Trend and Oscillation Double Strategy

Author: ChaoZhang, Date: 2024-01-04 17:32:26Tags:

Overview

The Trend and Oscillation Double Strategy is a quantitative trading strategy that combines trend and oscillation. It utilizes the combination of two indicators to identify the direction and strength of the trend, and find better entry opportunities during trend oscillations.

Principles

The strategy mainly utilizes two open indicators: Trend Surfers and Mawreez’s Trend Oscillator.

Trend Surfers is a trend tracking stop loss indicator. By calculating the highest and lowest prices over a certain period, it judges the price movement and gives suggested stop loss positions. For example, when the price breaks through the highest price of the most recent 168 K-lines, it is a bullish signal; when the price breaks through the lowest price of the most recent 168 K-lines, it is a bearish signal.

Mawreez’s Trend Oscillator is a dual-line oscillation indicator. Similar to MACD, it judges the direction and strength of the trend through the difference in DI. The values above 0 axis of this indicator curve indicate bullishness, while those below indicate bearishness.

The trading rules of this strategy are:

Long entry: Buy when Trend Surfers break through the highest line and Mawreez’s Trend Oscillator shows bullish signal

Short entry: Sell when Trend Surfers break through the lowest line and Mawreez’s Trend Oscillator shows bearish signal

The stop loss method is a combination of trend tracking stop loss and fixed stop loss.

Advantage Analysis

This strategy combines trend and oscillation indicators, which can capture trends and find better entry prices during oscillations. The main advantages are:

- The double indicator filtering can effectively avoid false breakouts

- The combination of trend and oscillation makes it easier to seize the low price in price ranges for bargain hunting or exit at high price for profit taking

- The multiple stop loss methods can control risks very well

Risk Analysis

There are also some risks with this strategy:

- The combination of double indicators may lead to missing trading signals

- Conflicting signals may occur between the trend indicator and oscillation indicator

- Fixed stop loss may stop out too early

To mitigate these risks, the following measures can be taken:

- Relax the parameters of the indicators properly to reduce filtration rate

- Add rules of trend judgment to avoid indicator conflicts

- Dynamically adjust stop loss positions

Optimization Directions

There is room for further optimization of this strategy:

- Test different parameter combinations and cycle parameters to find the optimal parameters

- Increase auxiliary rules based on volatility, trading volume etc.

- Adopt machine learning techniques to dynamically optimize indicators and parameters

Summary

The Trend and Oscillation Double Strategy integrates the advantages of trend tracking and oscillation indicators. It can identify trend directions and seize oscillation opportunities. With parameter and rule optimization, the profitability of this strategy can be further enhanced. This strategy has good prospects for development.

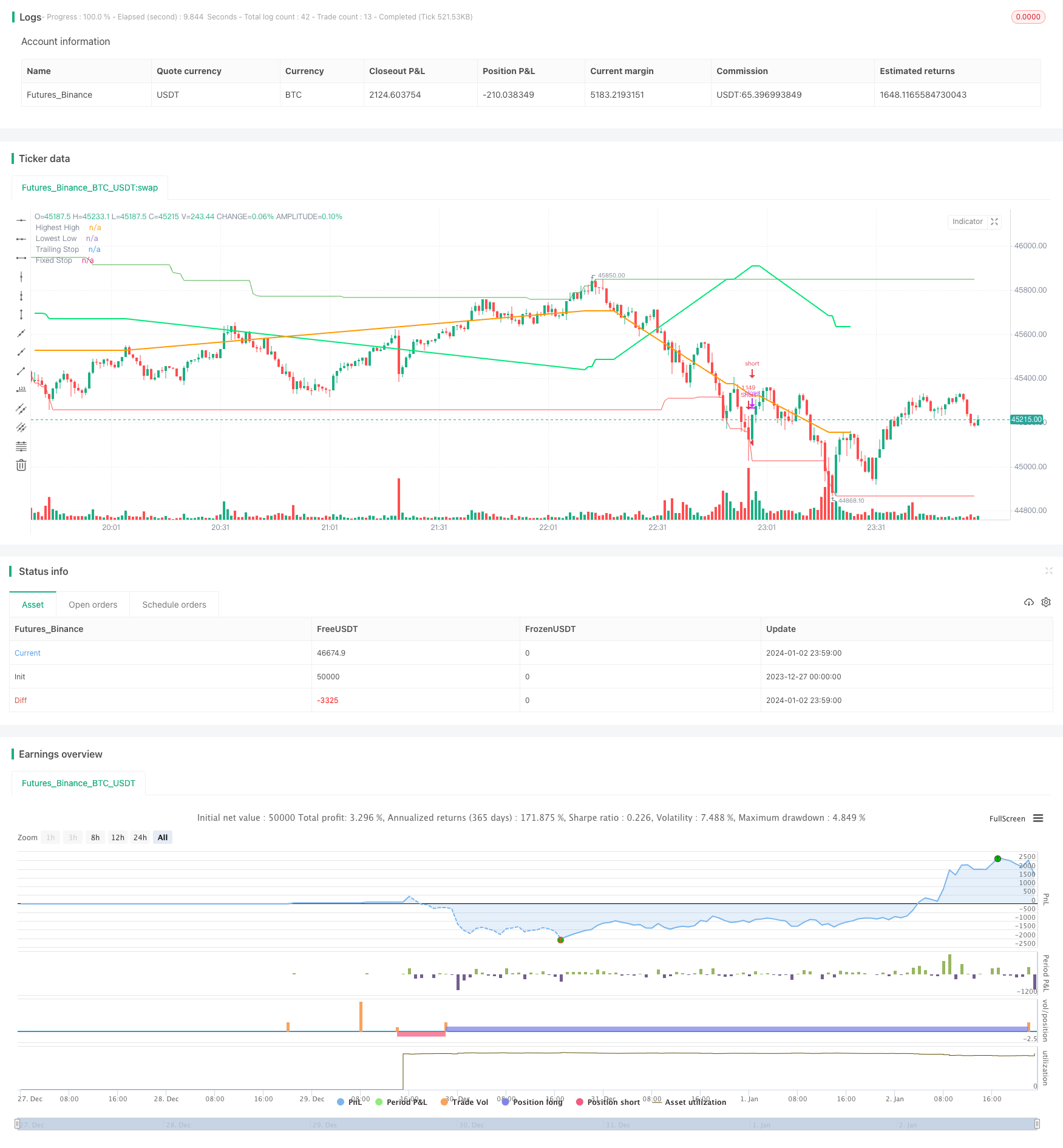

/*backtest

start: 2023-12-27 00:00:00

end: 2024-01-03 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © myn

//@version=5

strategy('Strategy Myth-Busting #8 - TrendSurfers+TrendOsc - [MYN]', max_bars_back=5000, overlay=true, pyramiding=0, initial_capital=20000, currency='USD', default_qty_type=strategy.percent_of_equity, default_qty_value=100.0, commission_value=0.075, use_bar_magnifier = false)

/////////////////////////////////////

//* Put your strategy logic below *//

/////////////////////////////////////

//cAe9It4ynO4

// Strategies

// Trend Surfers - Premium Indicator

// Mawreez' Trend Oscillator Indicator

// Trading Setup / Rules

// Long Condition

// Trend Surfers Trailing stop line goes below (Crosses) lowest low

// Bullish Candle (red)

// Mawreeze Trend Oscilator Indicator is green

// Short Condition

// Trend Surfers Trailing stop line goes above (Crosses) highest high

// Bearish Candle (red)

// Mawreeze Trend Oscilator Indicator is red

// Stop loss middle between high and low Risk 1:2

//@version=5

//strategy(shorttitle='Trend Surfers - Breakout', title='Trend Surfers - Premium Breakout', overlay=true, calc_on_every_tick=false, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type='percent', commission_value=0.04)

// Risk for position and pyramid

maxriskval = input.float(2, 'Max % risk', tooltip='Risk % over total equity / Position', group='Risk Management')

pairnumber = input.int(title='How many pairs', defval=1, tooltip='How many pairs are you trading with the strategy?', group='Risk Management')

// Emtry Exit

highPeriod = input.int(title='Highest High Period', defval=168, tooltip='Highest High of X bars - This will trigger a Long Entry when close is above. (Thin Green Line)', group='Entry Condition')

lowPeriod = input.int(title='Lowest Low Period', defval=168, tooltip='Lowest low of X bars - This will trigger a Short Entry when close is under. (Thin Red Line)', group='Entry Condition')

// Stoploss

trailingAtrPeriod = input.int(title='Trailing ATR Pediod', defval=10, tooltip='Average True Range for the Trailing Stop. (Thick Green Line) ', group='Exit Condition')

trailingAtrMultiplier = input.float(title='Trailing ATR Multiplier', defval=8, group='Exit Condition')

fixAtrPeriod = input.int(title='Fix ATR Pediod', defval=10, tooltip='Average True Range for the Fix Stoloss. (Thick Yellow Line)', group='Exit Condition')

fixAtrMultiplier = input.float(title='Fix ATR Multiplier', defval=2, group='Exit Condition')

// Pair info

pair = syminfo.basecurrency + syminfo.currency

// High Low Variable

highestHigh = ta.highest(high, highPeriod)[1]

lowestLow = ta.lowest(low, lowPeriod)[1]

trailingAtr = ta.atr(trailingAtrPeriod) * trailingAtrMultiplier

// Trade Condition

longConditionTrendSurfers = ta.crossover(close, highestHigh)

shortConditionTrendSurfers = ta.crossunder(close, lowestLow)

// Risk Variable

fixAtr = ta.atr(fixAtrPeriod) * fixAtrMultiplier

stopvaluelong = close[1] - fixAtr[1]

stopvalueshort = close[1] + fixAtr[1]

// Position size Long

maxpossize = strategy.equity / close

positionsizelong = maxriskval / 100 * strategy.equity / (close - stopvaluelong)

stopperclong = (close - stopvaluelong) / close * 100

leveragelong = math.max(1, math.ceil(positionsizelong / maxpossize)) * 2

posperclong = positionsizelong * close / strategy.equity * 100 / leveragelong / pairnumber

realposlong = posperclong / 100 * strategy.equity * leveragelong / close

// Position size Short

positionsizeshort = maxriskval / 100 * strategy.equity / (stopvalueshort - close)

stoppercshort = (close - stopvalueshort) / close * 100

leverageshort = math.max(1, math.ceil(positionsizeshort / maxpossize)) * 2

pospercshort = positionsizeshort * close / strategy.equity * 100 / leverageshort / pairnumber

realposshort = pospercshort / 100 * strategy.equity * leverageshort / close

// Alert Message

entry_long_message = '\nGo Long for ' + pair + 'NOW!' + '\nPosition Size % =' + str.tostring(posperclong) + '\nLeverage' + str.tostring(leveragelong) + '\nStoploss Price =' + str.tostring(stopvaluelong) + '\nClose any Short position that are open for ' + pair + '!' + '\n\nVisit TrendSurfersSignals.com' + '\nFor automated premium signals (FREE)'

entry_short_message = '\nGo Short for ' + pair + 'NOW!' + '\nPosition Size % =' + str.tostring(pospercshort) + '\nLeverage' + str.tostring(leverageshort) + '\nStoploss Price =' + str.tostring(stopvalueshort) + '\nClose any Long position that are open for ' + pair + '!' + '\n\nVisit TrendSurfersSignals.com' + '\nFor automated premium signals (FREE)'

exit_short_message = '\nExit Short for ' + pair + 'NOW!' + '\n\nVisit TrendSurfersSignals.com' + '\nFor automated premium signals (FREE)'

exit_long_message = '\nExit Long for ' + pair + 'NOW!' + '\n\nVisit TrendSurfersSignals.com' + '\nFor automated premium signals (FREE)'

// Order

// if longCondition

// strategy.entry('Long', strategy.long, stop=highestHigh, comment='Long', qty=realposlong, alert_message=entry_long_message)

// if shortCondition

// strategy.entry('Short', strategy.short, stop=lowestLow, comment='Short', qty=realposshort, alert_message=entry_short_message)

// Stoploss Trailing

longTrailing = close - trailingAtr

shortTrailing = close + trailingAtr

var longTrailingStop = 0.0

var shortTrailingStop = 999999.9

trailingStopLine = 0.0

trailingStopLine := na

fixedStopLine = 0.0

fixedStopLine := na

var inTrade = 0

if longConditionTrendSurfers or shortConditionTrendSurfers

if 0 == inTrade

if longConditionTrendSurfers

inTrade := 1

inTrade

else

inTrade := -1

inTrade

if 1 == inTrade and (shortConditionTrendSurfers or low <= math.max(fixedStopLine[1], longTrailingStop))

inTrade := 0

inTrade

if -1 == inTrade and (longConditionTrendSurfers or high >= math.min(fixedStopLine[1], shortTrailingStop))

inTrade := 0

inTrade

longTrailingStop := if 1 == inTrade

stopValue = longTrailing

math.max(stopValue, longTrailingStop[1])

else

0

shortTrailingStop := if -1 == inTrade

stopValue = shortTrailing

math.min(stopValue, shortTrailingStop[1])

else

999999

// Fix Stoploss

firstPrice = 0.0

firstFixAtr = 0.0

firstPrice := na

firstFixAtr := na

if 0 != inTrade

firstPrice := ta.valuewhen(inTrade != inTrade[1] and 0 != inTrade, close, 0)

firstFixAtr := ta.valuewhen(inTrade != inTrade[1] and 0 != inTrade, fixAtr, 0)

if 1 == inTrade

fixedStopLine := firstPrice - firstFixAtr

trailingStopLine := longTrailingStop

trailingStopLine

else

fixedStopLine := firstPrice + firstFixAtr

trailingStopLine := shortTrailingStop

trailingStopLine

// if strategy.position_size > 0

// strategy.exit(id='L Stop', stop=math.max(fixedStopLine, longTrailingStop), alert_message=exit_long_message)

// if strategy.position_size < 0

// strategy.exit(id='S Stop', stop=math.min(fixedStopLine, shortTrailingStop), alert_message=exit_short_message)

// Plot

plot(highestHigh, color=color.new(color.green, 0), linewidth=1, title='Highest High')

plot(lowestLow, color=color.new(color.red, 0), linewidth=1, title='Lowest Low')

plot(trailingStopLine, color=color.new(color.lime, 0), linewidth=2, offset=1, title='Trailing Stop')

plot(fixedStopLine, color=color.new(color.orange, 0), linewidth=2, offset=1, title='Fixed Stop')

// Trend Surfers Trailing stop line goes above (Crossesover) highest high

// Bearish Candle (red)

// Mawreeze Trend Oscilator Indicator is red

trendSurfersShortEntry = trailingStopLine > highestHigh and close < close[1]

trendSurfersLongEntry = trailingStopLine < lowestLow and close > close[1]

//@version=5

// Taken from the TradingView house rules regarding scripts:

// "All open source scripts that do not mention a specific open source license

// in their comments are licensed under the Mozilla Public License 2.0.

// Following the Mozilla License, any script reusing open source code originally

// published by someone else must also be open source, unless specific

// permission is granted by the original author."

//indicator('Mawreez\' Trend Oscillator', precision=3)

len = input.int(title='DI Length', minval=1, defval=14)

sens = input.float(title='Sensitivity', defval=25)

// Lag-free smoothing of a given series

smooth(series, len) =>

f28 = ta.ema(series, len)

f30 = ta.ema(f28, len)

vC = f28 * 1.5 - f30 * 0.5

f38 = ta.ema(vC, len)

f40 = ta.ema(f38, len)

v10 = f38 * 1.5 - f40 * 0.5

f48 = ta.ema(v10, len)

f50 = ta.ema(f48, len)

f48 * 1.5 - f50 * 0.5

// Constructing the +DI and -DI

up = ta.change(high)

down = -ta.change(low)

plus_dm = up > 0 and up > down ? up : 0

minus_dm = down > 0 and down > up ? down : 0

range_1 = ta.rma(ta.tr, len)

plus_di = smooth(ta.rma(plus_dm, len) / range_1, 3)

minus_di = smooth(ta.rma(minus_dm, len) / range_1, 3)

// Constructing and plotting the modified ADX

adj_adx = 100 * math.abs(plus_di - minus_di) / (plus_di + minus_di) - sens

adj_adx := (minus_di > plus_di ? -1 : 1) * (adj_adx < 0 ? 0 : adj_adx)

//plot(smooth(adj_adx, 3), color=plus_di > minus_di ? color.green : color.red, style=plot.style_columns)

trendOscShortEntry = plus_di < minus_di

trendOscLongEntry = plus_di > minus_di

//////////////////////////////////////

//* Put your strategy rules below *//

/////////////////////////////////////

longCondition = trendSurfersLongEntry and trendOscLongEntry

shortCondition = trendSurfersShortEntry and trendOscShortEntry

//define as 0 if do not want to use

closeLongCondition = 0

closeShortCondition = 0

// ADX

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

adxEnabled = input.bool(defval = false , title = "Average Directional Index (ADX)", tooltip = "", group ="ADX" )

adxlen = input(14, title="ADX Smoothing", group="ADX")

adxdilen = input(14, title="DI Length", group="ADX")

adxabove = input(25, title="ADX Threshold", group="ADX")

adxdirmov(len) =>

adxup = ta.change(high)

adxdown = -ta.change(low)

adxplusDM = na(adxup) ? na : (adxup > adxdown and adxup > 0 ? adxup : 0)

adxminusDM = na(adxdown) ? na : (adxdown > adxup and adxdown > 0 ? adxdown : 0)

adxtruerange = ta.rma(ta.tr, len)

adxplus = fixnan(100 * ta.rma(adxplusDM, len) / adxtruerange)

adxminus = fixnan(100 * ta.rma(adxminusDM, len) / adxtruerange)

[adxplus, adxminus]

adx(adxdilen, adxlen) =>

[adxplus, adxminus] = adxdirmov(adxdilen)

adxsum = adxplus + adxminus

adx = 100 * ta.rma(math.abs(adxplus - adxminus) / (adxsum == 0 ? 1 : adxsum), adxlen)

adxsig = adxEnabled ? adx(adxdilen, adxlen) : na

isADXEnabledAndAboveThreshold = adxEnabled ? (adxsig > adxabove) : true

//Backtesting Time Period (Input.time not working as expected as of 03/30/2021. Giving odd start/end dates

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

useStartPeriodTime = input.bool(true, 'Start', group='Date Range', inline='Start Period')

startPeriodTime = input(timestamp('1 Jan 2019'), '', group='Date Range', inline='Start Period')

useEndPeriodTime = input.bool(true, 'End', group='Date Range', inline='End Period')

endPeriodTime = input(timestamp('31 Dec 2030'), '', group='Date Range', inline='End Period')

start = useStartPeriodTime ? startPeriodTime >= time : false

end = useEndPeriodTime ? endPeriodTime <= time : false

calcPeriod = true

// Trade Direction

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tradeDirection = input.string('Long and Short', title='Trade Direction', options=['Long and Short', 'Long Only', 'Short Only'], group='Trade Direction')

// Percent as Points

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

per(pcnt) =>

strategy.position_size != 0 ? math.round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

// Take profit 1

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp1 = input.float(title='Take Profit 1 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 1')

q1 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 1')

// Take profit 2

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp2 = input.float(title='Take Profit 2 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 2')

q2 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 2')

// Take profit 3

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp3 = input.float(title='Take Profit 3 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 3')

q3 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 3')

// Take profit 4

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp4 = input.float(title='Take Profit 4 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit')

/// Stop Loss

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

stoplossPercent = input.float(title='Stop Loss (%)', defval=999, minval=0.01, group='Stop Loss') * 0.01

slLongClose = close < strategy.position_avg_price * (1 - stoplossPercent)

slShortClose = close > strategy.position_avg_price * (1 + stoplossPercent)

/// Leverage

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

leverage = input.float(1, 'Leverage', step=.5, group='Leverage')

contracts = math.min(math.max(.000001, strategy.equity / close * leverage), 1000000000)

/// Trade State Management

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

isInLongPosition = strategy.position_size > 0

isInShortPosition = strategy.position_size < 0

/// ProfitView Alert Syntax String Generation

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

alertSyntaxPrefix = input.string(defval='CRYPTANEX_99FTX_Strategy-Name-Here', title='Alert Syntax Prefix', group='ProfitView Alert Syntax')

alertSyntaxBase = alertSyntaxPrefix + '\n#' + str.tostring(open) + ',' + str.tostring(high) + ',' + str.tostring(low) + ',' + str.tostring(close) + ',' + str.tostring(volume) + ','

/// Trade Execution

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

longConditionCalc = (longCondition and isADXEnabledAndAboveThreshold)

shortConditionCalc = (shortCondition and isADXEnabledAndAboveThreshold)

if calcPeriod

if longConditionCalc and tradeDirection != 'Short Only' and isInLongPosition == false

strategy.entry('Long', strategy.long, qty=contracts)

alert(message=alertSyntaxBase + 'side:long', freq=alert.freq_once_per_bar_close)

if shortConditionCalc and tradeDirection != 'Long Only' and isInShortPosition == false

strategy.entry('Short', strategy.short, qty=contracts)

alert(message=alertSyntaxBase + 'side:short', freq=alert.freq_once_per_bar_close)

//Inspired from Multiple %% profit exits example by adolgo https://www.tradingview.com/script/kHhCik9f-Multiple-profit-exits-example/

strategy.exit('TP1', qty_percent=q1, profit=per(tp1))

strategy.exit('TP2', qty_percent=q2, profit=per(tp2))

strategy.exit('TP3', qty_percent=q3, profit=per(tp3))

strategy.exit('TP4', profit=per(tp4))

strategy.close('Long', qty_percent=100, comment='SL Long', when=slLongClose)

strategy.close('Short', qty_percent=100, comment='SL Short', when=slShortClose)

strategy.close_all(when=closeLongCondition or closeShortCondition, comment='Close Postion')

/// Dashboard

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Inspired by https://www.tradingview.com/script/uWqKX6A2/ - Thanks VertMT

showDashboard = input.bool(group="Dashboard", title="Show Dashboard", defval=false)

f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

_cellText = _title + "\n" + _value

table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// Draw dashboard table

if showDashboard

var bgcolor = color.new(color.black,0)

// Keep track of Wins/Losses streaks

newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

varip int winRow = 0

varip int lossRow = 0

varip int maxWinRow = 0

varip int maxLossRow = 0

if newWin

lossRow := 0

winRow := winRow + 1

if winRow > maxWinRow

maxWinRow := winRow

if newLoss

winRow := 0

lossRow := lossRow + 1

if lossRow > maxLossRow

maxLossRow := lossRow

// Prepare stats table

var table dashTable = table.new(position.bottom_right, 1, 15, border_width=1)

if barstate.islastconfirmedhistory

// Update table

dollarReturn = strategy.netprofit

f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

_profit = (strategy.netprofit / strategy.initial_capital) * 100

f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? color.green : color.red, color.white)

_numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? color.green : color.red, color.white)

_winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? color.red : _winRate < 75 ? #999900 : color.green, color.white)

f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? color.green : color.red, color.white)

f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)

- Trend Following Strategy Based on EMA and MACD across Timeframes

- Multi-indicator Collision Reversal Strategy

- Trend Reversal Strategy Based on EMA and SMA Crossover

- DMI DPO Guard Strategy

- Trend Tracking Short-term Trading Strategy

- RSI Trend Following Bull Strategy

- RSIndex and Moving Average Combination Strategy

- Multi-timeframe MA Trend Following Strategy

- Dual Indicators Bottom Buying Strategy

- Bearish Engulfing Reversal Strategy

- TrendSurfing - Double Moving Average Crossover Trend Strategy

- DMI and HMA Combination Strategy

- Improved RSI Scalping Strategy based on Relative Strength Index

- Dual Reversion RSI HistoAlert Strategy

- Momentum Breakout Strategy with ADX Filter

- Dynamic Average Cost Dollar Cost Averaging Compound Strategy

- Multi-EMA Crossover Trend Following Strategy

- Camarilla Pivot Breakout Strategy

- Adaptive Botvenko Indicator Long Short Strategy

- Bollinger Bands and VWAP based Quantitative Trading Strategy