Momentum Tracking CCI Strategy

Author: ChaoZhang, Date: 2023-10-25 17:37:39Tags:

Overview

This strategy is based on the Commodity Channel Index (CCI) indicator, aiming to go long in oversold conditions and go short in overbought conditions. It also optionally uses an Exponential Moving Average (EMA) filter to only trade in the direction of the trend. The strategy also provides fixed percentage or Average True Range (ATR) based stop loss and take profit.

Strategy Logic

Use CCI indicator to determine market trend

CCI measures momentum by comparing current price to the average price over a period

CCI above 150 is overbought, below -100 is oversold

Optionally use EMA filter

Only go long when price is above EMA, and short when below EMA

Use EMA to determine trend direction, avoid counter-trend trading

Provide two types of stop loss and take profit

Fixed percentage based stop loss and take profit: Use fixed percentage of entry price

ATR based stop loss and take profit: Use ATR multiplier for stop loss, calculate take profit based on risk reward ratio

Entry conditions

Go long when CCI crosses above -100

Go short when CCI crosses below 150

If EMA enabled, only enter when price is on right side of EMA

Exit conditions

Close position when stop loss or take profit is hit

Close position when CCI re-enters overbought/oversold region

Plotting

- Plot CCI indicator, color code regions

Advantage Analysis

Use CCI overbought/oversold for entry, a classic usage of CCI

Optional EMA ensures trading with the trend, avoid reversals

Provide two types of stop loss/take profit for flexibility

Close on CCI signal again locks in reversal profit

Plotting highlights CCI signals clearly

Simple and clear logic, easy to understand and optimize

Risk Analysis

CCI has lagging effect, may miss reversals or give false signals

Wrong EMA parameters may miss trends or render strategy ineffective

Fixed percentage stop loss/take profit less adaptive to market changes

ATR stop loss/take profit sensitive to ATR period, should optimize

Larger drawdown risk, position sizing should be adjusted

Performance varies across market conditions, re-evaluate parameters

Optimization Directions

Evaluate CCI periods to find optimal parameter combinations

Test different EMA periods for best trend estimation

Adjust stop loss/take profit for optimal risk reward ratio

Add other filters like volume to further avoid false signals

Combine with trendlines/chart patterns for pattern confirmation

Add position sizing rules like fixed size to control drawdown

Backtest across different market conditions, dynamically adjust

Summary

The strategy utilizes the classic CCI overbought/oversold principles for entry. The EMA filter controls trend trading. Two types of stop loss/take profit provided for flexibility. Plotting highlights signals clearly. Simple and clear logic, easy to understand and optimize. Further improvements can be made via parameter tuning, adding filters, risk control etc.

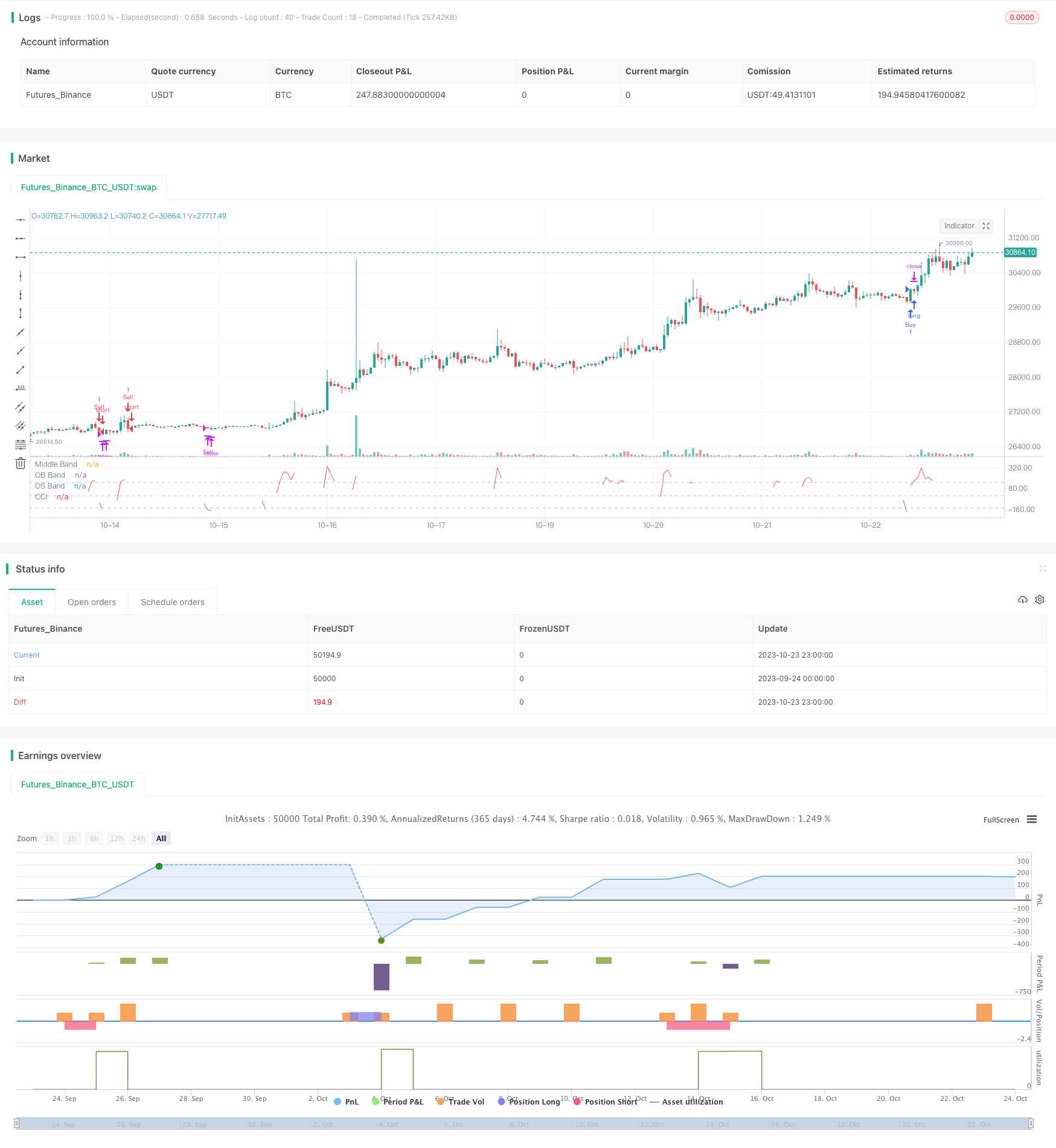

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © alifer123

//@version=5

// strategy("CCI+EMA Strategy with Percentage or ATR TP/SL [Alifer]", shorttitle = "CCI_EMA_%/ATR_TP/SL", overlay=false,

// initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=10, commission_type=strategy.commission.percent, commission_value=0.045)

length = input(14, "CCI Length")

overbought = input.int(150, step = 10, title = "Overbought")

oversold = input.int(-140, step = 10, title = "Oversold")

src = hlc3

ma = ta.sma(src, length)

cci = (src - ma) / (0.015 * ta.dev(src, length))

// EMA

useEMA = input(true, "Use EMA", tooltip = "Only enters long when price is above the EMA, only enters short when price is below the EMA")

emaLength = input(55, "EMA Length")

var float ema = na

if useEMA

ema := ta.ema(src, emaLength)

// Take Profit and Stop Loss Method

tpSlMethod_percentage = input(true, "Percentage TP/SL", group="TP/SL Method")

tpSlMethod_atr = input(false, "ATR TP/SL", group="TP/SL Method")

// Percentage-based Take Profit and Stop Loss

tp_percentage = input.float(10.0, title="Take Profit (%)", step=0.1, group="TP/SL Method")

sl_percentage = input.float(10.0, title="Stop Loss (%)", step=0.1, group="TP/SL Method")

// ATR-based Take Profit and Stop Loss

atrLength = input(20, title="ATR Length", group="TP/SL Method")

atrMultiplier = input(4, title="ATR SL Multiplier", group="TP/SL Method")

riskRewardRatio = input(2, title="Risk Reward Ratio", group="TP/SL Method")

// Calculate TP/SL levels based on the selected method, or leave them undefined if neither method is selected

longTP = tpSlMethod_percentage ? strategy.position_avg_price * (1 + tp_percentage / 100) : na

longSL = tpSlMethod_percentage ? strategy.position_avg_price * (1 - sl_percentage / 100) : na

shortTP = tpSlMethod_percentage ? strategy.position_avg_price * (1 - tp_percentage / 100) : na

shortSL = tpSlMethod_percentage ? strategy.position_avg_price * (1 + sl_percentage / 100) : na

if tpSlMethod_atr

longSL := strategy.position_avg_price - ta.atr(atrLength) * atrMultiplier

longTP := ((strategy.position_avg_price - longSL) * riskRewardRatio) + strategy.position_avg_price

shortSL := strategy.position_avg_price + ta.atr(atrLength) * atrMultiplier

shortTP := ((strategy.position_avg_price - shortSL) * riskRewardRatio) - strategy.position_avg_price

// Enter long position when CCI crosses below oversold level and price is above EMA

longCondition = ta.crossover(cci, oversold) and (not useEMA or close > ema)

if longCondition

strategy.entry("Buy", strategy.long)

// Enter short position when CCI crosses above overbought level and price is below EMA

shortCondition = ta.crossunder(cci, overbought) and (not useEMA or close < ema)

if shortCondition

strategy.entry("Sell", strategy.short)

// Close long positions with Take Profit or Stop Loss

if strategy.position_size > 0

strategy.exit("Long Exit", "Buy", limit=longTP, stop=longSL)

// Close short positions with Take Profit or Stop Loss

if strategy.position_size < 0

strategy.exit("Short Exit", "Sell", limit=shortTP, stop=shortSL)

// Close positions when CCI crosses back above oversold level in long positions or below overbought level in short positions

if ta.crossover(cci, overbought)

strategy.close("Buy")

if ta.crossunder(cci, oversold)

strategy.close("Sell")

// Plotting

color_c = cci > overbought ? color.red : (cci < oversold ? color.green : color.white)

plot(cci, "CCI", color=color_c)

hline(0, "Middle Band", color=color.new(#787B86, 50))

obband = hline(overbought, "OB Band", color=color.new(#78867a, 50))

osband = hline(oversold, "OS Band", color=color.new(#867878, 50))

fill(obband, osband, color=color.new(#787B86, 90))

- EMA Mean Reversion Trading Strategy

- Multi-indicator Combination Trading Strategy

- Multi-Factor Strategy Combination

- The strategy of voting with a stopgap

- Two-stage Stop Loss Strategy

- Quantitative Trading Strategy Based on Multiple Indicators

- Price Gap and Trend Following Trading Strategy

- Breakout Scalper - Catching Trend Changes Quickly

- EMA Crossover tracking Strategy

- SSL Channel Breakout Strategy with Trailing Stop Loss

- Gradual Accumulation Breakout Trading Strategy

- Dynamic Candle Direction Strategy

- RSI Divergence Trading Strategy

- Multi-indicator Decision Based Short Term Trend Strategy

- Multi Timeframe MACD Heatmap Strategy

- Double Moving Average Crossover Strategy

- ATR Adjustable Trailing Stop Loss Strategy

- Bollinger Band Width Scaling Double Moving Average Trend Filter Strategy

- Gradient Trailing Stop Loss Strategy

- Bollinger Bands and RSI indicators strategy