Overview

This strategy aims to implement an auto buy-in and hold coin scalper trading strategy based on the Stochastic RSI and EMA technical indicators. It is designed for 5-minute candlesticks, optimized for BTC. The goal is to hold coin as much as possible during sideways or non-significant downtrends.

Strategy Logic

The strategy uses RSI indicator to determine overbought and oversold levels, combined with the relationship between K and D values of Stochastic RSI to generate buy and sell signals.

It will trigger a buy signal when Stochastic RSI K line is below 20, considered oversold, and K is above D. After that, it will determine whether to sell based on three conditions: 1) price rises over 1% followed by EMA reversal; 2) Stochastic RSI K line below D; 3) stop loss price reaches 98.5% of entry price.

In addition, a downward turn of short term EMA after an uptrend will also be considered a sell signal.

Advantages

- Using Stochastic RSI for entry timing is more reliable, filtering false breakouts effectively.

- Incorporating EMA can better detect trend change timing.

- Applying stop loss helps control losses effectively.

- Holding coin as much as possible reduces trading frequency and fees.

Risks

- Potential false signals from RSI indicator. Fine tuning RSI parameters may help optimize.

- Stop loss set too tight may lead to expanded losses. Adjusting stop loss percentage appropriately.

- Improper EMA parameter setting may miss trend change timing. Testing different EMA periods.

Optimization Directions

- Test different combinations of RSI and Stochastic RSI parameters for optimal setting.

- Try different stop loss percentages to balance loss prevention and pullbacks.

- Test long and short EMA combinations to determine best parameters for catching trend changes.

- Consider adding other indicators to improve entry and exit timing accuracy.

Summary

This strategy integrates the strengths of Stochastic RSI, EMA and other indicators, using relatively robust methods to determine entry and exit timing. Further improvements on profitability and stability can be achieved through parameter optimization and risk management. Overall the strategy logic is sound and worth verifying and optimizing in live trading.

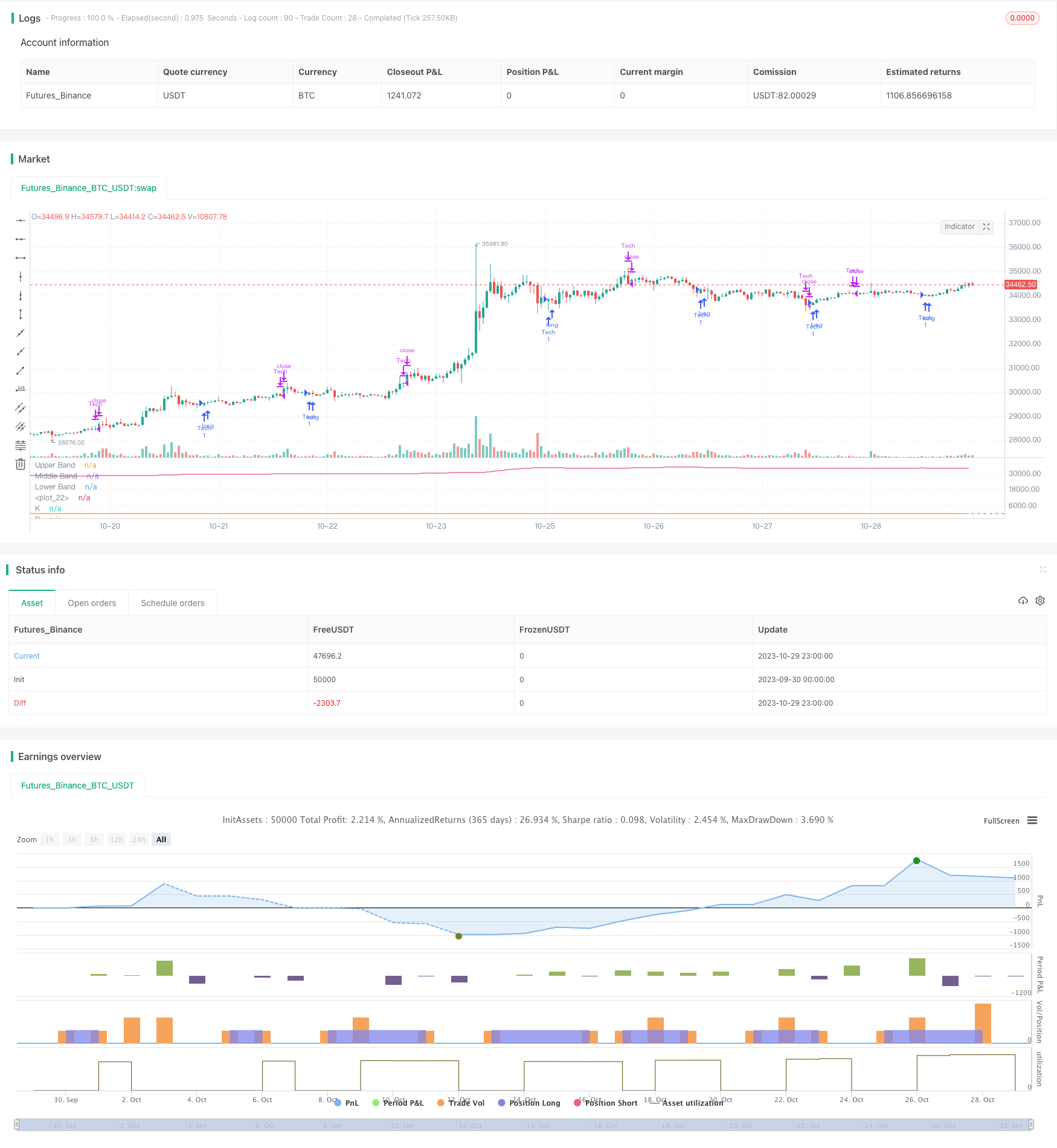

/*backtest

start: 2023-09-30 00:00:00

end: 2023-10-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Stochastic RSI W Auto Buy Scalper Scirpt III ", shorttitle="Stoch RSI_III", format=format.price, precision=2)

smoothK = input.int(3, "K", minval=1)

smoothD = input.int(3, "D", minval=1)

lengthRSI = input.int(14, "RSI Length", minval=1)

lengthStoch = input.int(14, "Stochastic Length", minval=1)

src = input(close, title="RSI Source")

rsi1 = ta.rsi(src, lengthRSI)

k = ta.sma(ta.stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = ta.sma(k, smoothD)

plot(k, "K", color=#2962FF)

plot(d, "D", color=#FF6D00)

h0 = hline(80, "Upper Band", color=#787B86)

hline(50, "Middle Band", color=color.new(#787B86, 50))

h1 = hline(20, "Lower Band", color=#787B86)

longStopLoss = strategy.opentrades.entry_price(0)* (.985)

stochDropping = ta.falling(k,2)

shortSma = ta.sma(hlc3,12)

shorterSma = ta.sma(hlc3,3)

plot(shortSma[3])

shortSmaFlip = (ta.change(shortSma,3)>0) and ta.falling(hlc3,1)

shorterSmaFlip = (ta.change(shorterSma,2)>0) and ta.falling(hlc3,1)

messageSellText ='"type": "sell", "symbol": "BTCUSD", "marketPosition": "{{strategy.market_position}}"'

messageBuyText ='"type": "buy", "symbol": "BTCUSD", "marketPosition": {{strategy.market_position}}"'

fill(h0, h1, color=color.rgb(33, 150, 243, 90), title="Background")

strategy.entry("Tech", strategy.long, when=(strategy.position_size <= 0 and k<17 and k>d),alert_message=messageBuyText)

//original: strategy.close("TL", when=(strategy.position_size >= 0 and (k>90 and k<d)))

takeProfit = hlc3 > strategy.opentrades.entry_price(0)*1.01

//longStopLoss = strategy.opentrades.entry_price(0)* (.995)

strategy.close("Tech", when=(strategy.position_size >= 0 and (k>90 and k<d and stochDropping)) or close<longStopLoss, comment="rsi or Stop sell",alert_message=messageSellText)

//strategy.close("Tech", when=(strategy.position_size >= 0 and close<longStopLoss), comment="stopLoss sell",alert_message=messageSellText)

strategy.close("Tech", when=(shortSmaFlip and k>20 and takeProfit),comment="Sma after profit",alert_message=messageSellText)