CCI Zero Cross Trading Strategy

Author: ChaoZhang, Date: 2023-12-07 18:18:41Tags:

Overview

The CCI Zero Cross Trading Strategy is a quantitative trading strategy based on the Commodity Channel Index (CCI). It generates trading signals by tracking the crossover situations between the CCI indicator and the zero level. It establishes long positions when the CCI crosses above zero and short positions when the CCI falls below zero. The strategy belongs to the trend-following type.

Strategy Principle

The basic principle of the CCI Zero Cross Trading Strategy is:

-

Use the CCI indicator to determine overbought and oversold conditions in the market. The CCI moving above 100 indicates an overbought signal while falling below -100 gives an oversold signal.

-

Monitor the crossover situations between the CCI and the zero level. A buy signal is generated when the CCI crosses zero from below. A sell signal is generated when the CCI drops below zero from the top.

-

Enter trades based on the buy and sell signals from CCI’s zero line crossovers, with stops set at the CCI overbought/oversold areas.

Specifically, the entry rules are:

-

When the CCI crosses from negative to positive values through the zero level, establish long positions with stops at -100.

-

When the CCI drops from positive to negative values through the zero level, go short with stops at +100.

The strategy mainly relies on the CCI indicator to determine overbought/oversold conditions in the market and aims to profit from capturing reversal opportunities. CCI’s zero line crossovers can effectively identify mid-term trend reversal points. Overall, the logic is simple and easy to implement.

Advantage Analysis

The main advantages of the CCI Zero Cross Trading Strategy are:

-

The signal depends solely on CCI’s zero line crossovers, enabling simple and effective trend tracking.

-

It captures mid-term trend reversal points effectively based on CCI’s reversal characteristics, giving large profit potential.

-

The stops are set at CCI overbought/oversold zones, allowing timely stop-outs and risk control.

-

The logic is simple and clear, easy to parameterize for algorithmic trading.

-

CCI is widely applicable across different markets, making the strategy highly adaptable.

Risk Analysis

The CCI Zero Cross Trading Strategy also has some risks:

-

CCI can lag prices, potentially missing optimal entry timing for fast reversals.

-

The stop range is relatively small and may fail to withstand larger price swings.

-

Relying solely on CCI makes it vulnerable to false breakouts and wrong signals.

-

It cannot effectively filter out range-bound price action and may increase trade frequency and slippage.

-

It does not define trade duration and profit targets.

These risks can be managed through parameter optimization, wider stops, adding filters etc.

Optimization Directions

Further optimizations for the strategy involve:

-

Optimizing CCI parameters based on asset characteristics.

-

Adding price breakout or pattern filters to avoid ranging markets.

-

Using trailing stops or take-profit levels to lock in profits.

-

Combining other indicators to create robust multi-indicator filters.

-

Increasing position size in established trends and decreasing in ranges.

Through parameter tuning, risk controls, adaptive exits etc., the efficiency and profitability of the strategy can be significantly improved.

Conclusion

The CCI Zero Cross Trading Strategy is a simple and effective CCI-based quantitative strategy. It profits from trend-trading signals generated by detecting CCI reversal points. Its advantages lie in simplicity, adaptability and fewer parameters, but also has inherent risks that need to be addressed through additional techniques. Overall, it has clear logic and room for extensions, making it a worthwhile addition to a quantitative trader’s playbook.

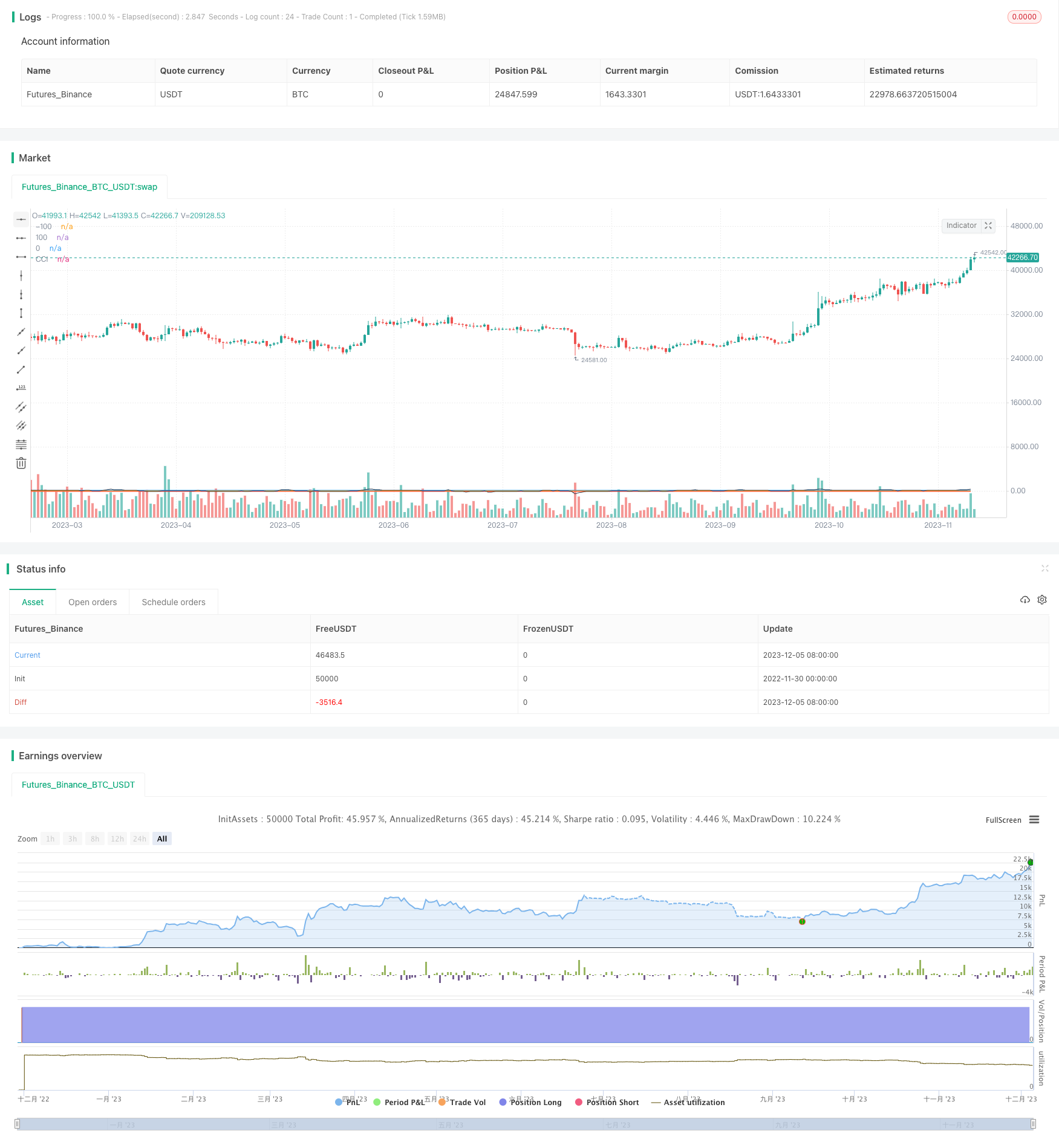

/*backtest

start: 2022-11-30 00:00:00

end: 2023-12-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("CCI 0Trend Strategy (by Marcoweb) v1.0", shorttitle="CCI_0T_Strat_v1.0", overlay=true)

///////////// CCI

CCIlength = input(20, minval=1, title="CCI Period Length")

CCIoverSold = -100

CCIoverBought = 100

CCIzeroLine = 0

CCI = cci(hlc3, CCIlength)

price = hlc3

vcci = cci(price, CCIlength)

source = close

buyEntry = crossover(source, CCIoverSold)

sellEntry = crossunder(source, CCIoverBought)

plot(CCI, color=black,title="CCI")

p1 = plot(CCIoverSold, color=red,title="-100")

p2 = plot(CCIoverBought, color=blue,title="100")

p3 = plot(CCIzeroLine, color=orange,title="0")

///////////// CCI 0Trend v1.0 Strategy

if (not na(vcci))

if (crossover(CCI, CCIoverSold))

strategy.entry("CCI_L", strategy.long, stop=CCIoverSold, comment="CCI_L")

else

strategy.cancel(id="CCI_L")

if (crossunder(CCI, CCIoverBought))

strategy.entry("CCI_S", strategy.short, stop=CCIoverBought, comment="CCI_S")

else

strategy.cancel(id="CCI_S")

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)

- Crossing Strategy Between Bollinger Bands and Hull Indicator

- Turtle Breakout Drawdown Adaptive Trading Strategy

- RSI Trend Following Strategy with Trailing Stop Loss

- Reversal Dynamic Pivot Points Exponential Moving Average Strategy

- kNN-based Trend Following Strategy

- Simple Momentum Strategy Based on SMA, EMA and Volume

- Donchian Channels Breakout Quantitative Trading Strategy

- N Consecutive Higher Closes Breakout Strategy

- Smart Quantitative Bottom Reversal Trading Strategy

- Bollinger + RSI Double Strategy (Long Only) v1.2

- Dual Moving Average Price Reversal Breakout Strategy

- Moving Average Pullback Trading Strategy

- Moving Average Aggregation Williams Commercial Bid-Ask Pressure Indicator Strategy

- Dual Moving Average Reversal Tracking Strategy

- Moving Average Aggregation MACD Strategy

- EMAskeletonstrategy

- Quantitative Trading Strategy Based on Random Numbers

- MACD-based Dual Trading Strategy

- Parabolic SAR and CCI Strategy with EMA Exit for Gold Trading

- EMA Momentum Moving Average Crossover Strategy