Dual Moving Average Crossover Strategy

Author: ChaoZhang, Date: 2023-12-01 14:53:05Tags:

Overview

The Dual Moving Average Crossover strategy generates trading signals by calculating two moving averages of different periods and detecting their crossover situations. It belongs to a commonly used technical analysis strategy. The core of this strategy is to use the crossover of a short-term moving average above a long-term moving average to generate a buy signal, and the crossover of the short-term moving average below the long-term moving average to generate a sell signal. By capturing the crossover patterns of short-term and long-term time series, it judges the inflection point of the price curve and determines when to buy or sell.

Principles

The technical principle of this strategy is: the long-term moving average reflects the average price over a long time period and is a relatively stable line, while the short-term moving average is more sensitive and reflects price changes over a short time period, which is a more active and strongly random line. When the short-term moving average crosses above the long-term moving average, it indicates that the price in the short-term cycle has risen above the average level of the long-term cycle, showing an accelerating upward trend. At this point, going long through buying can generate profits. And when the short-term moving average crosses below the long-term moving average again, it indicates that the upward momentum of prices has begun to slow down, which is the period of profit taking. At this time, reducing positions or clearing positions is a reasonable choice.

By comparing prices over short-term and long-term time cycles, this strategy emphasizes the investment philosophy of “riding the momentum” to buy and “profit taking” to sell. Such momentum strategies utilizing moving average crossover patterns are different from mean reversion strategies based on the “contrarian” idea that utilize reversed moving average crossovers. It belongs to a more proactive and decisive type of investment strategy.

Advantage Analysis

The dual moving average crossover strategy has the following advantages:

- The logic is clear and simple, easy to understand and implement.

- It intuitively reflects the changes in price patterns over short and long time cycles, which is conducive to grasping market rhythms.

- The trading signals are clear, making decision-making more decisive.

- It has strong extensibility and flexibility to select short and long moving average cycle combinations.

- Customized trading strategies can be incorporated with other factors in decision making.

Risk Analysis

The dual moving average crossover strategy also has some limitations and risks:

- When the short and long moving averages fluctuate frequently, it will generate more false signals and unnecessary trades.

- There is a lag in signal generation, unable to locate the optimal timing of price reversals.

- It only focuses on the time series changes of prices itself without comprehensively considering other micro and macro factors.

- Trading decisions are relatively mechanical and rigid without adjustments based on changing market environments.

The corresponding risk management and optimization methods include: adding filter conditions, adjusting moving average parameter combinations, incorporating other indicators for decision making, etc.

Optimization Directions

The dual moving average crossover strategy can be optimized in the following directions:

- Optimize the moving average parameter combinations to find the optimal parameters through exhaustive search and machine learning techniques.

- Add filter conditions to avoid false signals, such as trading volume conditions, price fluctuation range conditions, etc.

- Incorporate other indicators such as MACD, KDJ for multivariate decisions.

- Use adaptive techniques to dynamically optimize moving average parameters or switch strategy ensembles based on market environments.

- Incorporate advanced models like deep learning for more intelligent decisions and asset allocations.

Conclusion

The dual moving average crossover strategy judges the trend and inflection points of prices by comparing short and long moving averages, which is a relatively simple and direct technique in technical analysis. Its advantage lies in the clarity of logic and ease of implementation, but it also has problems such as generating false signals and rigid decisions. The future optimization directions are parameter optimization, risk control and incorporating more factors and new technologies for decision making. In general, the dual moving average strategy is one of the basic entry-level quantitative trading strategies that is worth in-depth research and application promotion.

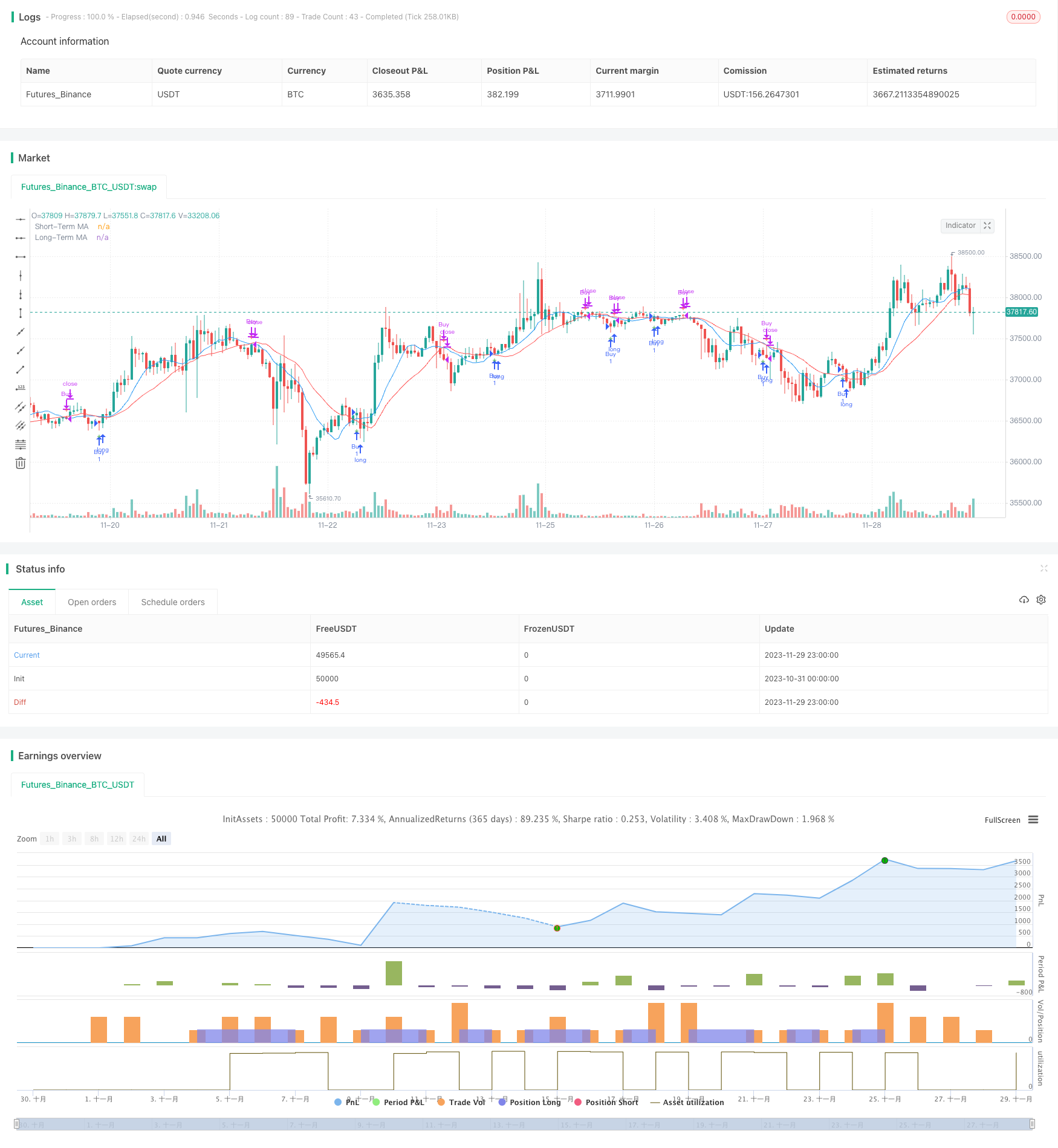

/*backtest

start: 2023-10-31 00:00:00

end: 2023-11-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Moving Average Crossover Strategy", overlay=true)

// Input parameters

short_term_period = input(10, title="Short-Term MA Period")

long_term_period = input(20, title="Long-Term MA Period")

// Calculate moving averages

short_term_ma = sma(close, short_term_period)

long_term_ma = sma(close, long_term_period)

// Buy signal

buy_signal = crossover(short_term_ma, long_term_ma)

// Sell signal

sell_signal = crossunder(short_term_ma, long_term_ma)

if (buy_signal)

strategy.entry("Buy", strategy.long)

if (sell_signal)

strategy.close("Buy")

// Plot moving averages

plot(short_term_ma, color=color.blue, title="Short-Term MA")

plot(long_term_ma, color=color.red, title="Long-Term MA")

// Plot buy and sell signals on the chart

plotshape(series=buy_signal, location=location.belowbar, color=color.green, style=shape.cross, title="Buy Signal")

plotshape(series=sell_signal, location=location.abovebar, color=color.red, style=shape.cross, title="Sell Signal")

- Dual Moving Average Crossover Reversal Strategy

- Moving Average Line Reverse Crossover Strategy

- Hull MA Channel and Linear Regression Swing Trading Strategy

- Triple SuperTrend Quantitative Trading Strategy

- Supertrend Trading Strategy Based on ATR and MA Combination

- Supertrend Bollinger Bands Strategy

- Double Reversal Tracking Strategy

- Holy Grail Strategy

- Multiple Percentage Profit Exits Strategy

- Modified Price-Volume Trend Strategy Based on Price-Volume Changes

- Dual Indicators Combo Crazy Intraday Scalping Strategy

- Dynamic Grid Trading Strategy

- Dual Moving Average Trading Strategy

- Early Profit-Taking Moving Average Opening Bell Exit Strategy

- Monthly Parabolic Breakout Strategy

- Trend Filter Moving Average Crossover Quantitative Strategy

- RSI and Moving Average Based Quantitative Trading Strategy

- Volatility Capture RSI-Bollinger Band Strategy

- Reverse Triad Quantitative Strategy

- FiboBuLL Wave Strategy Based on Bollinger Bands Breakout