Trend Tracking Breakout Strategy

Author: ChaoZhang, Date: 2023-12-26 10:52:51Tags:

Overview

The Trend Tracking Breakout Strategy is a trend following strategy based on moving average and Bollinger Bands indicators. It combines the ideas of trend analysis and breakout trading, seeking breakout opportunities while determining the market trend.

Strategy Logic

The strategy uses the 50-period simple moving average (SMA) to determine the trend direction. A long position is considered when the closing price crosses above the 50-day SMA, indicating a potential upward trend.

At the same time, it requires the closing price to be above the lower Bollinger Band, suggesting the price is not in the lower extreme and may be poised for an upward move. The low of the candle must be within 1% of the lower Bollinger Band, indicating potential support near that level for a breakout.

After the entry signal is triggered, the strategy checks if the next day’s opening price is above the stop level, which is set at 1 point above the highest price of the previous day, to confirm the actual entry.

The stop loss is preset at 5.7 points below the low of the entry bar. Take profit is set at 11.4 points above the closing price of the entry bar to achieve a 2:1 risk-reward ratio.

Advantage Analysis

The strategy combines trend judgment and breakout near key support levels to effectively filter false breakouts and improve win rate. Stop loss and take profit are set according to risk-reward principles to aid risk control.

The relatively simple indicators and entry rules make the strategy easy to understand and implement, suitable for beginners to learn algorithmic trading.

Risk Analysis

The strategy relies mainly on moving averages to determine trend direction, which may generate incorrect signals when the trend changes. Improper Bollinger Bands parameters could also lead to false breakouts.

The stop loss being too close may get stopped out prematurely. Take profit being too wide could also limit profits. These parameters need adjusting for different markets.

The strategy only considers the daily high and low prices and cannot react to overnight gaps.

Optimization Directions

Other indicators could be combined to determine the trend, like MACD. Or adaptive moving averages can be used to track trend changes.

Bollinger Bands parameters can be optimized to find the best combination. Stop loss and take profit levels can also be optimized based on backtesting results.

Logic can be added to judge overnight gaps, avoiding widened losses after gaps.

Conclusion

The strategy integrates the ideas of trend following and breakout trading, using simple indicators to create a filtering effect. Its advantage lies in being easy to understand and implement. Through parameter optimization, better results can be achieved. But there are also market risks to be aware of, requiring continuous improvements based on live trading results.

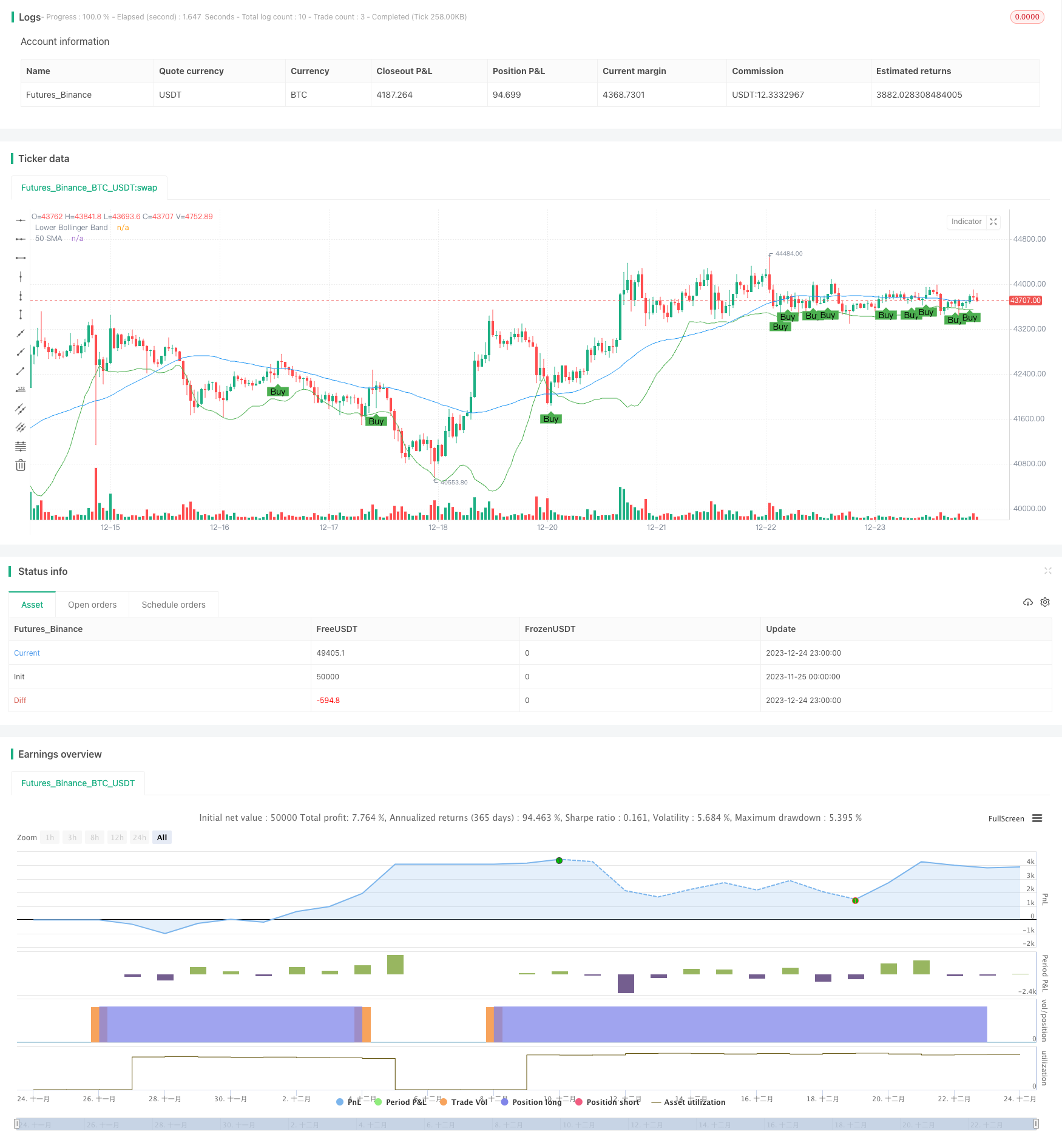

/*backtest

start: 2023-11-25 00:00:00

end: 2023-12-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Custom Strategy", overlay=true)

// Input variables

smaLength = 50

bbLength = 20

supportPercentage = 1

riskRewardRatio = 2

// Calculate indicators

sma = sma(close, smaLength)

bb_lower = sma(close, bbLength) - 2 * stdev(close, bbLength)

// Entry conditions based on provided details

enterLongCondition = crossover(close, sma) and close > bb_lower and low <= (bb_lower * (1 + supportPercentage / 100))

// Entry and exit logic

if (enterLongCondition)

strategy.entry("Long", strategy.long)

// Assuming the details provided are for the daily timeframe

stopLossPrice = low - 5.70

takeProfitPrice = close + 11.40

strategy.exit("Take Profit/Stop Loss", from_entry="Long", loss=stopLossPrice, profit=takeProfitPrice)

// Plotting

plot(sma, color=color.blue, title="50 SMA")

plot(bb_lower, color=color.green, title="Lower Bollinger Band")

// Plot entry points on the chart

plotshape(series=enterLongCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

- Stochastic RSI Momentum Oscillation Trading Strategy

- Trading Strategy of Short Selling When Bollinger Band Crosses Below Price with RSI Callback

- Moving Average Crossover Strategy

- Trend Tracking Strategy Based on Dynamic Pivot Bands

- Bollinger Bands Momentum Trend Following Strategy

- Dynamic Buying Selling Volume Breakout Strategy

- Supertrend MACD Quantitative Strategy

- 4 EMA Trend Strategy

- Bitcoin Trading Strategy Based on Quantitative Indicators

- Last N Candle Reverse Logic Strategy

- Simple Buy Low Sell High Strategy

- N Bar Close Below Open Short Strategy

- Statistical Volatility Backtest Strategy Based on Extreme Value Method

- Relative Strength Index Stop Loss Strategy

- Dual Channel Donchian Breakout Strategy

- A Multi-Period Trading Strategy Based on Moving Averages

- Pivot Reversal Upgraded Long Only - A Dual Momentum Strategy

- Turtle Trading Strategy

- Dual Moving Average Tracking Strategy

- Dual Moving Average Momentum Squeeze Strategy