Adaptive Take Profit and Stop Loss Strategy Based on Dual Time Frames and Momentum Indicators

Author: ChaoZhang, Date: 2023-11-23 17:57:52Tags:

Overview

This strategy combines dual time frames and momentum indicators to achieve adaptive take profit and stop loss. The main time frame monitors the trend direction, while the secondary time frame is used to confirm signals. Trading signals are generated when the directions of both align. After entering the market, take profit and stop loss levels are updated progressively.

Strategy Logic

-

The main time frame uses the Squeeze Momentum (SQM) linear regression indicator to determine the trend. The secondary time frame uses an EMA combination on the SQM indicator to filter false signals.

-

When the main chart SQM breaks out upwards and the secondary chart SQM also goes up, a long position is taken. When the main chart SQM breaks downwards and the secondary chart SQM also goes down, a short position is taken.

-

After entering the market, initial take profit and stop loss levels are set based on input parameters. When price reaches the take profit level, both take profit and stop loss levels are updated. Specifically, the take profit level is increased progressively and the stop loss level is tightened, achieving gradual profit taking.

Advantages

-

Dual time frames filter false signals and ensure accuracy.

-

The SQM indicator determines trend direction, avoiding market noise.

-

The adaptive take profit and stop loss mechanism locks in profits to the maximum extent and effectively controls risk.

Risk Analysis

-

Improper SQM parameter settings may miss trend turning points, leading to losses.

-

An improper secondary time frame may fail to filter noise effectively, causing erroneous trades.

-

If the stop loss amplitude is set too wide, the per trade loss can be substantial.

Enhancement Opportunities

-

SQM parameters need to be tuned for different markets to ensure sensitivity.

-

Different secondary time frame periods should be tested to find the best noise filtering effect.

-

Instead of a fixed value, the stop loss amplitude can have a range set dynamically based on market volatility.

Summary

Overall this is a very practical strategy. The combination of dual time frames with a momentum indicator to determine trends, together with the adaptive take profit and stop loss method can generate stable profits. By optimizing the SQM parameters, secondary time frame period, and stop loss amplitude, strategy results can be further improved for productive live application and enhancement.

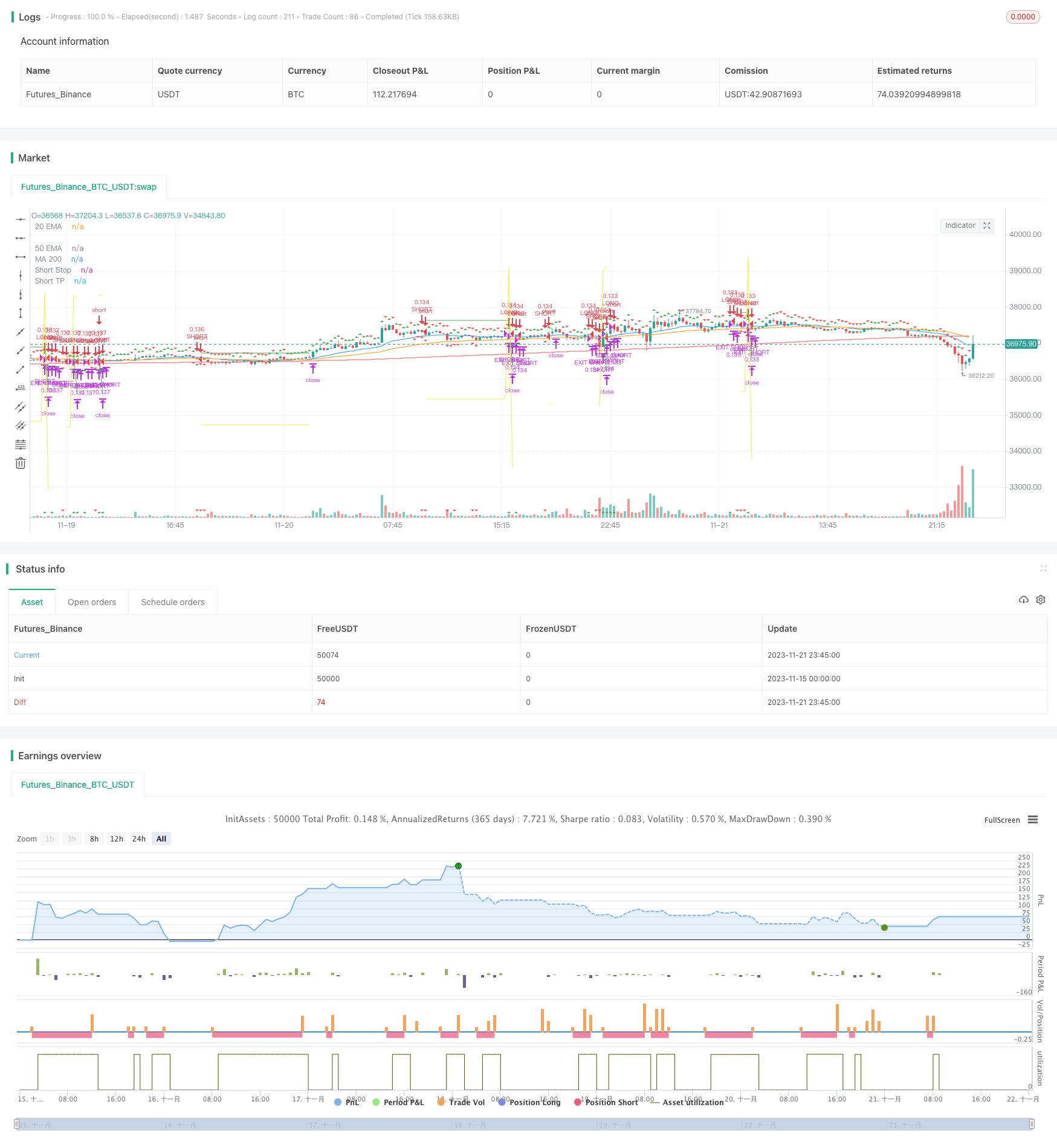

/*backtest

start: 2023-11-15 00:00:00

end: 2023-11-22 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("SQZ Multiframe Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

fast_ema_len = input(11, minval=5, title="Fast EMA")

slow_ema_len = input(34, minval=20, title="Slow EMA")

sqm_lengthKC = input(20, title="SQM KC Length")

kauf_period = input(20, title="Kauf Period")

kauf_mult = input(2,title="Kauf Mult factor")

min_profit_sl = input(5.0, minval=1, maxval=100, title="Min profit to start moving SL [%]")

longest_sl = input(10, minval=1, maxval=100, title="Maximum possible of SL [%]")

sl_step = input(0.5, minval=0.0, maxval=1.0, title="Take profit factor")

// ADMF

CMF_length = input(11, minval=1, title="CMF length") // EMA27 = SMMA/RMA14 ~ lunar month

show_plots = input(true, title="Show plots")

lower_resolution = timeframe.period=='1'?'5':timeframe.period=='5'?'15':timeframe.period=='15'?'30':timeframe.period=='30'?'60':timeframe.period=='60'?'240':timeframe.period=='240'?'D':timeframe.period=='D'?'W':'M'

higher_resolution = timeframe.period=='5'?'1':timeframe.period=='15'?'5':timeframe.period=='30'?'15':timeframe.period=='60'?'30':timeframe.period=='240'?'60':timeframe.period=='D'?'240':timeframe.period=='W'?'D':'W'

// Calculate Squeeze Momentum

sqm_val = linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0)

sqm_val_high = security(syminfo.tickerid, higher_resolution, linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0), lookahead=barmerge.lookahead_on)

sqm_val_low = security(syminfo.tickerid, lower_resolution, linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0), gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_on)

// Emas

high_close = security(syminfo.tickerid, higher_resolution, close, lookahead=barmerge.lookahead_on)

high_fast_ema = security(syminfo.tickerid, higher_resolution, ema(close, fast_ema_len), lookahead=barmerge.lookahead_on)

high_slow_ema = security(syminfo.tickerid, higher_resolution, ema(close, slow_ema_len), lookahead=barmerge.lookahead_on)

//low_fast_ema = security(syminfo.tickerid, lower_resolution, ema(close, fast_ema_len), lookahead=barmerge.lookahead_on)

//low_slow_ema = security(syminfo.tickerid, lower_resolution, ema(close, slow_ema_len), lookahead=barmerge.lookahead_on)

// CMF

ad = close==high and close==low or high==low ? 0 : ((2*close-low-high)/(high-low))*volume

money_flow = sum(ad, CMF_length) / sum(volume, CMF_length)

// Entry conditions

low_condition_long = (sqm_val_low > sqm_val_low[1])

low_condition_short = (sqm_val_low < sqm_val_low[1])

money_flow_min = (money_flow[4] > money_flow[3]) and (money_flow[3] > money_flow[2]) and (money_flow[2] < money_flow[1]) and (money_flow[1] < money_flow)

money_flow_max = (money_flow[4] < money_flow[3]) and (money_flow[3] < money_flow[2]) and (money_flow[2] > money_flow[1]) and (money_flow[1] > money_flow)

condition_long = ((sqm_val > sqm_val[1])) and (money_flow_min or money_flow_min[1] or money_flow_min[2] or money_flow_min[3]) and lowest(sqm_val, 5) < 0

condition_short = ((sqm_val < sqm_val[1])) and (money_flow_max or money_flow_max[1] or money_flow_max[2] or money_flow_max[3]) and highest(sqm_val, 5) > 0

high_condition_long = true//high_close > high_fast_ema and high_close > high_slow_ema //(high_fast_ema > high_slow_ema) //and (sqm_val_low > sqm_val_low[1])

high_condition_short = true//high_close < high_fast_ema and high_close < high_slow_ema//(high_fast_ema < high_slow_ema) //and (sqm_val_low < sqm_val_low[1])

enter_long = low_condition_long and condition_long and high_condition_long

enter_short = low_condition_short and condition_short and high_condition_short

// Stop conditions

var current_target_price = 0.0

var current_sl_price = 0.0 // Price limit to take profit

var current_target_per = 0.0

var current_profit_per = 0.0

set_targets(isLong, min_profit, current_target_per, current_profit_per) =>

target = 0.0

sl = 0.0

if isLong

target := close * (1.0 + current_target_per)

sl := close * (1.0 - (longest_sl/100.0)) // Longest SL

else

target := close * (1.0 - current_target_per)

sl := close * (1.0 + (longest_sl/100.0)) // Longest SL

[target, sl]

target_reached(isLong, min_profit, current_target_per, current_profit_per) =>

target = 0.0

sl = 0.0

profit_per = 0.0

target_per = 0.0

if current_profit_per == 0

profit_per := (min_profit*sl_step) / 100.0

else

profit_per := current_profit_per + ((min_profit*sl_step) / 100.0)

target_per := current_target_per + (min_profit / 100.0)

if isLong

target := strategy.position_avg_price * (1.0 + target_per)

sl := strategy.position_avg_price * (1.0 + profit_per)

else

target := strategy.position_avg_price * (1.0 - target_per)

sl := strategy.position_avg_price * (1.0 - profit_per)

[target, sl, profit_per, target_per]

hl_diff = sma(high - low, kauf_period)

stop_condition_long = 0.0

new_stop_condition_long = low - (hl_diff * kauf_mult)

if (strategy.position_size > 0)

if (close > current_target_price)

[target, sl, profit_per, target_per] = target_reached(true, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

current_profit_per := profit_per

current_target_per := target_per

stop_condition_long := max(stop_condition_long[1], current_sl_price)

else

stop_condition_long := new_stop_condition_long

stop_condition_short = 99999999.9

new_stop_condition_short = high + (hl_diff * kauf_mult)

if (strategy.position_size < 0)

if (close < current_target_price)

[target, sl, profit_per, target_per] = target_reached(false, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

current_profit_per := profit_per

current_target_per := target_per

stop_condition_short := min(stop_condition_short[1], current_sl_price)

else

stop_condition_short := new_stop_condition_short

// Submit entry orders

if (enter_long and (strategy.position_size <= 0))

if (strategy.position_size < 0)

strategy.close(id="SHORT")

current_target_per := (min_profit_sl / 100.0)

current_profit_per := 0.0

[target, sl] = set_targets(true, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

strategy.entry(id="LONG", long=true)

// if show_plots

// label.new(bar_index, high, text=tostring("LONG\nSL: ") + tostring(stop_condition_long), style=label.style_labeldown, color=color.green)

if (enter_short and (strategy.position_size >= 0))

if (strategy.position_size > 0)

strategy.close(id="LONG")

current_target_per := (min_profit_sl / 100.0)

current_profit_per := 0.0

[target, sl] = set_targets(false, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

strategy.entry(id="SHORT", long=false)

// if show_plots

// label.new(bar_index, high, text=tostring("SHORT\nSL: ") + tostring(stop_condition_short), style=label.style_labeldown, color=color.red)

if (strategy.position_size > 0)

strategy.exit(id="EXIT LONG", stop=stop_condition_long)

if (strategy.position_size < 0)

strategy.exit(id="EXIT SHORT", stop=stop_condition_short)

// Plot anchor trend

plotshape(low_condition_long, style=shape.triangleup,

location=location.abovebar, color=color.green)

plotshape(low_condition_short, style=shape.triangledown,

location=location.abovebar, color=color.red)

plotshape(condition_long, style=shape.triangleup,

location=location.belowbar, color=color.green)

plotshape(condition_short, style=shape.triangledown,

location=location.belowbar, color=color.red)

//plotshape((close < profit_target_short) ? profit_target_short : na, style=shape.triangledown,

// location=location.belowbar, color=color.yellow)

plotshape(enter_long, style=shape.triangleup,

location=location.bottom, color=color.green)

plotshape(enter_short, style=shape.triangledown,

location=location.bottom, color=color.red)

// Plot emas

plot(ema(close, 20), color=color.blue, title="20 EMA")

plot(ema(close, 50), color=color.orange, title="50 EMA")

plot(sma(close, 200), color=color.red, title="MA 200")

// Plot stop loss values for confirmation

plot(series=(strategy.position_size > 0) and show_plots ? stop_condition_long : na,

color=color.green, style=plot.style_linebr,

title="Long Stop")

plot(series=(strategy.position_size < 0) and show_plots ? stop_condition_short : na,

color=color.green, style=plot.style_linebr,

title="Short Stop")

plot(series=(strategy.position_size < 0) and show_plots ? current_target_price : na,

color=color.yellow, style=plot.style_linebr,

title="Short TP")

plot(series=(strategy.position_size > 0) and show_plots ? current_target_price : na,

color=color.yellow, style=plot.style_linebr,

title="Long TP")

//plot(series=(strategy.position_size < 0) ? profit_sl_short : na,

// color=color.gray, style=plot.style_linebr,

// title="Short Stop")

- Trend Following Strategy Based on Time Series Decomposition and Volume Weighted Bollinger Bands

- Detrended Price Oscillator Quantitative Trading Strategy

- Multi-indicator Trend Following Strategy

- CCI Dual Timeframe Trend Following Strategy

- T3-CCI Trend Tracking Strategy

- Cross Timeframe SuperTrend Breakout Strategy

- Momentum Reversal Moving Average Combination Strategy

- Dynamic Moving Average Retracement Martin Strategy

- Combo Momentum Reversal Dual-Rail Matching Strategy

- Ichimoku Cloud Quant Strategy

- Multi-Period RSI Grid Trading Strategy

- Dual Exponential Moving Average Crossover Strategy

- Trend Tracking Moving Average RSI Strategy

- Monthly Close Price and Moving Average Crossover Strategy

- Bollinger Bands Breakout short-term trend following Strategy

- Buying dips with take profit and stop loss

- RSI Axial Moving Average Crossover Strategy

- Dual SMA Crossover Strategy

- Dual EMA and RSI Combination Strategy

- Speculation Gulf : Trend Follow Strategy Based on SAR