RSI Cross-Cycle Trading Strategy

Author: ChaoZhang, Date: 2023-10-25 11:20:59Tags:

Overview

This strategy utilizes the overbought and oversold principles of the RSI indicator and combines multi-cycle RSI to generate signals, realizing cross-cycle operations. The strategy judges overbought and oversold signals according to the cycle settings of RSI, and uses the moving average of RSI for filtering to avoid wrong signals. It generates a buy signal when RSI crosses over its moving average and a sell signal when crossing below, forming a typical moving average crossover operating mode.

Strategy Logic

The strategy mainly generates trading signals through the overbought and oversold judgments of the RSI indicator. RSI stands for Relative Strength Index, its formula is: RSI = 100 - (100 / (1 + RS)), where RS is the ratio of average closing gains over average closing losses over a period. The RSI index ranges from 0 to 100, generally regarded as oversold below 30 and overbought above 70.

The strategy sets a high parameter sobrecompra and a low parameter sobreventa. When RSI is higher than sobrecompra, it is judged as overbought. When RSI is lower than sobreventa, it is judged as oversold. The default values of sobrecompra and sobreventa in the strategy are 70 and 30 respectively.

To generate buy and sell signals, the strategy uses the moving average line of the RSI indicator for filtering. When RSI crosses over its moving average line, the buy signal Es_compra is generated. When RSI crosses below its moving average line, the sell signal Es_venta is generated. The moving average parameter periodos_media defaults to 14 periods.

After generating buy and sell signals, the strategy opens positions for long or short trading. In addition, the strategy also sets stop loss and take profit in percentage to prevent excessive losses and lock in profits.

Advantages of the Strategy

Use RSI indicator to judge overbought and oversold conditions, avoiding chasing highs and selling lows.

Apply the moving average of RSI indicator for filtering to avoid false signals.

Combine multi-cycle settings of RSI indicator to generate more stable trading signals.

Set stop loss and take profit mechanisms to effectively control risks.

The strategy logic is simple and clear, easy to understand and modify.

Customizable parameters, adaptable to different products and cycles.

Risks of the Strategy

RSI indicator has lagging effect, may miss the best timing for price reversal.

Moving average causes trading signal delays, unable to capture trend reversals in time.

Fixed overbought and oversold parameter settings are not flexible enough, need adjustments for different cycles and products.

Improper stop loss and take profit settings may lead to losses or missed profits.

Long and short positions are only 1 lot, unable to fully utilize funds for spread trading.

Optimization Directions

Combine other indicators such as MACD, KD for trading signal judgment.

Apply adaptive moving average to track trends.

Set dynamic overbought and oversold parameters, adjust based on market volatility.

Optimize stop loss and take profit algorithms, such as trailing stop loss.

Add position management mechanism, dynamically adjust positions based on capital size.

Add trend filtering to avoid frequent trading in range-bound markets.

Backtest to optimize parameters and select the optimal parameter combination.

Summary

This strategy is based on the overbought and oversold principles of RSI indicator, uses moving average for filtering to generate trading signals, realizing typical cross-cycle trading. The strategy has clear logical structure and parameter settings, adaptable to different products and cycles through parameter tuning, making it a reliable and effective cross-cycle trading strategy. But limitations also exist in tools like RSI and moving average, requiring further optimizations to make strategy parameters more adaptive, filtering effects better, and risk lowered and profit increased to the maximum extent.

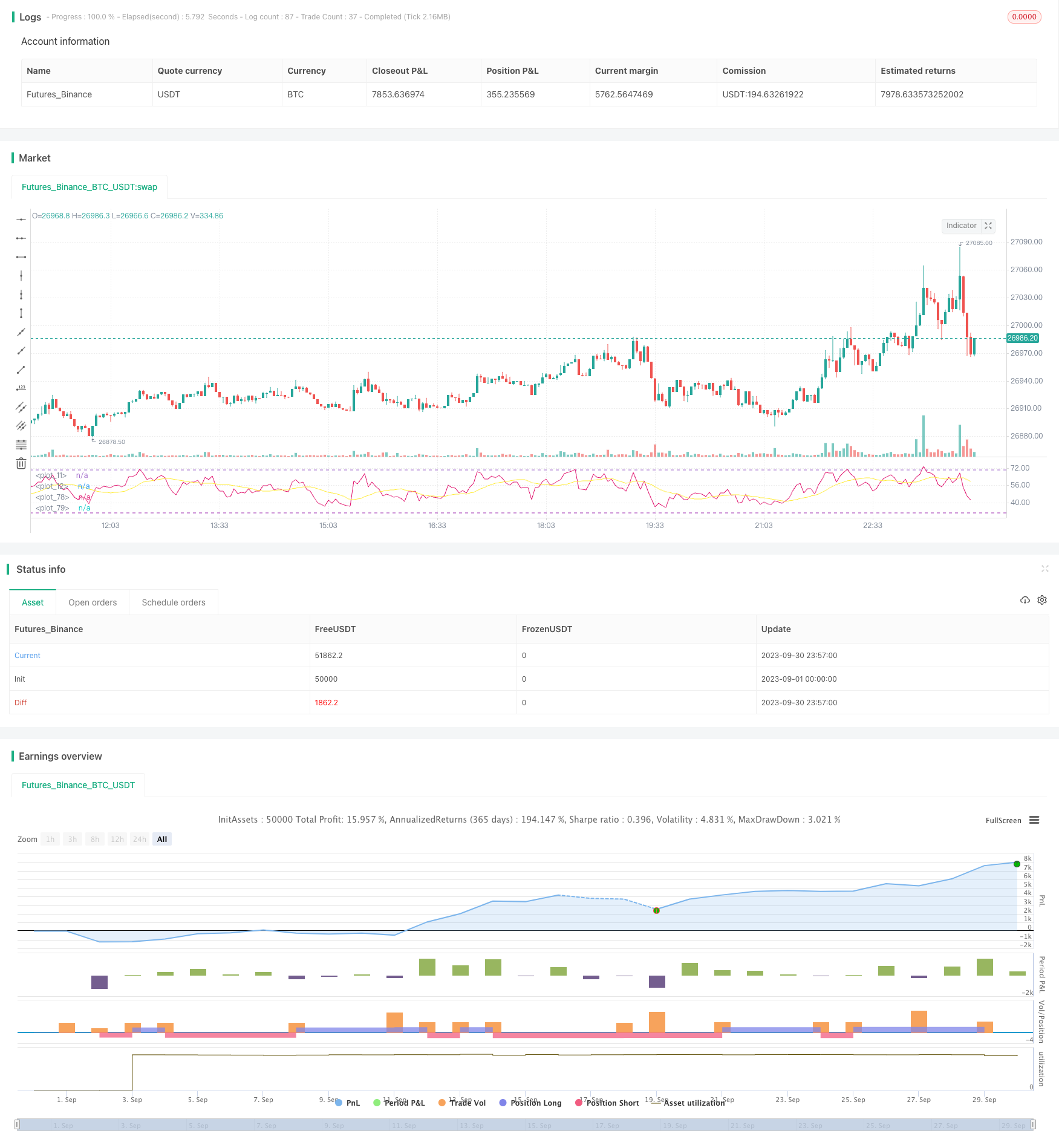

/*backtest

start: 2023-09-01 00:00:00

end: 2023-09-30 23:59:59

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © samuelkanneman

//@version=4

strategy("RSI KANNEMAN")

//////Entrada///////

i_startTime = input(title="Start Date Filter", defval=timestamp("01 Nov 2020 13:30 +0000"), type=input.time, tooltip="Date & time to begin trading from")

i_endTime = input(title="End Date Filter", defval=timestamp("1 Nov 2022 19:30 +0000"), type=input.time, tooltip="Date & time to stop trading")

sobrecompra= input(70, title="Sobre Compra", type=input.integer ,minval=50, maxval=100 )

sobreventa= input(30, title="Sobre Venta", type=input.integer ,minval=0, maxval=50 )

l1=hline(sobrecompra)

l2=hline(sobreventa, color=color.purple)

periodos= input(14, title="Periodos", type=input.integer ,minval=1, maxval=50 )

periodos_media= input(14, title="Logintud media movil", type=input.integer ,minval=1, maxval=200 )

var SL =0.0

var TP=0.0

StopLoss = input(2.0, title="SL %", step=0.2)

TakeProfit = input(5.0, title="TP %", step=0.2)

//////Proceso///////

mi_rsi=rsi(close,periodos)

mm_rsi=sma(mi_rsi,periodos_media)

Es_compra= crossover(mm_rsi,sobreventa)

Es_venta= crossunder(mm_rsi,sobrecompra)

comprado= strategy.position_size > 0

vendido = strategy.position_size < 0

//time to test

dateFilter = true

//timePeriod = time >= timestamp(syminfo.timezone, 2020, 11, 1, 0, 0)

// long

if (not comprado and Es_compra and dateFilter )

// realizar long

cantidad = strategy.equity/hlc3

strategy.entry ("compra", strategy.long , cantidad)

SL := close*(1-(StopLoss/100))

TP := close*(1+(TakeProfit/100))

if close >= TP

strategy.close ("compra" , comment="Salto TP")

if (comprado and Es_venta )

strategy.close ("compra" , comment="Sobre Venta")

if close <= SL

strategy.close ("compra" , comment="Salto SL")

// short

if (not vendido and Es_venta and dateFilter )

// realizar short

cantidad = strategy.equity/hlc3

strategy.entry ("venta", strategy.short , cantidad)

SL := close*(1+(StopLoss/100))

TP := close*(1-(TakeProfit/100))

if close <= TP

strategy.close ("venta" , comment="Salto TP")

if (vendido and Es_compra )

strategy.close ("venta" , comment="Sobre Compra")

if close >= SL

strategy.close ("venta" , comment="Salto SL")

///////Salida//////

fill(l1,l2)

plot(mi_rsi)

plot(mm_rsi, color=color.yellow)

bgcolor(Es_compra ? color.blue : na , transp=0)

bgcolor(Es_venta ? color.red : na , transp=0)

// 1d 70 22 5 4 3 15 6 meses

//1h 70 20 6 4 5 7 1 mese

//15m 70 20 5 4 4 7 1 semana

- Ichimoku Balance Line trend following Strategy

- Dual EMA Spread Breakout Strategy

- Contrarian Breakout Trading Strategy

- Williams VIX Fix Strategy

- RSI Dual-rail Oscillation Line Long and Short Bi-directional Trading Strategy

- Multi-factor Momentum Rotation Strategy

- RSI EMA Crossover Strategy

- Trend Following Dual Moving Average Strategy

- Glory Hole Breakout Strategy

- Heiken Ashi Moving Average Crossover Strategy with MACD Filter V3

- SuperTrend Enhanced Pivot Reversal Strategy

- Momentum Arbitrage Strategy Backtest Analysis

- Mean Reversion Bollinger Bands Strategy

- Linear Regression Moving Average Trading Strategy

- Dual Bandpass Filter Strategy

- Dual Moving Average Cross Market Trading Strategy

- Bollinger Band Fitting Strategy

- Bull and Bear Power Backtest Strategy

- Moving Average Crossover Strategy

- Stochastic Momentum Breakout Strategy