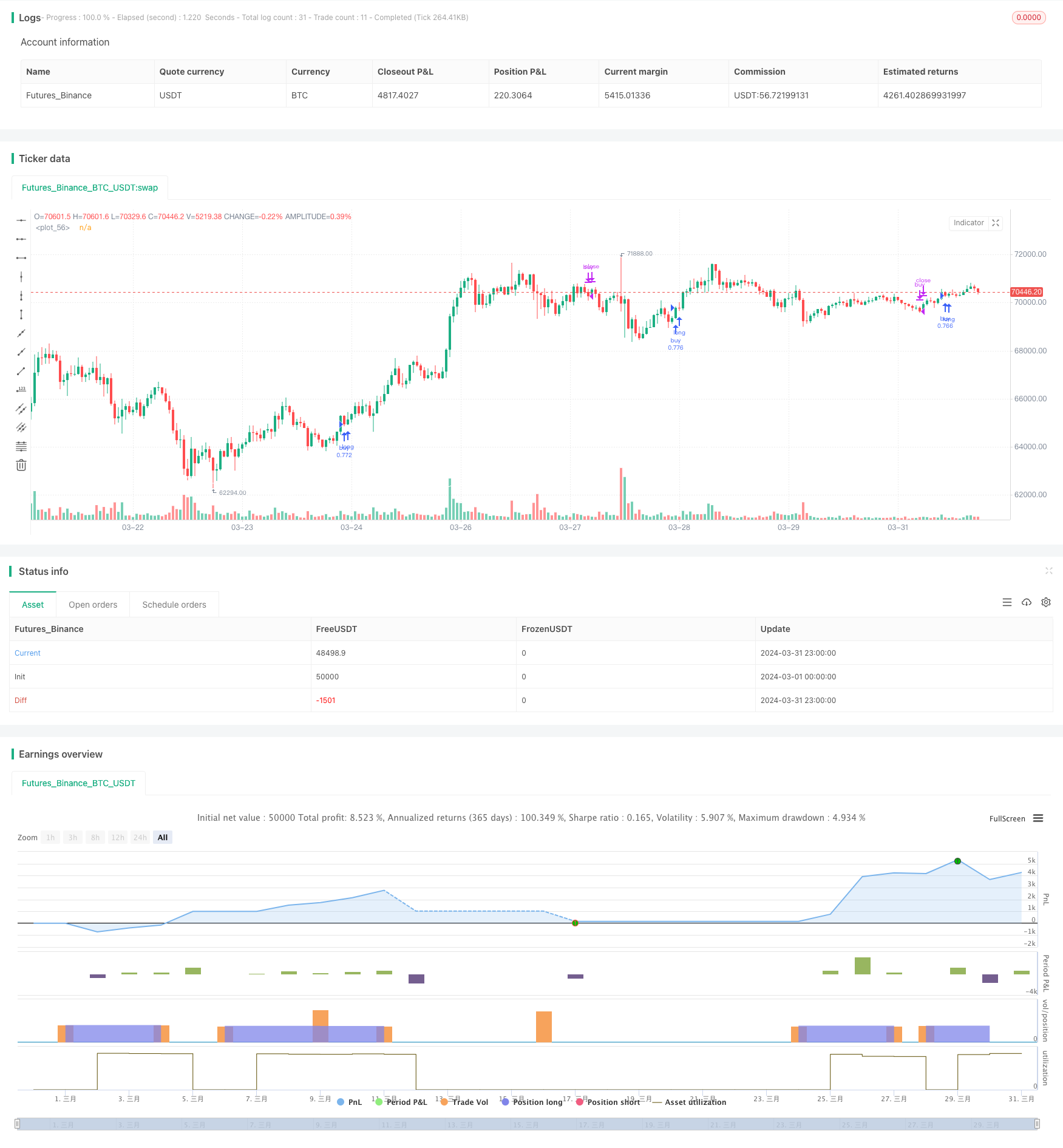

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Q_D_Nam_N_96

//@version=5

strategy("Long BTC Strategy", overlay=true,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100, initial_capital = 1000, currency = currency.USD)

Volume_Quartile(vol) =>

qvol1 = ta.percentile_linear_interpolation(vol, 60,15)

qvol2 = ta.percentile_linear_interpolation(vol, 60,95)

vol > qvol1 and vol < qvol2

smma(src, length) =>

smma = 0.0

smma := na(smma[1]) ? ta.sma(src, length) : (smma[1] * (length - 1) + src) / length

smma

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"RMA" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

"HMA" => ta.hma(source, length)

"SMMA" => smma(source, length)

DMI(len, lensig) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

trur = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / trur)+11

minus = fixnan(100 * ta.rma(minusDM, len) / trur)-11

sum = plus + minus

adx = 100 * ta.vwma(math.abs(plus - minus-11) / (sum == 0 ? 1 : sum), lensig)

[adx, plus, minus]

cond1 = Volume_Quartile(volume*hlcc4)

ma1 = ma(close,9, "VWMA")

// plot(ma1, color = color.blue)

ma2 = ma(close,14, "VWMA")

// plot(ma2, color = color.orange)

n = switch timeframe.period

"240" => 0.997

=> 0.995

ma3 = (0.1*ma(ta.highest(close,89),89, "VWMA") +

0.9*ma(ta.lowest(close,89),89, "VWMA"))*n

plot(ma3, color = color.white)

[adx, plus, minus] = DMI(7, 10)

cond2 = adx > 18 and plus - math.abs(minus) > 15

var int count = 0

if barstate.isconfirmed and strategy.position_size != 0

count += 1

else

count := 0

p_roc = 0

if timeframe.period == '240'

p_roc := 14

else

p_roc := 10

longCondition = ta.crossover(ma1, ma2) and (close > open ? close > ma3 : open > ma3) and ((ma3 - ma3[1])*100/ma3[1] >= -0.2) and ((close-close[p_roc])*100/close[p_roc] > -2.0)

float alpha = 0.0

float sl_src = high[1]

if (longCondition and cond1 and cond2 and strategy.position_size == 0)

strategy.entry("buy", strategy.long)

if timeframe.period == '240'

alpha := 0.96

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+5, sl_src*alpha, width = 2, color = color.white)

else if timeframe.period == '30'

alpha := 0.985

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

else if timeframe.period == '45'

alpha := 0.985

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

else if timeframe.period == '60'

alpha := 0.98

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

else if timeframe.period == '120'

alpha := 0.97

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

else if timeframe.period == '180'

alpha := 0.96

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

else if timeframe.period == 'D'

alpha := 0.95

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

else

alpha := 0.93

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

period = switch timeframe.period

"240" => 90

"180" => 59

"120" => 35

"30" => 64

"45" => 40

"60" => 66

"D" => 22

=> 64

if (count > period or close < ma3)

strategy.close('buy', immediately = true)

相关推荐

- 多均线交叉趋势跟踪与波动率过滤策略

- 多周期均线交叉趋势跟踪策略

- 双均线交叉动量跟踪量化策略

- Momentum-based ZigZag

- 自适应移动平均线交叉策略

- BB均线突破策略

- 布林带交叉移动平均策略

- 多指标融合动态移动平均线交叉量化策略

- 动态RSI智能择时波段交易策略

- 多周期均线带及MACD交叉策略系统

全部留言

qazwsz888

加个移动止盈会好些吧

2024-04-03 21:16:00