Trend Following Strategy Based on EMA and MACD across Timeframes

Author: ChaoZhang, Date: 2024-01-05 11:16:17Tags:

Overview

This strategy combines EMA lines and MACD indicator across timeframes to identify trend signals and capture mid-to-long term trends. It takes trend following actions when short-term trend aligns with mid-to-long term trend. Meanwhile, the strategy uses ATR indicator to set stop loss and take profit to control risks from fluctuations.

Principles

The strategy uses 50-day EMA and 100-day EMA to determine mid-to-long term trend direction. When short-term trend is identified by MACD indicator, it checks if the directions align. If yes, it takes trend following actions.

Specifically, when MACD fast line crosses above slow line, and closes > 50-day EMA and closes > 100-day EMA, it goes long. When MACD fast line crosses below slow line, and closes < 50-day EMA and closes < 100-day EMA, it goes short.

Also, the strategy uses ATR indicator to calculate range of fluctuations and set stop loss and take profit prices. It sets certain multiplier of ATR based on close price as stop loss level, and certain multiplier of ATR based on close price as take profit level.

Advantage Analysis

-

Combining EMA lines and MACD indicator across timeframes helps identify trend signals and prevents missing mid-to-long term trends

-

Using ATR indicator to set stop loss and take profit based on market fluctuation effectively controls risks

-

Avoiding market neutral zones prevents unnecessary losses

Risk Analysis

-

EMA lines have lagging effect and may miss turning points

-

MACD indicator has multiple timeframes and parameter settings that impact results

-

ATR ranges cannot fully represent future price fluctuations, cannot eliminate risks

Counter measures:

-

Confirm signals with other indicators to avoid EMA lagging issues

-

Adjust MACD parameters and optimize results

-

Reasonably set ATR multiplier to control maximum loss

Optimization Directions

-

Test different combinations of EMA line periods

-

Optimize MACD parameter settings

-

Use machine learning methods to automatically find optimal ATR stop loss/take profit multipliers

Summary

The strategy combines EMA, MACD and ATR indicators to implement trend following operations across timeframes. Through parameter optimization, it has the potential to achieve good strategy return rates. Also need to prevent risks including indicator lagging, improper parameter adjustment and fluctuation control, and continue to optimize and enhance.

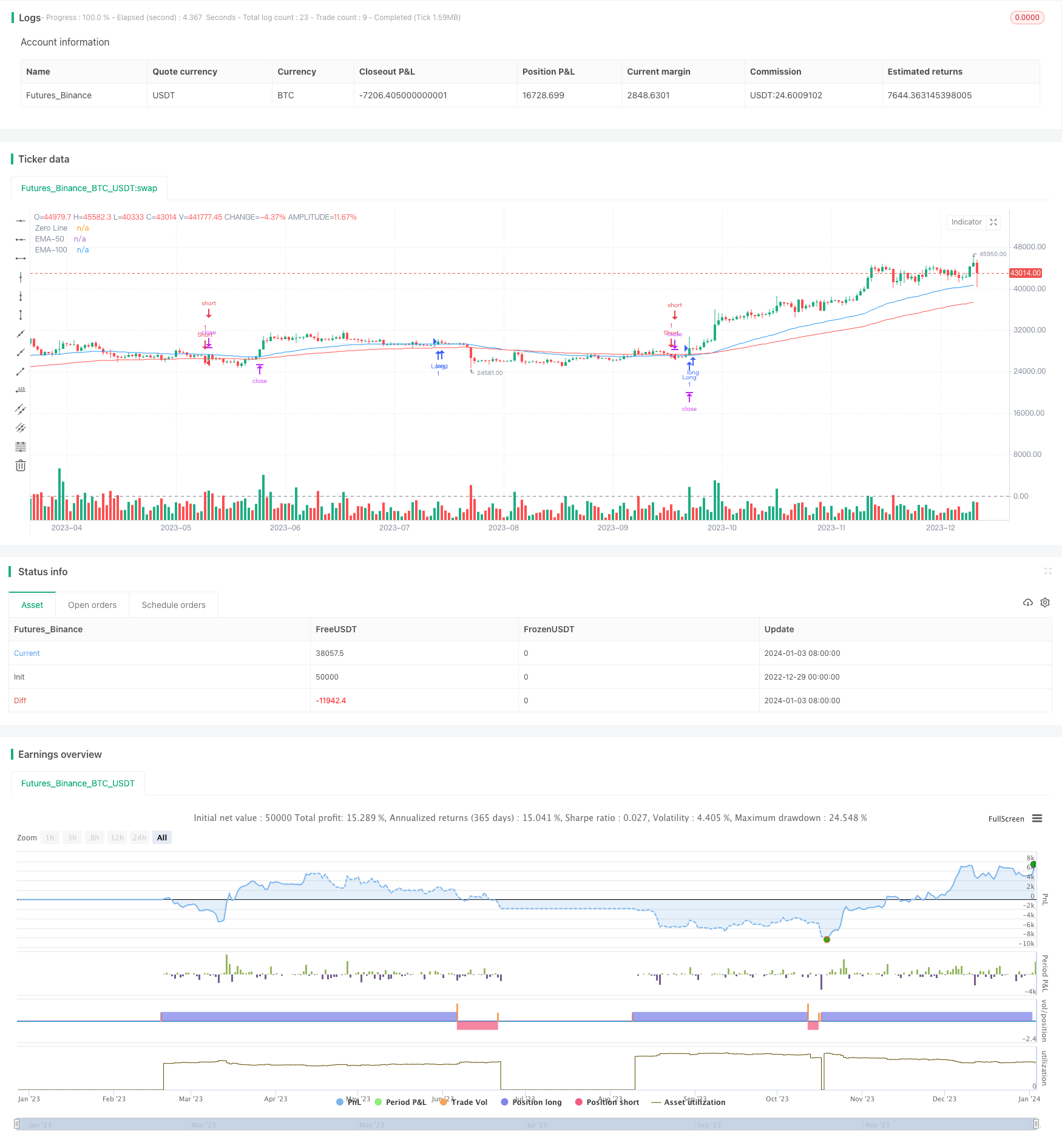

/*backtest

start: 2022-12-29 00:00:00

end: 2024-01-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA-50, EMA-100, and MACD Strategy with ATR for Stop Loss/Profit", overlay=true)

// MACD hesaplama

fastLength = input(12, title="Fast Length")

slowLength = input(26, title="Slow Length")

signalLength = input(9, title="Signal Length")

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalLength)

// EMA-50 ve EMA-100 hesaplama

ema50 = ta.ema(close, 50)

ema100 = ta.ema(close, 100)

// ATR hesaplama

atrLength = input(14, title="ATR Length")

atrValue = ta.atr(atrLength)

// Take Profit ve Stop Loss çoklayıcıları

takeProfitMultiplier = input(3.0, title="Take Profit Multiplier") // TP, 3 katı ATR

stopLossMultiplier = input(1.0, title="Stop Loss Multiplier")

// Long Pozisyon Koşulları

longCondition = ta.crossover(macdLine, signalLine) and close > ema50 and close > ema100

// Short Pozisyon Koşulları

shortCondition = ta.crossunder(macdLine, signalLine) and close < ema50 and close < ema100

// Take Profit ve Stop Loss Seviyeleri

takeProfitLevel = close + takeProfitMultiplier * atrValue

stopLossLevel = close - stopLossMultiplier * atrValue

// Long Pozisyon İşlemleri

strategy.entry("Long", strategy.long, when=longCondition)

strategy.exit("Take Profit/Stop Loss", from_entry="Long", loss=stopLossLevel, profit=takeProfitLevel)

// Short Pozisyon İşlemleri

strategy.entry("Short", strategy.short, when=shortCondition)

strategy.exit("Take Profit/Stop Loss", from_entry="Short", loss=stopLossLevel, profit=takeProfitLevel)

// Grafikte Gösterme

plot(ema50, color=color.blue, title="EMA-50")

plot(ema100, color=color.red, title="EMA-100")

hline(0, "Zero Line", color=color.gray)

- Trend Following Momentum Breakout Strategy

- Breakout and Intelligent Bollinger Bands Price Channel Strategy

- Simple Trend Following Strategy

- Long Breakthrough Strategy Based on K-Line Construction

- Momentum Oscillating Moving Average Trading Strategy Based on Buffered Bollinger Bands

- Adaptive Backtest Date Range Selection Strategy Based on Double MA

- Multi-Timeframe Moving Average Crossover Optimization Strategy

- Breakthrough Tracking Strategy

- Adaptive Trading Strategy Based on Momentum Indicators

- Pivot Point and Fibonacci Retracement Based Automatic Trend Following Strategy

- Multi-indicator Collision Reversal Strategy

- Trend Reversal Strategy Based on EMA and SMA Crossover

- DMI DPO Guard Strategy

- Trend Tracking Short-term Trading Strategy

- RSI Trend Following Bull Strategy

- RSIndex and Moving Average Combination Strategy

- Multi-timeframe MA Trend Following Strategy

- Dual Indicators Bottom Buying Strategy

- Bearish Engulfing Reversal Strategy

- Trend and Oscillation Double Strategy