Dual Moving Average Crossover Persistent Uptrend Strategy

Author: ChaoZhang, Date: 2023-11-13 10:47:48Tags:

Overview

This is a trading strategy that utilizes moving average crossover patterns along with persistent uptrend to enter trades. When the fast MA crosses above the slow MA, a golden crossover signal is generated. If the uptrend persists after the crossover, a long position can be opened. When the price rallies to the stop loss or take profit levels, the position can be closed for stop loss or take profit.

Strategy Logic

The strategy is primarily based on moving average crossover for entry signals. Specifically, a fast MA (MA1) and slow MA (MA2) are defined. When MA1 crosses above MA2, it’s a signal to go long.

To avoid false signals from short-term crossovers, an angle threshold is added, so that a buy signal is only triggered when the MA2 angle is above a set threshold. This filters out some non-trending short-term rallies.

The strategy also sets a stop loss and take profit. The stop loss avoids losses in case of sudden market reversal, while take profit locks in profits. They are set as a percentage range from the entry price.

When price rallies to take profit point, the strategy will close long for profit taking. Also, if the rally is strong, the strategy will open a short position for mean reversion.

Advantage Analysis

This is a simple and intuitive trend following strategy. The advantages are:

- MA combo filters out market noise and locks in trend direction

- Angle threshold avoids being misled by short-term oscillations

- Two-way trading allows profiting from range-bound markets

- Stop loss and take profit controls risk

Risk Analysis

There are some risks to note:

- MAs have lag and may miss turning points

- Stop loss is not guaranteed, can be gapped in fast markets

- Double-edge trading doubles risk, timing of short entry is key

- Poor parameter tuning like MA periods can affect results

Improvement Areas

Some ways to further optimize the strategy:

- Add trend filters like MACD, Bollinger to improve accuracy

- Use machine learning to dynamically optimize MA periods

- Optimize stop loss and take profit settings e.g. trailing stops

- Add position sizing to limit losses

- Gauge trend strength with ADX to size mean reversion position

Conclusion

Overall this is a simple and practical trend following strategy. It has pros but also risks. Further refinements like parameter tuning, optimal indicators, stop loss settings etc. can improve it. But no strategy eliminates systemic risk fully. Risk management is key for prudent trading.

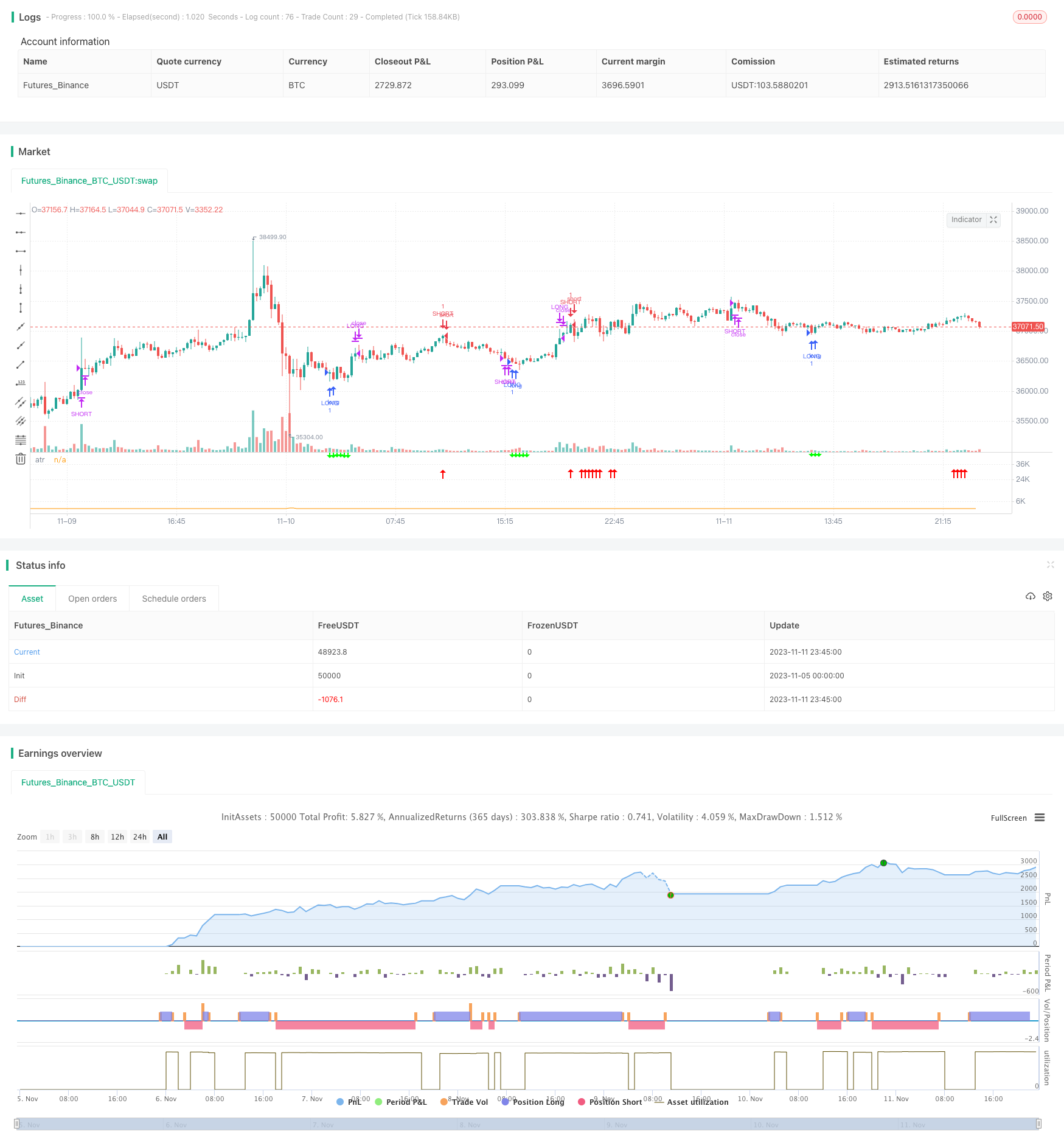

/*backtest

start: 2023-11-05 00:00:00

end: 2023-11-12 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//written by markjames12210@gmail.com

//@version=5

strategy(title="MJ-Dual Moving Average",initial_capital=10000,overlay=false)

// import TradingView/ZigZag/6 as ZigZagLib

// // Create Zig Zag instance from user settings.

// var zigZag = ZigZagLib.newInstance(

// ZigZagLib.Settings.new(

// input.float(5.0, "Price deviation for reversals (%)", 0.00001, 100.0, 0.5, "0.00001 - 100"),

// input.int(10, "Pivot legs", 2),

// input(#2962FF, "Line color"),

// input(true, "Extend to last bar"),

// input(true, "Display reversal price"),

// input(true, "Display cumulative volume"),

// input(true, "Display reversal price change", inline = "priceRev"),

// input.string("Absolute", "", ["Absolute", "Percent"], inline = "priceRev"),

// true)

// )

// // Update 'zigZag' object on each bar with new pivots, volume, lines, labels.

// zigZag.update()

// // plot(zigZag.pivots, "zigZag")

ma1= ta.sma(close,8)

ma2= ta.sma(close,21)

angleCriteria = input.int(title="Angle", defval=7, minval=1, maxval=13)

i_lookback = input.int(2, "Angle Period", minval = 1)

i_atrPeriod = input.int(10, "ATR Period", minval = 1)

i_angleLevel = input.int(6, "Angle Level", minval = 1)

i_maSource = input.source(close, "MA Source")

TP = input.float(1, "TP", minval = 0.1)

SL = input.float(1, "SL", minval = 0.1)

f_angle(_src, _lookback, _atrPeriod) =>

rad2degree = 180 / 3.141592653589793238462643 //pi

ang = rad2degree * math.atan((_src[0] - _src[_lookback]) / ta.atr(_atrPeriod)/_lookback)

ang

_angle = f_angle(ma2, i_lookback, i_atrPeriod)

plot(ta.atr(i_atrPeriod), "atr")

// plot(ma1,color=#FF0000)

// plot(ma2,color=#00FF00)

crosso=ta.crossover(ma1,ma2)

crossu=ta.crossunder(ma1,ma2)

_lookback = 15

f_somethingHappened(_cond, _lookback) =>

bool _crossed = false

for i = 1 to _lookback

if _cond[i]

_crossed := true

_crossed

longcrossed = f_somethingHappened(crosso,_lookback)

shortcrossed = f_somethingHappened(crossu,_lookback)

atr_factor = 1

atr = ta.atr(i_atrPeriod)

e = atr * atr_factor

afr = close

afr := nz(afr[1], afr)

atr_factoryHigh = close + e

atr_factoryLow = close - e

if atr_factoryLow > afr

afr := atr_factoryLow

if atr_factoryHigh < afr

afr := atr_factoryHigh

// plot(afr, "afr", display = display.data_window)

// plot(atr_factoryHigh, "afr", color = color.yellow, display = display.all)

// plot(atr_factoryLow, "afr", color = color.green, display = display.all)

inLong() => strategy.position_size > 0

inShort() => strategy.position_size < 0

inZero() => not inLong() and not inShort()

long = longcrossed and _angle > angleCriteria

short= shortcrossed and _angle < -(angleCriteria)

plotshape(long, "Buy", shape.arrowup, location.belowbar, color = #FF0000)

plotshape(short, "Sell", shape.arrowdown, location.abovebar, color = #00FF00)

var longTp = 0.0

var longSl = 0.0

var shortTp = 0.0

var shortSl = 0.0

[b_middle, b_high, b_low] = ta.bb(close, 20, 2)

entry_price = strategy.opentrades.entry_price(0)

if inZero()

if short

longTp := close * (1 + TP/100)

longSl := close * (1 - SL/100)

strategy.entry("LONG",strategy.long, comment = "tp:" + str.tostring(longTp) + " sl:" + str.tostring(longSl))

if long

shortTp := close * (1 - TP/100)

shortSl := close * (1 + SL/100)

strategy.entry("SHORT",strategy.short, comment = "tp:" + str.tostring(shortTp) + " sl:" + str.tostring(shortSl))

if inLong()

// if close - entry_price > close * 0.005

// longSl := entry_price + close * 0.001

if high > longTp

strategy.close("LONG")

if (close - open) > close * 0.014

shortTp := close * (1 - TP/100)

shortSl := close * (1 + SL/100)

strategy.entry("SHORT",strategy.short, comment = "tp:" + str.tostring(shortTp) + " sl:" + str.tostring(shortSl))

if close < longSl

strategy.close("LONG")

if open >= b_high and close >= b_high

strategy.close("LONG")

// if high > b_high and entry_price < high

// strategy.close("LONG")

if inShort()

// if entry_price - close > close * 0.005

// shortSl := entry_price - close * 0.001

if low < shortTp

strategy.close("SHORT")

if (open - close) > close * 0.014

longTp := close * (1 + TP/100)

longSl := close * (1 - SL/100)

strategy.entry("LONG",strategy.long, comment = "tp:" + str.tostring(longTp) + " sl:" + str.tostring(longSl))

if close > shortSl

strategy.close("SHORT")

if open < b_low and close < b_low

strategy.close("SHORT")

// if low < b_low and entry_price > low

// strategy.close("SHORT")

- Moving Average Crossover and Upper Rail Breakthrough Impulse Strategy

- Coppock Curve Based Quantitative Trading Strategy

- High Probability Breakthrough Trading Strategy Based on Pressure Balance

- Fast RSI Risk Control Compound Futures Trading Strategy

- Dual DI Crossover Daily Trading Strategy

- Bollinger Band Breakout Strategy

- Moving Average Trading Strategy

- Williams' Alligator Strategy

- Dual Moving Average Crossover Strategy

- Long-Term Trend Reversal Strategy

- Comprehensive Automated Trading Moving Average Rainbow Strategy

- Twin Range Filter Trading Strategy

- Dynamic Channel Breakout Strategy

- Dynamic Moving Average Crossover Trading Strategy

- Quantitative Trading Strategy Based on Ichimoku with Multiple Signals

- Bollinger Breakout Strategy

- RSI Pullback Breakout Strategy

- Traders Dynamic Index Strategy

- Momentum Reversal Strategy

- Dual Moving Average RSI Indicator Combination Reversal Strategy