Overview

The Speculation Gulf strategy is a quantitative trading strategy that tracks trends. It uses the SAR Parabolic curve as the main trading signal, with additional EMA, Squeeze Momentum and Volatility Oscillator filters to identify trend reversal points with SAR parameters, and achieve low-risk trend tracking. This strategy is well suited for medium-to-long term investing.

Strategy Logic

The strategy uses Parabolic SAR as the primary trading signal indicator. SAR can effectively determine price trend reversal points. When the SAR sign changes, it means the trend has reversed. This strategy generally generates buy or sell signals when the SAR flips.

In addition, the strategy also provides a SAR breakout option - generating signals when the price breaks through the last SAR value before SAR fully flips. This further improves the sensitivity of the strategy.

To filter false signals, the strategy also introduces EMA, Squeeze Momentum and Volatility Oscillator as three auxiliary filters, which can be used alone or in combination to confirm the reliability of price trends and trading signals.

Finally, the strategy provides three types of stop loss methods - fixed stop loss, fixed take profit and risk reward ratio stop loss. This allows the strategy to flexibly adapt to the characteristics of different types of trading instruments.

Advantage Analysis

SAR can accurately determine price trend reversals and timely capture new price trends, suitable for medium and long term trend tracking.

Multiple filters reduce the probability of false breakouts and improve signal reliability.

Simple and flexible configuration, customizable parameters to suit different trading instruments.

Provides multiple types of take profit and stop loss to balance risk and reward.

Can directly connect to trading bots for automated trading.

Risk Analysis

In non-trending markets, there may be increased occurrences of false signals and ineffective trades.

Improper SAR parameter settings also affect the accuracy of signal judgments.

As a trend following strategy, significant fluctuations in the market can easily hit the stop loss line.

To address the above risks, appropriately adjust the SAR parameters or filter parameters to reduce the probability of invalid trades. Stop loss limits can also be moderately relaxed to withstand greater market fluctuations.

Optimization Directions

SAR Parameter Optimization. Optimize the SAR increment and step parameters through historical backtest data to obtain a more stable and efficient trading strategy.

Introduce Trend Judgment Indicators. Add auxiliary trend judgment indicators like MACD and DMI to improve trend judgment capabilities.

Optimize risk-return ratio. Adjust fixed stop loss percentage and risk-return ratio to take on higher risks for higher returns.

Support more instruments. Currently only crypto is supported, can be extended to support Forex, commodity and securities trading instruments.

Conclusion

The Speculation Gulf strategy is a very practical trend following quantitative strategy. It has responsive signals, reliable judgments and can achieve long-term steady returns through stop loss management. With appropriate parameter and rules optimization, the efficiency of the strategy can be further improved. This is an efficient quantitative strategy worth using long term.

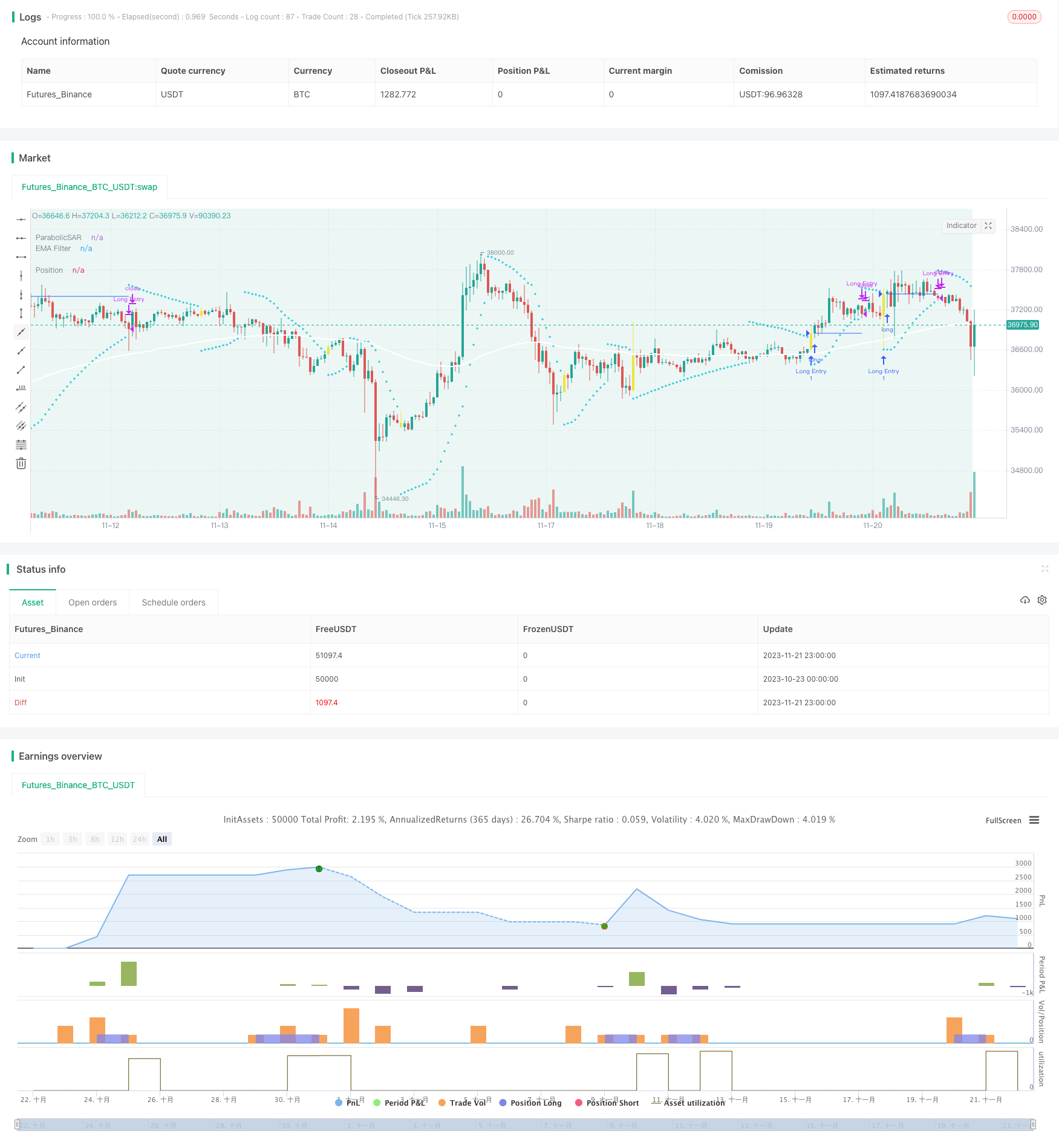

/*backtest

start: 2023-10-23 00:00:00

end: 2023-11-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//VERSION =================================================================================================================

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// This strategy is intended to study.

// It can also be used to signal a bot to open a deal by providing the Bot ID, email token and trading pair in the strategy settings screen.

// As currently written, this strategy uses a SAR PARABOLIC to send signal, and EMA, Squeeze Momentum, Volatility Oscilator as filter.

// There are two enter point, when SAR Flips, or Breakout Point - the last SAR Value before it Flips.

// There are tree options for exit: SAR Flips, Fixed Stop Loss ande Fixed Take Profit in % and Risk Reward tha can be set, 0.5/1, 1/1, 1/2 etc.

//Autor M4TR1X_BR

//▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

//STRATEGY ================================================================================================================

strategy(title = 'BT-SAR Ema, Squeeze, Voltatility',

shorttitle = 'SAR ESV',

overlay = true)

//▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// INPUTS =================================================================================================================

// TIME INPUTS

usefromDate = input.bool(defval = true, title = 'Start date', inline = '0', group = "Time Filters")

initialDate = input(defval = timestamp('01 Jan 2022 00:00 UTC'), title = '', inline = "0",group = 'Time Filters',tooltip="This start date is in the time zone of the exchange ")

usetoDate = input.bool(defval = true, title = 'End date', inline = '1', group = "Time Filters")

finalDate = input(defval = timestamp('31 Dec 2029 23:59 UTC'), title = '', inline = "1",group = 'Time Filters',tooltip="This end date is in the time zone of the exchange")

// TIME LOGIC

inTradeWindow = true

// SAR PARABOLIC INPUTS ==================================================================================================

string sargroup= "SAR PARABOLIC ========================================="

start = input.float(defval=0.02,title='Start',inline='',group = sargroup)

increment = input.float(defval=0.02,title='Increment',inline='',group = sargroup)

maximum = input.float(defval=0.2,title='Maximo',inline='',group = sargroup)

// SAR PARABOLIC LOGIC

out = ta.sar(start, increment, maximum)

// SAR FLIP OR BREAKOUT OPTIONS

string bkgroup ='SAR TRADE SIGNAL ====================================== '

sarTradeSignal =input.string(defval='SAR Flip',title='SAR Trade Signal', options= ['SAR Flip','SAR Breakout'],group=bkgroup, tooltip='SAR Flip: Once the parabolic SAR flips it will send a signal, SAR Breakout: Will wait the price cross last Sar Value before it flips.')

nBars = input.int(defval=4,title='Bars',group=bkgroup, tooltip ='Define the number of bars for a entry when the price cross breakout point')

float sarBreakoutPoint= ta.valuewhen((close[1] < out[1]) and (close > out),out[1],0) //Get Sar Breakout Point

bool check = (close[1] < out[1]) and (close > out) //Verify when sar flips

bool BreakoutPrice = sarTradeSignal=='SAR Breakout'? (ta.barssince(check) < nBars) and ((open < sarBreakoutPoint) and (close > sarBreakoutPoint)): (ta.barssince(check) < nBars) and (close > out)

barcolor (check? color.yellow:na,title="Signal Bar color" )

// MOVING AVERAGES INPUTS ================================================================================================

string magroup = "Moving Average ========================================"

useEma = input.bool(defval = true, title = 'Moving Average Filter',inline='', group= magroup,tooltip='This will enable or disable Exponential Moving Average Filter on Strategy')

emaType=input.string (defval='Ema',title='Type',options=['Ema','Sma'],inline='', group= magroup)

emaSource = input.source(defval=close,title=" Source",inline="", group= magroup)

emaLength = input.int(defval=100,title="Length",minval=0,inline='', group= magroup)

// MOVING AVERAGE LOGIC

float ema = emaType=='Ema'? ta.ema(emaSource,emaLength): ta.sma(emaSource,emaLength)

// VOLATILITY OSCILLATOR =================================================================================================

string vogroup = "VOLATILITY OSCILLATOR ================================="

useVltFilter=input.bool(defval=true,title="Volatility Oscillator Filter",inline='',group= vogroup,tooltip='This will enable or disable Volatility Oscillator filter on Strategy')

vltFilterLength = input.int(defval=100,title="Volatility Oscillator",inline='',group=vogroup)

vltFilterSpike = close - open

vltFilterX = ta.stdev(vltFilterSpike,vltFilterLength)

vltFilterY = ta.stdev(vltFilterSpike,vltFilterLength) * -1

// SQUEEZE MOMENTUM INPUTS ==============================================================================================

string sqzgroup = "SQUEEZE MOMENTUM ====================================="

useSqzFilter=input.bool(defval=true,title="Squeeze Momentum Filter",inline='',group= sqzgroup, tooltip='This will enable or disable Squeeze Momentum filter on Strategy')

sqzFilterlength = input.int(defval=20, title='Bollinger Bands Length',inline='',group= sqzgroup)

sqzFiltermult = input.float(defval=2.0, title='Boliinger Bands Mult',inline='',group= sqzgroup)

keltnerLength = input.int(defval=20, title='Keltner Channel Length',inline='',group= sqzgroup)

keltnerMult = input.float(defval=1.5, title='Keltner Channel Mult',inline='',group= sqzgroup)

useTrueRange = input(true, title='Use TrueRange (KC)', inline='',group= sqzgroup)

// CALCULATE BOLLINGER BANDS

sqzFilterSrc = close

basis = ta.sma(sqzFilterSrc, sqzFilterlength)

dev = keltnerMult * ta.stdev(sqzFilterSrc, sqzFilterlength)

upperBB = basis + dev

lowerBB = basis - dev

// CALCULATE KELTNER CHANNEL

sma = ta.sma(sqzFilterSrc, keltnerLength)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.sma(range_1, keltnerLength)

upperKC = sma + rangema * keltnerMult

lowerKC = sma - rangema * keltnerMult

// CHECK IF BOLLINGER BANDS IS IN OR OUT OF KELTNER CHANNEL

sqzOn = lowerBB > lowerKC and upperBB < upperKC

sqzOff = lowerBB < lowerKC and upperBB > upperKC

noSqz = sqzOn == false and sqzOff == false

// SQUEEZE MOMENTUM LOGIC

val = ta.linreg(sqzFilterSrc - math.avg(math.avg(ta.highest(high, keltnerLength), ta.lowest(low, keltnerLength)),ta.sma(close, keltnerLength)), keltnerLength, 0)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// TAKE PROFIT STOP LOSS INPUTS =========================================================================================

string tkpgroup='Take Profit =================================================='

tpType = input.string(defval = 'SAR Flip', title='Take Profit and Stop Loss', options=['SAR Flip','Fixed % TP/SL', 'Risk Reward TP/SL'], group=tkpgroup )

longTakeProfitPerc = input.float(defval = 1.5, title = 'Fixed TP %', minval = 0.05, step = 0.5, group=tkpgroup, tooltip = 'The percentage increase to set the take profit price target.')/100

longLossPerc = input.float(defval=1.0, title="Fixed Long SL %", minval=0.1, step=0.5, group = tkpgroup, tooltip = 'The percentage increase to set the Long Stop Loss price target.') * 0.01

//shortLossPerc = input.float(defval=1.5, title="Fixed Short SL (%)", minval=0.1, step=0.5, group = tkpgroup, tooltip = 'The percentage increase to set the Short Stop Loss price target.') * 0.01

longTakeProfitRR = input.float(defval = 1, title = 'Risk Reward TP', minval = 0.25, step = 0.25, group=tkpgroup, tooltip = 'The Risk Reward parameter.')

var plotStopLossRR = input.bool(defval=false, title='Show RR Stop Loss', group=tkpgroup)

//enableStopLossRR = input.bool(defval = false, title = 'Enable Risk Reward TP',group=tkpgroup, tooltip = 'Enable Variable Stop Loss.')

string trpgroup='Traling Profit ==============================================='

enableTrailing = input.bool(defval = false, title = 'Enable Trailing',group=trpgroup, tooltip = 'Enable or disable the trailing for take profit.')

trailingTakeProfitDeviationPerc = input.float(defval = 0.1, title = 'Trailing Take Profit Deviation %', minval = 0.01, maxval = 100, step = 0.01, group=trpgroup, tooltip = 'The step to follow the price when the take profit limit is reached.') / 100

// BOT MESSAGES

string msgroup='Alert Message For Bot ========================================='

messageEntry = input.string("", title="Strategy Entry Message",group=msgroup)

messageExit =input.string("",title="Strategy Exit Message",group=msgroup)

messageClose = input.string("", title="Strategy Close Message",group=msgroup)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITIONS =============================================================================================================

//VERIFY IF THE BUY FILTERS ARE ON OR OFF

bool emaFilterBuy = useEma? (close > ema):(close >= ema) or (close <= ema)

bool volatilityFilterBuy = useVltFilter? (vltFilterSpike > vltFilterX) : (vltFilterSpike >= 0) or (vltFilterSpike <= 0)

bool sqzFilterBuy = useSqzFilter? (val > val[1]): (val >= val[1] or val <=val[1])

bool sarflip = (close > out)

//LONG / SHORT POSITIONS LOGIC

//Var 'check' will verify if the SAR flips and if the exit price occurs it will limit in bars number a new entry on the same signal.

bool limitEntryNumbers = (ta.barssince(check) < nBars)

bool openLongPosition = sarTradeSignal == 'SAR Flip'? (sarflip and emaFilterBuy and volatilityFilterBuy and sqzFilterBuy and limitEntryNumbers) :sarTradeSignal=='SAR Breakout'? (BreakoutPrice and emaFilterBuy and volatilityFilterBuy and sqzFilterBuy): na

bool openShortPosition = na

bool closeLongPosition= tpType=='SAR Flip'? (close < out):na

bool closeShortPosition=na

// CHEK OPEN POSITONS =====================================================================================================

// open signal when not already into a position

bool validOpenLongPosition = openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) <= 0

bool longIsActive = validOpenLongPosition or strategy.opentrades.size(strategy.opentrades - 1) > 0

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// TAKE PROFIT STOP LOSS CONFIG ==========================================================================================

// FIXED TAKE PROFIT IN %

float posSize = strategy.opentrades.entry_price(strategy.opentrades - 1) //Get the entry price

var float longTakeProfitPrice = na

longTakeProfitPrice := if (longIsActive)

if (openLongPosition and not (strategy.opentrades.size(strategy.opentrades - 1) > 0))

posSize * (1 + longTakeProfitPerc)

else

nz(longTakeProfitPrice[1], close * (1 + longTakeProfitPerc))

else

na

longTrailingTakeProfitStepTicks = longTakeProfitPrice * trailingTakeProfitDeviationPerc / syminfo.mintick

// FIXED STOP LOSS IN %

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

//shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

// TAKE PROFIT BY RISK/REWARD

// Set stop loss

tta = not (strategy.opentrades.size(strategy.opentrades - 1) > 0)

float lastb = ta.valuewhen(check and tta,ta.lowest(low,5),0) - (10 * syminfo.mintick)

// TAKE PROFIT CALCULATION

float stopLossRisk = (posSize - lastb)

float takeProfitRR = posSize + (longTakeProfitRR * stopLossRisk)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITION ORDERS =====================================================================================================

// LOGIC ===============================================================================================================

// getting into LONG position

if (openLongPosition) and (inTradeWindow)

strategy.entry(id = 'Long Entry', direction = strategy.long, alert_message=messageEntry)

//submit exit orders for trailing take profit price

if (longIsActive) and (inTradeWindow)

strategy.exit(id = 'Long Take Profit', from_entry = 'Long Entry', limit = enableTrailing ? na : tpType=='Fixed % TP/SL'? longTakeProfitPrice: tpType == 'Risk Reward TP/SL'? takeProfitRR:na, trail_price = enableTrailing ? longTakeProfitPrice : na, trail_offset = enableTrailing ? longTrailingTakeProfitStepTicks : na, stop = tpType =='Fixed % TP/SL' ? longStopPrice: tpType == 'Risk Reward TP/SL'? lastb:na) //, alert_message='{ "action": "close_at_market_price", "message_type": "bot", "bot_id": 9330698, "email_token": "392265bc-84eb-4a54-a99c-758383ff9449", "delay_seconds": 0,"pair":"USDT_{{ticker}}" }')

if (closeLongPosition)

strategy.close(id = 'Long Entry', alert_message='{ "action": "close_at_market_price", "message_type": "bot", "bot_id": 9330698, "email_token": "392265bc-84eb-4a54-a99c-758383ff9449", "delay_seconds": 0,"pair":"USDT_{{ticker}}" }')

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// PLOTS ===============================================================================================================

// TRADE WINDOW ========================================================================================================

bgcolor(color = inTradeWindow ? color.new(#089981,90):na, title = 'Time Window')

// SAR PARABOLIC

var sarColor = color.new(#00bcd4,0)

plot(out, "ParabolicSAR", color=sarColor, linewidth=1,style=plot.style_cross)

//BREAKOUT LINE

var plotBkPoint = input.bool(defval=false, title='Show Breakout Point', group=bkgroup)

plot(series = (sarTradeSignal=='SAR Breakout' and plotBkPoint == true)? sarBreakoutPoint:na, title = 'Breakout line', color =color.new(#ffeb3b,50) , linewidth = 1, style = plot.style_linebr, offset = 0)

// EMA/SMA

var emafilterColor = color.new(color.white, 0)

plot(series=useEma? ema:na, title = 'EMA Filter', color = emafilterColor, linewidth = 2, style = plot.style_line)

// ENTRY PRICE

var posColor = color.new(#2962ff, 0)

plot(series = strategy.opentrades.entry_price(strategy.opentrades - 1), title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr,offset=0)

// FIXED TAKE PROFIT

var takeProfitColor = color.new(#ba68c8, 0)

plot(series = tpType=='Fixed % TP/SL'? longTakeProfitPrice:na, title = 'Fixed TP', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 0)

// FIXED STOP LOSS

var stopLossColor = color.new(#ff0000, 0)

plot(series = tpType=='Fixed % TP/SL' ? longStopPrice:na, title = 'Fixed SL', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 0)

// RISK REWARD TAKE PROFIT

var takeProfitRRColor = color.new(#ba68c8, 0)

plot(series=tpType == 'Risk Reward TP/SL'? takeProfitRR:na,title='Risk Reward TP',color=takeProfitRRColor,linewidth=1,style=plot.style_linebr)

// STOP LOSS RISK REWARD

plot(series = (check and plotStopLossRR)? lastb:na, title = 'Last Bottom', color =color.new(#ff0000,0), linewidth = 2, style = plot.style_linebr, offset = 0)

// ======================================================================================================================