RSI Daredevil Squadron Fusion Strategy

Author: ChaoZhang, Date: 2023-11-02 14:52:03Tags:

Overview

The RSI Daredevil Squadron Fusion Strategy is a fusion strategy combining the RSI indicator, Ichimoku Cloud, and 200-day moving average. It identifies bullish or bearish RSI daredevil patterns and uses the Ichimoku Cloud to determine trend direction and the 200-day MA as support/resistance for additional signal confirmation before generating trading signals.

Strategy Logic

Firstly, this strategy uses the RSI indicator to identify bullish or bearish daredevil patterns. The RSI daredevil pattern refers to a bearish pattern when price makes a new high but RSI does not, or a bullish pattern when price makes a new low but RSI does not. This pattern often implies an impending price reversal.

Secondly, the strategy uses the Ichimoku Cloud’s leading line 1 and leading line 2 to determine the trend direction. An uptrend is identified when leading line 1 is above leading line 2, and a downtrend when below. The Ichimoku Cloud determines trend direction through the combination of the conversion line, base line, and lagging span, and is considered a reliable trend identification tool.

Lastly, the 200-day moving average is also introduced. The MA is often seen as an important support/resistance level. When the Ichimoku Cloud shows an uptrend and price stands above the 200-day MA, it gives a bullish signal. Conversely, when the Cloud shows a downtrend and price breaks below the 200-day MA, it gives a bearish signal.

By combining signals from multiple indicators, some false signals can be filtered out, making trade decisions more reliable. Only when the RSI shows a daredevil pattern, the Ichimoku Cloud confirms the trend direction, and the price-MA relationship meets expectations, will this strategy generate actual trading signals.

Advantages

The biggest advantage of this multi-indicator fusion strategy is filtering out false signals and improving reliability of trading decisions.

Firstly, the RSI daredevil pattern itself has some predictive power to spot potential price reversals ahead of time. But the pattern alone is insufficient to determine trade signals.

Secondly, introducing the Ichimoku Cloud provides better trend direction judgment, avoiding wrong signals in range-bound markets. The combination of leading lines is very effective for trend identification.

Lastly, the support/resistance effect of the 200-day MA also helps further confirm signal reliability. Trading signals are only generated when the Ichimoku Cloud confirms the trend and the price-MA relationship is appropriate.

In summary, by requiring consensus across indicators, this multi-indicator strategy can screen out many false signals and only generate actual signals when alignment exists. This is the biggest advantage of the strategy.

Risks

Although the multi-indicator strategy helps improve signal quality, some risks need to be noted:

Firstly, the more complex strategy may miss out on some opportunities that individual indicators could catch. Being too conservative may lead to insufficient signal generation.

Secondly, conflicts may exist between different indicators. For example, the RSI may show a daredevil pattern while the Ichimoku Cloud trend conflicts. How to balance different indicators is a challenge.

Thirdly, parameter settings also greatly impact the strategy. Inappropriate moving average periods, RSI parameters etc. may undermine strategy performance.

Lastly, there is still large room for optimization between components. Machine learning algorithms could potentially enable dynamic parameter optimization based on changing market conditions. More indicators could also be tested to find better combinations.

In general, the biggest risk is increased complexity and difficulty of optimizing a multi-indicator combination. Continuous testing and optimization across different market environments is needed for the strategy to reach its maximum potential.

Optimization Opportunities

Some optimization opportunities for this strategy include:

-

Test different indicator parameter settings and optimize parameters. Moving average periods, RSI parameters etc. could be evaluated to find the optimal combination.

-

Introduce other indicators like MACD, Bollinger Bands to enrich the multi-indicator mix and find better combinations.

-

Utilize machine learning algorithms to dynamically optimize parameters based on market conditions, allowing the strategy to auto adjust its settings.

-

Incorporate stop loss strategies to control trading risk. Consider stop losses when price breaks through support/resistance levels.

-

Optimize entry opportunities by reducing filtering standards for more chances, while balancing risk/reward.

-

Optimize code based on backtesting results to reduce resource usage and improve efficiency.

-

Explore more complex relationships between indicators to find stronger combined signals, but be wary of over-optimization risks.

Conclusion

The RSI Daredevil Squadron Fusion Strategy filters out noise through a multi-indicator confirmation mechanism, improving signal quality. The key advantage is multiple indicator consensus, which reduces false signals but also introduces complexity. Much room remains for future optimization, especially around parameters and indicator combinations. Overall it represents a relatively conservative and reliable trading strategy worthy of further research and exploration.

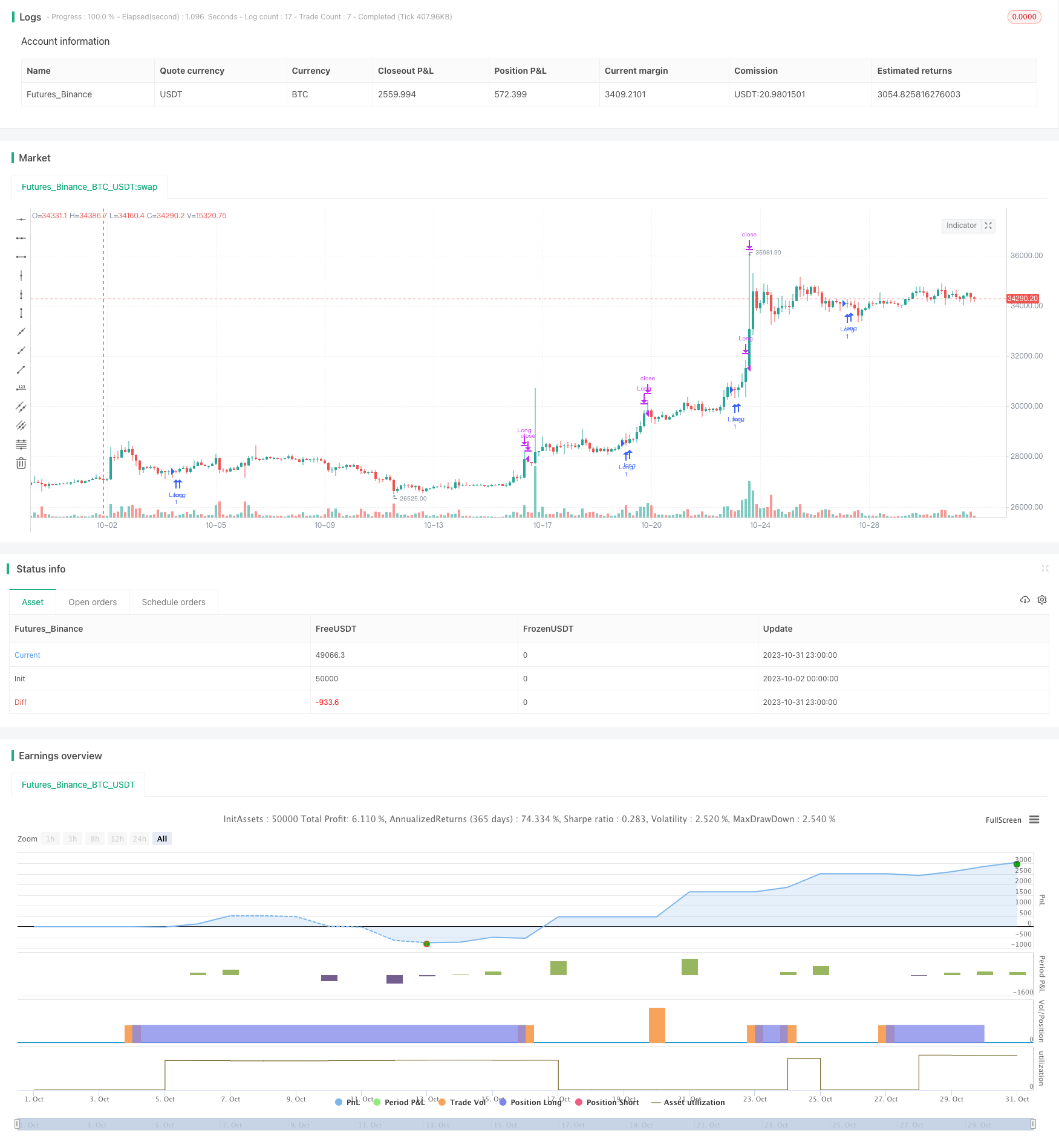

/*backtest

start: 2023-10-02 00:00:00

end: 2023-11-01 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © tradethrills

//@version=4

strategy("RSI Divergence X Ichimoku Cloud X 200EMA", overlay=true)

//RSI Indicator

len = input(defval=14, minval=1)

src = input(defval=close)

lbR = input(defval=5)

lbL = input(defval=5)

takeProfitLevellong = input(minval = 70, defval = 75)

takeProfitLevelshort = input(minval = 30, defval = 25)

rangeUpper = input(defval=60)

rangeLower = input(defval=5)

//200 EMA

ema200 = ema(close, 200)

//Ichimoku Cloud Indicator

conversionPeriods = input(9, minval=1)

basePeriods = input(26, minval=1)

laggingSpan2Periods = input(52, minval=1)

displacement = input(26, minval=1)

donchian(len) => avg(lowest(len), highest(len))

conversionLine = donchian(conversionPeriods)

baseLine = donchian(basePeriods)

leadLine1 = avg(conversionLine, baseLine)

leadLine2 = donchian(laggingSpan2Periods)

abovecloud = max(leadLine1, leadLine2)

belowcloud = min(leadLine1, leadLine2)

//RSI Divergence Strategy

osc = rsi(src, len)

_inrange(cond) =>

bars = barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

pricelowfound = na(pivotlow(osc, lbL, lbR)) ? false : true

pricehighfound = na(pivothigh(osc, lbL, lbR)) ? false : true

//Regular Bullish

osc_higherlow = osc[lbR] > valuewhen(pricelowfound, osc[lbR], 1) and _inrange(pricelowfound[1])

price_lowerlow = low[lbR] < valuewhen(pricelowfound, low[lbR], 1)

bullCond = price_lowerlow and osc_higherlow and pricelowfound

//Hidden Bullish

osc_lowerlow = osc[lbR] < valuewhen(pricelowfound, osc[lbR], 1) and _inrange(pricelowfound[1])

price_higherlow = low[lbR] > valuewhen(pricelowfound, low[lbR], 1)

hiddenbullCond = price_higherlow and osc_lowerlow and pricelowfound

//Regular Bearish

osc_lowerhigh = osc[lbR] < valuewhen(pricehighfound, osc[lbR], 1) and _inrange(pricehighfound[1])

price_higherhigh = high[lbR] > valuewhen(pricehighfound, high[lbR], 1)

bearCond = price_higherhigh and osc_lowerhigh and pricehighfound

//Hidden Bearish

osc_higherhigh = osc[lbR] > valuewhen(pricehighfound, osc[lbR], 1) and _inrange(pricehighfound[1])

price_lowerhigh = high[lbR] < valuewhen(pricehighfound, high[lbR], 1)

hiddenbearCond = price_lowerhigh and osc_higherhigh and pricehighfound

//Entry and Exit

longCondition = (bullCond or hiddenbullCond) and (abovecloud > ema200)

closelongCondition = crossover(osc, takeProfitLevellong)

shortCondition = (bearCond or hiddenbearCond) and (ema200 > belowcloud)

closeshortCondition = crossover(osc, takeProfitLevelshort)

strategy.entry("Long", strategy.long, when=longCondition)

strategy.close("Long", when=closelongCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

strategy.close("Short", when=closeshortCondition)

- Dual Indicator Strategy

- EVWBB Strategy Based on EVWMA and Bollinger Bands

- MACD Trend Prediction Strategy

- Moving Average Ribbon Trend Strategy

- CCI and EMA Trend Following Trading Strategy

- Richard Bookstaber Momentum Breakout Strategy

- Dual Moving Average Strategy

- Adaptive Moving Average Channel Breakout Strategy

- Momentum Swing Effective Profit Strategy

- Hull Moving Average Trend Following Strategy

- Triple Moving Average Trading Strategy

- Prime Number Oscillator Trading Strategy

- Momentum Breakout Identifies Strategy

- Triple RSI Extremum Trading Strategy

- Golden Cross Keltner Channel Trend Following Strategy

- Monthly Opening Long and Month-end Closing Strategy

- Dual Moving Average Crossover Trading Strategy

- Trend Line Trading Strategy

- Stochastic RSI and Volume Based Trading Strategy

- Multi-indicator Strategy to Identify Trading Inflection Points in Quant Trading