Overview

This strategy uses moving average crossovers as trading signals, combined with volatility indicator BB and a custom momentum indicator for filtration, aiming to improve the reliability of MA crossover signals and reduce false signals.

Principles

Use 50-period EMA and 200-period SMA to form golden cross and death cross signals.

When price is in an uptrend, require price to be above 200-day line and custom momentum indicator value below 25 to generate buy signals.

When price is in a downtrend, require price to be below 200-day line and custom momentum indicator value above 75 to generate sell signals.

Custom momentum indicator maps BB midline and band distance into 0-100 range based on historical maximums and minimums.

Momentum indicator reflects relative price volatility, threshold filtering helps reduce false crossovers.

Advantages

Utilize strengths of EMA and SMA to capture medium-long term trends.

Increased filtration with momentum indicator improves reliability and reduces false signals.

BB band distance reflects volatility intensity, historical normalization avoids parameter dependency.

Customizable EMA, SMA periods and momentum threshold adaptable to varying market environments.

Simple logic with optimization flexibility, strong practicality.

Risk Analysis

EMA and SMA have lagging effect, may miss short-term opportunities.

Trend following nature unsuitable for range-bound markets.

Momentum threshold requires iterative backtesting for optimal parameter, risks overfitting.

Longer-term systems offer steady but potentially limited absolute returns.

Can shorten MA periods or add complementary indicators to improve adaptability.

Enhancement Opportunities

Test different MA combinations for optimal parameters.

Add complementary indicators like MACD, KD for additional validation.

Optimize momentum indicator parameters like lookback period, mapping range.

Incorporate stop loss to control risks.

Adjust for symbol-specific parameters using machine learning feature extraction.

Add volume indicators to avoid unreasonable crossover signals.

Conclusion

This strategy combines the strengths of long-term trend following and dual momentum threshold filtering for high reliability and practical value. Further improvements are possible through parameter optimization and complementary techniques. The innovative concept provides valuable insights for other trend systems. A valuable addition to the algorithmic trading strategy library.

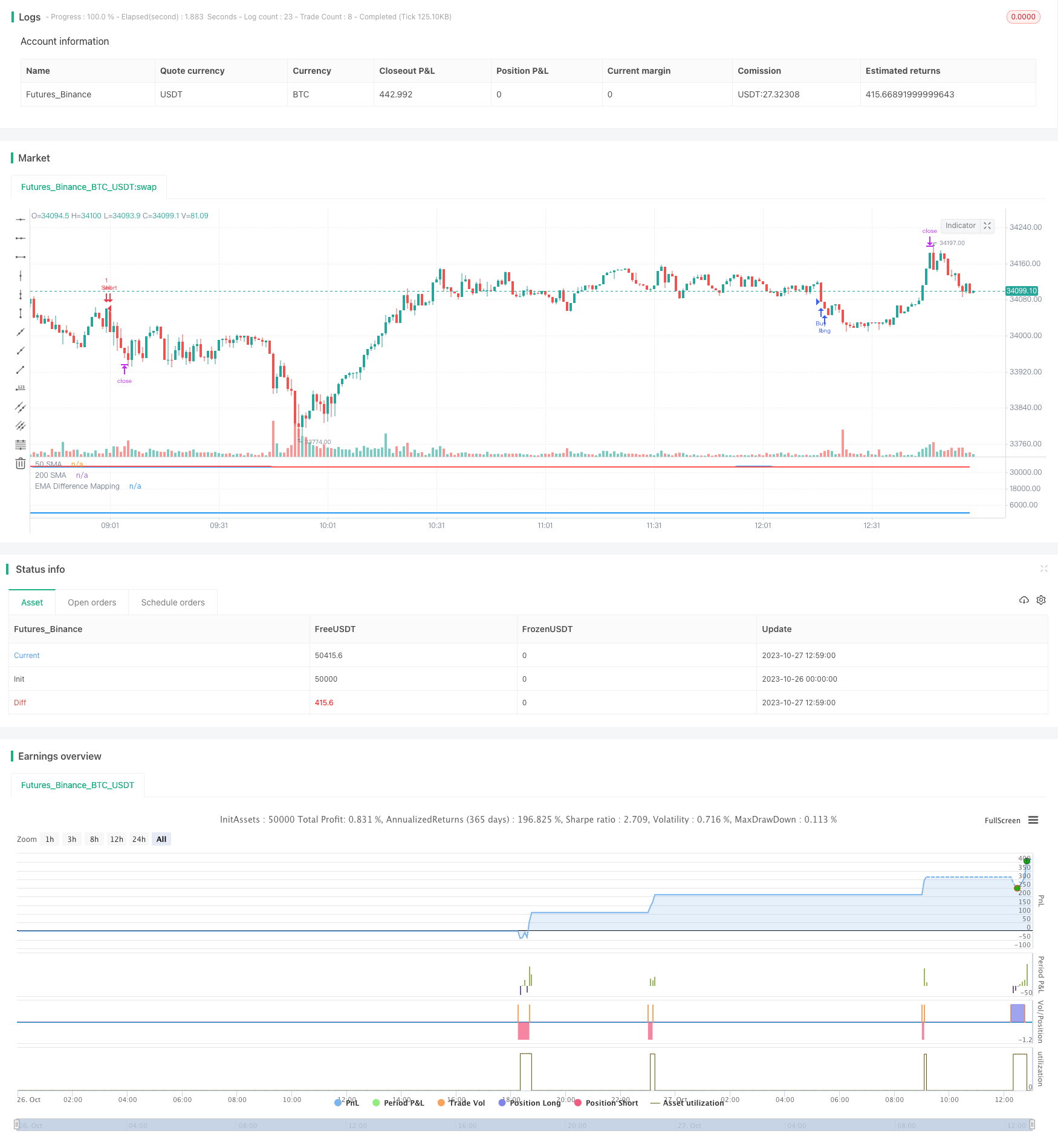

/*backtest

start: 2023-10-26 00:00:00

end: 2023-10-27 13:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="EMA Difference Mapping with Trades", shorttitle="EMA Diff Map", overlay=false)

// Inputs

emaLength = input(20, "EMA Length")

stdDevLength = input(2, "Standard Deviation Length")

priceSource = close

takeProfitPoints = input(1000, title="Take Profit (in Points)")

stopLossPoints = input(2500, title="Stop Loss (in Points)")

// Calculate EMA

ema = ema(priceSource, emaLength)

// Calculate Standard Deviation

stdDev = stdev(priceSource, stdDevLength)

// Calculate differences

diff1 = (ema + stdDev) - ema

diff2 = ema - (ema - stdDev)

// Calculate min and max differences from last year

lookbackPeriod = 504 // Number of trading days in a year

minDiff1 = lowest(diff1, lookbackPeriod)

maxDiff1 = highest(diff1, lookbackPeriod)

minDiff2 = lowest(diff2, lookbackPeriod)

maxDiff2 = highest(diff2, lookbackPeriod)

// Map differences based on requirements

mappedDiff1 = 50 + 50 * ((diff1 - minDiff1) / (maxDiff1 - minDiff1))

mappedDiff2 = 50 - 50 * ((diff2 - minDiff2) / (maxDiff2 - minDiff2))

// Combine mapped differences into a single line

mappedLine = if close > ema

mappedDiff1

else

mappedDiff2

// Plot 'mappedLine' in the main chart area conditionally

plot(mappedLine, title="EMA Difference Mapping", color=(close > ema ? color.blue : na), style=plot.style_line, linewidth=2)

// Calculate the 50EMA and 200SMA

ema50 = ema(close, 50)

sma200 = sma(close, 200)

// Plot the 50EMA and 200SMA on the main chart

plot(ema50, color=color.blue, title="50 SMA", linewidth=2)

plot(sma200, color=color.red, title="200 SMA", linewidth=2)

// Initialize trade variables

var bool waitingForBuy = na

var bool waitingForSell = na

var bool buyConditionMet = false

var bool sellConditionMet = false

if not sellConditionMet and crossunder(ema50, sma200)

sellConditionMet := true

waitingForBuy := false

if sellConditionMet

waitingForSell := true

sellConditionMet := false

if waitingForSell and close < sma200 and mappedLine > 75

strategy.entry("Sell", strategy.short)

strategy.exit("Sell Exit", "Sell", profit=takeProfitPoints, loss=stopLossPoints)

waitingForSell := false

// Define the strategy conditions and execute trades

if not buyConditionMet and crossover(ema50, sma200)

buyConditionMet := true

waitingForSell := false

if buyConditionMet

waitingForBuy := true

buyConditionMet := false

if waitingForBuy and close > sma200 and mappedLine < 25

strategy.entry("Buy", strategy.long)

strategy.exit("Buy Exit", "Buy", profit=takeProfitPoints, loss=stopLossPoints)

waitingForBuy := false